- China

- /

- Communications

- /

- SZSE:300559

Chengdu Jiafaantai Education Technology Co.,Ltd.'s (SZSE:300559) P/E Is Still On The Mark Following 26% Share Price Bounce

Those holding Chengdu Jiafaantai Education Technology Co.,Ltd. (SZSE:300559) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Notwithstanding the latest gain, the annual share price return of 9.5% isn't as impressive.

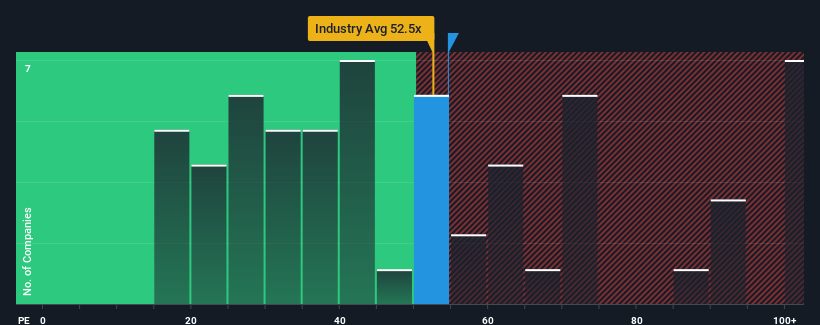

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Chengdu Jiafaantai Education TechnologyLtd as a stock to avoid entirely with its 54.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Chengdu Jiafaantai Education TechnologyLtd as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Chengdu Jiafaantai Education TechnologyLtd

How Is Chengdu Jiafaantai Education TechnologyLtd's Growth Trending?

In order to justify its P/E ratio, Chengdu Jiafaantai Education TechnologyLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 56% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 116% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Chengdu Jiafaantai Education TechnologyLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Chengdu Jiafaantai Education TechnologyLtd have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Chengdu Jiafaantai Education TechnologyLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Chengdu Jiafaantai Education TechnologyLtd that we have uncovered.

Of course, you might also be able to find a better stock than Chengdu Jiafaantai Education TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300559

Chengdu Jiafaantai Education TechnologyLtd

Chengdu Jiafaantai Education Technology Co.,Ltd.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success