- China

- /

- Electronic Equipment and Components

- /

- SZSE:300128

Suzhou Jinfu Technology Co., Ltd.'s (SZSE:300128) 33% Price Boost Is Out Of Tune With Revenues

Suzhou Jinfu Technology Co., Ltd. (SZSE:300128) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, despite the strong performance over the last month, the full year gain of 6.1% isn't as attractive.

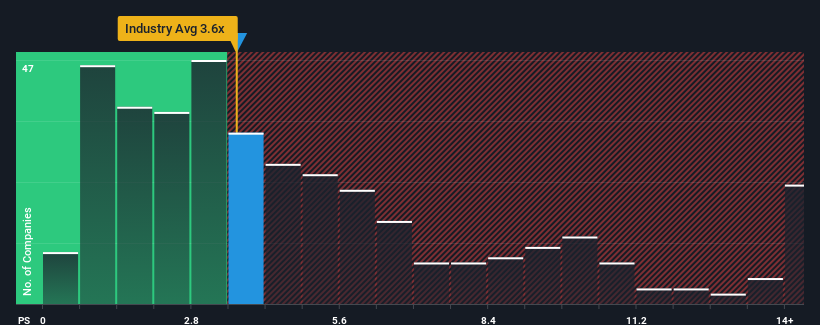

In spite of the firm bounce in price, there still wouldn't be many who think Suzhou Jinfu Technology's price-to-sales (or "P/S") ratio of 3.6x is worth a mention when it essentially matches the median P/S in China's Electronic industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Suzhou Jinfu Technology

How Suzhou Jinfu Technology Has Been Performing

Revenue has risen firmly for Suzhou Jinfu Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Suzhou Jinfu Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Suzhou Jinfu Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

In light of this, it's curious that Suzhou Jinfu Technology's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Suzhou Jinfu Technology's P/S?

Its shares have lifted substantially and now Suzhou Jinfu Technology's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Suzhou Jinfu Technology revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for Suzhou Jinfu Technology (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Suzhou Jinfu Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300128

Suzhou Jinfu Technology

Engages in the research and development, manufacture, sale, and service of precision parts of electronic products, liquid crystal display modules, and detection and automation equipment.

Low risk and slightly overvalued.

Market Insights

Community Narratives