- China

- /

- Entertainment

- /

- SZSE:300133

November 2024's High Insider Ownership Growth Leaders

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are closely monitoring economic indicators like jobless claims and home sales for signs of sustained growth. Amidst this backdrop of optimism tempered by geopolitical uncertainties, companies with high insider ownership often attract attention due to the perceived alignment of interests between management and shareholders, potentially making them appealing in today's market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Underneath we present a selection of stocks filtered out by our screen.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research, development, production, sale, and technical services of mass spectrometry products in China with a market cap of CN¥2.83 billion.

Operations: The company's revenue is primarily generated from its Mass Spectrometer Business, which amounts to CN¥266.19 million.

Insider Ownership: 34.4%

Guangzhou Hexin Instrument Co., Ltd. is experiencing significant revenue growth, forecasted at 67% annually, outpacing the broader CN market's 13.8%. Despite a current net loss of CNY 22.15 million for the first nine months of 2024, it is expected to become profitable within three years. The recent private placement announced on November 4, with a lock-up period of 36 months, indicates strategic insider confidence amidst highly volatile share prices recently observed.

- Take a closer look at Guangzhou Hexin InstrumentLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Guangzhou Hexin InstrumentLtd is priced higher than what may be justified by its financials.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

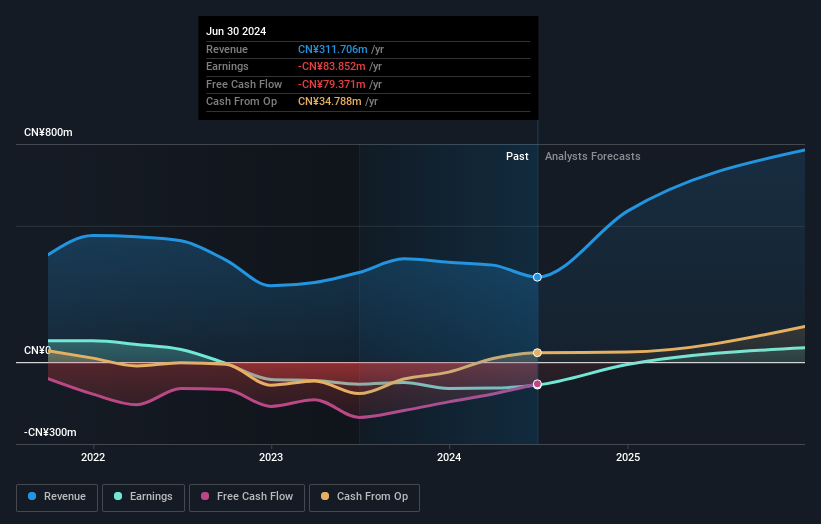

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥14 billion.

Operations: The company generates revenue from the production, distribution, and derivative activities related to film and television dramas across domestic and international markets.

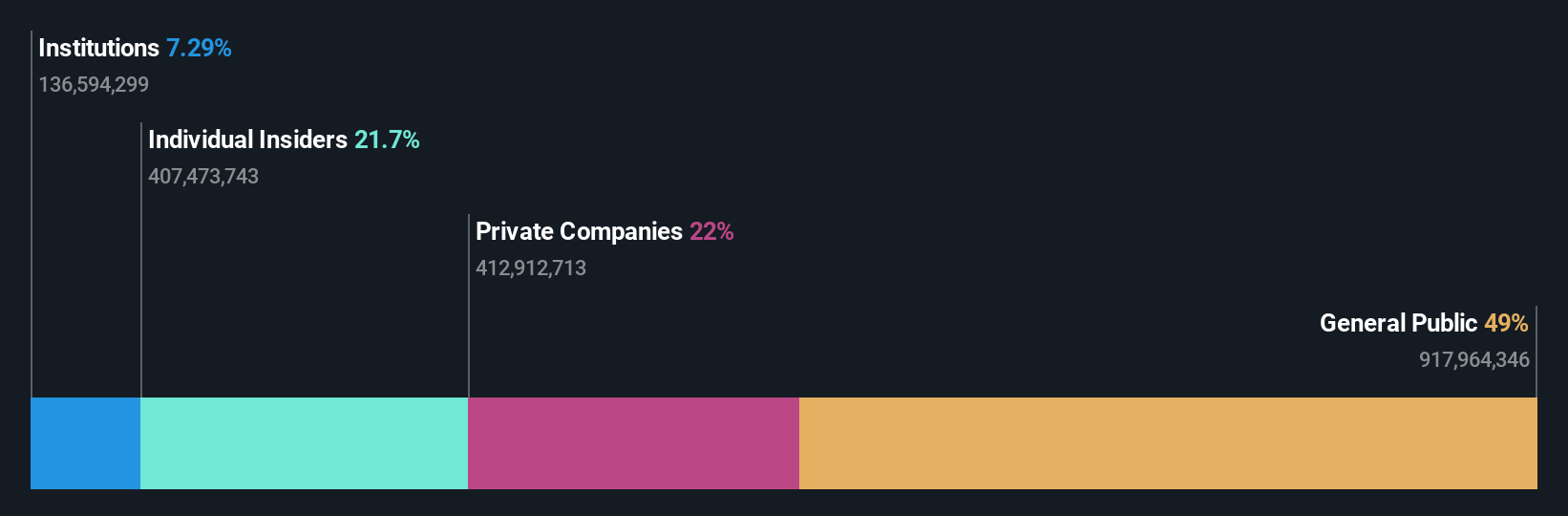

Insider Ownership: 21.7%

Zhejiang Huace Film & TV is forecast to achieve robust earnings growth of 35.5% annually, surpassing the CN market's average. However, recent financial results show a decline in revenue to CNY 892.54 million from CNY 1.46 billion year-over-year, with net income halving to CNY 166.23 million. Despite high insider ownership, no significant insider trading was reported recently, and the share price has been highly volatile over the past three months.

- Click to explore a detailed breakdown of our findings in Zhejiang Huace Film & TV's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Zhejiang Huace Film & TV shares in the market.

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. develops and sells micro-electromechanical systems (MEMS) products in China, with a market capitalization of CN¥13.69 billion.

Operations: Sai MicroElectronics Inc. focuses on the development and sale of micro-electromechanical systems (MEMS) products within China.

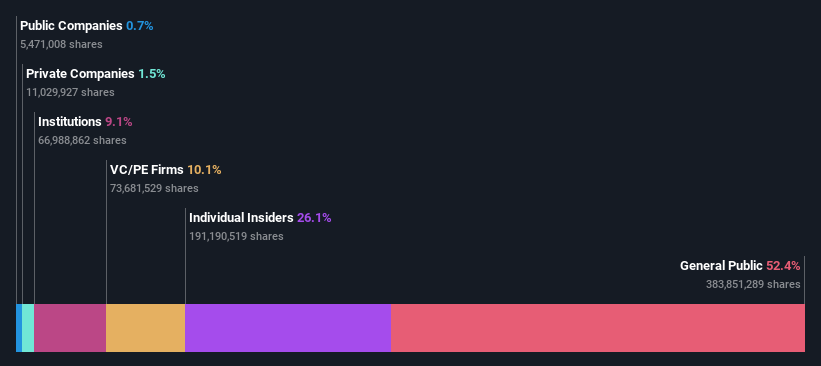

Insider Ownership: 26%

Sai MicroElectronics is forecast to achieve substantial revenue growth of 30.1% annually, outpacing the CN market average. Despite this positive outlook, recent financial results reveal a decline in revenue from CNY 909.44 million to CNY 825.23 million year-over-year and a net loss of CNY 117.77 million compared to a prior net income of CNY 12.26 million. The company has experienced significant share price volatility recently, with no notable insider trading activity reported over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Sai MicroElectronics.

- Our valuation report here indicates Sai MicroElectronics may be overvalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1529 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huace Film & TV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

High growth potential with excellent balance sheet.