- China

- /

- Electronic Equipment and Components

- /

- SZSE:300416

We Think Suzhou Sushi Testing GroupLtd (SZSE:300416) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Suzhou Sushi Testing Group Co.,Ltd. (SZSE:300416) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Suzhou Sushi Testing GroupLtd

What Is Suzhou Sushi Testing GroupLtd's Debt?

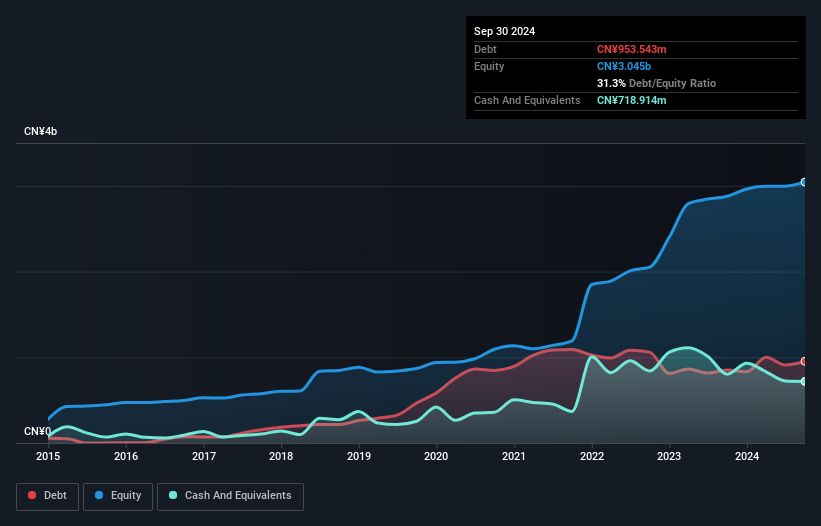

The image below, which you can click on for greater detail, shows that at September 2024 Suzhou Sushi Testing GroupLtd had debt of CN¥953.5m, up from CN¥851.1m in one year. However, because it has a cash reserve of CN¥718.9m, its net debt is less, at about CN¥234.6m.

How Healthy Is Suzhou Sushi Testing GroupLtd's Balance Sheet?

According to the last reported balance sheet, Suzhou Sushi Testing GroupLtd had liabilities of CN¥1.44b due within 12 months, and liabilities of CN¥466.8m due beyond 12 months. On the other hand, it had cash of CN¥718.9m and CN¥1.44b worth of receivables due within a year. So it can boast CN¥247.0m more liquid assets than total liabilities.

This short term liquidity is a sign that Suzhou Sushi Testing GroupLtd could probably pay off its debt with ease, as its balance sheet is far from stretched.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Suzhou Sushi Testing GroupLtd's net debt is only 0.49 times its EBITDA. And its EBIT easily covers its interest expense, being 16.1 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. But the bad news is that Suzhou Sushi Testing GroupLtd has seen its EBIT plunge 19% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Suzhou Sushi Testing GroupLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Suzhou Sushi Testing GroupLtd burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We feel some trepidation about Suzhou Sushi Testing GroupLtd's difficulty conversion of EBIT to free cash flow, but we've got positives to focus on, too. To wit both its interest cover and net debt to EBITDA were encouraging signs. Looking at all the angles mentioned above, it does seem to us that Suzhou Sushi Testing GroupLtd is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Suzhou Sushi Testing GroupLtd that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300416

Suzhou Sushi Testing GroupLtd

Provides environmental and reliability test verification and analysis services and solutions.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026