- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

October 2024's Top Insider Picks For Growth Stocks

Reviewed by Simply Wall St

As global markets grapple with rising Treasury yields and a mixed economic outlook, investors are increasingly focusing on growth stocks that can weather these fluctuations. In this environment, companies with high insider ownership often stand out, as they reflect confidence from those closest to the business and may offer potential resilience amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. is engaged in the manufacturing and marketing of power modules, digital tuners, and electronic shelf labels for customers both in South Korea and globally, with a market cap of approximately ₩914.23 billion.

Operations: The company's revenue is derived from its ICT Business segment, contributing ₩470.84 million, and its Electronic Components Division, which generates ₩1.16 billion.

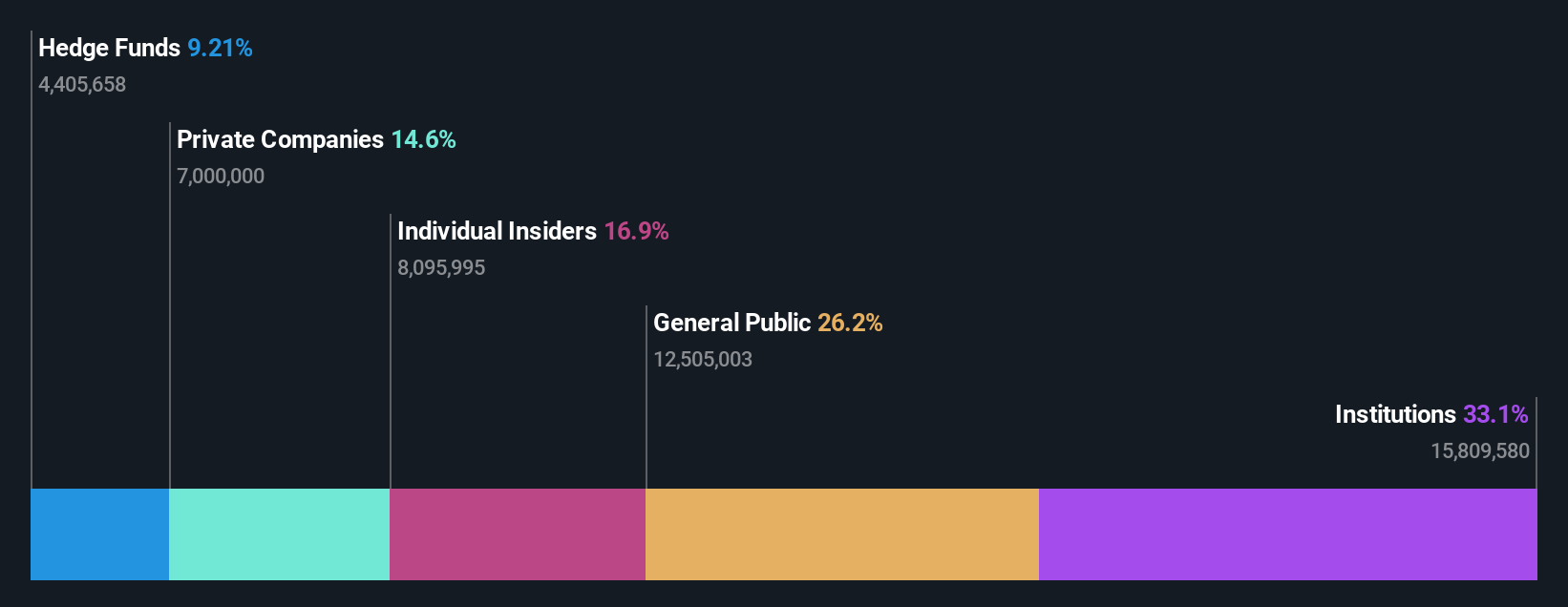

Insider Ownership: 16.6%

Revenue Growth Forecast: 14.3% p.a.

Solum is trading at 45.7% below its estimated fair value, presenting a potential opportunity for investors. With expected annual earnings growth of 36.8%, outpacing the KR market, and a high forecasted return on equity of 22.6%, Solum shows strong growth potential despite having a high level of debt. The recent announcement of a KRW 20 billion share buyback plan aims to enhance shareholder value by stabilizing stock prices through August 2025.

- Unlock comprehensive insights into our analysis of Solum stock in this growth report.

- Our comprehensive valuation report raises the possibility that Solum is priced lower than what may be justified by its financials.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. operates in the research, development, production, and marketing of edible bird’s nest products in China, with a market capitalization of approximately HK$5.39 billion.

Operations: The company's revenue segments include CN¥21.07 million from sales to online distributors, CN¥508.94 million from sales to offline distributors, CN¥907.52 million from direct sales to online customers, CN¥344.32 million from direct sales to offline customers, and CN¥290.51 million from direct sales to e-commerce platforms.

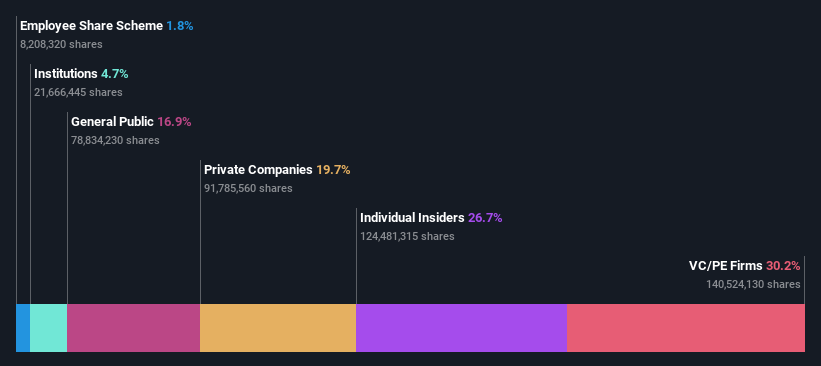

Insider Ownership: 26.7%

Revenue Growth Forecast: 13.1% p.a.

Xiamen Yan Palace Bird's Nest Industry is poised for growth with earnings expected to rise 23.9% annually, surpassing the Hong Kong market average. Revenue is projected to increase by 13.1% per year, though below the 20% mark, it still exceeds market expectations. Despite a decline in net income for the first half of 2024 compared to last year, substantial insider ownership could align management interests with shareholders and potentially drive future performance improvements.

- Click to explore a detailed breakdown of our findings in Xiamen Yan Palace Bird's Nest Industry's earnings growth report.

- In light of our recent valuation report, it seems possible that Xiamen Yan Palace Bird's Nest Industry is trading beyond its estimated value.

XGD (SZSE:300130)

Simply Wall St Growth Rating: ★★★★☆☆

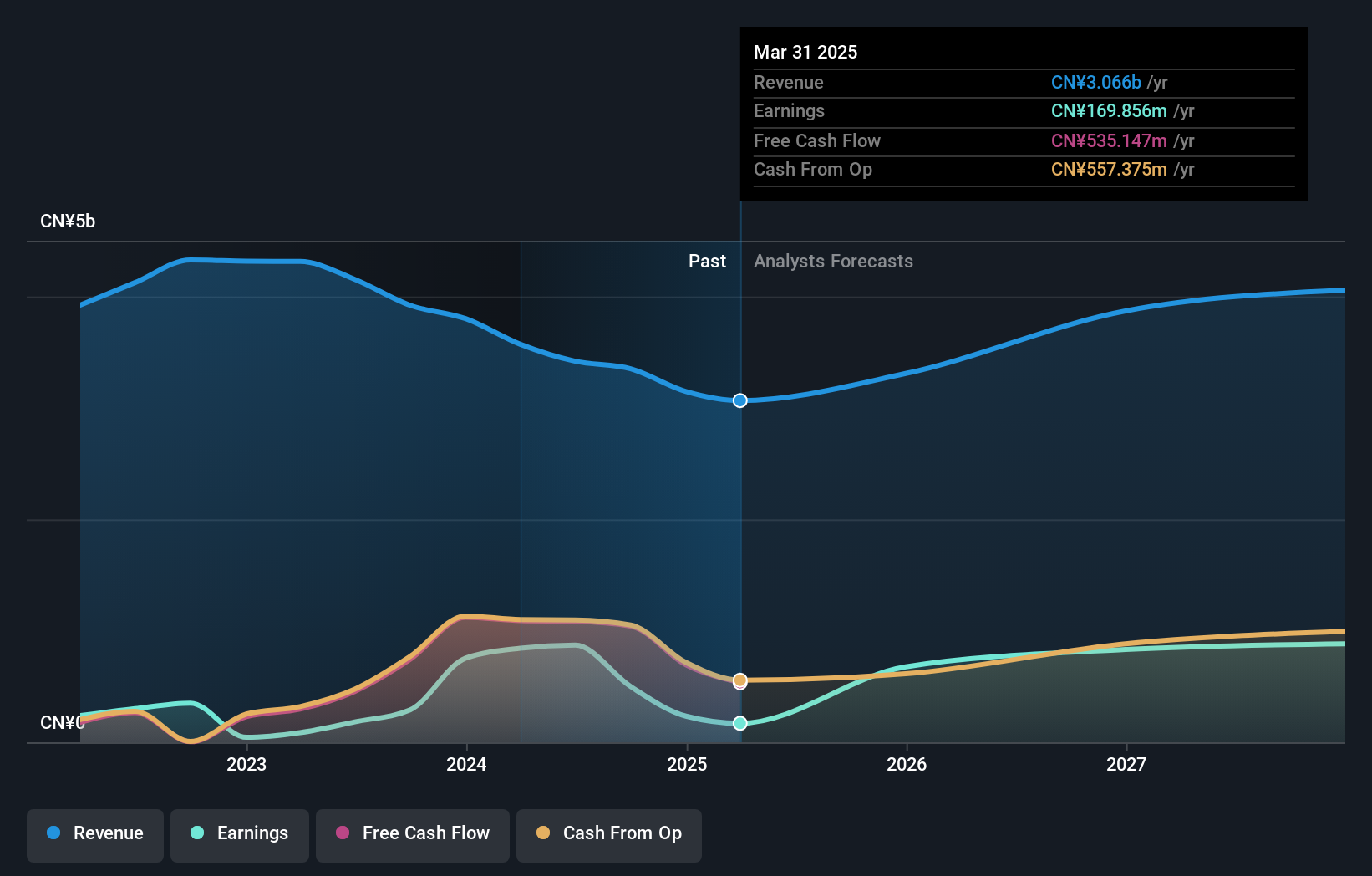

Overview: XGD Inc., along with its subsidiaries, engages in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally, with a market cap of CN¥15.11 billion.

Operations: XGD's revenue is primarily derived from its activities in the research, development, manufacturing, sales, and servicing of payment terminals across domestic and international markets.

Insider Ownership: 38.5%

Revenue Growth Forecast: 18.2% p.a.

XGD shows potential as a growth company with earnings forecasted to rise significantly by 33.4% annually, outpacing the CN market. Despite recent volatility and past shareholder dilution, it trades at a substantial discount of 52.9% below fair value estimates. Revenue is expected to grow at 18.2% per year, also above market rates but not exceeding the 20% threshold. Recent earnings reports indicate challenges with declining net income compared to the previous year.

- Dive into the specifics of XGD here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, XGD's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 1530 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives