Exploring High Growth Tech Stocks Including Gosuncn Technology Group

Reviewed by Simply Wall St

In recent weeks, global markets have faced a mix of challenges, including tariff uncertainties and softer-than-expected U.S. job growth, which have contributed to declines in major indices such as the S&P 500 and Nasdaq Composite. Amid these conditions, high-growth tech stocks continue to draw attention for their potential resilience and innovation-driven prospects; evaluating factors like strong earnings performance and market adaptability can be key when exploring opportunities in this sector, including companies like Gosuncn Technology Group.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1216 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

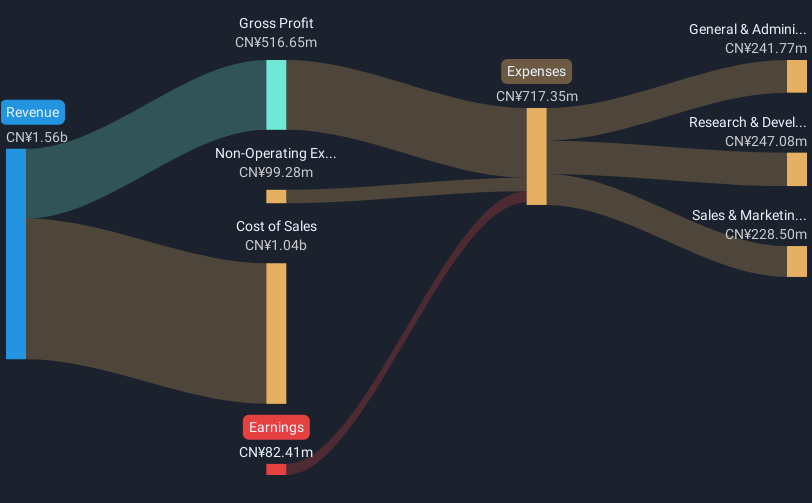

Overview: Gosuncn Technology Group Co., Ltd. offers IoT products and services both in China and internationally, with a market capitalization of CN¥10.25 billion.

Operations: Gosuncn Technology Group generates revenue through its IoT products and services, catering to both domestic and international markets. The company's business model focuses on leveraging technology solutions to address various industry needs.

Gosuncn Technology Group, amidst a challenging tech landscape, demonstrates promising financial dynamics with an annualized revenue growth of 14.3% and an expected leap to profitability within three years. Despite its current unprofitability, the company's earnings have surged by 43.7% annually over the past five years, signaling robust underlying business strength. With R&D expenses marked at 15% of total revenue last year, Gosuncn is heavily investing in innovation, which could catalyze future growth in its communications segment—already a significant revenue contributor. This strategic focus on research may well position Gosuncn favorably against slower market growth projections and a highly volatile share price environment.

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

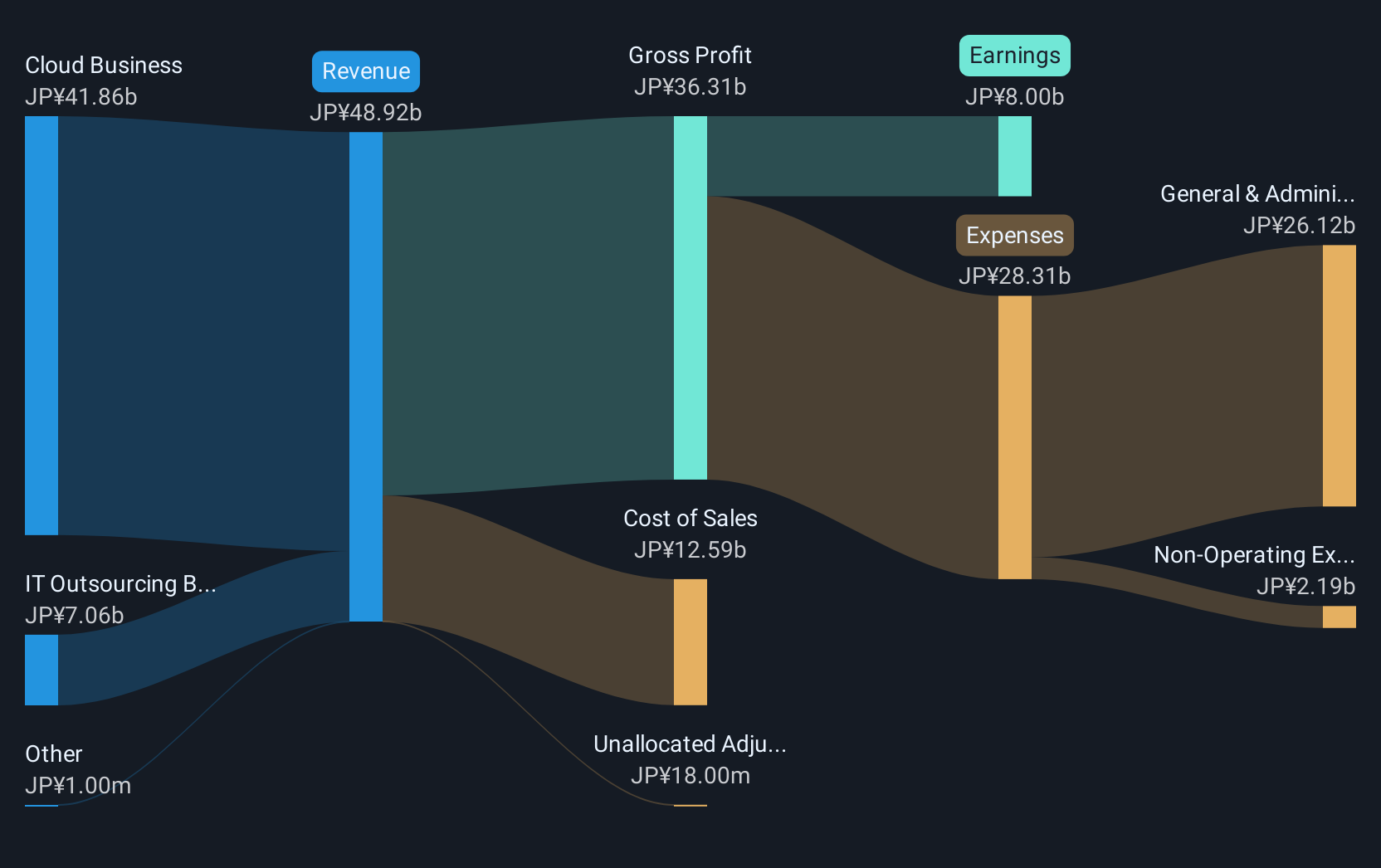

Overview: Rakus Co., Ltd. is a Japanese company that, along with its subsidiaries, specializes in providing cloud services and has a market capitalization of ¥366.79 billion.

Operations: Rakus Co., Ltd. generates revenue primarily through its Cloud Business, which accounts for ¥37.28 billion, complemented by its IT Outsourcing Business bringing in ¥6.49 billion.

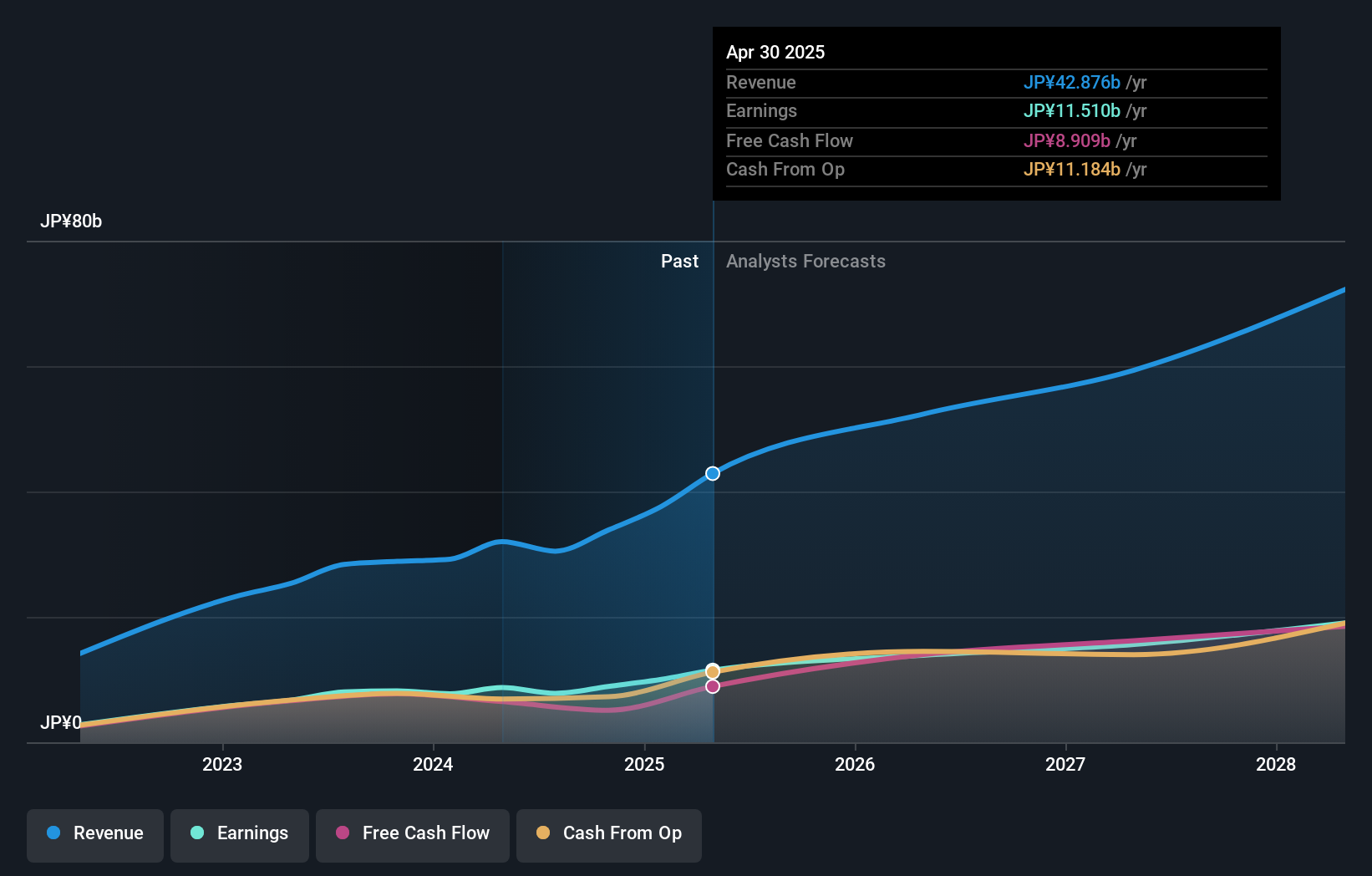

Rakus Co., Ltd. is carving a niche in the high-growth tech sector, underscored by its recent strategic moves to expand globally and enhance its software development capabilities. With a robust annualized revenue growth of 16.7% and earnings growth outpacing the industry at 25.6%, Rakus's commitment to innovation is evident from its significant R&D investment, which aligns with industry trends towards cloud services and SaaS models. The establishment of a new subsidiary in Indonesia highlights its strategy to leverage emerging markets, enhancing both local and global developmental capacities. Moreover, revised upward financial guidance for FY2025 reflects confidence in sustained profitability and market share expansion, positioning Rakus as an agile player in the competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Rakus' health report.

Examine Rakus' past performance report to understand how it has performed in the past.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company that operates both in Japan and internationally, with a market capitalization of ¥215.01 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment services, which include virtual YouTubers and digital content creation. The company focuses on leveraging its talent pool to produce engaging content that attracts a global audience. Its business model emphasizes innovation in digital media, contributing to the company's financial growth and expansion in international markets.

ANYCOLOR Inc. stands out in the tech landscape, marked by a robust revenue growth of 13.9% annually, which surpasses the Japanese market average of 4.2%. This growth is complemented by an earnings increase of 14.7% per year, indicating efficient operations and market adaptability. The company's commitment to innovation is further evidenced by its R&D spending trends, aligning with its strategic focus on expanding into new technological frontiers. Recently announced Q2 results are expected to reflect these ongoing efforts and potentially enhance its competitive stance in a rapidly evolving industry sector.

- Dive into the specifics of ANYCOLOR here with our thorough health report.

Understand ANYCOLOR's track record by examining our Past report.

Taking Advantage

- Get an in-depth perspective on all 1216 High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3923

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion