- China

- /

- Communications

- /

- SZSE:300079

Sumavision TechnologiesLtd's (SZSE:300079) Shareholders Have More To Worry About Than Only Soft Earnings

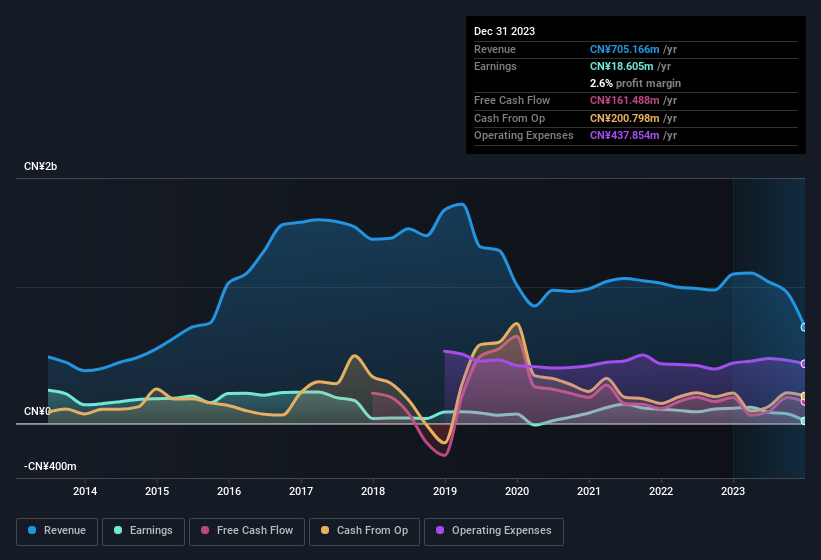

Last week's earnings announcement from Sumavision Technologies Co.,Ltd. (SZSE:300079) was disappointing to investors, with a sluggish profit figure. Our analysis has found some reasons to be concerned, beyond the weak headline numbers.

View our latest analysis for Sumavision TechnologiesLtd

Operating Revenue Or Not?

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. It's worth noting that Sumavision TechnologiesLtd saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from CN¥40.3m last year to CN¥58.1m this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sumavision TechnologiesLtd.

Our Take On Sumavision TechnologiesLtd's Profit Performance

As discussed above, Sumavision TechnologiesLtd's sharp increase in non-operating revenue boosted its profit over the last year, and if that non-operating revenue is not repeated, then the trailing twelve months profit probably isn't as good as it seems. Therefore, it seems possible to us that Sumavision TechnologiesLtd's true underlying earnings power is actually less than its statutory profit. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Sumavision TechnologiesLtd at this point in time. To that end, you should learn about the 2 warning signs we've spotted with Sumavision TechnologiesLtd (including 1 which is concerning).

Today we've zoomed in on a single data point to better understand the nature of Sumavision TechnologiesLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300079

Sumavision TechnologiesLtd

Provides video delivery solutions for broadcast, cable, satellite, internet, and mobile and telco video service in China and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion