- China

- /

- Communications

- /

- SZSE:300308

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming their value counterparts. In this environment, investors might focus on high-growth tech stocks that demonstrate strong innovation and adaptability, as these qualities can be crucial in capitalizing on market opportunities amidst economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Lingyi iTech (Guangdong) (SZSE:002600)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥68.32 billion.

Operations: Lingyi iTech (Guangdong) specializes in smart manufacturing services and solutions, focusing on advanced technological integration. The company operates with a market cap of CN¥68.32 billion, emphasizing innovation in its service offerings to enhance production efficiencies for various industries.

Lingyi iTech (Guangdong) exhibits a mixed financial landscape within the high-tech sector, marked by a robust annual earnings growth forecast at 25.5%, outpacing the CN market average of 25.1%. However, its revenue growth, while solid at 15.5% annually, does not reach the high-growth threshold of 20% per year that typifies leading tech firms. The company's commitment to innovation is underscored by its R&D investments which are crucial for sustaining long-term competitiveness in technology development. Recent activities include a significant share buyback program completed last year and strategic decisions made during their latest extraordinary shareholders meeting aimed at enhancing operational capabilities and financial strategies for 2025. These steps reflect Lingyi iTech’s proactive approach in refining its business model amidst evolving market demands and technological advancements.

Zhongji Innolight (SZSE:300308)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhongji Innolight Co., Ltd. specializes in the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market capitalization of CN¥118.68 billion.

Operations: Zhongji Innolight focuses on optical communication transceiver modules and devices, leveraging its expertise in research, development, and production within the Chinese market.

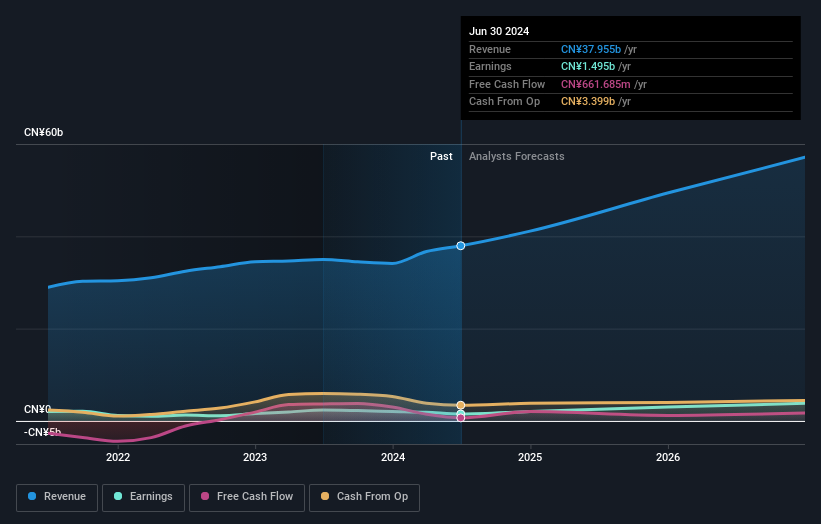

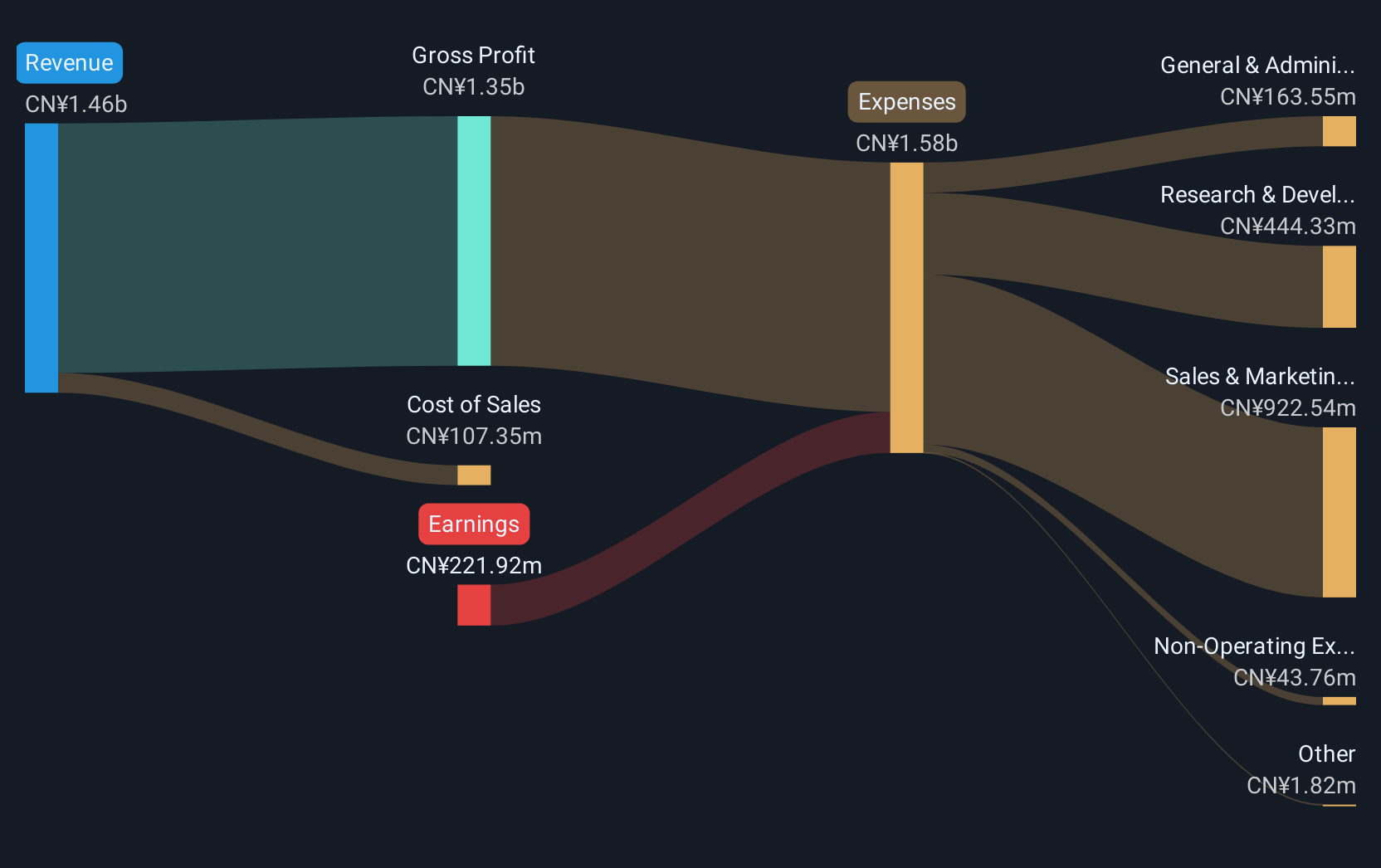

Zhongji Innolight is navigating the tech landscape with impressive agility, evidenced by its annual revenue growth of 32.4%, significantly outpacing the broader CN market's average of 13.3%. This growth trajectory is bolstered by a remarkable increase in earnings, up by 177.7% over the past year, dwarfing the Communications industry's decline. The firm dedicates substantial resources to R&D, an investment reflecting in a forecasted earnings growth of 33.3% per annum. These figures not only highlight Zhongji Innolight’s robust financial health but also its commitment to maintaining a competitive edge through continuous innovation and strategic market positioning.

- Navigate through the intricacies of Zhongji Innolight with our comprehensive health report here.

Understand Zhongji Innolight's track record by examining our Past report.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products both in China and internationally, with a market cap of CN¥15.17 billion.

Operations: Wondershare Technology Group Co., Ltd. specializes in creating application software products for both domestic and international markets.

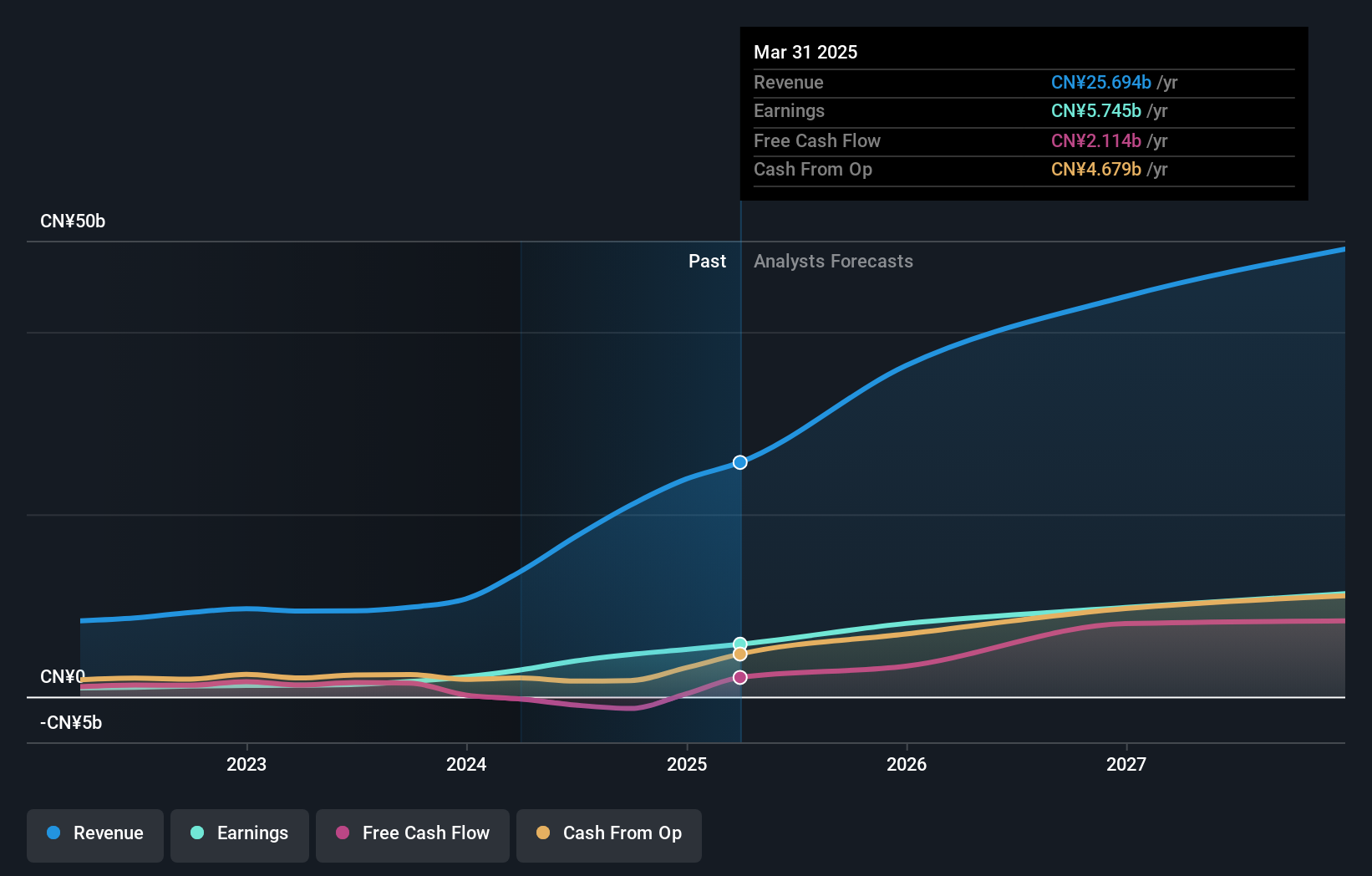

Wondershare Technology Group is making significant strides in the tech industry, particularly with its AI-driven software solutions. At the recent LEAP 2025 event, the company unveiled advanced tools like Filmora and EdrawMax, which leverage AI to enhance content creation and design efficiency. These innovations are part of why Wondershare's annualized revenue growth stands at 16.2%, outpacing the broader market's growth. The firm also maintains a robust commitment to R&D, dedicating substantial resources that have led to an impressive annualized earnings growth of 74.5%. This strategic focus not only underscores Wondershare’s adaptability in a competitive landscape but also positions it well for sustained future growth amidst evolving digital demands.

- Get an in-depth perspective on Wondershare Technology Group's performance by reading our health report here.

Gain insights into Wondershare Technology Group's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1210 more companies for you to explore.Click here to unveil our expertly curated list of 1213 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhongji Innolight, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhongji Innolight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300308

Zhongji Innolight

Researches, develops, produces, and sells optical communication transceiver modules and optical devices in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives