- China

- /

- Electronic Equipment and Components

- /

- SZSE:300115

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investors are closely monitoring the Federal Reserve's potential interest rate cuts and geopolitical tensions impacting market sentiment. In this environment of economic growth and strong labor market indicators, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation capabilities and adaptability to evolving technological demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelink Technologies Co., Ltd. is engaged in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products mainly in China with a market capitalization of CN¥33.43 billion.

Operations: Accelink generates revenue primarily from its communication equipment manufacturing segment, which accounts for CN¥7.10 billion. The company's operations focus on optoelectronic technology products within China.

Accelink Technologies CoLtd has demonstrated robust financial performance, with a notable revenue increase to CNY 5.38 billion, up 24.3% from the previous year, reflecting strong market demand. This growth is complemented by an earnings surge of 12.3%, outpacing the broader Electronic industry's growth rate significantly. The company's commitment to innovation is evident in its R&D investments, which have strategically focused on enhancing technological capabilities in high-demand sectors such as optical communication technologies—a move that not only aligns with industry trends but also positions Accelink favorably against competitors. The firm's strategic decisions during shareholder meetings and its inclusion in the FTSE All-World Index underscore its operational and strategic resilience, potentially increasing investor confidence. Looking ahead, Accelink is poised for continued growth with projected annual earnings increases of 27.9%, suggesting a promising outlook for stakeholders invested in the trajectory of tech innovations within China’s burgeoning markets.

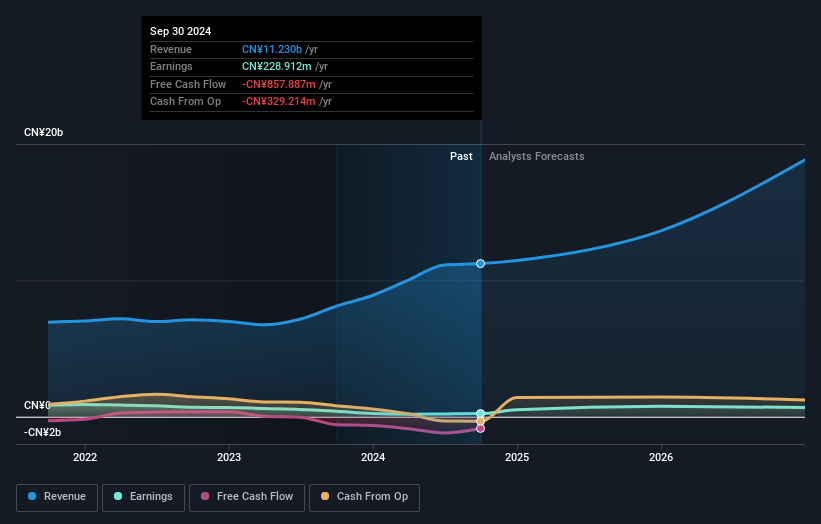

Wuhu Token Sciences (SZSE:300088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhu Token Sciences Co., Ltd. specializes in the R&D, processing, manufacturing, sales, and servicing of key touch display device materials in China with a market cap of CN¥16.74 billion.

Operations: Wuhu Token Sciences generates revenue primarily through its electronic components and parts segment, which reported CN¥11.23 billion. The company focuses on the development and sale of materials essential for touch display devices in China.

Wuhu Token Sciences has recently shown a significant uptick in revenue, reporting CNY 8.64 billion for the nine months ending September 2024, up from CNY 6.30 billion the previous year, marking a growth rate of approximately 37%. This surge is underpinned by robust R&D investments which have consistently escalated to align with revenue increases—evidence of their commitment to innovation and technological advancement in their sector. The company also strategically repurchased shares worth CNY 150.18 million, reflecting confidence in its operational stability and future prospects. With projected annual earnings growth at an impressive 43.6%, Wuhu Token Sciences is positioning itself as a dynamic player within the tech landscape, leveraging both market trends and internal capabilities to foster sustainable growth.

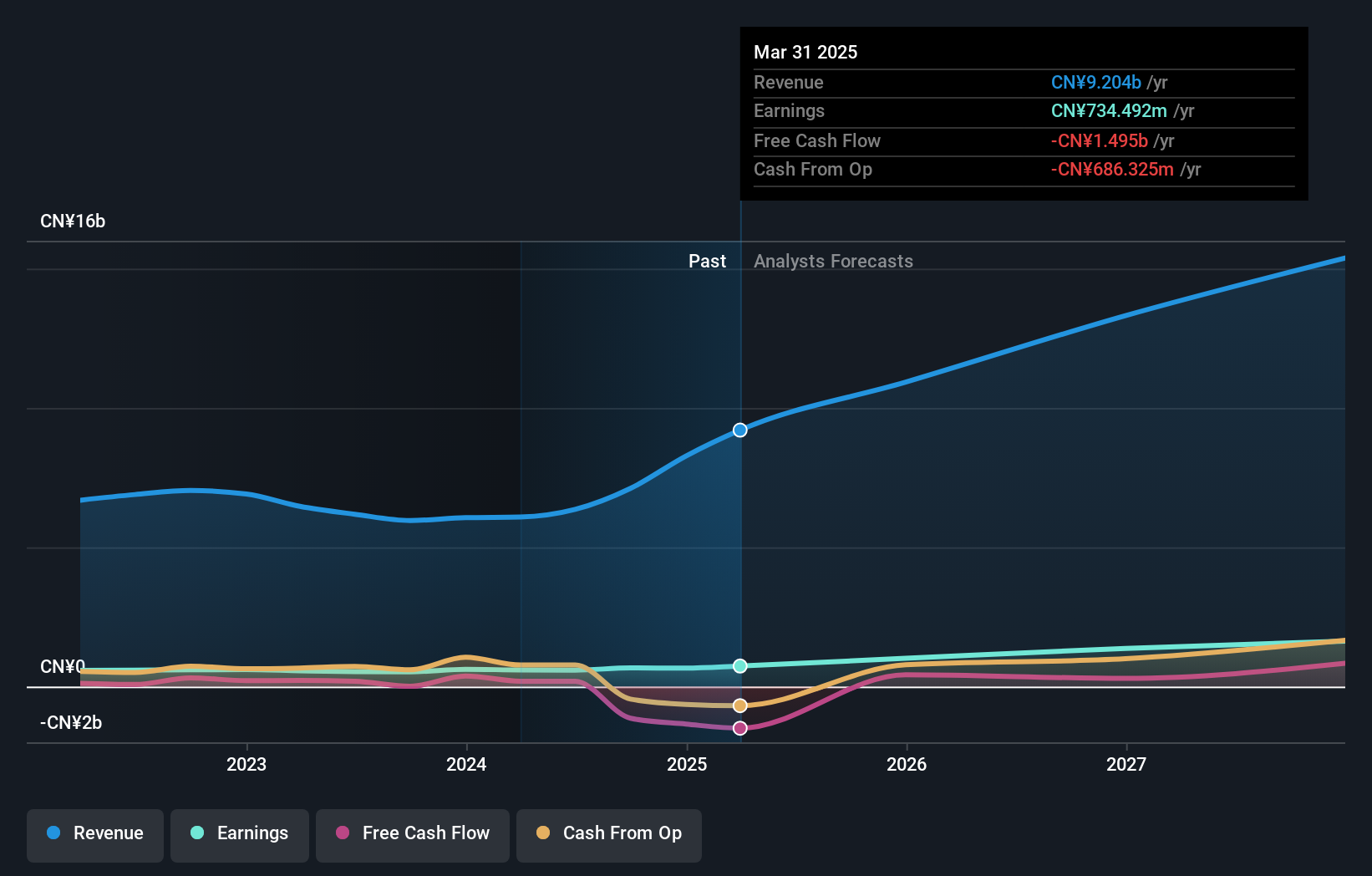

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision manufacturing industry and has a market capitalization of CN¥22.29 billion.

Operations: Shenzhen Everwin Precision Technology Co., Ltd. focuses on precision manufacturing, contributing to its market presence with a valuation of CN¥22.29 billion.

Shenzhen Everwin Precision Technology has demonstrated a remarkable turnaround, with its recent reports showing a surge in revenue to CNY 12.1 billion and net income escalating to CNY 594.2 million from just CNY 1.55 million the previous year. This growth is underpinned by substantial R&D investments, reflecting an aggressive pursuit of innovation; notably, R&D expenses have been aligned proportionally with revenue increases, emphasizing a strategic focus on technological advancement. The company's earnings are expected to grow by 27.6% annually, outpacing the broader Chinese market's forecast of 26.2%, showcasing its potential within the competitive tech landscape despite a highly volatile share price in recent months.

- Take a closer look at Shenzhen Everwin Precision Technology's potential here in our health report.

Understand Shenzhen Everwin Precision Technology's track record by examining our Past report.

Key Takeaways

- Click this link to deep-dive into the 1289 companies within our High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300115

Shenzhen Everwin Precision Technology

Shenzhen Everwin Precision Technology Co., Ltd.

Solid track record with reasonable growth potential.