- China

- /

- Communications

- /

- SZSE:002465

High Growth Tech Stocks in Asia for May 2025

Reviewed by Simply Wall St

The Asian tech market is currently navigating a landscape shaped by global trade tensions and mixed economic signals, with small- and mid-cap indexes showing resilience despite broader uncertainties. In this environment, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation capabilities and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 29.02% | 34.17% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| PharmaEssentia | 32.31% | 59.75% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

We'll examine a selection from our screener results.

Guangzhou Haige Communications Group (SZSE:002465)

Simply Wall St Growth Rating: ★★★★★☆

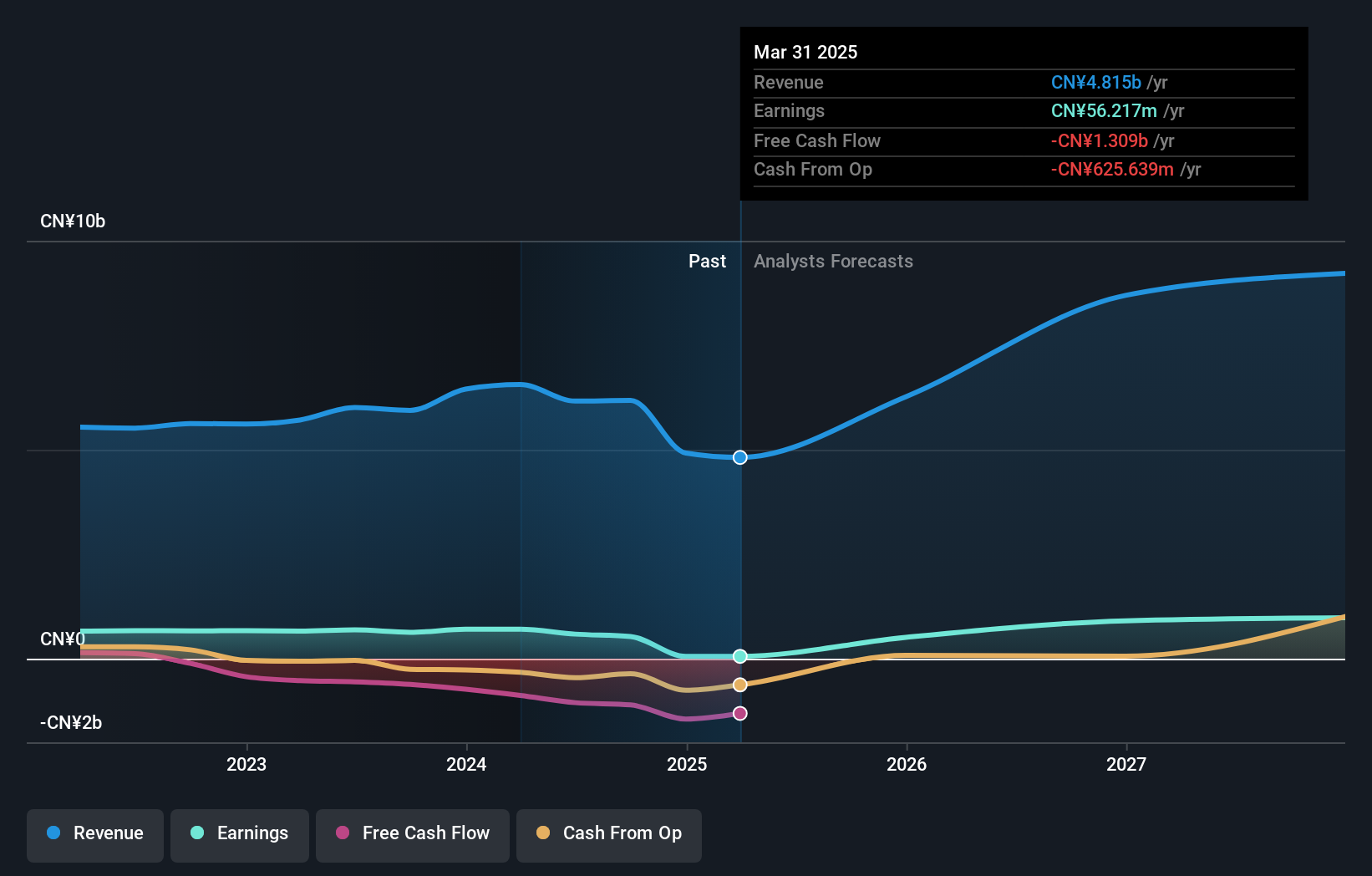

Overview: Guangzhou Haige Communications Group Incorporated Company, along with its subsidiaries, operates in the wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors in China and has a market cap of CN¥26.80 billion.

Operations: Haige Communications focuses on wireless communications, Beidou navigation, aerospace, and digital intelligence ecology within China. The company generates revenue primarily from these sectors, with a notable emphasis on digital intelligence solutions. Its financial performance reflects strategic investments in technology development and sector-specific innovations.

Despite a challenging year with net profit margins shrinking to 1.2% from 10.7%, Guangzhou Haige Communications Group's strategic maneuvers show promise for recovery. The company recently announced a share repurchase program worth CNY 400 million, signaling confidence in its future prospects and commitment to shareholder value. Moreover, the expected revenue growth at an annual rate of 23.6% outpaces the Chinese market forecast of 12.6%, underscoring its potential resilience and adaptability in the competitive communications sector.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

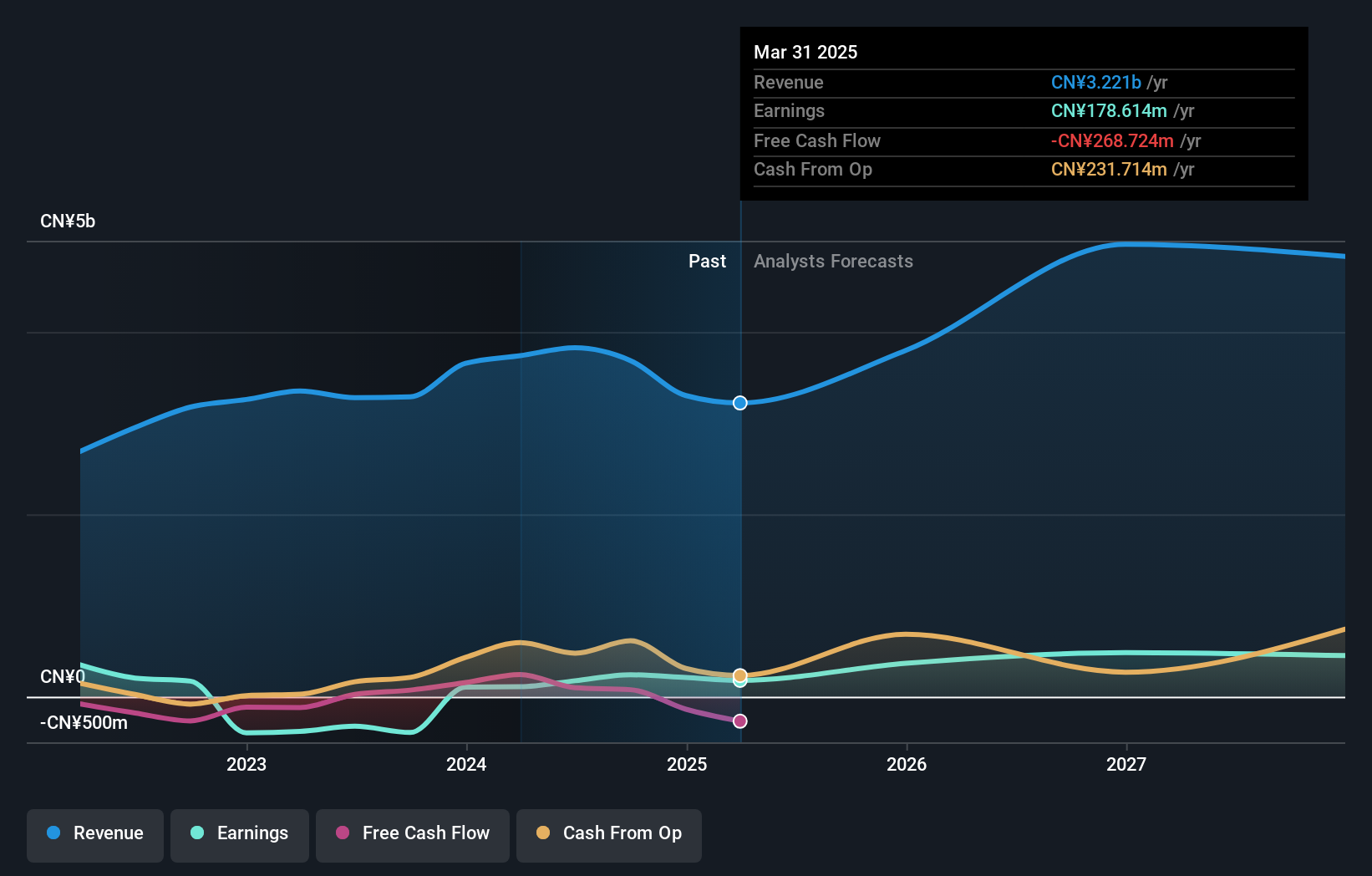

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and internationally, with a market cap of CN¥11.01 billion.

Operations: The company focuses on industrial bulk material handling and mobile Internet services, generating revenue primarily from these sectors. It operates both within China and internationally.

Wuxi Boton Technology, amidst a dynamic tech landscape, has demonstrated robust financial growth with a notable increase in annual earnings by 25.8% and revenue growth at 14.8% per year, outpacing broader market trends. The firm's commitment to innovation is evident from its R&D spending which aligns closely with its revenue increases, ensuring continuous improvement in product offerings and market competitiveness. Recent moves include a dividend payout signaling strong future confidence and an impressive doubling of net income from CNY 106.06 million to CNY 209.93 million year-over-year as of December 2024, showcasing effective operational execution and strategic market positioning within Asia’s tech sector.

- Delve into the full analysis health report here for a deeper understanding of Wuxi Boton Technology.

Explore historical data to track Wuxi Boton Technology's performance over time in our Past section.

Kyland Technology (SZSE:300353)

Simply Wall St Growth Rating: ★★★★★☆

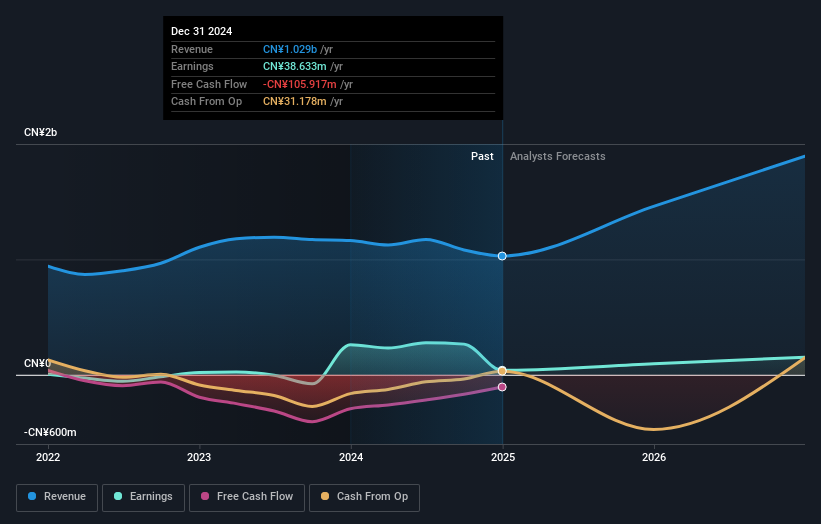

Overview: Kyland Technology Co., Ltd. specializes in industrial Ethernet technology both in China and internationally, with a market cap of CN¥14.26 billion.

Operations: Kyland Technology Co., Ltd. focuses on industrial Ethernet technology, serving both domestic and international markets.

Kyland Technology, navigating through a challenging tech landscape, has shown resilience with its recent financial performance. Despite a net loss reduction from CNY 89.12 million to CNY 49.88 million in Q1 2025, the company's revenue growth rate stands at an impressive 23.8% annually, outstripping the Chinese market average of 12.6%. However, earnings have contracted significantly by -66.4% over the past year compared to the industry's growth of 10%, highlighting volatility in its operational success. This juxtaposition underscores Kyland's potential amidst uncertainties, bolstered by strategic R&D investments which are crucial for sustaining innovation and competitiveness in Asia’s fast-evolving tech sector.

Key Takeaways

- Discover the full array of 483 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Guangzhou Haige Communications Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002465

Guangzhou Haige Communications Group

Engages in the wireless communications, Beidou navigation, Aerospace, and Digital intelligence ecology businesses in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives