- China

- /

- Electronic Equipment and Components

- /

- SZSE:300557

Uncovering Wuhan Ligong Guangke And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a week marked by economic uncertainty and mixed performance across global markets, small-cap stocks have struggled to keep pace with their larger counterparts. As the Russell 2000 Index records another week of underperformance against the S&P 500, investors are increasingly on the lookout for hidden opportunities within this segment. In such an environment, identifying promising small-cap stocks like Wuhan Ligong Guangke can be crucial for those seeking potential growth amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Wuhan Ligong Guangke (SZSE:300557)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Ligong Guangke Co., Ltd. specializes in offering optical fiber sensor products and Internet of Things solutions for security and fire protection sectors in China, with a market capitalization of approximately CN¥2.95 billion.

Operations: The company's primary revenue stream is from the optical fiber sensor and smart instrument manufacturing industry, generating CN¥614.43 million.

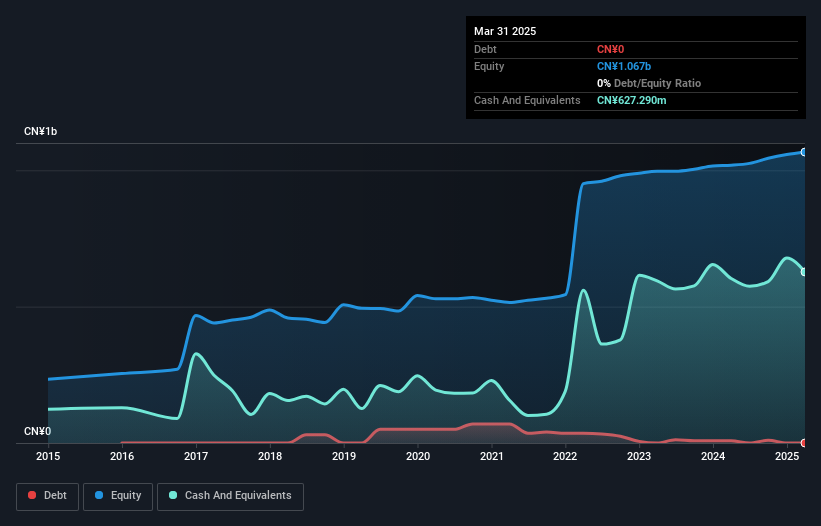

Wuhan Ligong Guangke, a smaller player in the electronics industry, has shown impressive earnings growth of 55.1% over the past year, outpacing the industry's 1.9%. With high-quality earnings and a reduced debt-to-equity ratio from 10.3% to just 1% over five years, it seems financially sound. The company reported sales of CNY 412 million for nine months ending September 2024, up from CNY 402 million last year. Net income rose to CNY 26.84 million from CNY 17.86 million previously, with basic earnings per share climbing to CNY 0.29 from CNY 0.19 a year ago, suggesting robust financial health and potential for future value creation.

Talant Optronics (Suzhou) (SZSE:301045)

Simply Wall St Value Rating: ★★★★★☆

Overview: Talant Optronics (Suzhou) Co., Ltd. focuses on the research, development, production, and sale of photoelectric light guide plates and related components both in China and internationally, with a market cap of CN¥2.63 billion.

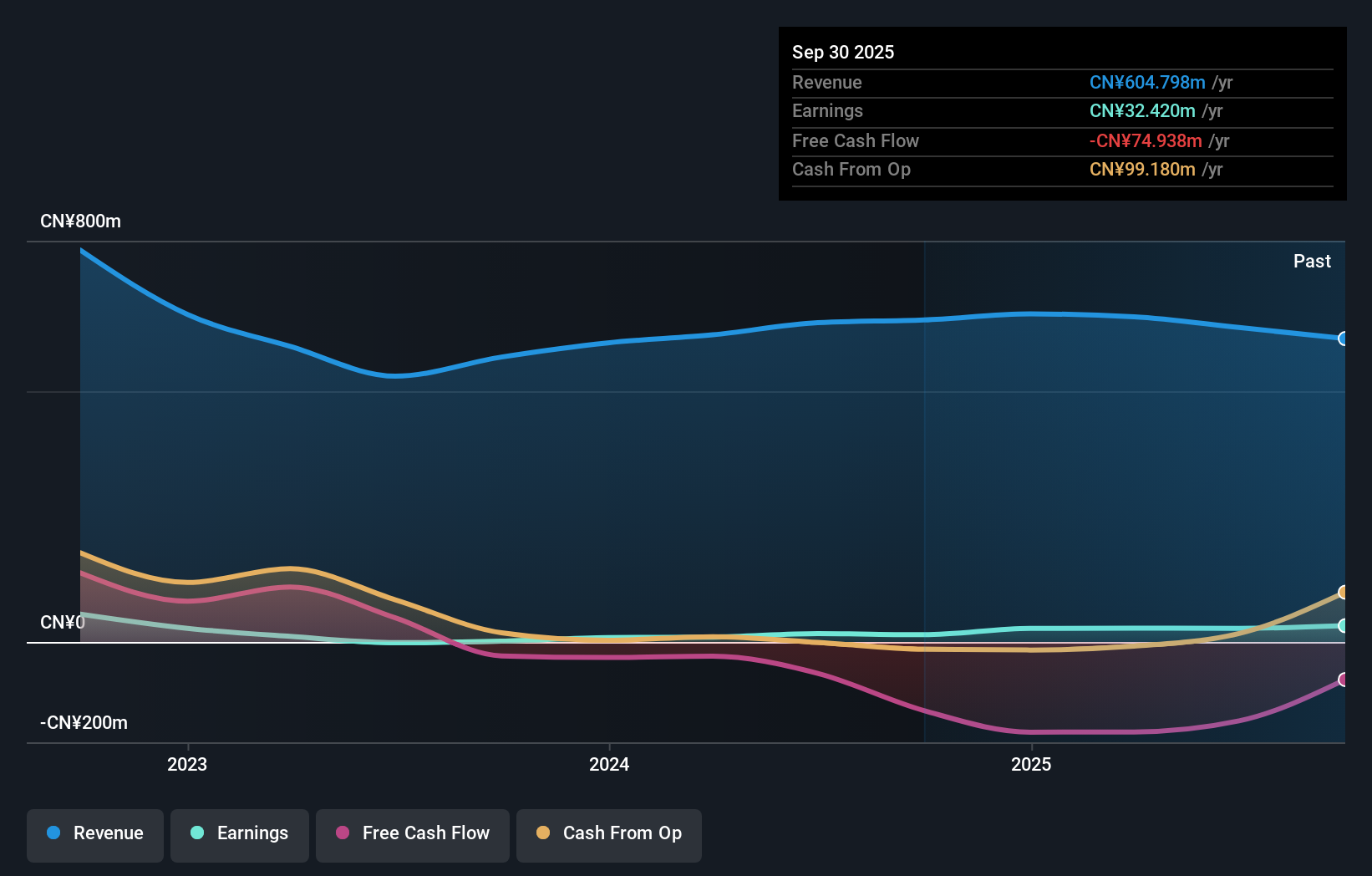

Operations: Talant Optronics generates its revenue primarily from the sale of computer peripherals, amounting to CN¥642.10 million.

Talant Optronics, a smaller player in the electronics sector, has shown impressive earnings growth of 866.5% over the past year, outpacing the industry average of 1.9%. The company's debt to equity ratio has improved significantly from 31.5% to 9.4% over five years, suggesting better financial health. Despite recent shareholder dilution and negative free cash flow figures like -CNY 136.84 million as of September 2024, Talant's high non-cash earnings indicate solid operational performance. Recent developments include a CNY 99.52 million stake acquisition by Shanghai Fortune Asset Management and others, highlighting investor interest in its potential growth trajectory.

TAUNS LaboratoriesInc (TSE:197A)

Simply Wall St Value Rating: ★★★★★☆

Overview: TAUNS Laboratories, Inc. is involved in the development, manufacture, export/import, and sale of in vitro diagnostics and research reagents both in Japan and internationally, with a market cap of ¥54.27 billion.

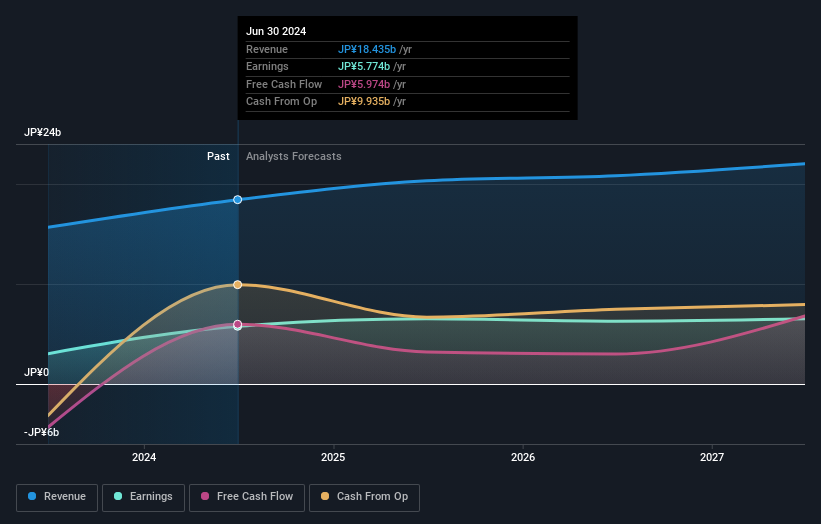

Operations: The primary revenue stream for TAUNS Laboratories comes from its IVD Business, generating ¥18.43 billion. The company's market cap stands at ¥54.27 billion, reflecting its valuation in the industry.

TAUNS Laboratories Inc. is making waves with a notable earnings growth of 90% over the past year, far outpacing the Medical Equipment industry's 6%. The company trades at an attractive value, being 42% below its estimated fair value, which suggests potential upside for investors. Despite recent volatility in its share price, TAUNS maintains a satisfactory net debt to equity ratio of 0.8%, indicating prudent financial management. Recent executive changes aim to strengthen leadership across key divisions like Sales & Marketing and R&D, potentially setting the stage for continued growth and innovation in their operations.

- Click here to discover the nuances of TAUNS LaboratoriesInc with our detailed analytical health report.

Gain insights into TAUNS LaboratoriesInc's past trends and performance with our Past report.

Seize The Opportunity

- Discover the full array of 4615 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Ligong Guangke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300557

Wuhan Ligong Guangke

Provides optical fiber sensor products and Internet of Things solutions in the fields of security and fire protection in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives