- China

- /

- Communications

- /

- SZSE:300353

Optimistic Investors Push Kyland Technology Co., Ltd. (SZSE:300353) Shares Up 50% But Growth Is Lacking

Kyland Technology Co., Ltd. (SZSE:300353) shares have continued their recent momentum with a 50% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

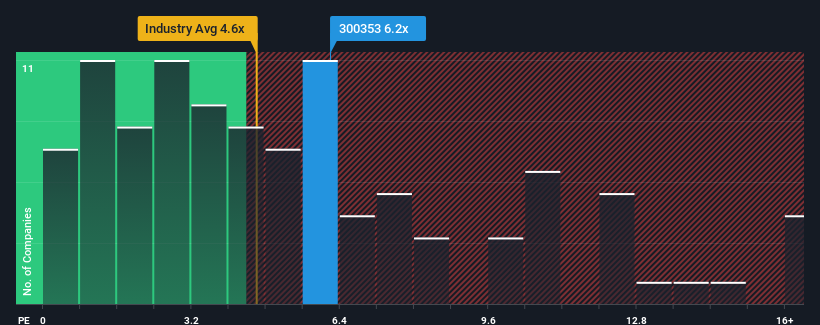

Since its price has surged higher, Kyland Technology may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.2x, since almost half of all companies in the Communications in China have P/S ratios under 4.6x and even P/S lower than 2x are not unusual. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kyland Technology

What Does Kyland Technology's Recent Performance Look Like?

Kyland Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Kyland Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kyland Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Kyland Technology would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 85% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 27% over the next year. Meanwhile, the rest of the industry is forecast to expand by 43%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Kyland Technology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Kyland Technology's P/S?

Kyland Technology's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Kyland Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Kyland Technology that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kyland Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300353

Kyland Technology

Provides industrial Ethernet technology in China and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives