- China

- /

- Electronic Equipment and Components

- /

- SZSE:300515

The past one-year earnings decline for Hunan Sundy Science and Technology (SZSE:300515) likely explains shareholders long-term losses

Hunan Sundy Science and Technology Co., Ltd (SZSE:300515) shareholders should be happy to see the share price up 12% in the last week. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 22% in the last year, well below the market return.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Hunan Sundy Science and Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

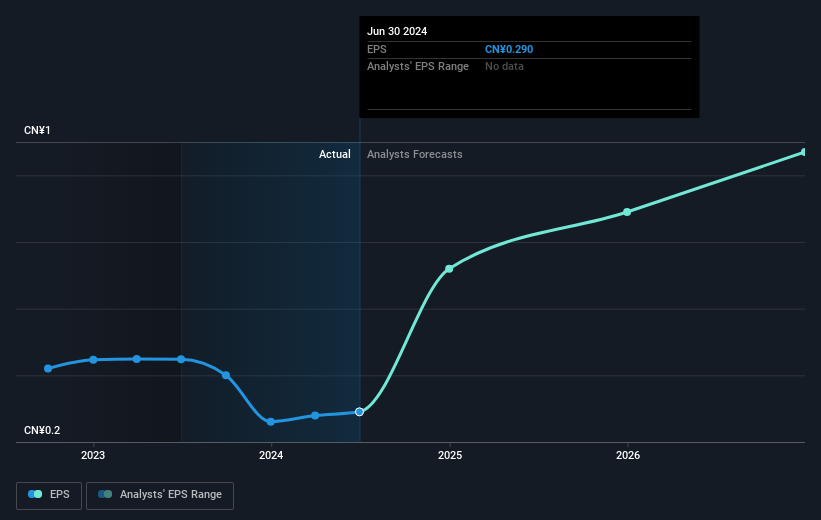

Unfortunately Hunan Sundy Science and Technology reported an EPS drop of 35% for the last year. This fall in the EPS is significantly worse than the 22% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, Hunan Sundy Science and Technology shareholders did even worse, losing 21% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Hunan Sundy Science and Technology better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Hunan Sundy Science and Technology .

We will like Hunan Sundy Science and Technology better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Sundy Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300515

Hunan Sundy Science and Technology

Supplies coal analysis solutions in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.