- China

- /

- Electronic Equipment and Components

- /

- SZSE:300184

Wuhan P&S Information Technology Co., Ltd. (SZSE:300184) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Wuhan P&S Information Technology Co., Ltd. (SZSE:300184) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 59%, which is great even in a bull market.

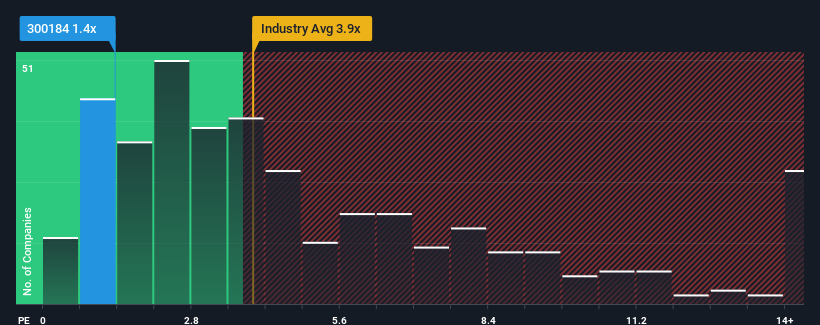

Even after such a large drop in price, Wuhan P&S Information Technology may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.9x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Wuhan P&S Information Technology

How Has Wuhan P&S Information Technology Performed Recently?

Revenue has risen firmly for Wuhan P&S Information Technology recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wuhan P&S Information Technology's earnings, revenue and cash flow.How Is Wuhan P&S Information Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Wuhan P&S Information Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 29% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 26% shows it's an unpleasant look.

In light of this, it's understandable that Wuhan P&S Information Technology's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Wuhan P&S Information Technology's P/S Mean For Investors?

Wuhan P&S Information Technology's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Wuhan P&S Information Technology confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Wuhan P&S Information Technology that we have uncovered.

If these risks are making you reconsider your opinion on Wuhan P&S Information Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan P&S Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300184

Wuhan P&S Information Technology

Wuhan P&S Information Technology Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives