- China

- /

- Communications

- /

- SZSE:300098

High Growth Tech And These 2 Top Stocks with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have been under pressure, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainty in the U.S. Meanwhile, resilient labor markets and a hawkish Federal Reserve outlook suggest that interest rates might remain elevated for longer. In this environment, identifying high-growth tech stocks with strong fundamentals and innovative potential can be crucial for investors seeking opportunities within a challenging economic backdrop.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

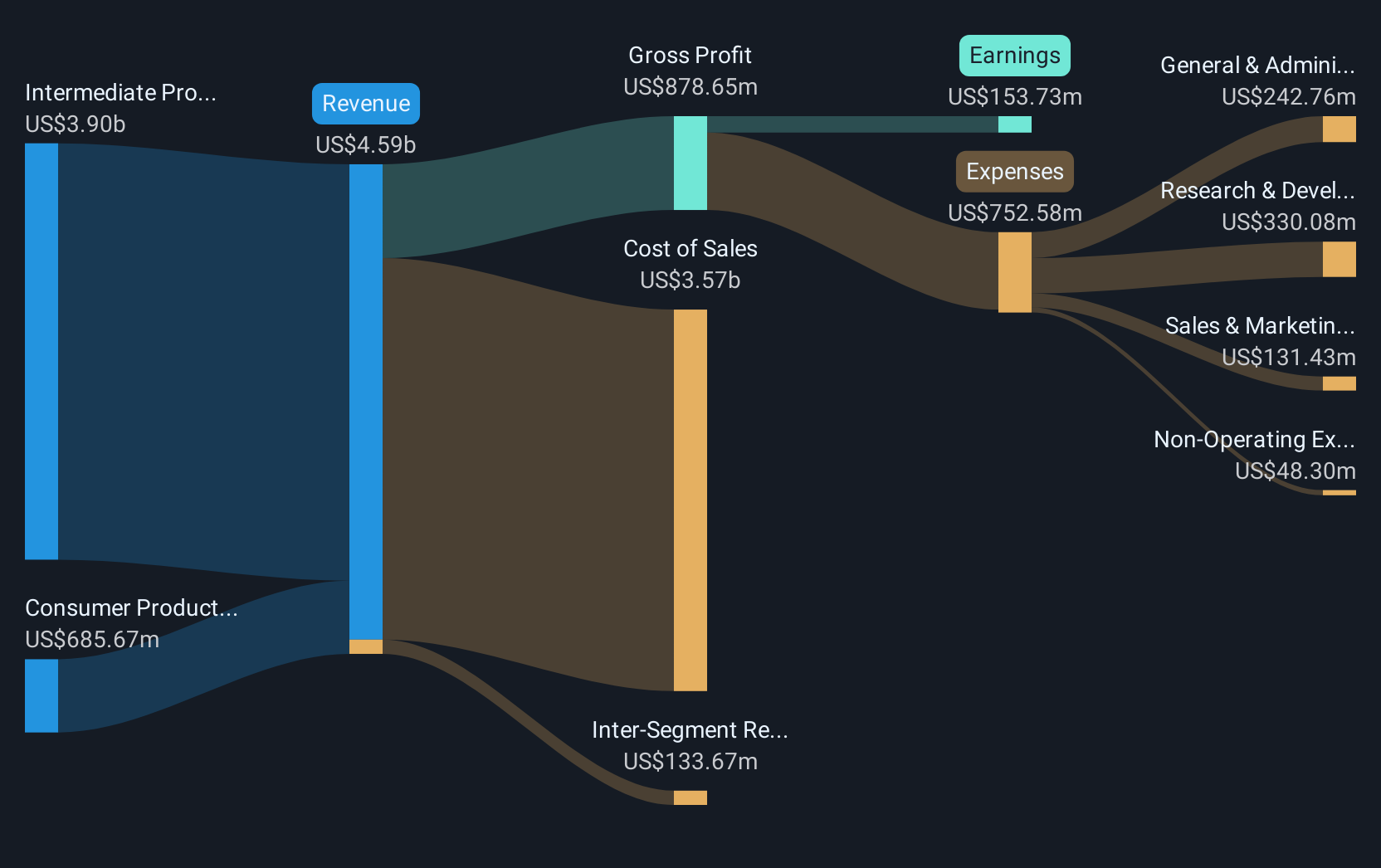

Overview: FIT Hon Teng Limited, with a market cap of HK$25.08 billion, is engaged in the manufacturing and sale of mobile and wireless devices and connectors both in Taiwan and internationally.

Operations: FIT Hon Teng generates revenue primarily from Consumer Products and Intermediate Products, with the latter contributing significantly more at $3.94 billion compared to $690.95 million for Consumer Products. The company's business model focuses on manufacturing and selling these products in both domestic and international markets.

FIT Hon Teng's recent unveiling of AI data center connectivity and immersion-cooling technologies at the 2024 OCP Global Summit marks a significant stride in addressing the complex challenges of modern AI-driven data centers. With a robust 125.6% earnings growth over the past year, outpacing the electronics industry's average, FIT is set to enhance its market position further. The company's forward-looking innovations, such as 224G+ sockets and co-packaged architectures, are critical for scaling high-density AI workloads efficiently. These advancements not only reflect FIT’s commitment to technological leadership but also align with an expected revenue growth of 17.5% per year, surpassing Hong Kong's market average. Despite not having positive free cash flow currently, FIT Hon Teng’s strategic focus on developing cutting-edge solutions for AI infrastructure demonstrates potential for sustained growth, especially with an anticipated annual earnings increase of 30.8%. This projection notably exceeds the broader Hong Kong market forecast of 11.1%, underscoring FIT’s competitive edge in a rapidly evolving sector. By continually investing in R&D and pushing boundaries in AI technology integration within data centers, FIT is well-positioned to capitalize on future industry demands while enhancing its financial health and market presence.

- Navigate through the intricacies of FIT Hon Teng with our comprehensive health report here.

Assess FIT Hon Teng's past performance with our detailed historical performance reports.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

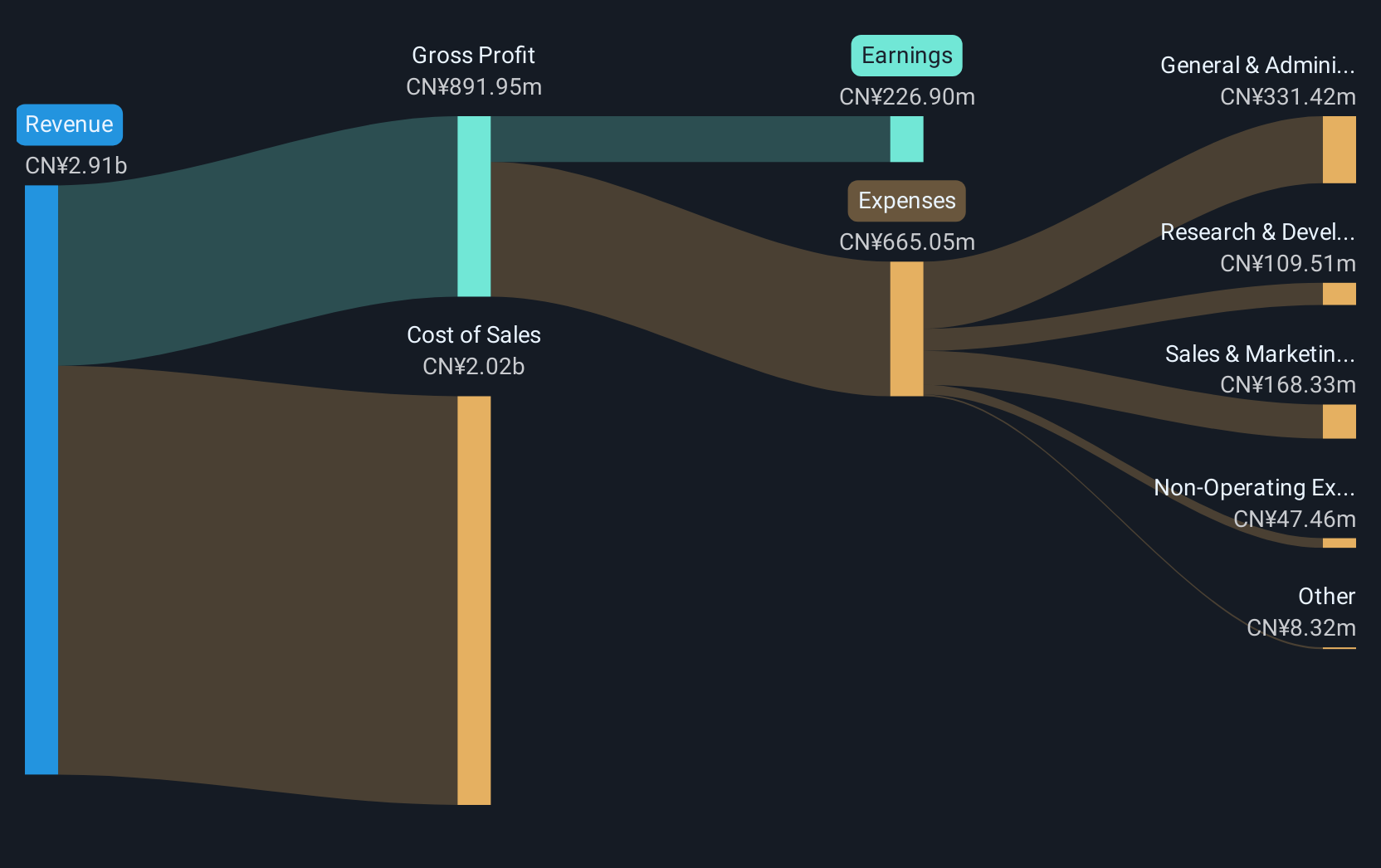

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry and has a market capitalization of CN¥12.69 billion.

Operations: Fujian Torch Electron Technology generates revenue primarily from the production and sale of electronic components. The company's cost structure is influenced by raw material expenses and manufacturing costs. Its net profit margin has shown variability, reflecting fluctuations in operational efficiency and market conditions.

Fujian Torch Electron Technology, despite a challenging past year with earnings shrinking by 32.8%, is poised for a rebound with an anticipated annual earnings growth of 36.5% and revenue growth at 21.9%. These figures starkly contrast the broader Chinese market's averages of 25.2% for earnings and 13.5% for revenue growth, underscoring the company's potential to outpace its peers significantly. The firm recently hosted a special shareholders meeting, signaling proactive governance amidst these financial fluctuations. Moreover, Fujian Torch's commitment to innovation is evident from its R&D expenditure trends, which are critical in sustaining long-term competitiveness in the fast-evolving tech landscape.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

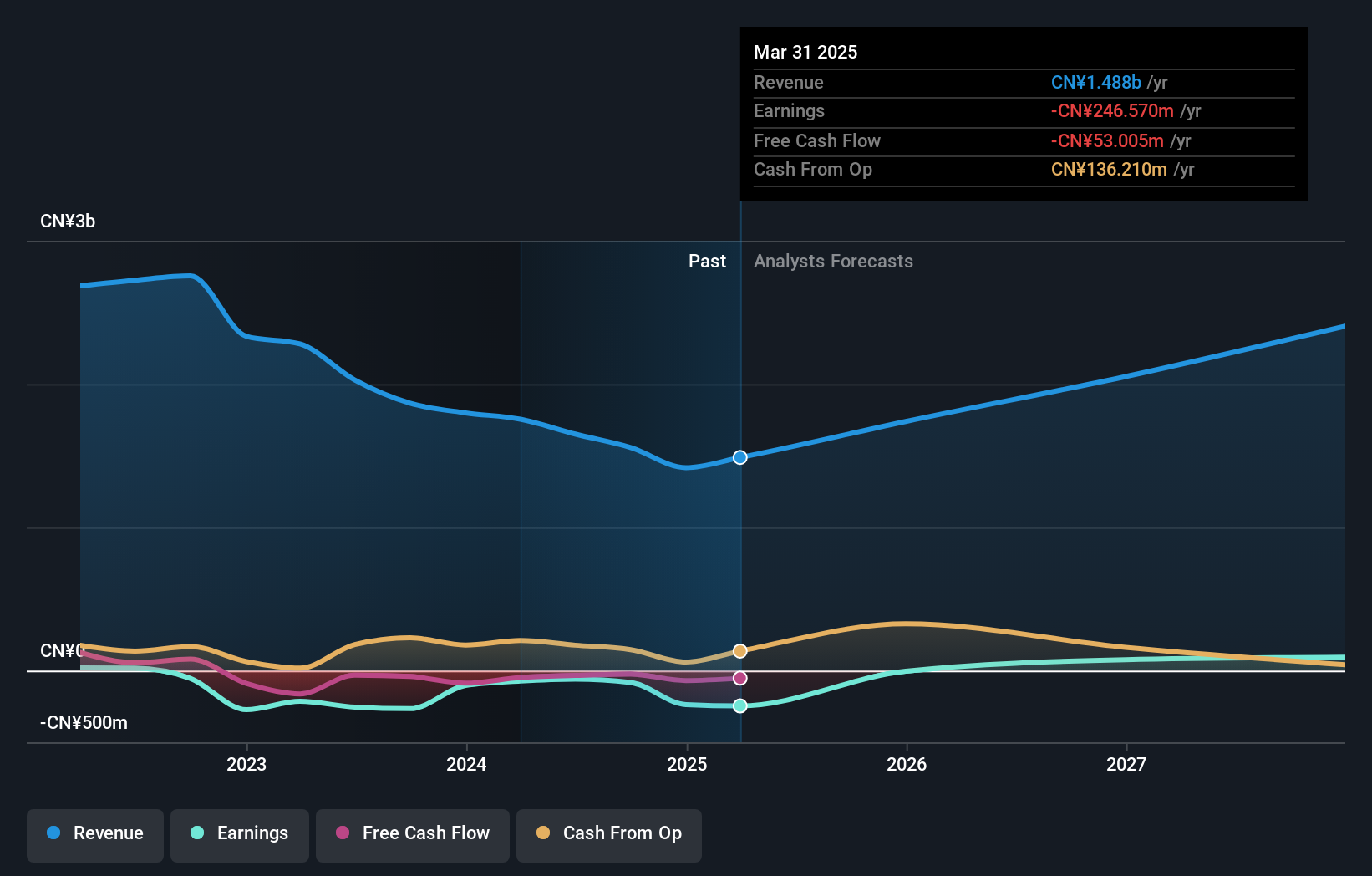

Overview: Gosuncn Technology Group Co., Ltd. specializes in providing IoT products and services in China, with a market cap of CN¥8.99 billion.

Operations: Gosuncn Technology Group focuses on IoT products and services, generating revenue primarily from this sector in China. The company's business operations are centered around leveraging IoT technology to offer innovative solutions within its market.

Gosuncn Technology Group, despite recent challenges with a sales drop to CNY 947.83 million from CNY 1,189.38 million year-over-year and a net loss reduction to CNY 45.99 million from CNY 66.84 million, shows resilience and potential for recovery. The company's proactive approach is evident in its recent shareholder meeting where strategic adjustments were discussed, including reappointment of audit firms and remuneration revisions. This aligns with its commitment to governance amid financial adjustments while maintaining focus on long-term growth prospects in the tech industry, underscored by an expected revenue growth of 13.9% per year which outpaces the broader Chinese market average of 13.5%.

- Get an in-depth perspective on Gosuncn Technology Group's performance by reading our health report here.

Learn about Gosuncn Technology Group's historical performance.

Key Takeaways

- Take a closer look at our High Growth Tech and AI Stocks list of 1223 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300098

Gosuncn Technology Group

Provides IoT products and services in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion