- China

- /

- Auto Components

- /

- SHSE:603009

3 Insider-Favored Growth Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, growth stocks have generally lagged behind value shares, with small-caps showing resilience compared to their larger counterparts. In this environment, insider ownership can be a key indicator of confidence in a company's potential for growth, making it an important factor to consider when evaluating stocks.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

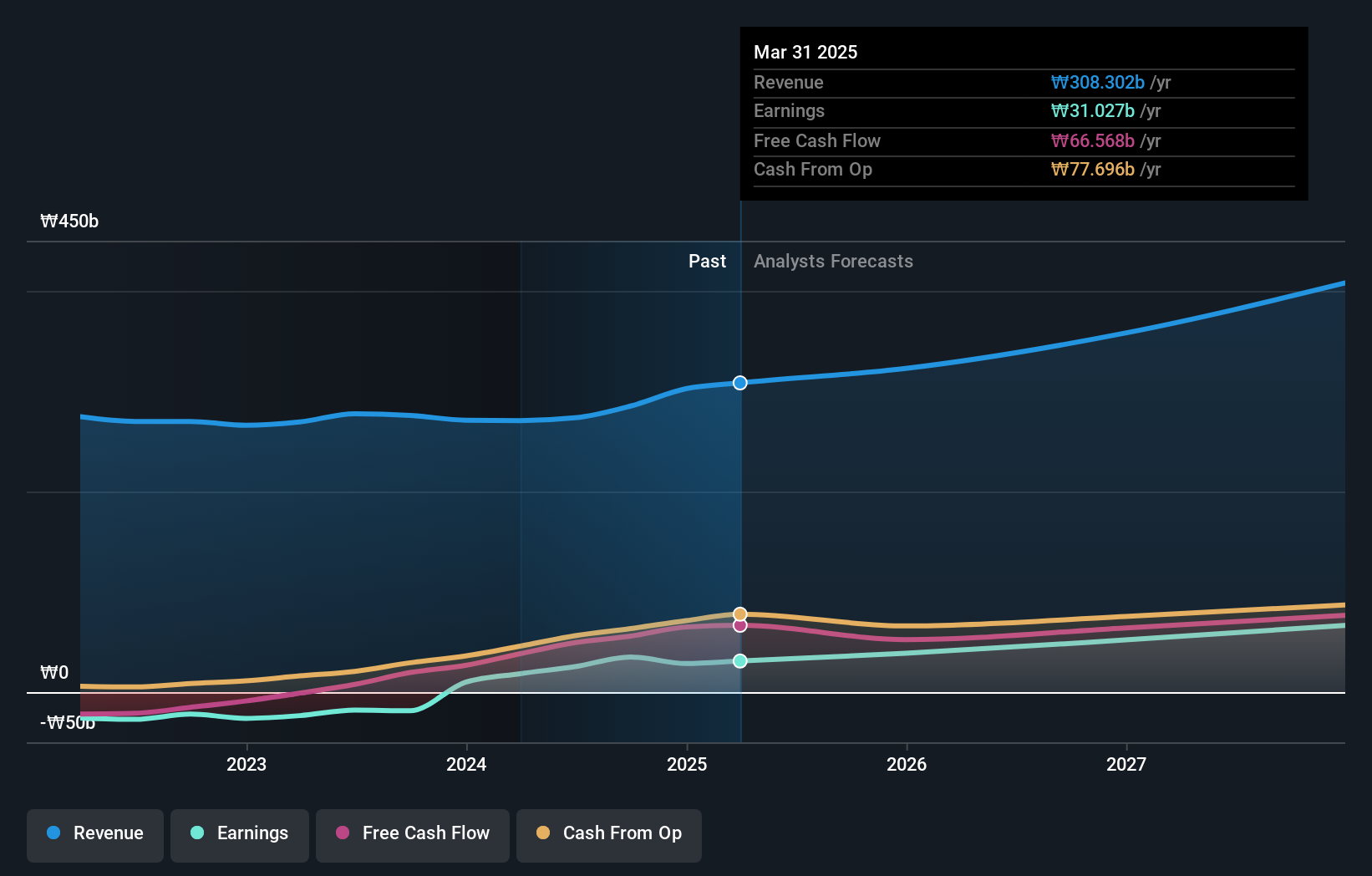

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩599.62 billion.

Operations: The company generates revenue through its e-commerce platform with segments including Transit at ₩42.97 billion, Clothing at ₩21.03 billion, and Internet Business Solution at ₩230.51 billion.

Insider Ownership: 23.4%

Earnings Growth Forecast: 42.8% p.a.

Cafe24 has shown potential as a growth company with high insider ownership, becoming profitable this year and forecasting significant earnings growth of 42.78% annually over the next three years. Despite recent shareholder dilution and a volatile share price, its revenue is expected to grow faster than the Korean market at 11% per year. Trading at 35.4% below estimated fair value suggests an attractive entry point, although return on equity remains low at 13.3%.

- Get an in-depth perspective on Cafe24's performance by reading our analyst estimates report here.

- The analysis detailed in our Cafe24 valuation report hints at an inflated share price compared to its estimated value.

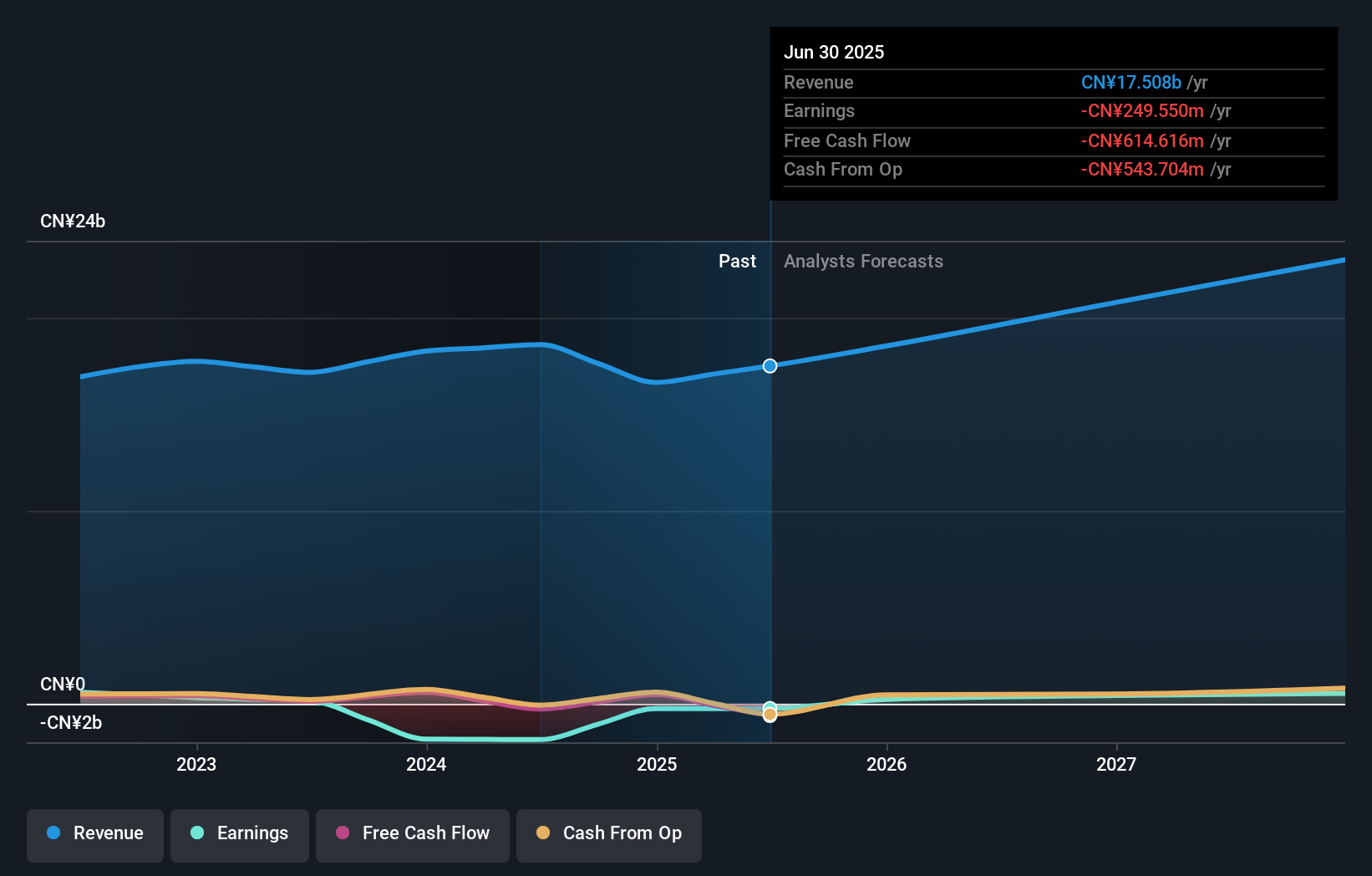

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers mainly in Mainland China, with a market capitalization of approximately HK$4.70 billion.

Operations: The company's revenue is derived from three main segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion).

Insider Ownership: 23.5%

Earnings Growth Forecast: 61.8% p.a.

Digital China Holdings, trading at 50.2% below estimated fair value, offers potential as a growth company with substantial insider ownership. Despite facing competitive pressures impacting profitability, the company's earnings are forecast to grow significantly at 61.82% annually and it is expected to become profitable within three years. Revenue growth of 9.8% per year is projected to outpace the Hong Kong market average of 7.8%, positioning it well against industry peers despite current low return on equity forecasts of 7.6%.

- Click to explore a detailed breakdown of our findings in Digital China Holdings' earnings growth report.

- The analysis detailed in our Digital China Holdings valuation report hints at an deflated share price compared to its estimated value.

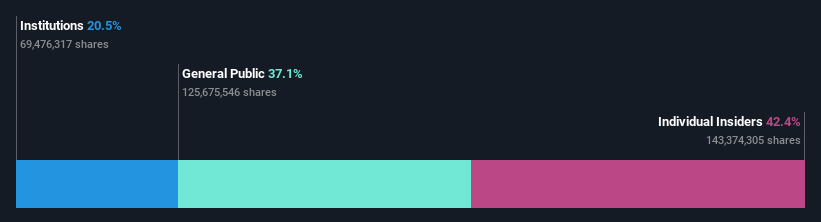

Shanghai Beite Technology (SHSE:603009)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Beite Technology Co., Ltd. operates in China, offering chassis parts, automotive air-conditioning compressors, high-precision parts, and aluminum forging lightweight components with a market cap of CN¥9.49 billion.

Operations: The company's revenue segments include chassis parts, automotive air-conditioning compressors, high-precision components, and aluminum forging lightweight parts in China.

Insider Ownership: 40%

Earnings Growth Forecast: 36.7% p.a.

Shanghai Beite Technology demonstrates strong growth potential with recent earnings showing a net income increase to CNY 60.81 million from CNY 28.82 million year-over-year. The company's revenue is expected to grow at 21.8% annually, surpassing the Chinese market average of 14%. Although insider trading data is unavailable for the past three months, projected annual earnings growth of 36.7% suggests robust performance prospects despite a modest future return on equity forecast of 8.6%.

- Click here to discover the nuances of Shanghai Beite Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Shanghai Beite Technology implies its share price may be too high.

Turning Ideas Into Actions

- Explore the 1534 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603009

Shanghai Beite Technology

Provides chassis parts, automotive air-conditioning compressors, high-precision parts, and aluminum forging lightweight parts in China.

High growth potential with solid track record.