- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

High Growth Tech Stocks in Asia to Watch for Potential Expansion

Reviewed by Simply Wall St

Amidst global economic uncertainties and fluctuating market sentiments, the Asian tech sector continues to capture attention with its potential for high growth, driven by innovation and rapid technological advancements. In such a dynamic environment, identifying promising stocks often involves looking at companies that demonstrate resilience and adaptability in response to shifting trade policies and economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Dmall | 31.16% | 141.63% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Pictures Group Limited is an investment holding company engaged in content creation, technology, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market capitalization of approximately HK$17.23 billion.

Operations: Alibaba Pictures Group focuses on content creation, technology, and IP merchandising within Hong Kong and the People's Republic of China. The company's revenue streams are primarily derived from these segments, contributing to its market presence in the region.

Alibaba Pictures Group, amidst executive shifts with Mr. Tung's recent resignation, is navigating through a transformative phase. Despite a significant one-off loss of CN¥480.9 million last year, the firm's earnings are projected to surge by 45.5% annually over the next three years, outpacing the Hong Kong market's average of 11.5%. This growth is underpinned by an expected revenue increase of 15% per year, which also exceeds the local market forecast of 7.8%. However, challenges persist as its Return on Equity is anticipated to remain low at 7.3%, reflecting underlying operational pressures and a need for strategic adjustments in its business model to enhance shareholder value.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

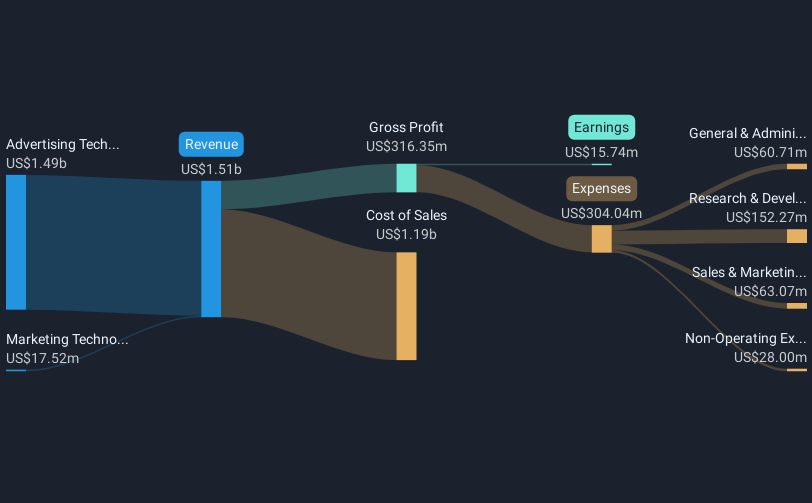

Overview: Mobvista Inc. and its subsidiaries provide advertising and marketing technology services essential for developing the mobile internet ecosystem globally, with a market cap of HK$10.43 billion.

Operations: Mobvista focuses on advertising and marketing technology services that support the growth of the mobile internet ecosystem worldwide. The company generates revenue primarily through its mobile advertising platform, which connects advertisers with targeted audiences. Its cost structure includes expenses related to technology development and operational activities. Notably, Mobvista's gross profit margin has shown a trend of fluctuation over recent periods, reflecting changes in operational efficiency and market conditions.

Mobvista, a player in the high-growth tech sector in Asia, is demonstrating robust financial health with a remarkable earnings forecast growth of 67.6% annually. This figure notably surpasses the average market projection of 11.5%. Additionally, its revenue is expected to expand by 30% each year, outpacing the Hong Kong market's forecast of 7.8%. The company's strategic focus on innovative technologies and market expansion was underscored at its recent board meeting where future business development plans were crafted to enhance shareholder value amidst evolving legal challenges.

- Navigate through the intricacies of Mobvista with our comprehensive health report here.

Explore historical data to track Mobvista's performance over time in our Past section.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

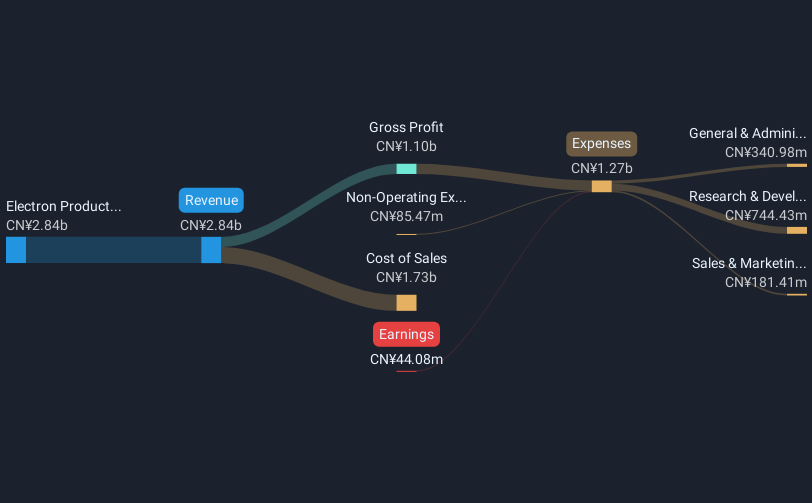

Overview: Wuhan Jingce Electronic Group Co., Ltd specializes in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market cap of CN¥19.11 billion.

Operations: Jingce Electronic focuses on the development and sale of detection systems for display, semiconductor, and new energy sectors. The company's primary revenue stream is from electronic products, generating CN¥2.72 billion.

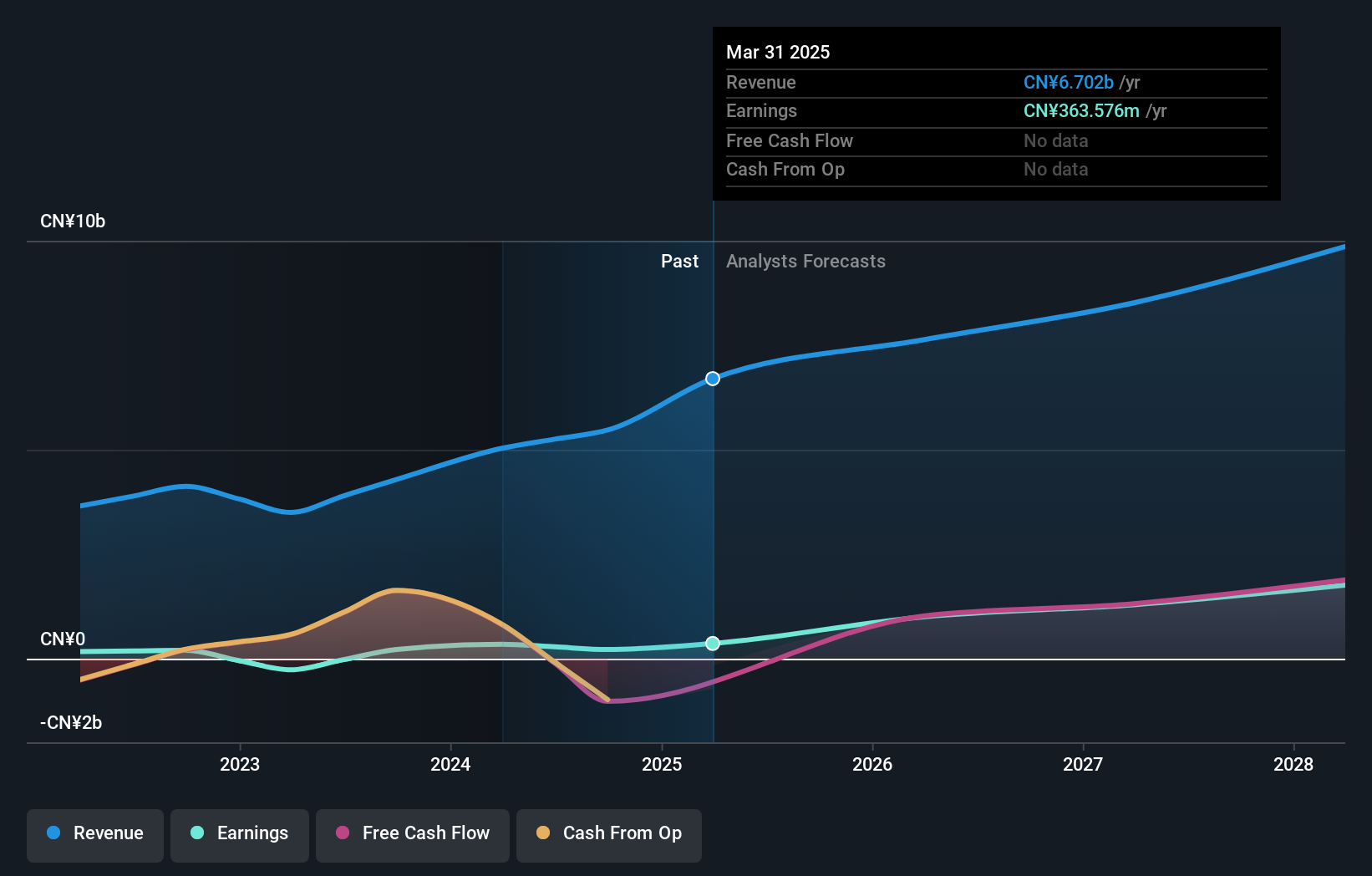

Wuhan Jingce Electronic Group Co., Ltd. is capturing attention with its impressive earnings growth of 111.8% over the past year, significantly outperforming the electronic industry's average by 4%. This surge is supported by a robust annual revenue increase forecast at 22.5%, which eclipses the broader Chinese market expectation of 13.1%. Despite challenges in covering debt with operating cash flow, recent governance changes and strategic board enhancements signal a proactive approach to steering future growth and stability in an evolving tech landscape.

- Unlock comprehensive insights into our analysis of Wuhan Jingce Electronic GroupLtd stock in this health report.

Understand Wuhan Jingce Electronic GroupLtd's track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 511 Asian High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy detection systems.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives