- China

- /

- Communications

- /

- SZSE:300250

Some Confidence Is Lacking In Hangzhou CNCR-IT Co.,Ltd (SZSE:300250) As Shares Slide 25%

Hangzhou CNCR-IT Co.,Ltd (SZSE:300250) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

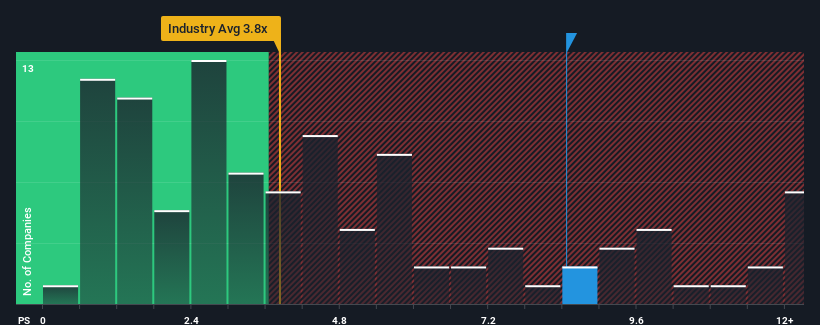

Even after such a large drop in price, you could still be forgiven for thinking Hangzhou CNCR-ITLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.5x, considering almost half the companies in China's Communications industry have P/S ratios below 3.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Hangzhou CNCR-ITLtd

What Does Hangzhou CNCR-ITLtd's P/S Mean For Shareholders?

For example, consider that Hangzhou CNCR-ITLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Hangzhou CNCR-ITLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Hangzhou CNCR-ITLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, revenue from three years ago have also fallen 25% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 50% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Hangzhou CNCR-ITLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Hangzhou CNCR-ITLtd's P/S

A significant share price dive has done very little to deflate Hangzhou CNCR-ITLtd's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Hangzhou CNCR-ITLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Hangzhou CNCR-ITLtd with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou CNCR-ITLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300250

Hangzhou CNCR-ITLtd

Provides digital and intelligent industrial solutions and operations services for government and enterprise markets in China and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026