- China

- /

- Electronic Equipment and Components

- /

- SZSE:300546

What Shenzhen Emperor Technology Co., Ltd.'s (SZSE:300546) 46% Share Price Gain Is Not Telling You

Shenzhen Emperor Technology Co., Ltd. (SZSE:300546) shares have continued their recent momentum with a 46% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

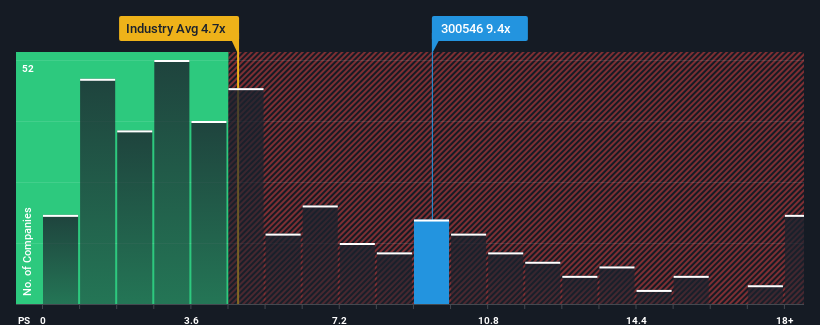

Since its price has surged higher, Shenzhen Emperor Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.4x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Shenzhen Emperor Technology

How Shenzhen Emperor Technology Has Been Performing

As an illustration, revenue has deteriorated at Shenzhen Emperor Technology over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Shenzhen Emperor Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Shenzhen Emperor Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Shenzhen Emperor Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Shenzhen Emperor Technology is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Shenzhen Emperor Technology's P/S?

The strong share price surge has lead to Shenzhen Emperor Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Shenzhen Emperor Technology currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen Emperor Technology, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300546

Shenzhen Emperor Technology

Operates as an identity products and solutions provider in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026