- China

- /

- Commercial Services

- /

- SHSE:603568

3 Growth Companies With Insider Ownership Up To 34%

Reviewed by Simply Wall St

As global markets navigate a mix of rising U.S. Treasury yields, fluctuating consumer confidence, and modest gains in major stock indexes, investors are increasingly focused on identifying resilient growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong alignment between management and shareholder interests, potentially enhancing long-term growth prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Weiming Environment Protection (SHSE:603568)

Simply Wall St Growth Rating: ★★★★★☆

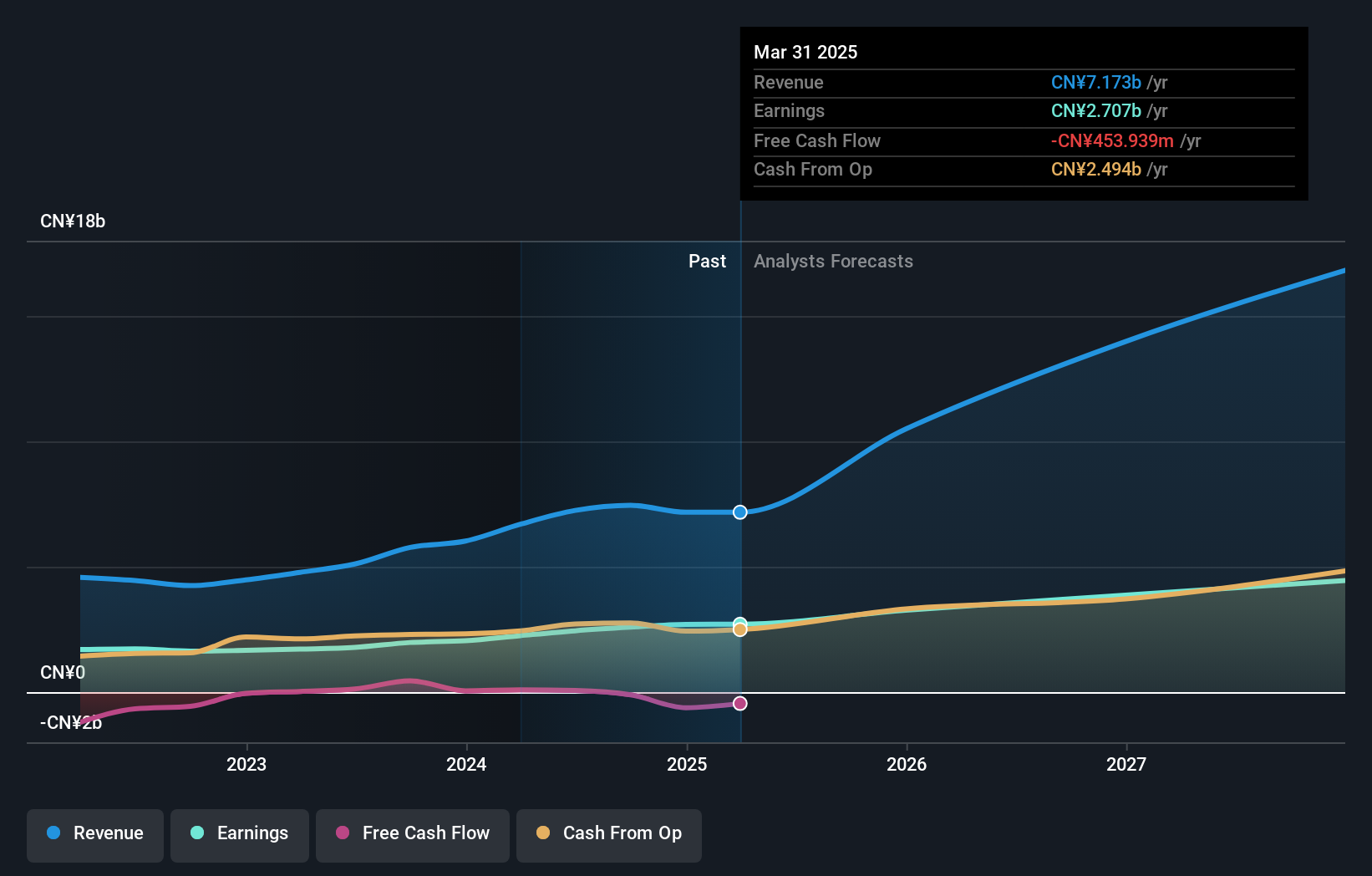

Overview: Zhejiang Weiming Environment Protection Co., Ltd. operates in the environmental protection industry and has a market cap of CN¥36.73 billion.

Operations: The company's revenue from industrial operations amounts to CN¥7.45 billion.

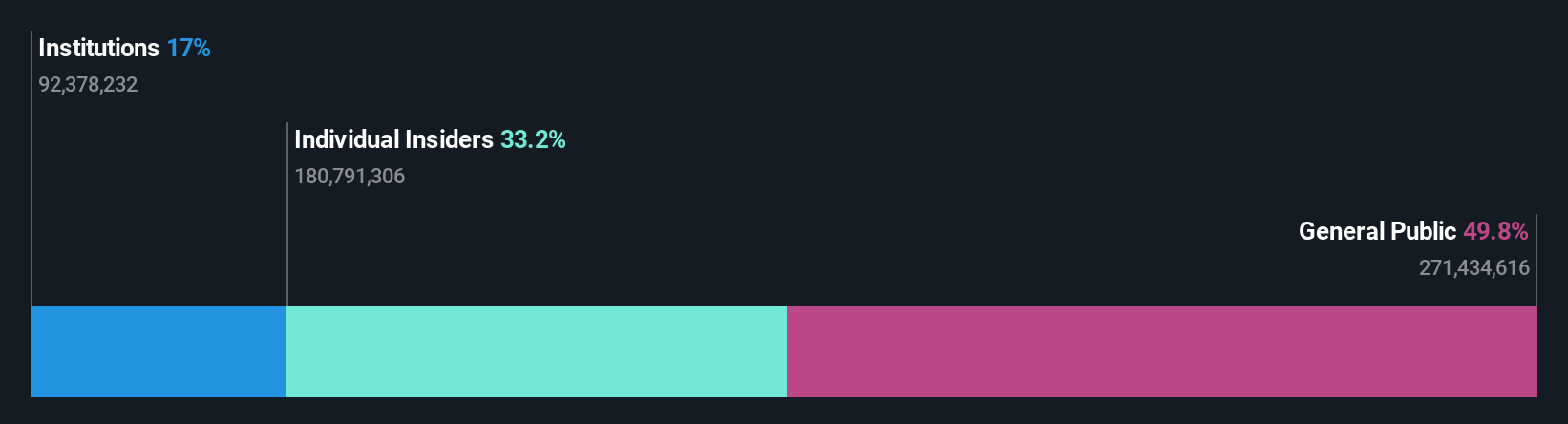

Insider Ownership: 24%

Zhejiang Weiming Environment Protection demonstrates strong growth potential with revenue forecasted to increase 34.5% annually, outpacing the broader CN market. The company reported significant earnings growth of 30.8% over the past year, supported by a favorable price-to-earnings ratio of 14.2x compared to the industry average. Despite these positives, its dividend yield of 1.15% is not well covered by free cash flows, indicating potential concerns for dividend sustainability amidst rapid expansion efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Zhejiang Weiming Environment Protection.

- Our comprehensive valuation report raises the possibility that Zhejiang Weiming Environment Protection is priced lower than what may be justified by its financials.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD is involved in the R&D, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥33.61 billion.

Operations: The company generates revenue through its involvement in electrical automation, offering comprehensive hardware, software, and system solutions.

Insider Ownership: 34.5%

Shenzhen Megmeet Electrical shows promising growth with expected revenue and earnings increases of 22.7% and 29.96% per year, respectively, surpassing the CN market averages. However, recent financials indicate a decline in net income to CNY 411.15 million from CNY 482.66 million year-over-year, alongside shareholder dilution concerns. The company completed a buyback of 852,300 shares for CNY 20.01 million but reported no insider trading activities over the past three months.

- Navigate through the intricacies of Shenzhen Megmeet Electrical with our comprehensive analyst estimates report here.

- The analysis detailed in our Shenzhen Megmeet Electrical valuation report hints at an inflated share price compared to its estimated value.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

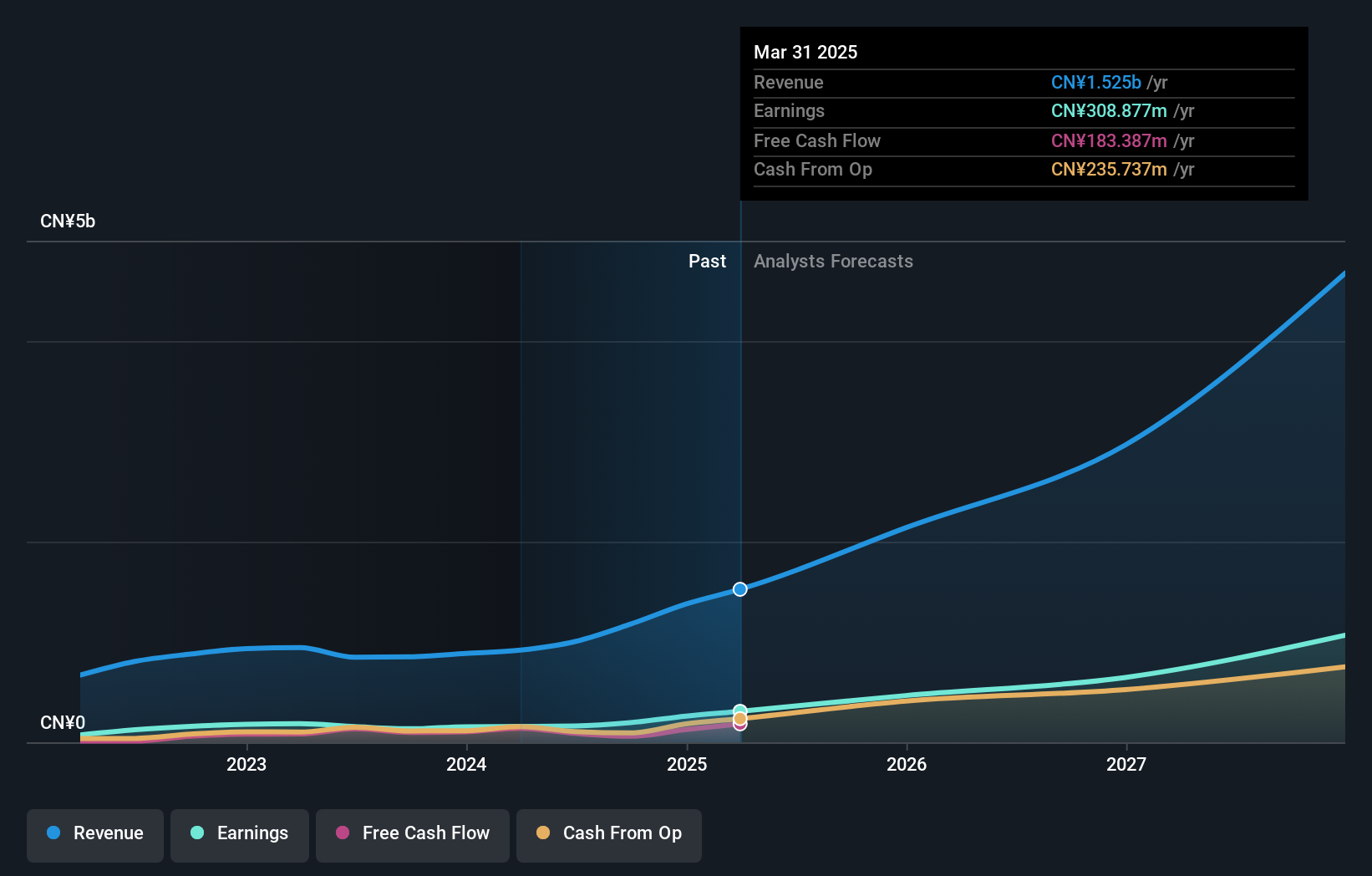

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in China with a market cap of CN¥17.50 billion.

Operations: The company generates revenue from Optical Communication Components amounting to CN¥1.17 billion.

Insider Ownership: 24.9%

T&S Communications Ltd. demonstrates strong growth potential with earnings projected to increase by 44.71% annually, outpacing the CN market's 25.5%. Revenue is also expected to grow significantly at 38.3% per year, exceeding market averages. Recent financials reflect robust performance, with sales rising to CNY 915.87 million from CNY 623.05 million year-over-year and net income increasing to CNY 145.81 million from CNY 104.83 million, despite a volatile share price and unsustainable dividend coverage by free cash flows.

- Dive into the specifics of T&S CommunicationsLtd here with our thorough growth forecast report.

- Our valuation report here indicates T&S CommunicationsLtd may be overvalued.

Make It Happen

- Delve into our full catalog of 1512 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Weiming Environment Protection might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603568

Zhejiang Weiming Environment Protection

Zhejiang Weiming Environment Protection Co., Ltd.

High growth potential with solid track record.

Market Insights

Community Narratives