- China

- /

- Electronic Equipment and Components

- /

- SZSE:300515

Hunan Sundy Science and Technology Co., Ltd. (SZSE:300515) Shares Fly 29% But Investors Aren't Buying For Growth

Those holding Hunan Sundy Science and Technology Co., Ltd. (SZSE:300515) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

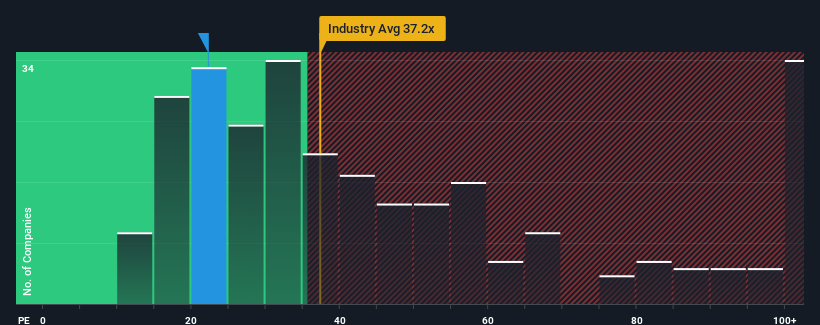

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Hunan Sundy Science and Technology as an attractive investment with its 22.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Hunan Sundy Science and Technology over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Hunan Sundy Science and Technology

Is There Any Growth For Hunan Sundy Science and Technology?

In order to justify its P/E ratio, Hunan Sundy Science and Technology would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 4.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 45% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Hunan Sundy Science and Technology is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Hunan Sundy Science and Technology's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hunan Sundy Science and Technology maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hunan Sundy Science and Technology, and understanding these should be part of your investment process.

You might be able to find a better investment than Hunan Sundy Science and Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hunan Sundy Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300515

Hunan Sundy Science and Technology

Supplies coal analysis solutions in the People’s Republic of China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026