- China

- /

- Communications

- /

- SZSE:300394

Brokers Are Upgrading Their Views On Suzhou TFC Optical Communication Co., Ltd. (SZSE:300394) With These New Forecasts

Suzhou TFC Optical Communication Co., Ltd. (SZSE:300394) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

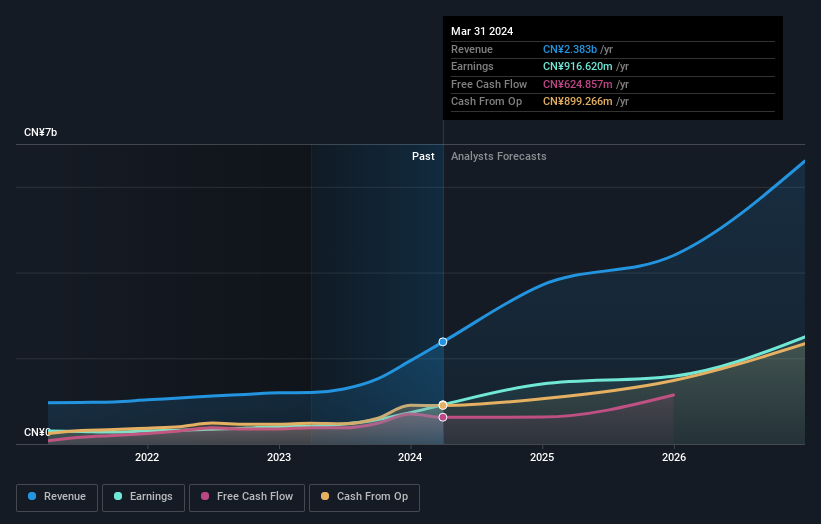

Following the upgrade, the most recent consensus for Suzhou TFC Optical Communication from its twelve analysts is for revenues of CN¥3.7b in 2024 which, if met, would be a sizeable 56% increase on its sales over the past 12 months. Statutory earnings per share are presumed to jump 53% to CN¥3.55. Previously, the analysts had been modelling revenues of CN¥3.1b and earnings per share (EPS) of CN¥2.82 in 2024. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for Suzhou TFC Optical Communication

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Suzhou TFC Optical Communication's rate of growth is expected to accelerate meaningfully, with the forecast 80% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 28% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 22% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Suzhou TFC Optical Communication is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The clear improvement in sentiment should be enough to get most shareholders feeling more optimistic about Suzhou TFC Optical Communication's future.

Analysts are definitely bullish on Suzhou TFC Optical Communication, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including concerns around earnings quality. You can learn more, and discover the 1 other flag we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300394

Suzhou TFC Optical Communication

Suzhou TFC Optical Communication Co., Ltd.

Exceptional growth potential, undervalued and pays a dividend.

Market Insights

Community Narratives