High Growth Tech Stocks Including Intellego Technologies And Two More

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by cautious sentiment as major U.S. stock indexes, including the Nasdaq Composite and Russell 2000, experienced declines amid hawkish commentary from Federal Reserve officials and ongoing inflation concerns. Despite these challenges, high-growth tech stocks like Intellego Technologies continue to attract attention for their potential to offer innovative solutions and capture market opportunities in a rapidly evolving economic landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Intellego Technologies (OM:INT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Intellego Technologies AB, with a market cap of SEK4.34 billion, specializes in the production and sale of colorimetric ultraviolet indicators in Sweden.

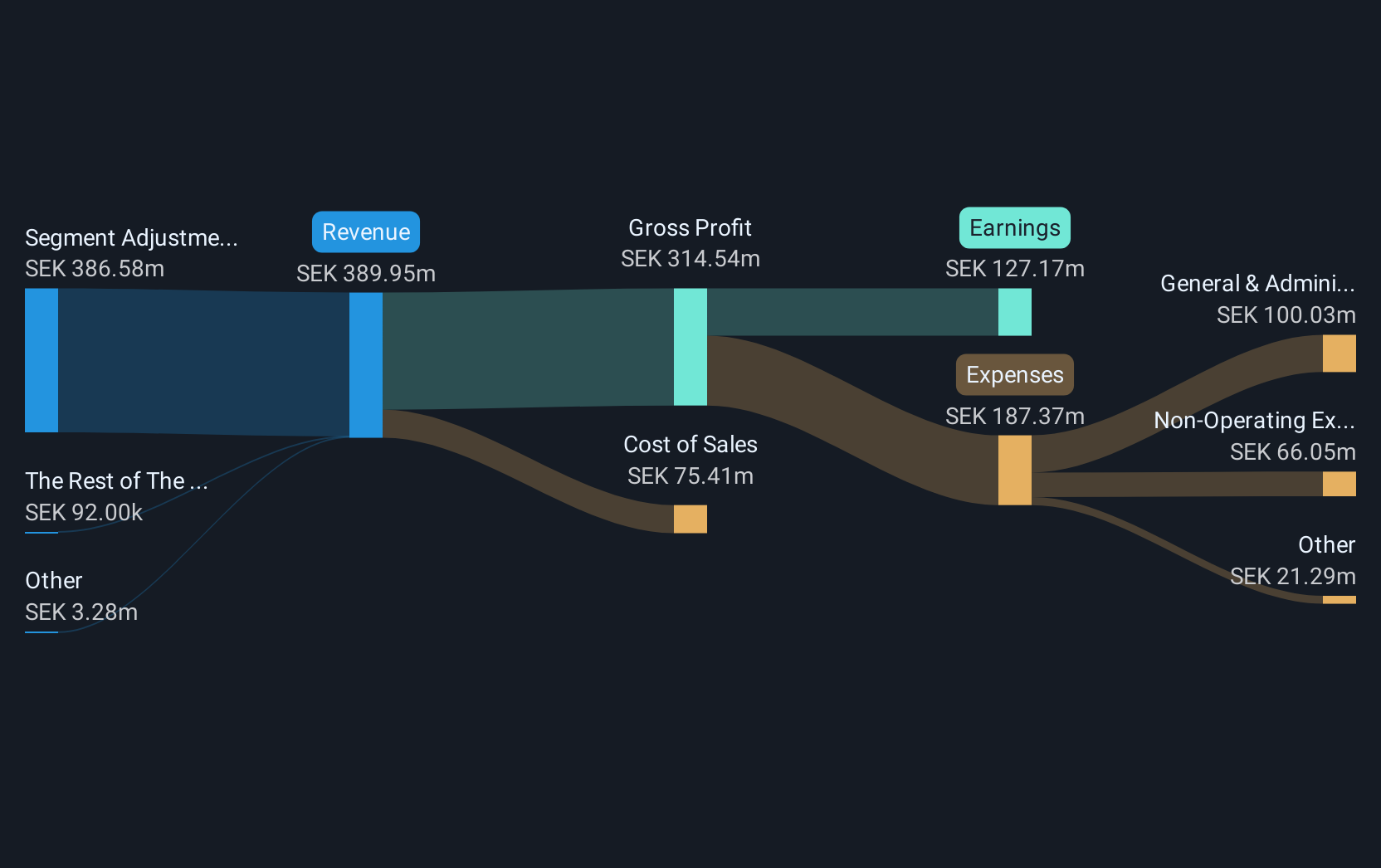

Operations: Intellego Technologies AB generates revenue primarily from its Electronic Components & Parts segment, which contributes SEK554.24 million. The company focuses on the production and sale of colorimetric ultraviolet indicators within Sweden.

Intellego Technologies has demonstrated remarkable growth, with earnings surging by 172.6% over the past year and an anticipated annual increase of 46.9%. This performance starkly outpaces the broader Swedish market's growth, positioning INT for potential future gains. Recent inclusion in the S&P Global BMI Index underscores its rising industry stature amid volatile market conditions. With a robust forecast for both revenue and earnings growth significantly above market averages, Intellego is navigating its sector with strategic prowess, evidenced by a fourfold increase in half-year revenues to SEK 418 million from SEK 132 million previously. This financial trajectory is supported by high non-cash earnings, suggesting efficient operations and potentially sustainable profitability moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Intellego Technologies.

Assess Intellego Technologies' past performance with our detailed historical performance reports.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers a range of network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥18.95 billion.

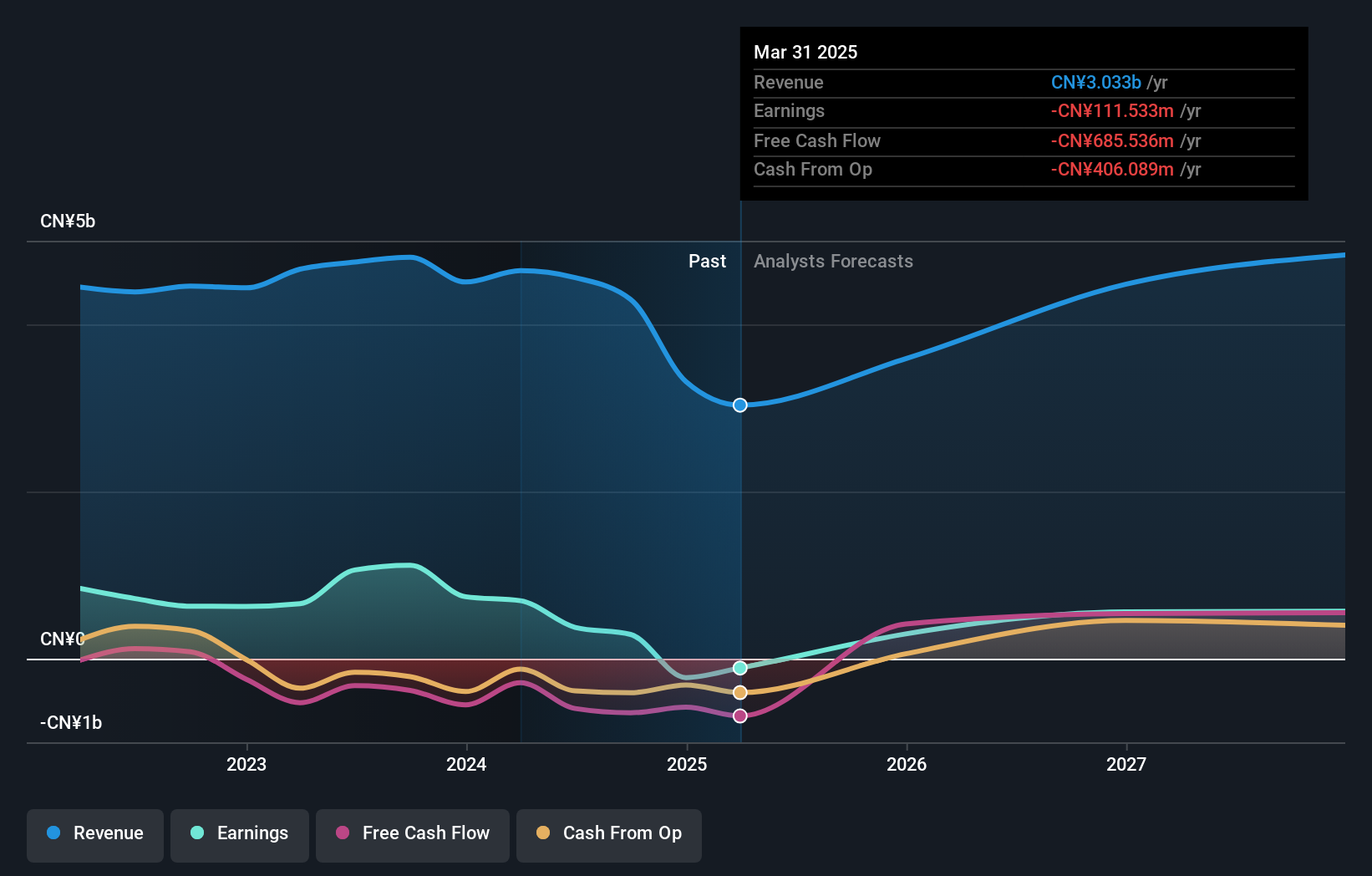

Operations: The company's primary revenue stream is from Information Network Security, generating CN¥2.85 billion.

Venustech Group, navigating through a transformative phase, is poised to shift from unprofitability with a projected annual earnings growth of 47.84%. This anticipated change is supported by an aggressive R&D investment strategy, crucial for fostering innovation in cybersecurity solutions. Despite current challenges, the company's revenue is expected to expand at 19.5% annually, outpacing the broader Chinese market's growth rate of 14.1%. With its upcoming earnings release on August 27, 2025, Venustech aims to showcase the fruits of its strategic pivots and R&D endeavors in a highly competitive tech landscape.

- Dive into the specifics of Venustech Group here with our thorough health report.

Explore historical data to track Venustech Group's performance over time in our Past section.

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both domestically in the People’s Republic of China and internationally, with a market cap of CN¥4.04 billion.

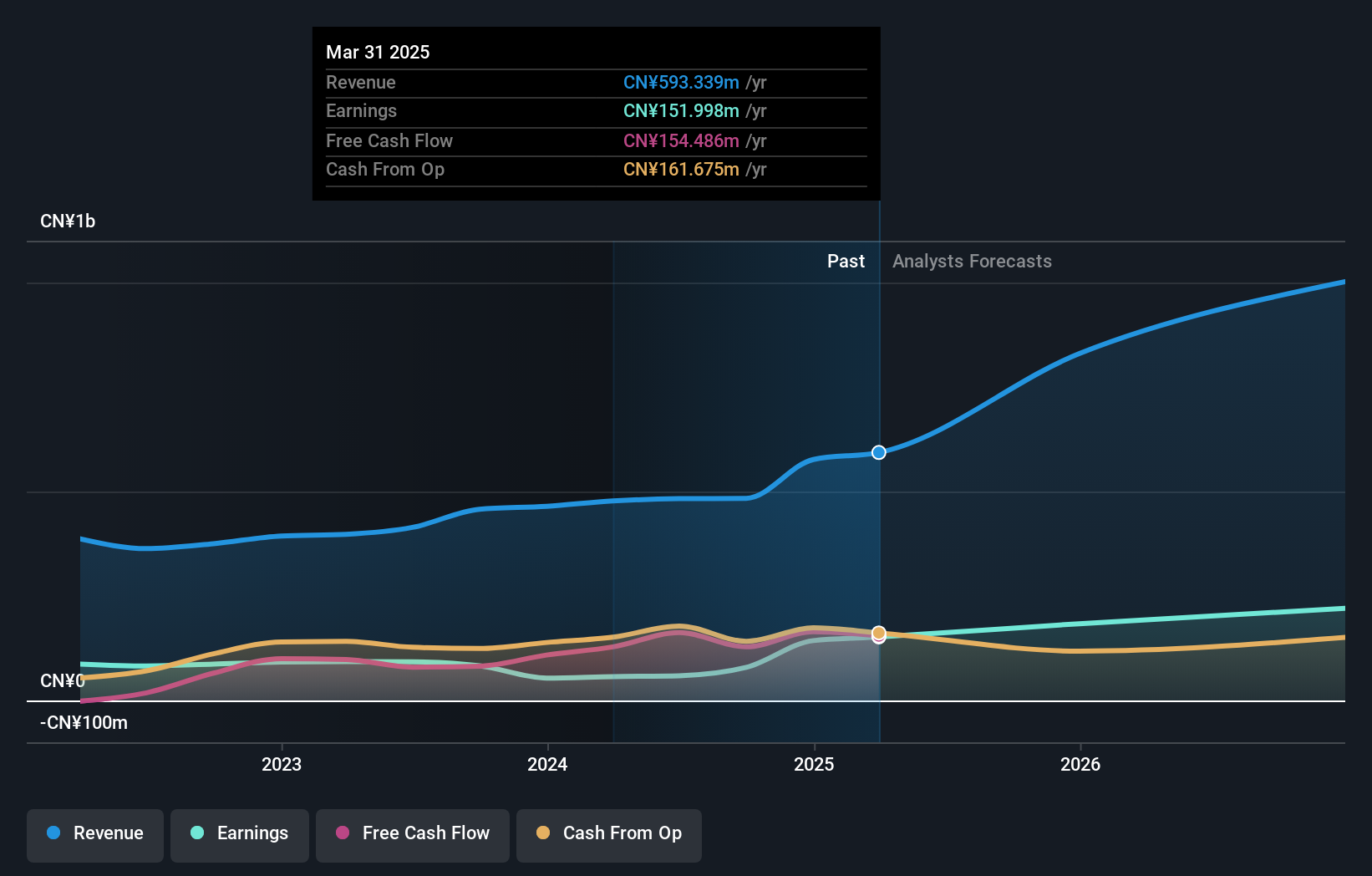

Operations: Sundy Science and Technology generates revenue primarily from its instrumentation industry segment, totaling CN¥638.94 million. The company focuses on supplying coal analysis solutions across domestic and international markets.

Hunan Sundy Science and Technology has demonstrated robust growth, with a notable increase in half-year revenues to CNY 248.83 million from CNY 186.48 million, reflecting a surge of 33.5%. This growth is underpinned by an aggressive R&D strategy, which saw expenses climb significantly, aligning with the company's focus on innovation in its tech offerings. Recent corporate governance enhancements also signal a strategic pivot aimed at bolstering operational efficiency and market responsiveness. As earnings per share rose from CNY 0.2083 to CNY 0.3056, the company's financial health appears resilient amidst volatile market conditions.

- Unlock comprehensive insights into our analysis of Hunan Sundy Science and Technology stock in this health report.

Understand Hunan Sundy Science and Technology's track record by examining our Past report.

Next Steps

- Dive into all 243 of the Global High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INT

Intellego Technologies

Manufactures and sells colorimetric ultraviolet indicators in Sweden.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives