- China

- /

- Electronic Equipment and Components

- /

- SZSE:300331

Investors in SVG Tech GroupLtd (SZSE:300331) from three years ago are still down 27%, even after 6.9% gain this past week

It is a pleasure to report that the SVG Tech Group Co.,Ltd. (SZSE:300331) is up 75% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 27% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

The recent uptick of 6.9% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for SVG Tech GroupLtd

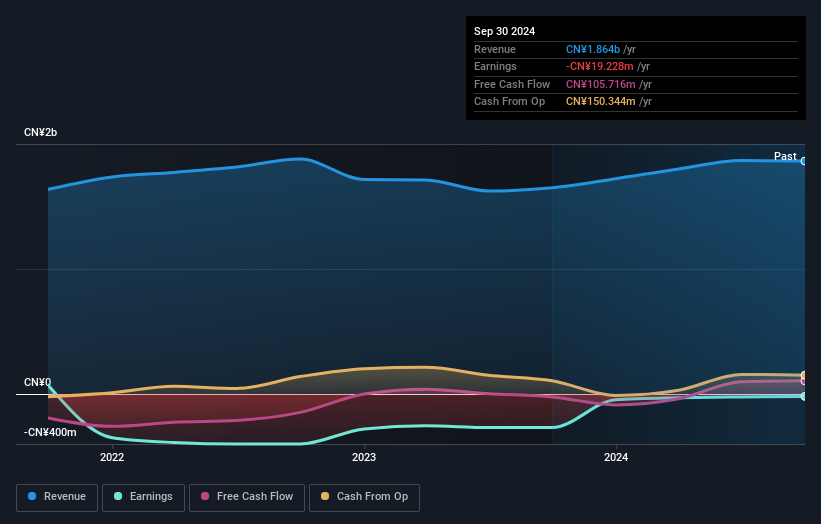

SVG Tech GroupLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, SVG Tech GroupLtd saw its revenue grow by 1.6% per year, compound. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 8% over the last three years. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on SVG Tech GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

SVG Tech GroupLtd provided a TSR of 9.1% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 4% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for SVG Tech GroupLtd (1 is concerning!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300331

SVG Tech GroupLtd

Engages in the research and industrial operations of optoelectronic materials and devices in the fields of information photonics and advanced displays in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives