Amidst a backdrop of global market optimism fueled by expectations of economic growth and tax reforms following the recent U.S. election, major indices like the small-cap Russell 2000 have experienced significant gains, reflecting investor confidence in potentially favorable business conditions. In this environment, identifying promising high-growth tech stocks involves focusing on companies with innovative solutions and strong adaptability to evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

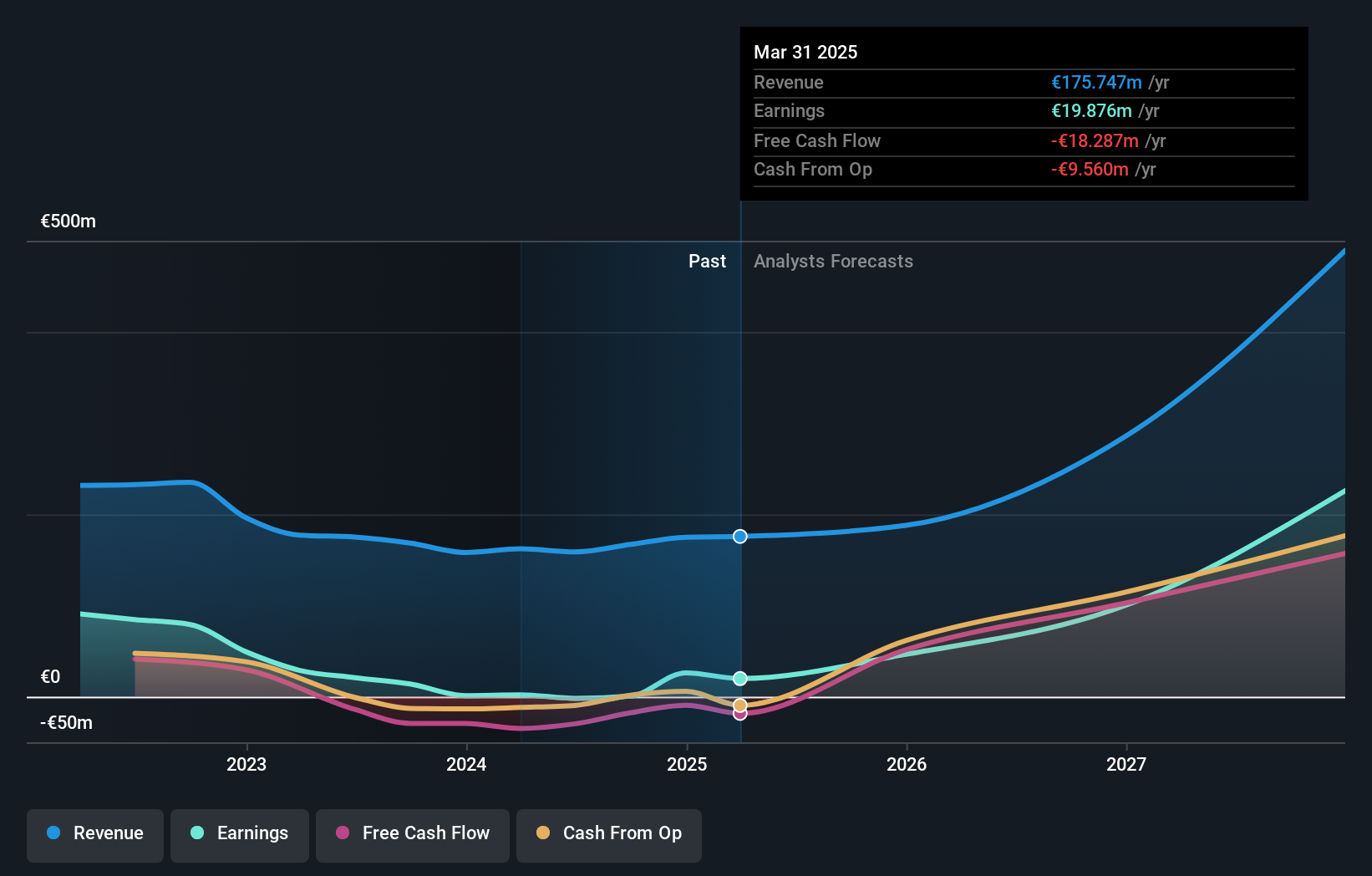

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of approximately €1.38 billion.

Operations: The company primarily generates revenue from its oncology segment, amounting to approximately €154.75 million. It operates across multiple international markets, including Spain, Italy, Germany, Ireland, France, the rest of the European Union, and the United States.

Pharma Mar, despite a challenging year with earnings shrinking by 95.5%, remains poised for substantial growth, forecasting a 56.4% annual increase in earnings. This potential is underpinned by robust projected revenue growth of 26.9% per year, significantly outpacing the Spanish market's average. Recent clinical successes further bolster its prospects; notably, the Phase 3 trial of Zepzelca® combined with Tecentriq® showed promising results, enhancing overall survival rates in lung cancer treatment—a key milestone that could lead to European regulatory approval in early 2025.

- Take a closer look at Pharma Mar's potential here in our health report.

Assess Pharma Mar's past performance with our detailed historical performance reports.

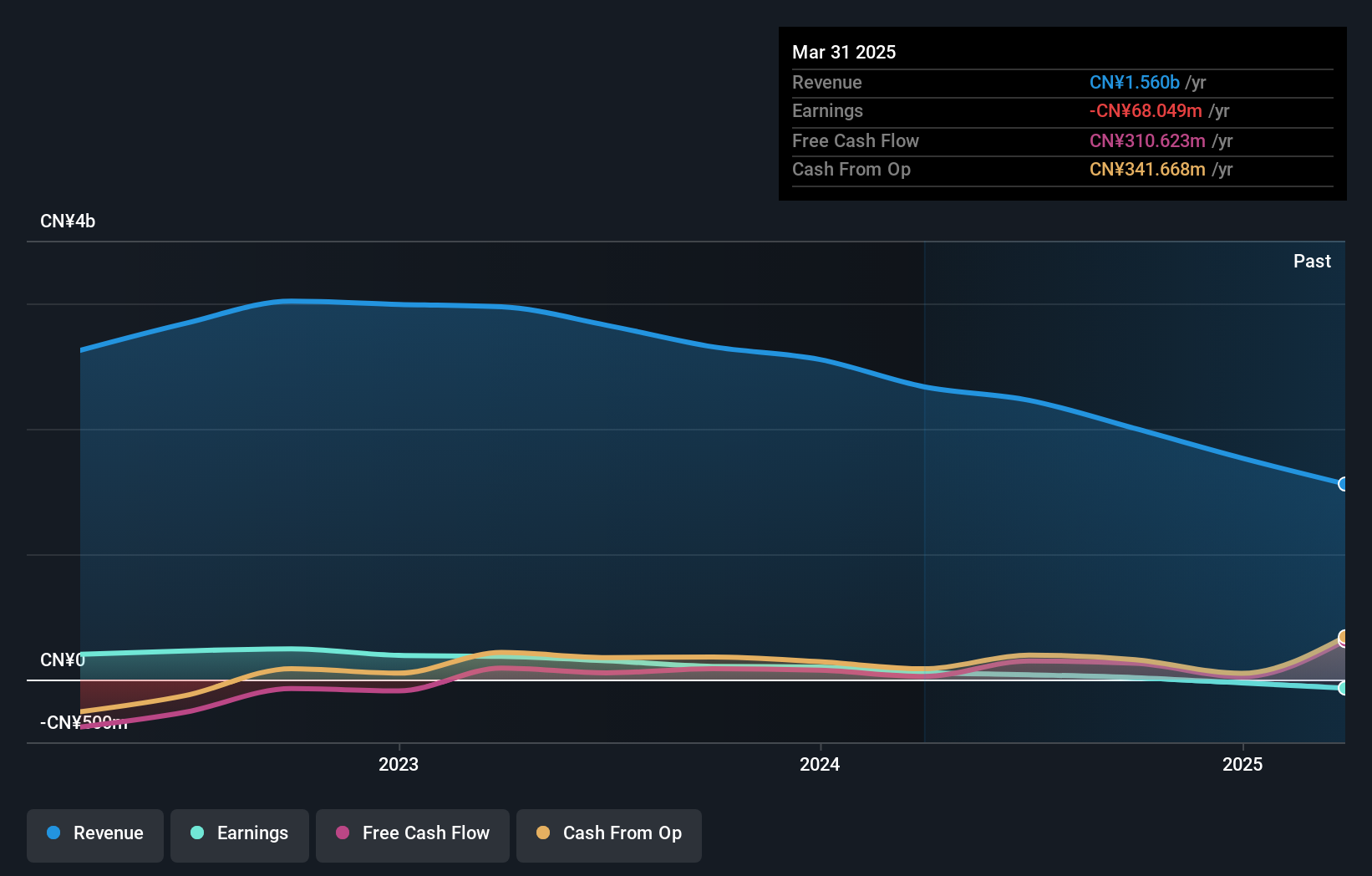

Sichuan Tianyi Comheart Telecom (SZSE:300504)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Tianyi Comheart Telecom Co., Ltd. operates in the telecommunications industry and has a market capitalization of CN¥5.04 billion.

Operations: Sichuan Tianyi Comheart Telecom Co., Ltd. focuses on the telecommunications sector, generating revenue through various service offerings tailored to this industry. The company's financial structure is influenced by its operational costs and strategic investments in technology and infrastructure.

Sichuan Tianyi Comheart Telecom, despite a challenging year with revenue falling to CNY 1.45 billion from CNY 2 billion and net income dropping to CNY 38.47 million from CNY 123.63 million, is positioned for recovery with expected earnings growth of 64.1% annually. The company's inclusion in the S&P Global BMI Index underscores its potential relevance in the tech sector, particularly as it navigates through market volatility with a focus on expanding its technological capabilities and enhancing operational efficiencies. This strategic pivot is crucial as it aims to outpace China's communications industry growth rate of 14%, targeting a more robust revenue increase of 17.7% per year, reflecting its commitment to regain momentum and strengthen market position.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a wide range of internet services globally and has a market capitalization of ¥288.47 billion.

Operations: The company generates revenue primarily from its Internet Infrastructure segment, which contributes ¥177.49 billion, followed by the Internet Finance Business at ¥44.04 billion and the Internet Advertising and Media Business at ¥34.54 billion. The Crypto Asset Business also plays a role with ¥6.49 billion in revenue, while the Incubation Business adds ¥1.04 billion to its financial portfolio.

GMO Internet Group, navigating through a tech landscape marked by rapid change, reported a robust earnings growth of 284.6% over the past year, significantly outpacing the IT industry's average of 10.2%. This performance is underpinned by strategic R&D investments which have been crucial in maintaining a competitive edge. The company's commitment to innovation is evident from its R&D expenses, aligning closely with revenue growth projections of 8.1% annually—though slightly below the high-growth benchmark of 20%. Additionally, GMO has actively returned value to shareholders by repurchasing shares worth ¥3.409 billion, enhancing shareholder confidence amidst market fluctuations. Looking ahead, with an expected annual profit growth rate of 14.4%, GMO stands well-positioned to capitalize on evolving market dynamics and sustain its growth trajectory in the competitive tech sector.

- Navigate through the intricacies of GMO internet group with our comprehensive health report here.

Understand GMO internet group's track record by examining our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 1284 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GMO internet group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9449

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives