- China

- /

- Electronic Equipment and Components

- /

- SHSE:603678

High Growth Tech Stocks In China To Watch October 2024

Reviewed by Simply Wall St

As Chinese equities faced a downturn over a holiday-shortened week, with the Shanghai Composite Index and the CSI 300 both experiencing notable declines, market participants are closely monitoring Beijing's economic stimulus measures to gauge their potential impact on growth. In this environment, identifying high-growth tech stocks in China requires careful consideration of companies that demonstrate resilience and adaptability amid shifting economic policies and global market dynamics.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.62% | 31.72% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Torch Electron Technology Co., Ltd. is a company listed on the Shanghai Stock Exchange, with a market cap of CN¥12.12 billion, engaged in the development and manufacturing of electronic components.

Operations: Fujian Torch Electron Technology focuses on the development and manufacturing of electronic components. The company generates revenue primarily from its product sales in the electronics sector, with a significant portion attributed to specific high-demand components.

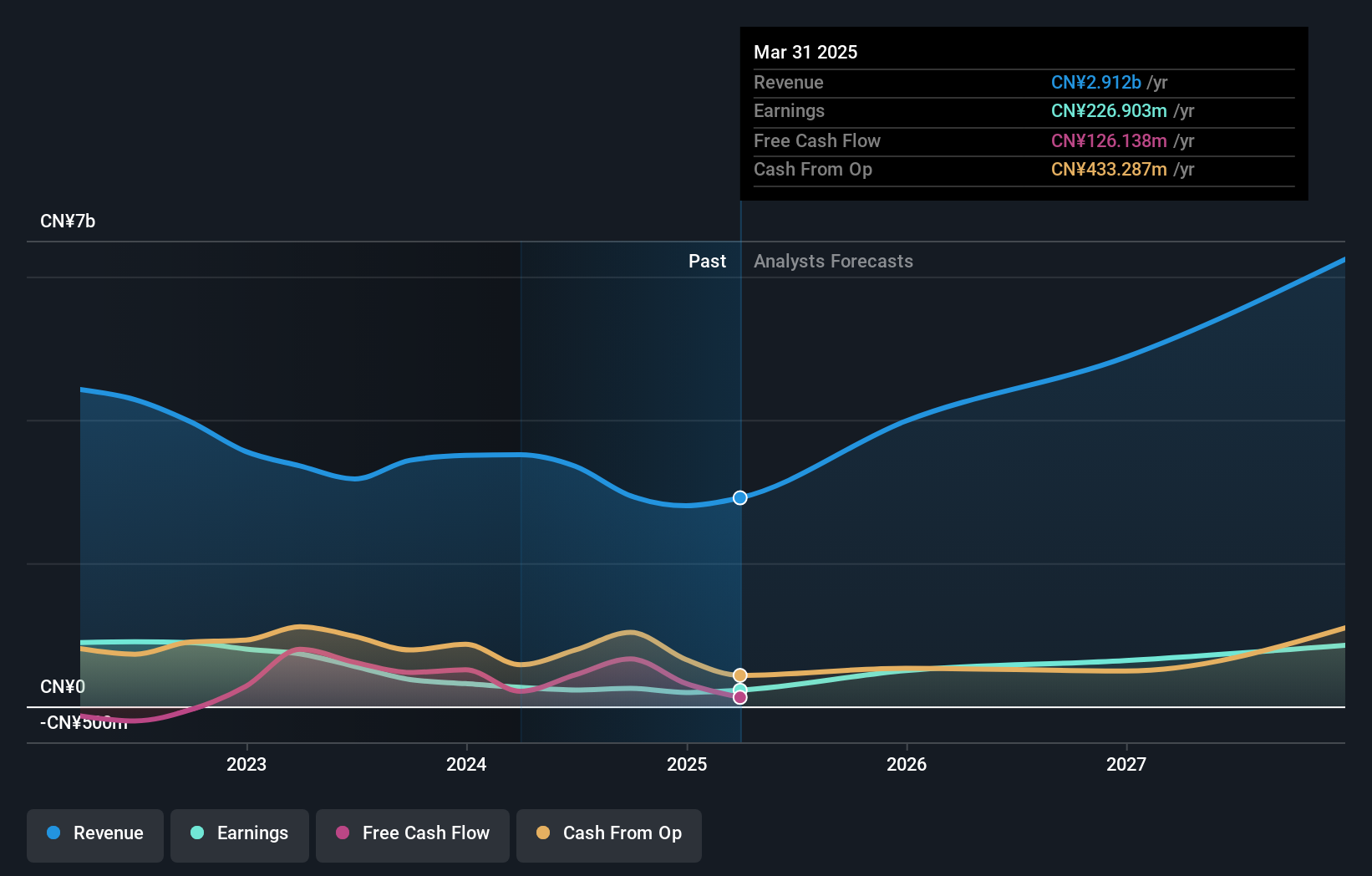

Fujian Torch Electron Technology, amidst a challenging fiscal period, reported a significant revenue drop to CNY 1.43 billion from CNY 1.58 billion year-over-year, alongside a stark decline in net income from CNY 253.68 million to CNY 164.27 million. Despite these setbacks, the company's projected annual earnings growth of 31.9% outpaces the Chinese market's average of 23.4%, highlighting its potential resilience and adaptability in the high-tech sector. Additionally, with an R&D expense ratio that has consistently aligned with top-tier tech innovation standards, Fujian Torch is poised to maintain its competitive edge through continuous technological advancements and product development.

- Click here to discover the nuances of Fujian Torch Electron Technology with our detailed analytical health report.

Understand Fujian Torch Electron Technology's track record by examining our Past report.

Skyworth Digital (SZSE:000810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Skyworth Digital Co., Ltd. is engaged in the global production and sale of home video entertainment and intelligent connectivity solutions, with a market cap of CN¥12.89 billion.

Operations: Skyworth Digital focuses on manufacturing and distributing home video entertainment systems and intelligent connectivity products globally. The company generates revenue through these core segments, with a market cap of CN¥12.89 billion.

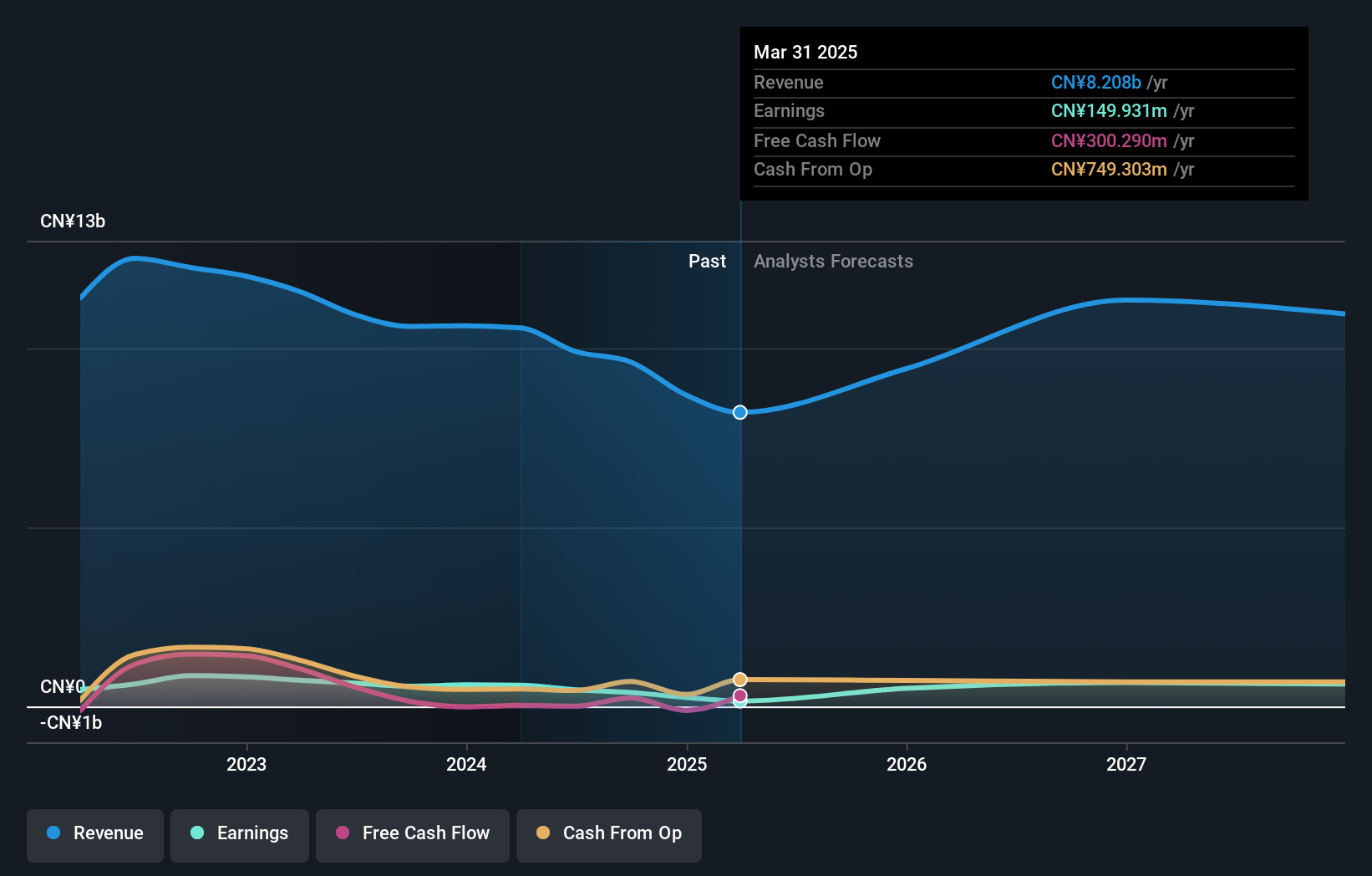

Skyworth Digital, navigating a turbulent market, saw a revenue dip to CNY 4.45 billion from CNY 5.17 billion year-over-year, reflecting broader industry challenges. Despite this downturn, the company's earnings are expected to surge by 27.9% annually, outpacing the Chinese market average growth of 23.4%. This robust projection is underpinned by Skyworth's commitment to innovation as evidenced by its R&D expenses which have been pivotal in maintaining its competitive edge in the high-tech landscape of China. With an eye on future trends and customer needs, Skyworth is poised for recovery and growth as it continues to invest in transformative technologies and product development strategies.

- Unlock comprehensive insights into our analysis of Skyworth Digital stock in this health report.

Evaluate Skyworth Digital's historical performance by accessing our past performance report.

Sichuan Tianyi Comheart Telecom (SZSE:300504)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Tianyi Comheart Telecom Co., Ltd. operates in the telecommunications sector and has a market capitalization of CN¥4.44 billion.

Operations: Sichuan Tianyi Comheart Telecom Co., Ltd. generates its revenue primarily from the telecommunications sector, focusing on various service offerings within this industry. The company emphasizes operational efficiency and cost management to optimize profitability, reflected in its financial metrics.

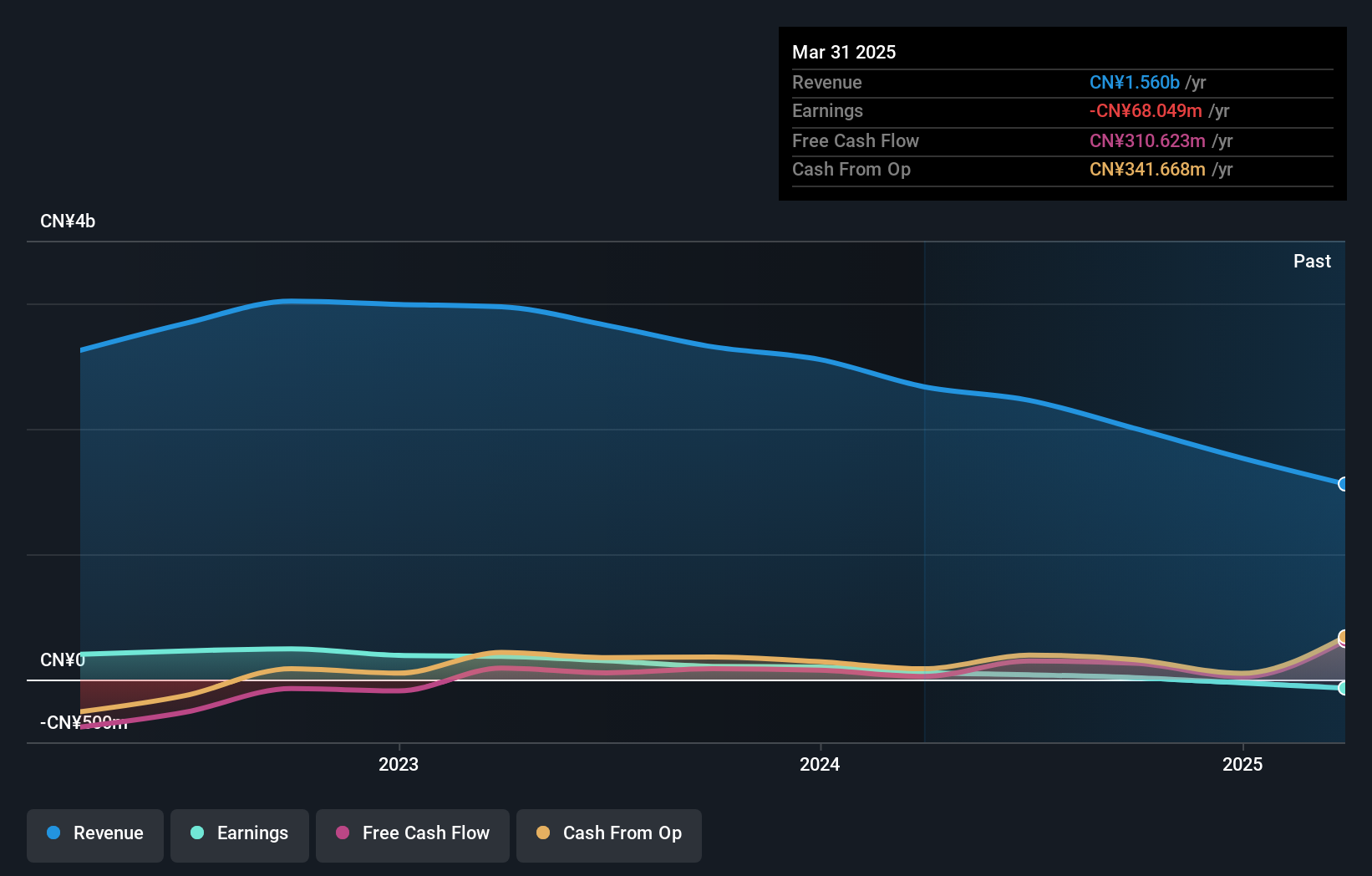

Despite a challenging period with a significant revenue drop from CNY 1.38 billion to CNY 1.05 billion, Sichuan Tianyi Comheart Telecom has managed to keep investor interest by being added to the S&P Global BMI Index. This inclusion reflects its potential in the tech sector, underscored by an aggressive R&D strategy which continues to fuel innovation and competitiveness in a rapidly evolving market. Moreover, with earnings expected to surge by 53.1% annually—outperforming the broader Chinese market growth of 23.4%—the company is positioning itself for a robust recovery and sustained growth, leveraging both its technological advancements and strategic market maneuvers.

- Dive into the specifics of Sichuan Tianyi Comheart Telecom here with our thorough health report.

Learn about Sichuan Tianyi Comheart Telecom's historical performance.

Summing It All Up

- Explore the 256 names from our Chinese High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603678

Fujian Torch Electron Technology

Fujian Torch Electron Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives