In the current global market landscape, characterized by a busy earnings season and mixed economic signals, investors are navigating through cautious growth forecasts and fluctuating indices. Amidst these conditions, dividend stocks continue to attract attention for their potential to provide steady income streams; especially appealing when markets are volatile. A good dividend stock in such an environment is one that not only offers a reliable yield but also demonstrates resilience against broader economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2023 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Shede Spirits (SHSE:600702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shede Spirits Co., Ltd., along with its subsidiaries, designs, produces, and sells liquor products in China with a market capitalization of CN¥22.22 billion.

Operations: Shede Spirits Co., Ltd. generates its revenue primarily from the design, production, and sale of liquor products in China.

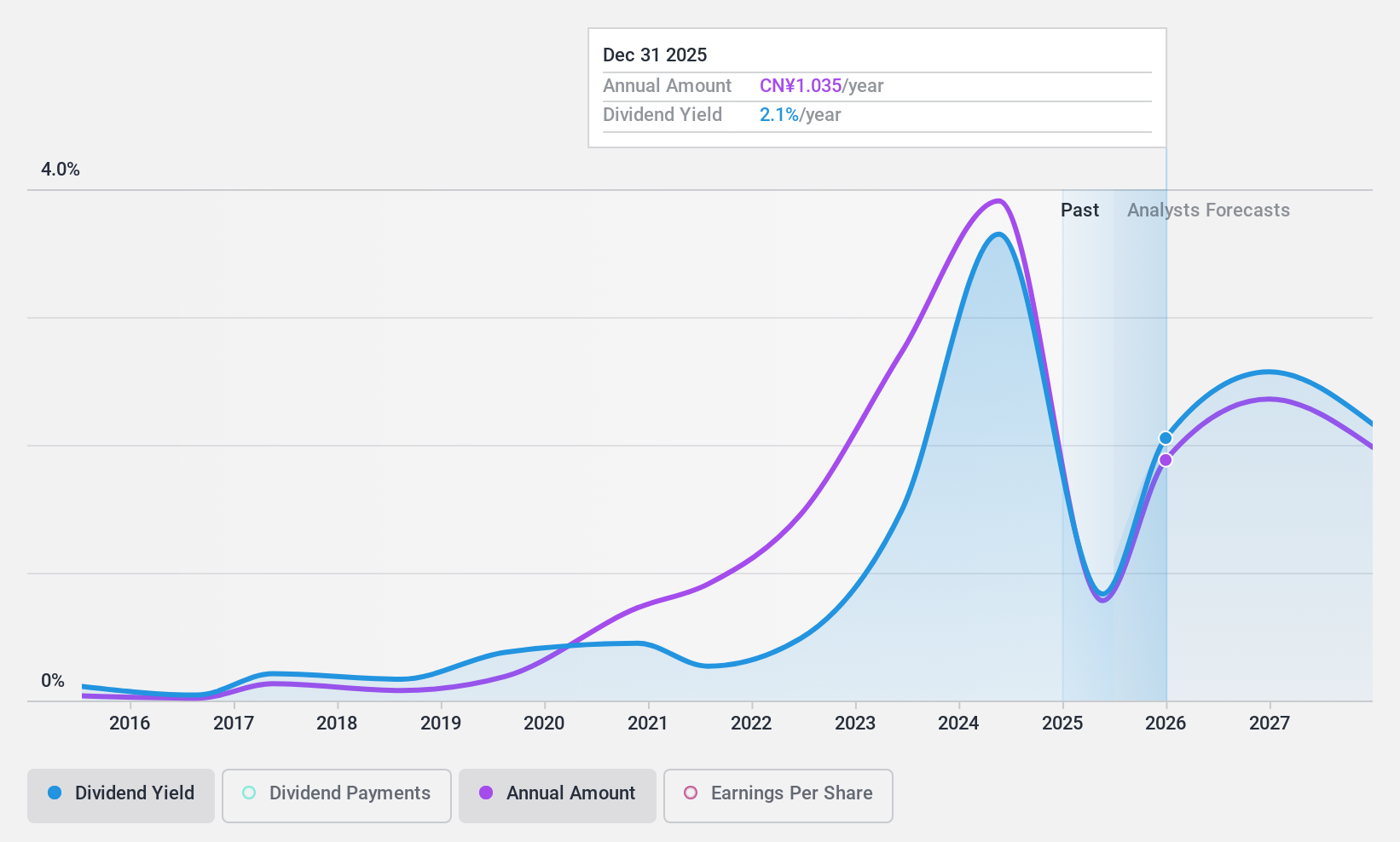

Dividend Yield: 3%

Shede Spirits offers a mixed dividend profile. While its dividend yield of 3.03% ranks in the top 25% of CN market payers, the dividends have been unreliable and volatile over the past decade. Despite a reasonable payout ratio, dividends are not well covered by free cash flows. The company is trading at a significant discount to its estimated fair value and has initiated a share repurchase program, reflecting efforts to enhance shareholder value amidst declining earnings and revenue.

- Get an in-depth perspective on Shede Spirits' performance by reading our dividend report here.

- Our valuation report here indicates Shede Spirits may be undervalued.

Anhui HeliLtd (SHSE:600761)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Heli Co., Ltd. manufactures and sells industrial vehicles both in China and internationally, with a market cap of CN¥16.56 billion.

Operations: Anhui Heli Co., Ltd.'s revenue primarily comes from its Forklifts and Accessories segment, which generated CN¥17.75 billion.

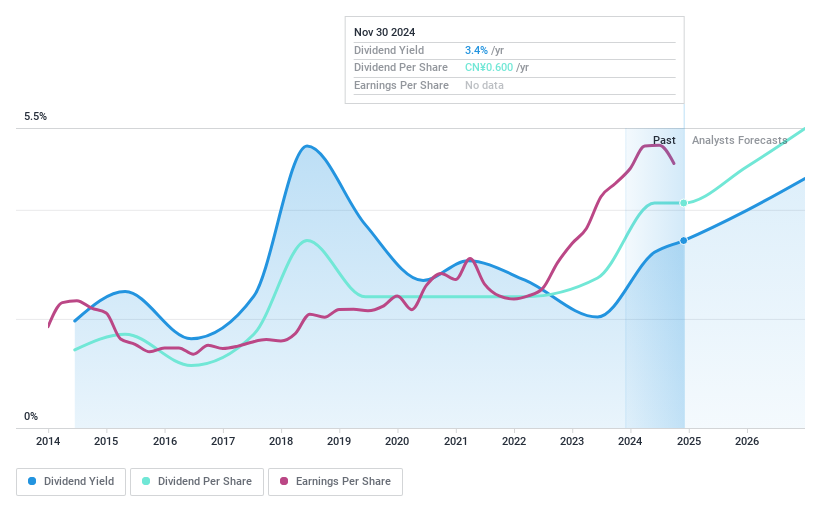

Dividend Yield: 3.1%

Anhui Heli Ltd. presents a nuanced dividend profile. Its 3.09% yield is among the top 25% in the CN market, supported by a low payout ratio of 34%. However, dividends have been volatile and not well covered by free cash flows, raising sustainability concerns. Despite this, earnings grew by 15.5% over the past year with recent net income reaching CNY 1.10 billion for nine months ending September 2024, indicating potential for future stability if cash flow issues are addressed.

- Dive into the specifics of Anhui HeliLtd here with our thorough dividend report.

- Our valuation report unveils the possibility Anhui HeliLtd's shares may be trading at a discount.

Kanematsu (TSE:8020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kanematsu Corporation engages in the trading of commercial products both in Japan and internationally, with a market cap of ¥194.02 billion.

Operations: Kanematsu Corporation's revenue is derived from several key segments, including Electronic Devices at ¥350.19 billion, Food, Meat & Grain at ¥350.11 billion, Steel/Materials/Plants at ¥210.71 billion, and Vehicles/Aviation at ¥103.78 billion.

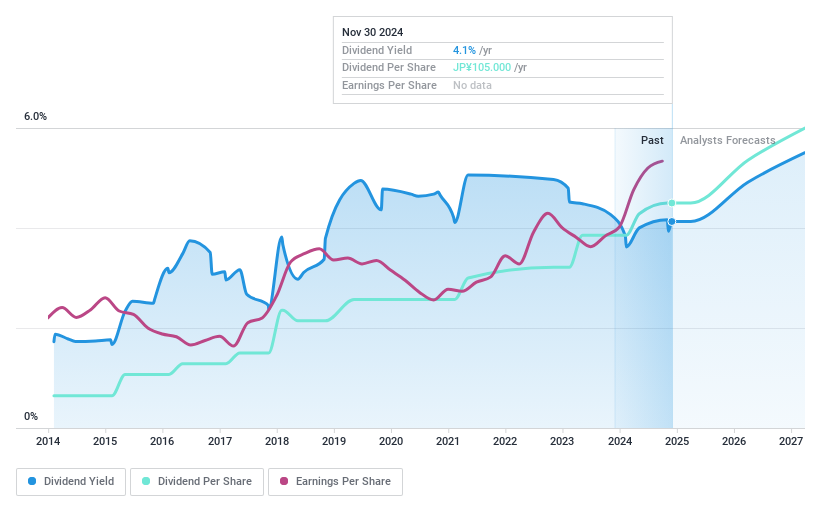

Dividend Yield: 4.2%

Kanematsu offers a compelling dividend profile with a yield of 4.19%, ranking in the top 25% within Japan, and a low payout ratio of 31.3% indicating strong earnings coverage. However, its dividends have been volatile over the past decade despite recent growth in payments. The company's financial position is challenged by high debt levels, yet it trades at good value compared to peers and industry standards, suggesting potential investment appeal amidst these risks.

- Click here to discover the nuances of Kanematsu with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Kanematsu is priced lower than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 2023 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600761

Anhui HeliLtd

Engages in the manufacture and sale of industrial vehicles in the People’s Republic of China and internationally.

Adequate balance sheet average dividend payer.