- China

- /

- Interactive Media and Services

- /

- SZSE:300494

High Growth Tech And 2 Other Innovative Stocks With Potential For Expansion

Reviewed by Simply Wall St

Amidst a volatile week for global markets, characterized by the Federal Reserve's steady interest rates and competitive tensions in the AI sector, technology stocks have experienced notable fluctuations. In this dynamic environment, identifying high-growth tech companies with innovative solutions and robust earnings potential can be crucial for investors seeking opportunities in sectors poised for expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1232 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

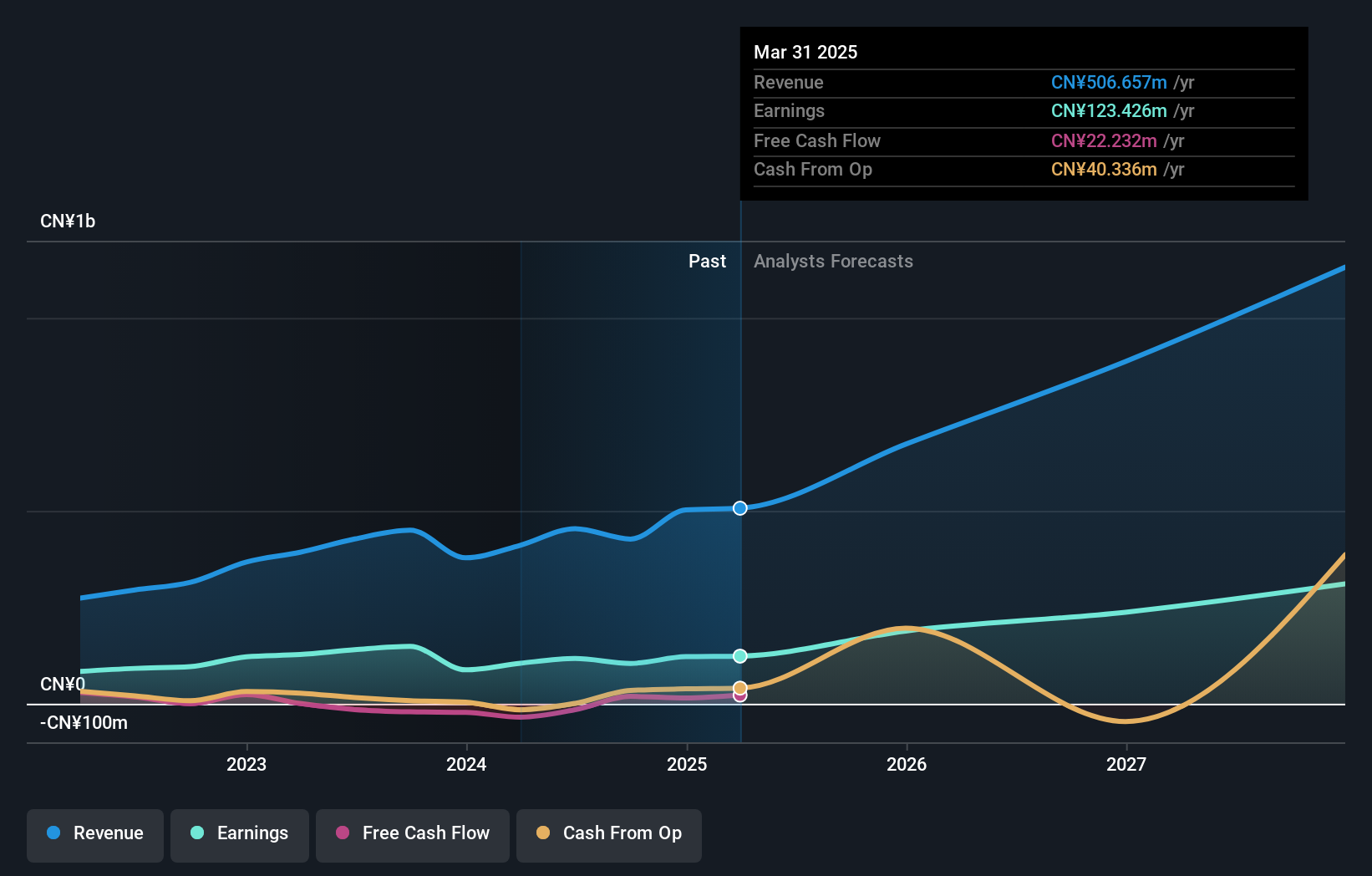

DongHua Testing Technology (SZSE:300354)

Simply Wall St Growth Rating: ★★★★★★

Overview: DongHua Testing Technology Co., Ltd. specializes in providing structural mechanical property testing services in China, with a market capitalization of CN¥5.50 billion.

Operations: The company generates revenue primarily from its instrumentation testing segment, amounting to CN¥426.74 million.

DongHua Testing Technology, amidst a robust tech landscape, is poised for significant growth with its revenue and earnings forecast to surge by 35.6% and 41% annually, outpacing the broader Chinese market's growth rates of 13.3% and 25%, respectively. Despite a recent dip in earnings by -29.6%, contrasting with the industry's modest gain of 2.3%, DongHua's aggressive investment in R&D highlights its commitment to innovation—crucial for sustaining long-term competitiveness in high-tech sectors. This strategic focus not only fuels future prospects but also enhances its standing among tech firms where continuous evolution is key to maintaining relevance and driving industry standards forward.

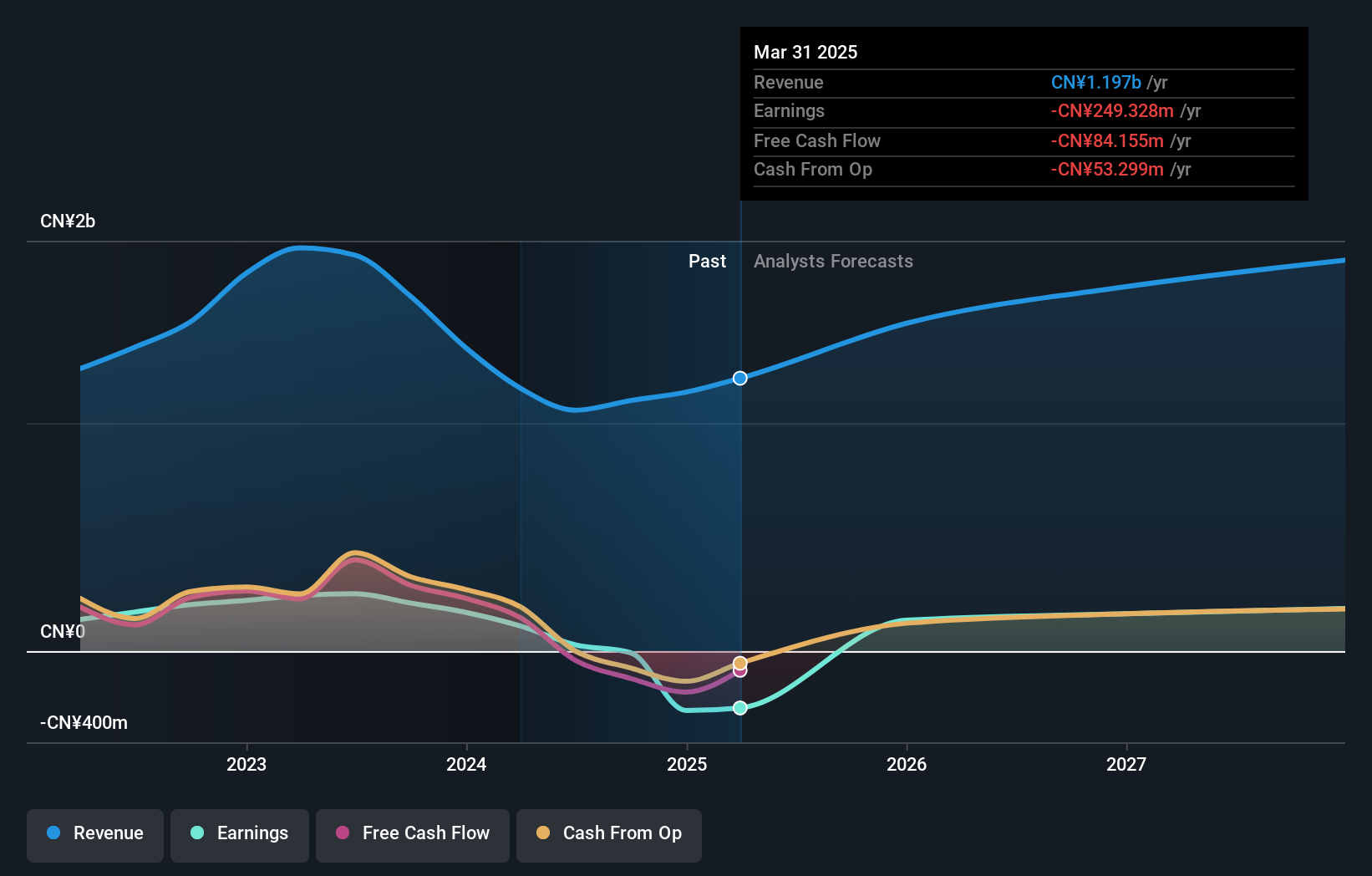

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market cap of CN¥5.83 billion.

Operations: The company focuses on online entertainment services, generating revenue primarily through its digital platform offerings. Its financial performance is characterized by a notable net profit margin trend, reflecting its operational efficiency in the competitive entertainment sector.

Hubei Century Network Technology is navigating the competitive tech landscape with a promising trajectory, evidenced by its revenue growth at 22.7% annually, outpacing the broader Chinese market's average of 13.3%. The company's commitment to innovation is underscored by its R&D expenses which are strategically aligned to foster advancements in high-demand tech sectors. Despite current unprofitability, Hubei Century's aggressive revenue targets and an expected earnings surge of 56.7% annually suggest potential for robust financial health, aligning with industry shifts towards more sustainable and innovative business models.

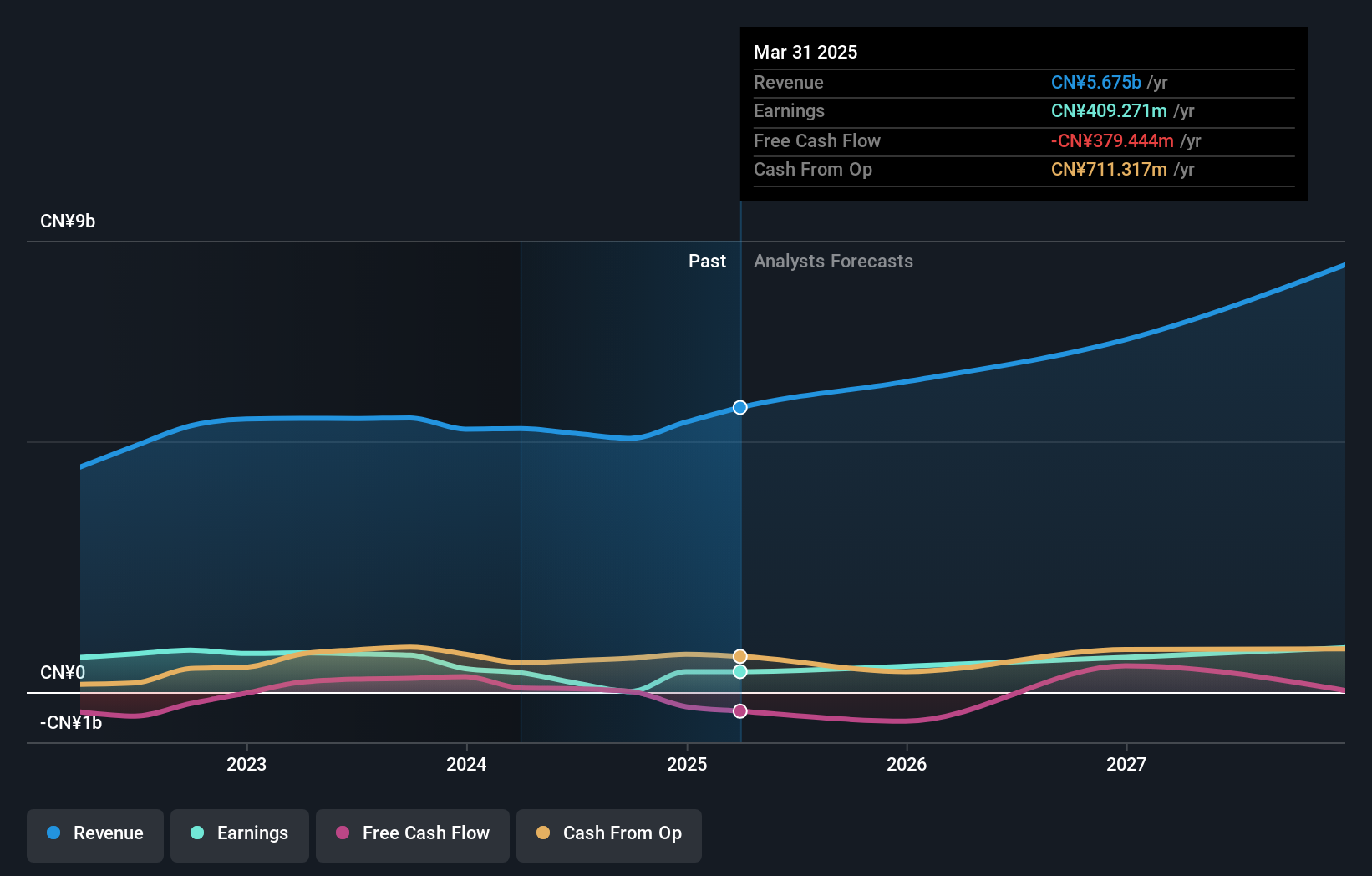

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of CN¥28.59 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue primarily through its operating-system products distributed globally, including key markets such as China, Europe, the United States, and Japan. The company has a market capitalization of CN¥28.59 billion.

Thunder Software Technology Ltd. is carving a niche in the intelligent mobility ecosystem, evidenced by its strategic partnership with HERE Technologies to enhance intelligent navigation and high-definition mapping solutions. This collaboration leverages ThunderSoft's Aqua Drive OS and HERE's advanced location data, setting a new standard in navigation technology. Despite a highly volatile share price recently, ThunderSoft demonstrates robust potential with projected revenue growth of 16.9% annually, outpacing the broader Chinese market average of 13.3%. Additionally, its earnings are expected to surge by 71.6% annually, supported by significant R&D investment aimed at driving innovation in tech sectors critical for future growth.

- Take a closer look at Thunder Software TechnologyLtd's potential here in our health report.

Learn about Thunder Software TechnologyLtd's historical performance.

Summing It All Up

- Navigate through the entire inventory of 1232 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Century Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300494

Hubei Century Network Technology

Operates an online entertainment platform in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives