- China

- /

- Aerospace & Defense

- /

- SZSE:300324

3 Promising Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap indexes outperforming large-caps, investors are increasingly looking beyond traditional stocks for opportunities. Penny stocks, though a term from earlier market days, continue to represent a viable investment area by spotlighting smaller or newer companies with potential growth. By focusing on those with strong financials and clear growth prospects, investors can uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.59 | MYR352.84M | ★★★★★★ |

Click here to see the full list of 5,786 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Beijing UBOX Online Technology (SEHK:2429)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing UBOX Online Technology Corp. operates vending machines in Mainland China and has a market cap of HK$4.02 billion.

Operations: The company's revenue is primarily derived from its Unmanned Retail Business, which generated CN¥1.96 billion, followed by Merchandise Wholesale at CN¥419.28 million, Advertising and System Support Services at CN¥119.95 million, and Vending Machine Sales and Leases contributing CN¥32.02 million.

Market Cap: HK$4.02B

Beijing UBOX Online Technology Corp. has shown resilience in its financial structure, with short-term assets of CN¥833.6 million exceeding both short and long-term liabilities, indicating solid liquidity management. Despite being unprofitable, the company has successfully reduced its net loss over recent years and reported a slight increase in sales to CN¥1.34 billion for the first half of 2024. The seasoned management team contributes to strategic stability, although high share price volatility persists as a risk factor for investors considering this stock within the penny stock landscape. The company also maintains a significant cash runway extending beyond three years.

- Jump into the full analysis health report here for a deeper understanding of Beijing UBOX Online Technology.

- Evaluate Beijing UBOX Online Technology's historical performance by accessing our past performance report.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cnlight Co., Ltd manufactures and sells lighting products in China, with a market cap of CN¥2.35 billion.

Operations: Cnlight Co., Ltd does not report specific revenue segments for its operations in China.

Market Cap: CN¥2.35B

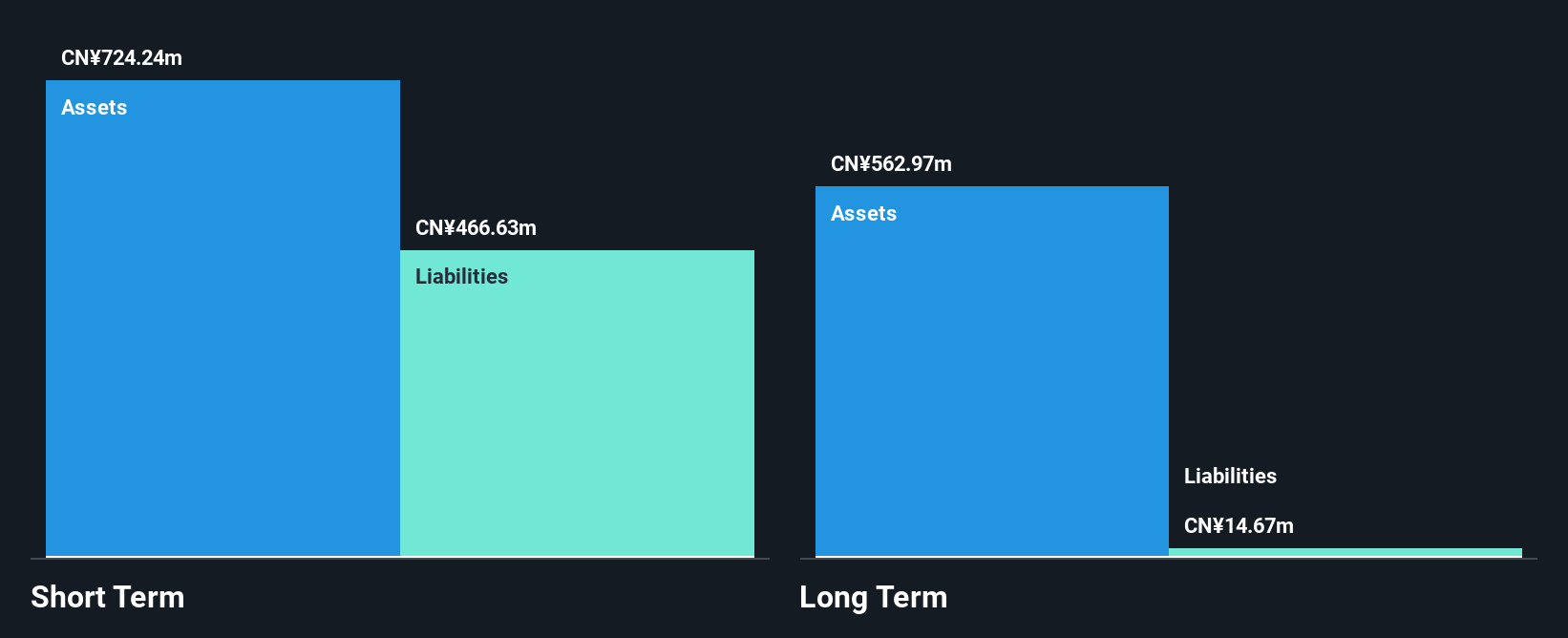

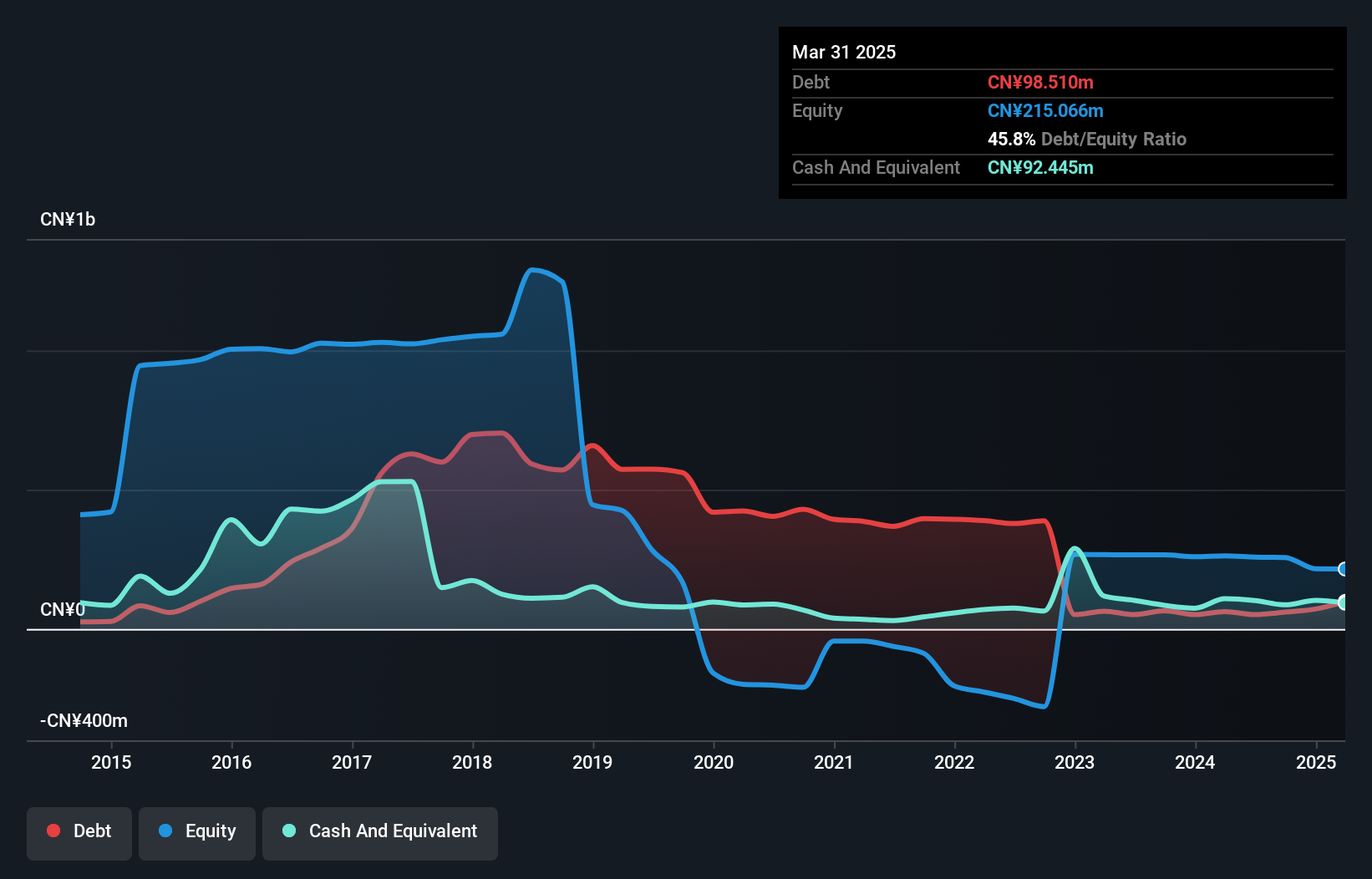

Cnlight Co., Ltd has demonstrated improved financial health, with short-term assets of CN¥267.8 million surpassing both short and long-term liabilities, reflecting effective liquidity management. The company remains unprofitable but has significantly narrowed its net loss over the past five years by 67.8% annually and reported a revenue increase to CN¥123.98 million for the first nine months of 2024 compared to the previous year. Although its debt-to-equity ratio has dramatically reduced over five years, Cnlight faces challenges with less than a year of cash runway if current free cash flow trends continue, posing risks in the penny stock environment.

- Click to explore a detailed breakdown of our findings in CnlightLtd's financial health report.

- Learn about CnlightLtd's historical performance here.

Beijing Watertek Information Technology (SZSE:300324)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Watertek Information Technology Co., Ltd. operates in the information technology sector and has a market cap of CN¥6.53 billion.

Operations: The company's revenue primarily comes from the Software and Information Technology Services Industry, amounting to CN¥2.68 billion.

Market Cap: CN¥6.53B

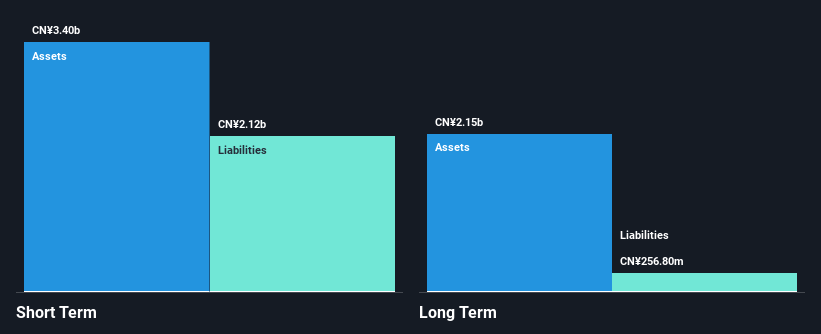

Beijing Watertek Information Technology Co., Ltd. has a market cap of CN¥6.53 billion and operates within the Software and Information Technology Services Industry, generating revenue of CN¥2.68 billion. Despite its unprofitability, the company maintains a solid liquidity position with short-term assets of CN¥3.4 billion exceeding both short- and long-term liabilities, indicating effective financial management amidst declining earnings over recent years. The firm has experienced increased losses, reporting a net loss of CN¥143.91 million for the first nine months of 2024 compared to the previous year, yet it benefits from having more cash than total debt and no significant shareholder dilution recently observed in this volatile penny stock landscape.

- Take a closer look at Beijing Watertek Information Technology's potential here in our financial health report.

- Gain insights into Beijing Watertek Information Technology's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Discover the full array of 5,786 Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Watertek Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300324

Beijing Watertek Information Technology

Beijing Watertek Information Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.