As global markets navigate a choppy start to the year, with U.S. equities facing inflation concerns and political uncertainties, investors are increasingly looking for stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those seeking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.01% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Zhejiang Qianjiang Motorcycle (SZSE:000913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Qianjiang Motorcycle Co., Ltd. engages in the research, development, manufacturing, and sale of motorcycles, engines, and components in China with a market cap of CN¥9.33 billion.

Operations: Zhejiang Qianjiang Motorcycle Co., Ltd. generates its revenue primarily through the production and sale of motorcycles, engines, and related components in China.

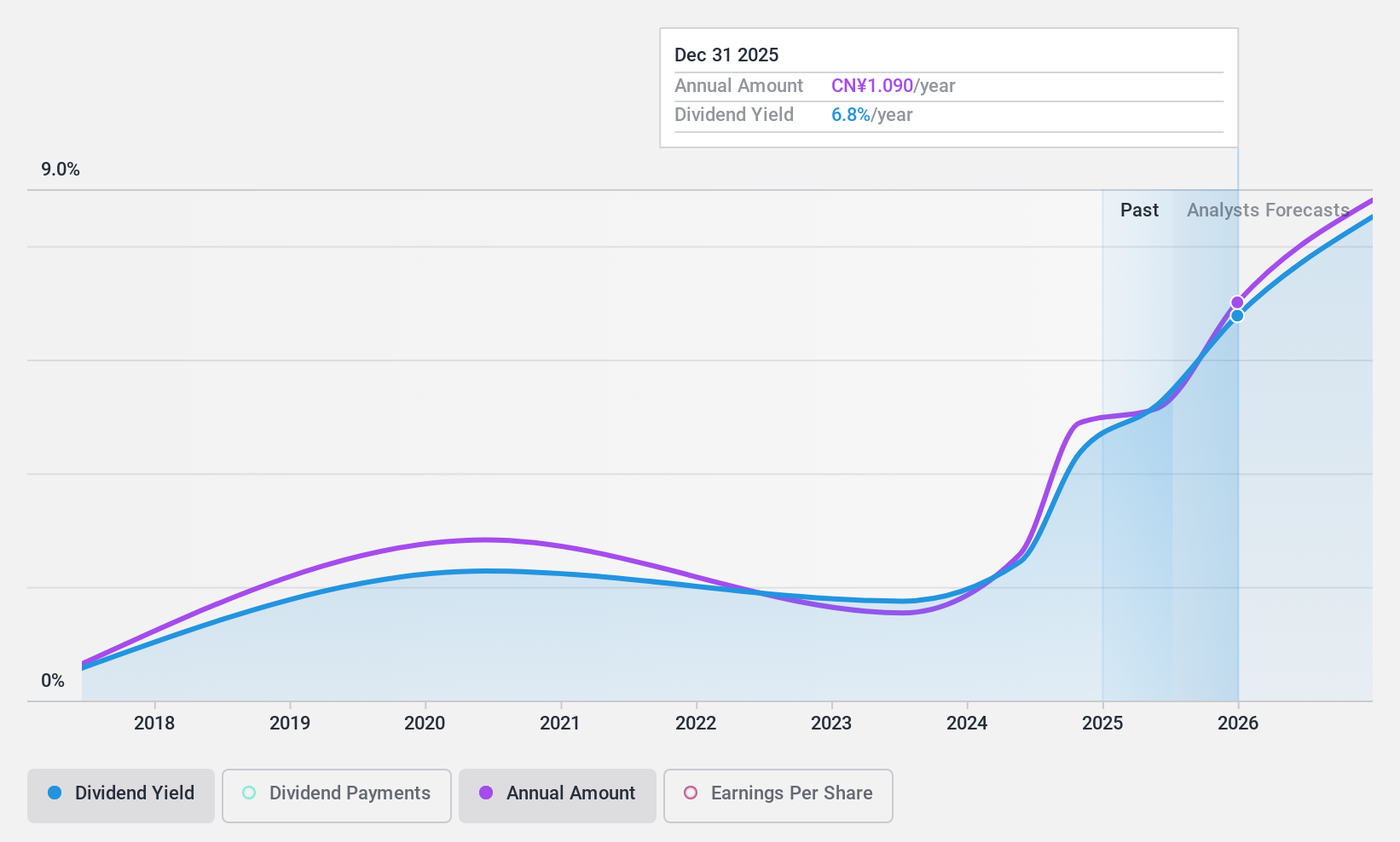

Dividend Yield: 4.1%

Zhejiang Qianjiang Motorcycle's dividend yield of 4.07% ranks in the top 25% of CN market payers, though its track record is unstable with only eight years of payments and volatility over time. The payout ratio stands at 80.4%, indicating dividends are covered by earnings, while a cash payout ratio of 62.7% suggests coverage by cash flows as well. Recent earnings growth supports sustainability, but investors should note the historical unreliability in dividend consistency.

- Click to explore a detailed breakdown of our findings in Zhejiang Qianjiang Motorcycle's dividend report.

- According our valuation report, there's an indication that Zhejiang Qianjiang Motorcycle's share price might be on the expensive side.

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China with a market cap of CN¥5.30 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its provision of digital solutions for smart gas, smart water, and hydrogen metering in China.

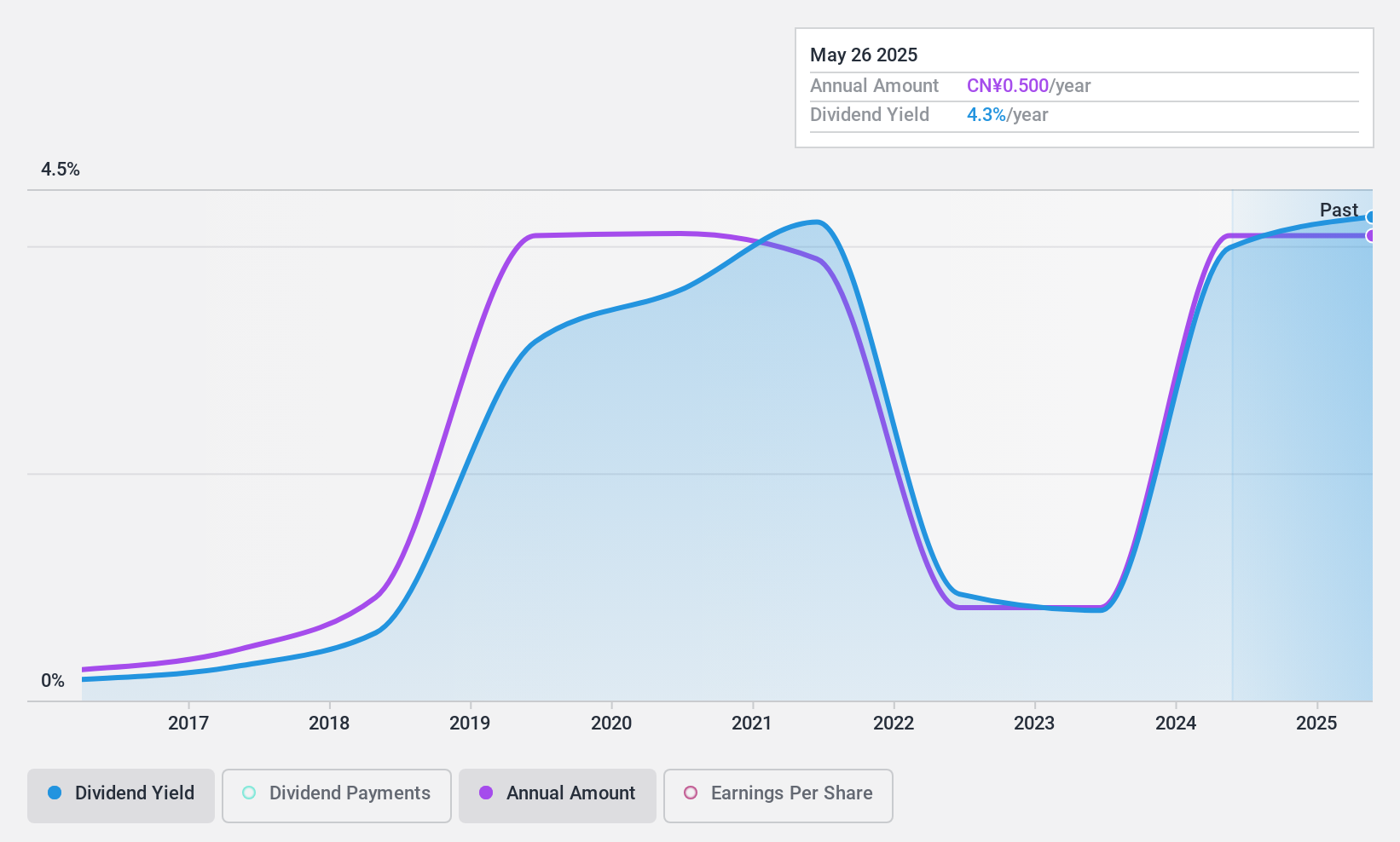

Dividend Yield: 3.9%

Goldcard Smart Group offers a dividend yield of 3.87%, placing it in the top 25% among CN market payers, but its dividends have been volatile over the past decade. The payout ratio is a manageable 50%, indicating coverage by earnings, though not by free cash flows. Despite recent earnings growth of 5.8% and good relative value with a P/E ratio of 13.2x below the market average, dividend sustainability remains questionable due to inconsistent past payments and lack of free cash flow coverage.

- Click here to discover the nuances of Goldcard Smart Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Goldcard Smart Group is priced lower than what may be justified by its financials.

Nachi-Fujikoshi (TSE:6474)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nachi-Fujikoshi Corp. is a machinery manufacturer with operations in Japan, the rest of Asia, China, the Americas, and Europe, and has a market cap of approximately ¥72.45 billion.

Operations: Nachi-Fujikoshi Corp. generates revenue through its machinery manufacturing operations across various regions, including Japan, the rest of Asia, China, the Americas, and Europe.

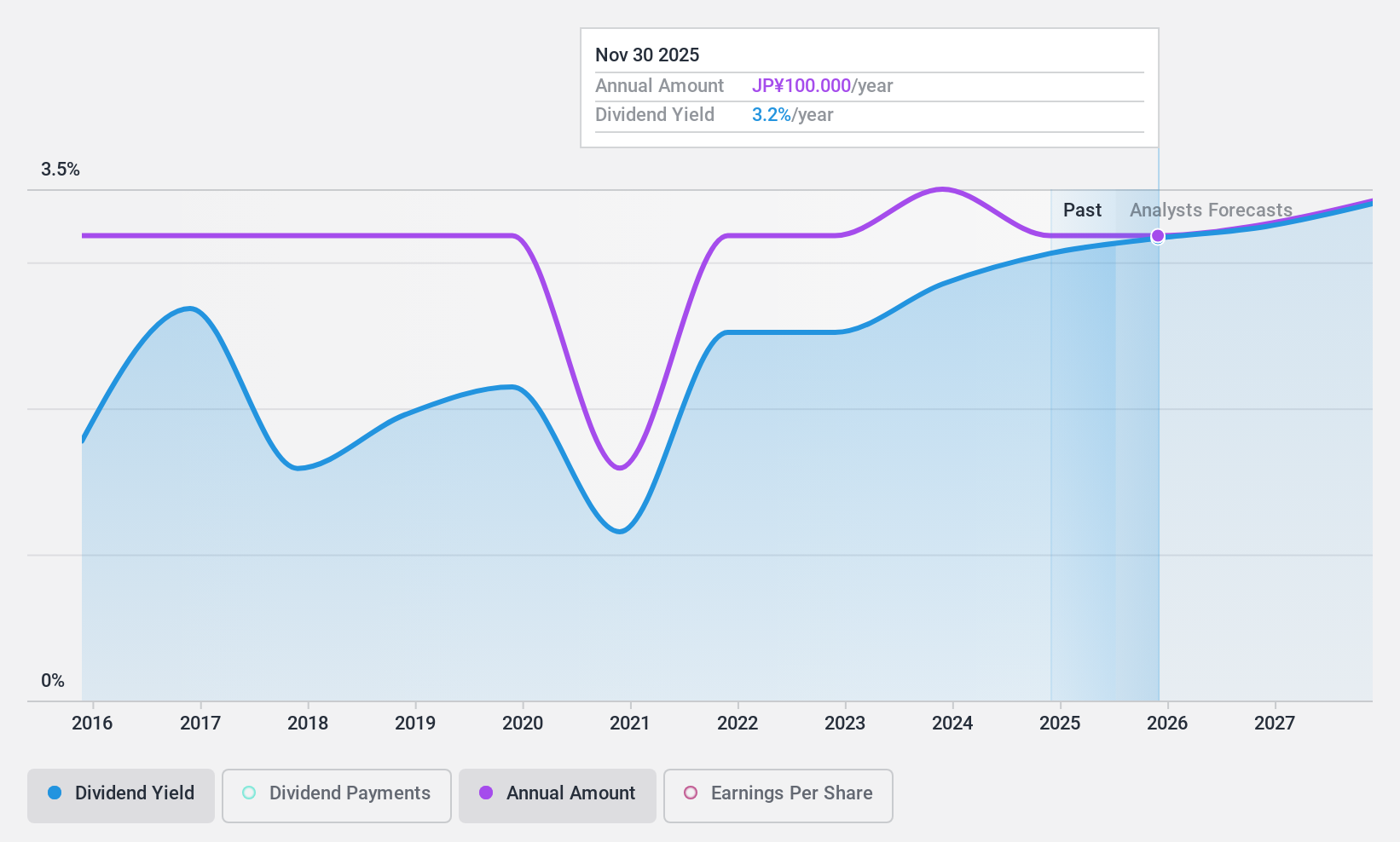

Dividend Yield: 3%

Nachi-Fujikoshi's dividend yield of 3.03% falls short of the top quartile in Japan, with a high payout ratio of 87%, indicating earnings coverage but not stability due to a volatile track record. Recent reductions in dividends from JPY 110 to JPY 100 per share highlight this inconsistency. However, strong cash flow coverage at a low cash payout ratio of 12.5% provides some reassurance for future payments despite fluctuating profit margins and recent buybacks reflecting strategic flexibility.

- Delve into the full analysis dividend report here for a deeper understanding of Nachi-Fujikoshi.

- Our valuation report unveils the possibility Nachi-Fujikoshi's shares may be trading at a premium.

Seize The Opportunity

- Get an in-depth perspective on all 1996 Top Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Qianjiang Motorcycle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000913

Zhejiang Qianjiang Motorcycle

Researches and develops, manufactures, sells, and services motorcycles and accessories in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives