- Japan

- /

- Semiconductors

- /

- TSE:8035

Global's March 2025 Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflationary pressures, and growth concerns, investors are witnessing significant volatility across major indices. Amidst this uncertainty, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies. A good stock in these conditions is often characterized by strong fundamentals and a price that reflects less than its intrinsic value, providing a margin of safety in turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tabuk Cement (SASE:3090) | SAR13.30 | SAR26.31 | 49.4% |

| Vimi Fasteners (BIT:VIM) | €0.965 | €1.91 | 49.4% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.40 | CN¥30.45 | 49.4% |

| APAC Realty (SGX:CLN) | SGD0.42 | SGD0.83 | 49.5% |

| Power Wind Health Industry (TWSE:8462) | NT$120.50 | NT$238.12 | 49.4% |

| JSHLtd (TSE:150A) | ¥555.00 | ¥1107.96 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1091.00 | ¥2181.55 | 50% |

| Vista Energy. de (BMV:VISTA A) | MX$969.00 | MX$1918.86 | 49.5% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.54 | CN¥17.01 | 49.8% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15940.00 | ₩31573.92 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

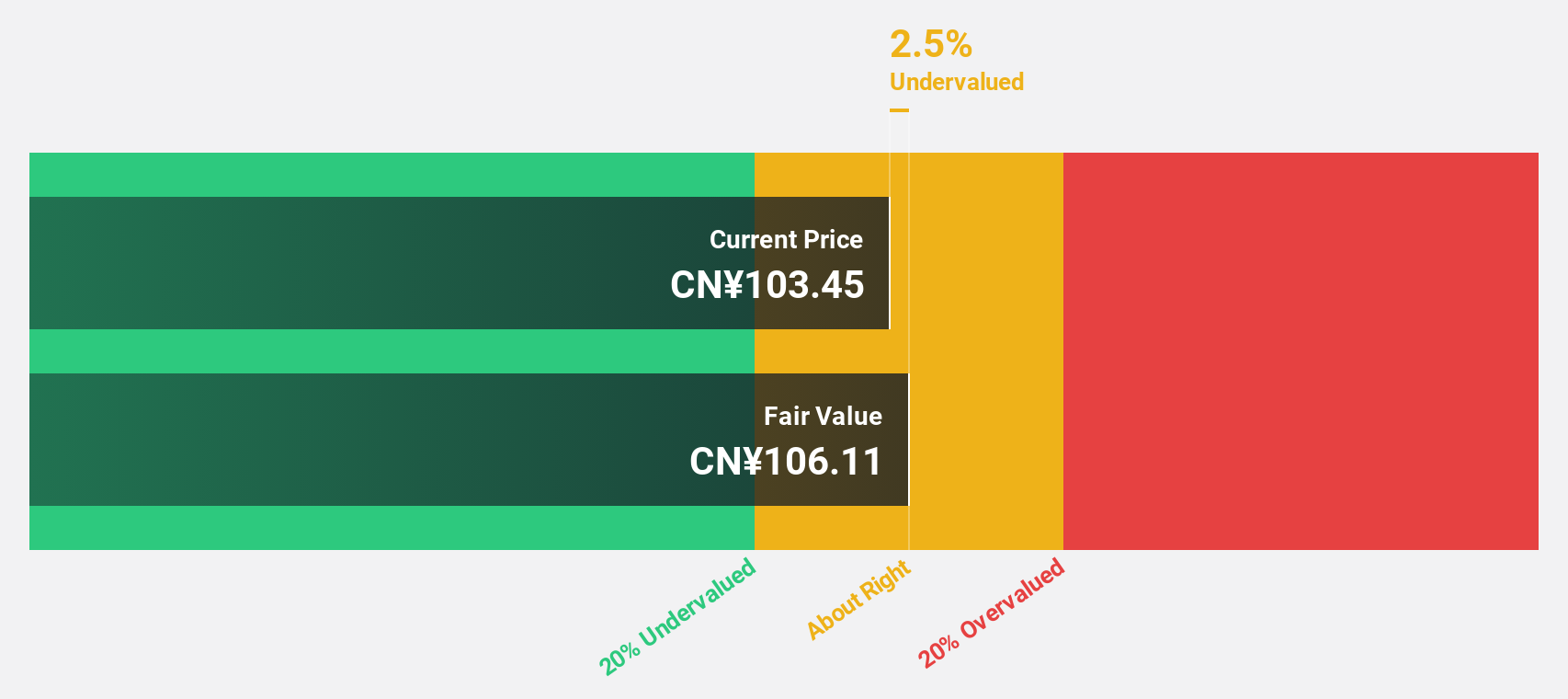

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is engaged in the research, development, production, and sale of optical communication transceiver modules and optical devices in China with a market cap of CN¥113.22 billion.

Operations: Zhongji Innolight generates its revenue primarily from the research, development, production, and sale of optical communication transceiver modules and optical devices within China.

Estimated Discount To Fair Value: 36.8%

Zhongji Innolight's recent earnings report highlights a substantial increase in sales and net income, with CNY 23.86 billion in sales and CNY 5.17 billion in net income for 2024. The stock is trading at a significant discount to its estimated fair value of CNY 164.65, currently priced at CNY 103.99, representing a potential undervaluation based on cash flows. Earnings are projected to grow significantly over the next three years, outpacing market averages despite recent share price volatility.

- Insights from our recent growth report point to a promising forecast for Zhongji Innolight's business outlook.

- Click to explore a detailed breakdown of our findings in Zhongji Innolight's balance sheet health report.

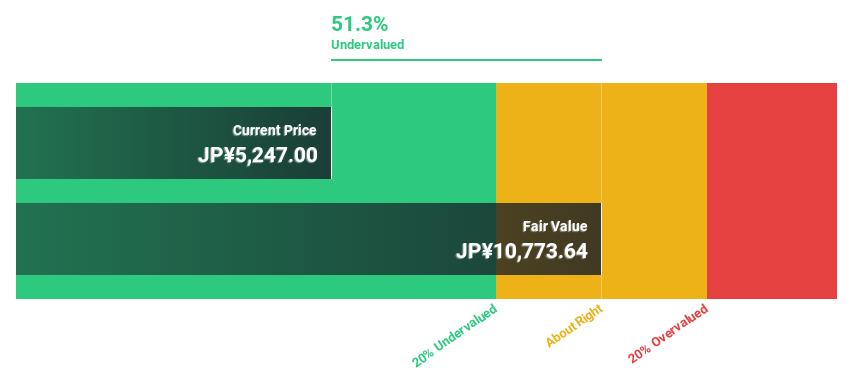

Fujikura (TSE:5803)

Overview: Fujikura Ltd. operates in the energy, telecommunications, electronics, automotive, and real estate sectors across Japan, the United States, China, and internationally with a market cap of approximately ¥1.59 trillion.

Operations: The company's revenue segments include the Information and Communication Business Division at ¥386.30 billion, Automotive Business Division at ¥180.62 billion, Electronics Business Division at ¥179.31 billion, Power Systems Business Division at ¥147.19 billion, and Real Estate Business Sector at ¥10.74 billion.

Estimated Discount To Fair Value: 11.1%

Fujikura is trading at ¥6,217, below its estimated fair value of ¥6,990.01, with analysts agreeing on a potential 24.7% price rise. Earnings grew by 146.1% last year and are expected to grow 16% annually, outpacing the Japanese market's 8.1%. Despite recent share price volatility and slower revenue growth than some peers, Fujikura's fixed-income offering of ¥10 billion in climate bonds highlights its commitment to sustainability initiatives.

- The growth report we've compiled suggests that Fujikura's future prospects could be on the up.

- Get an in-depth perspective on Fujikura's balance sheet by reading our health report here.

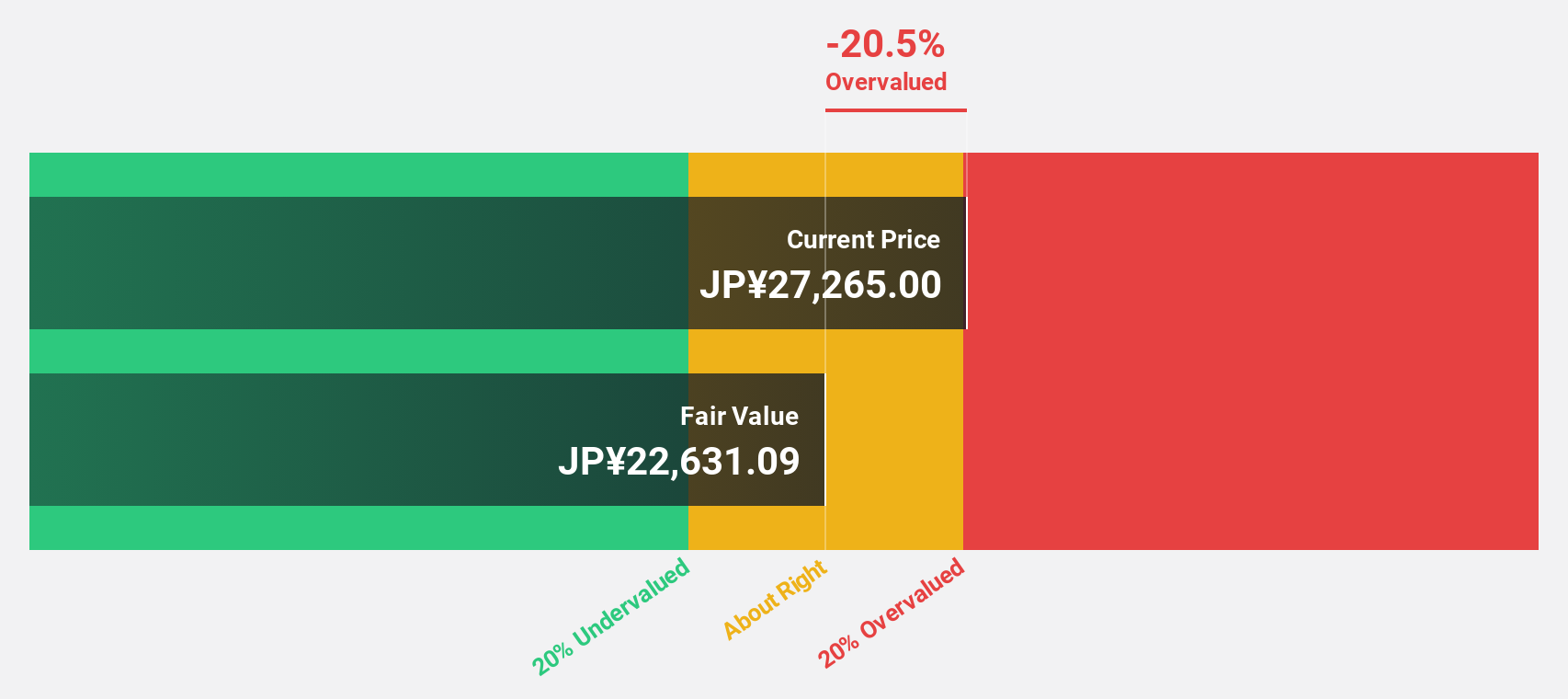

Tokyo Electron (TSE:8035)

Overview: Tokyo Electron Limited, along with its subsidiaries, is engaged in the development, manufacturing, and sale of semiconductor and flat panel display production equipment globally, with a market cap of approximately ¥9.77 trillion.

Operations: The company's revenue is primarily derived from its semiconductor production equipment segment, which generated approximately ¥2.32 billion.

Estimated Discount To Fair Value: 17.8%

Tokyo Electron is trading at ¥21,550, below its estimated fair value of ¥26,215.56. Analysts forecast a 48% price rise and expect earnings to grow 9.36% annually, outpacing the Japanese market's 8.1%. Despite a volatile share price and dividends not well covered by free cash flows, the company projects net income of ¥526 billion for fiscal year ending March 2025 and has completed a buyback worth ¥46.95 billion to enhance shareholder value.

- In light of our recent growth report, it seems possible that Tokyo Electron's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Tokyo Electron.

Make It Happen

- Unlock more gems! Our Undervalued Global Stocks Based On Cash Flows screener has unearthed 497 more companies for you to explore.Click here to unveil our expertly curated list of 500 Undervalued Global Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor production equipment in Japan, South Korea, Taiwan, China, North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives