- China

- /

- Construction

- /

- SZSE:002551

Global Penny Stocks: 3 Picks With Market Caps Up To US$400M

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with recent developments such as the U.S.-UK trade deal and ongoing tariff discussions influencing investor sentiment. Amid this backdrop, small- and mid-cap indexes have shown resilience, highlighting opportunities for discerning investors. While the term "penny stocks" may seem outdated, these stocks continue to offer potential growth opportunities in smaller or newer companies when backed by strong financials. Let's explore several penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.96 | MYR1.5B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.315 | MYR914.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR2.76 | MYR2B | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.40 | MYR669.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$46.48B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.92 | £442.98M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,654 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Uju Holding (SEHK:1948)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Uju Holding Limited is an investment holding company offering digital marketing services and live-streaming e-commerce in the People’s Republic of China, with a market cap of HK$1.58 billion.

Operations: The company generates revenue primarily from its All-In-One Online Marketing Solutions Services, amounting to CN¥9.15 billion.

Market Cap: HK$1.58B

Uju Holding Limited, with a market cap of HK$1.58 billion, primarily generates revenue from its All-In-One Online Marketing Solutions Services, reporting CN¥9.15 billion in sales for 2024. Despite a volatile share price and high weekly volatility increasing from 23% to 46%, the company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt. Recent earnings growth of 3.7% surpasses the media industry average, although net profit margins have slightly declined to 1%. A recent executive change introduced Mr. Li Nian as joint CEO alongside Mr. Peng Liang.

- Get an in-depth perspective on Uju Holding's performance by reading our balance sheet health report here.

- Gain insights into Uju Holding's historical outcomes by reviewing our past performance report.

Shenzhen Glory MedicalLtd (SZSE:002551)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Glory Medical Co., Ltd. offers hospital construction and medical system integrated solutions both in China and internationally, with a market cap of CN¥2.79 billion.

Operations: Shenzhen Glory Medical Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.79B

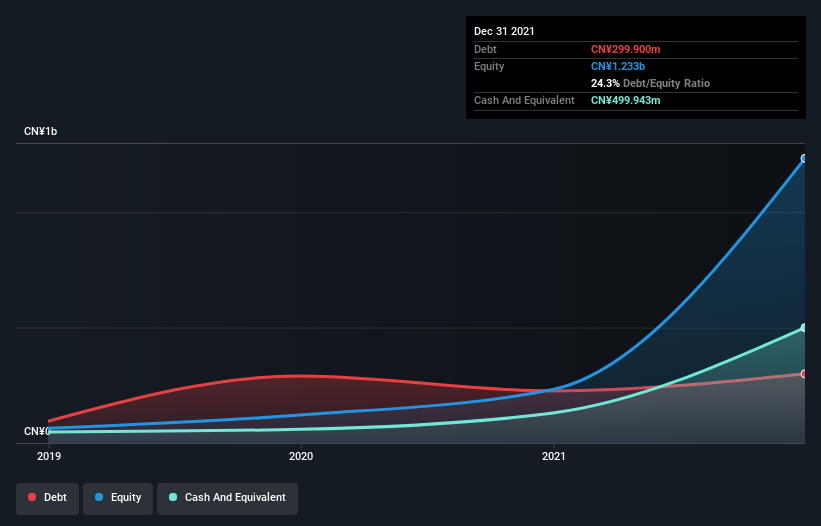

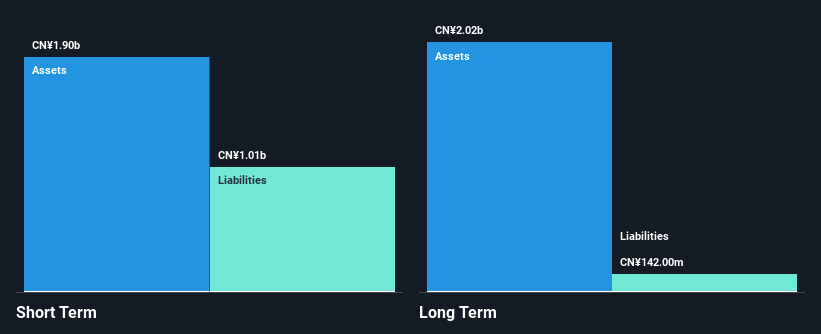

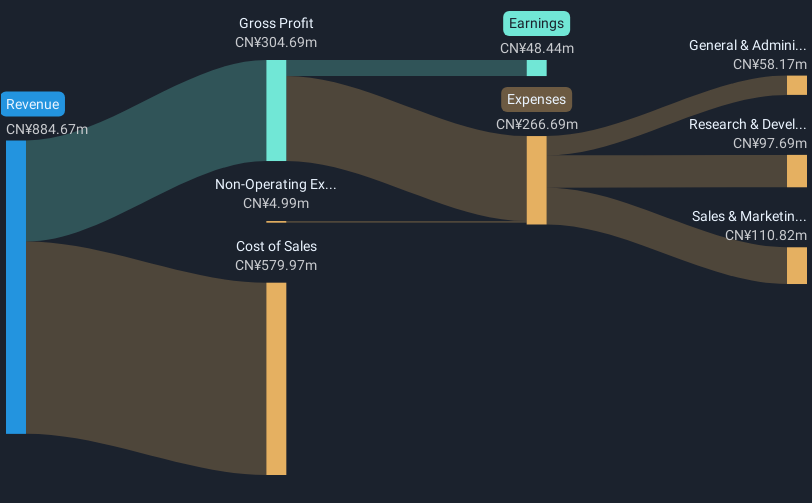

Shenzhen Glory Medical Co., Ltd., with a market cap of CN¥2.79 billion, reported first-quarter sales of CN¥279.74 million, showing slight growth from the previous year. Despite being unprofitable and having a negative return on equity, the company has more cash than total debt and its short-term assets significantly exceed both short- and long-term liabilities. The company's debt is well covered by operating cash flow, reflecting sound financial management despite ongoing profitability challenges. Recent dividend affirmations suggest confidence in future operations amidst stable weekly volatility over the past year at 6%.

- Jump into the full analysis health report here for a deeper understanding of Shenzhen Glory MedicalLtd.

- Explore historical data to track Shenzhen Glory MedicalLtd's performance over time in our past results report.

Beijing Century Real TechnologyLtd (SZSE:300150)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Century Real Technology Co., Ltd specializes in manufacturing and selling railway traffic safety monitoring systems, as well as urban rail transit passenger information and broadcast systems, with a market cap of CN¥2.74 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.74B

Beijing Century Real Technology Co., Ltd., with a market cap of CN¥2.74 billion, has recently turned profitable, reporting full-year sales of CN¥847.26 million and net income of CN¥34.17 million after a previous loss. Its short-term assets significantly exceed liabilities, and the company holds more cash than total debt, indicating strong financial health. Despite this positive turnaround, the return on equity remains low at 3%. The company's earnings have been stable over the past year with no significant shareholder dilution, suggesting cautious optimism for investors interested in financially stable penny stocks with recent profitability improvements.

- Dive into the specifics of Beijing Century Real TechnologyLtd here with our thorough balance sheet health report.

- Learn about Beijing Century Real TechnologyLtd's historical performance here.

Summing It All Up

- Discover the full array of 5,654 Global Penny Stocks right here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002551

Shenzhen Glory MedicalLtd

Provides hospital construction and medical system integrated solutions in China and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives