- New Zealand

- /

- Machinery

- /

- NZSE:SKL

Asian Penny Stocks To Consider In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a cautious optimism that could influence investor strategies. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for those looking to explore beyond established market giants. Despite being considered somewhat outdated, the potential for growth in these stocks is still very much alive, particularly when they exhibit strong financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Phol Dhanya (SET:PHOL) | THB2.82 | THB571.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.82 | THB2.99B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.098 | SGD41.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.19 | SGD37.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.23 | SGD8.78B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.11 | HK$1.85B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.90 | HK$1.58B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,158 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Skellerup Holdings (NZSE:SKL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skellerup Holdings Limited designs, manufactures, and distributes engineered products for specialist industrial and agricultural applications, with a market cap of NZ$827.42 million.

Operations: The company's revenue is derived from two main segments: Agri, contributing NZ$107.3 million, and Industrial, generating NZ$232.02 million.

Market Cap: NZ$827.42M

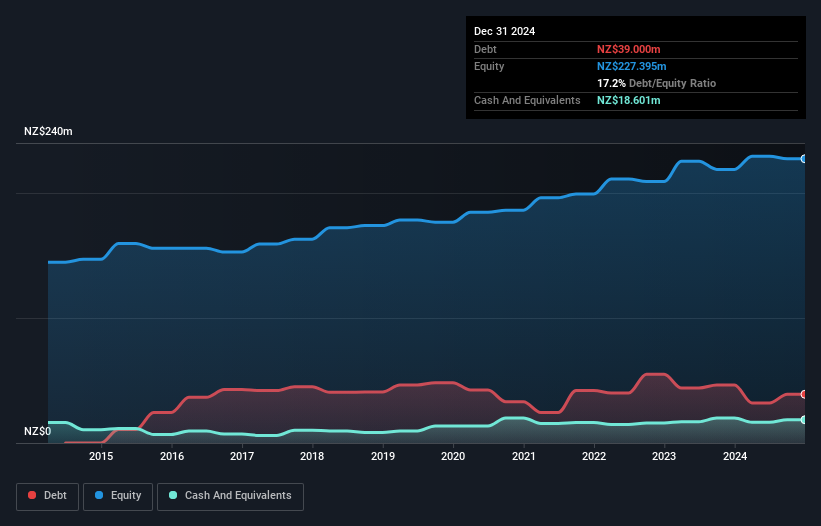

Skellerup Holdings, with a market cap of NZ$827.42 million, demonstrates financial stability and growth potential within the penny stock segment. Despite a slight decline in net profit margins from 15.2% to 14.6%, the company maintains high-quality earnings and robust debt management, with its debt well covered by operating cash flow at 170.7%. The board is experienced with an average tenure of 8.2 years, supporting strategic decisions like the recent dividend increase to 9 cents per share. Skellerup's return on equity stands strong at 21.8%, indicating effective use of shareholder funds amidst stable weekly volatility of 5%.

- Click to explore a detailed breakdown of our findings in Skellerup Holdings' financial health report.

- Learn about Skellerup Holdings' future growth trajectory here.

Citychamp Dartong Advanced Materials (SHSE:600067)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Citychamp Dartong Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market capitalization of CN¥3.50 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.5B

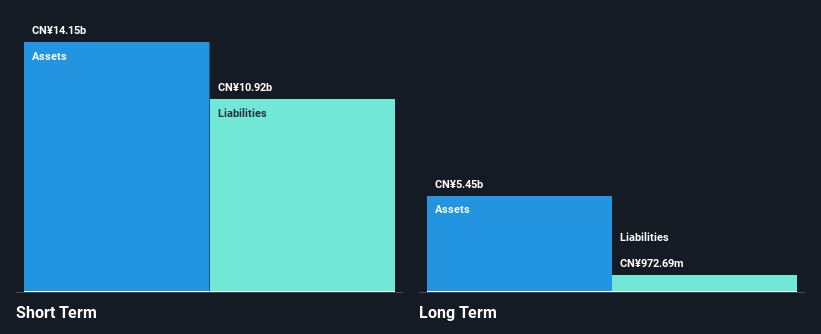

Citychamp Dartong Advanced Materials, with a market cap of CN¥3.50 billion, faces financial challenges as it remains unprofitable and pre-revenue. The company's losses have increased significantly over the past five years, though its debt is considered satisfactory with a net debt to equity ratio of 31%. Operating cash flow covers 26.1% of its debt, yet interest payments are not well covered by EBIT. Despite trading below estimated fair value by 30.2%, the seasoned management and board offer stability with average tenures of 6.9 and 8.3 years respectively, while short-term assets comfortably cover both short- and long-term liabilities.

- Dive into the specifics of Citychamp Dartong Advanced Materials here with our thorough balance sheet health report.

- Understand Citychamp Dartong Advanced Materials' track record by examining our performance history report.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥4.26 billion.

Operations: Sanchuan Wisdom Technology Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥4.26B

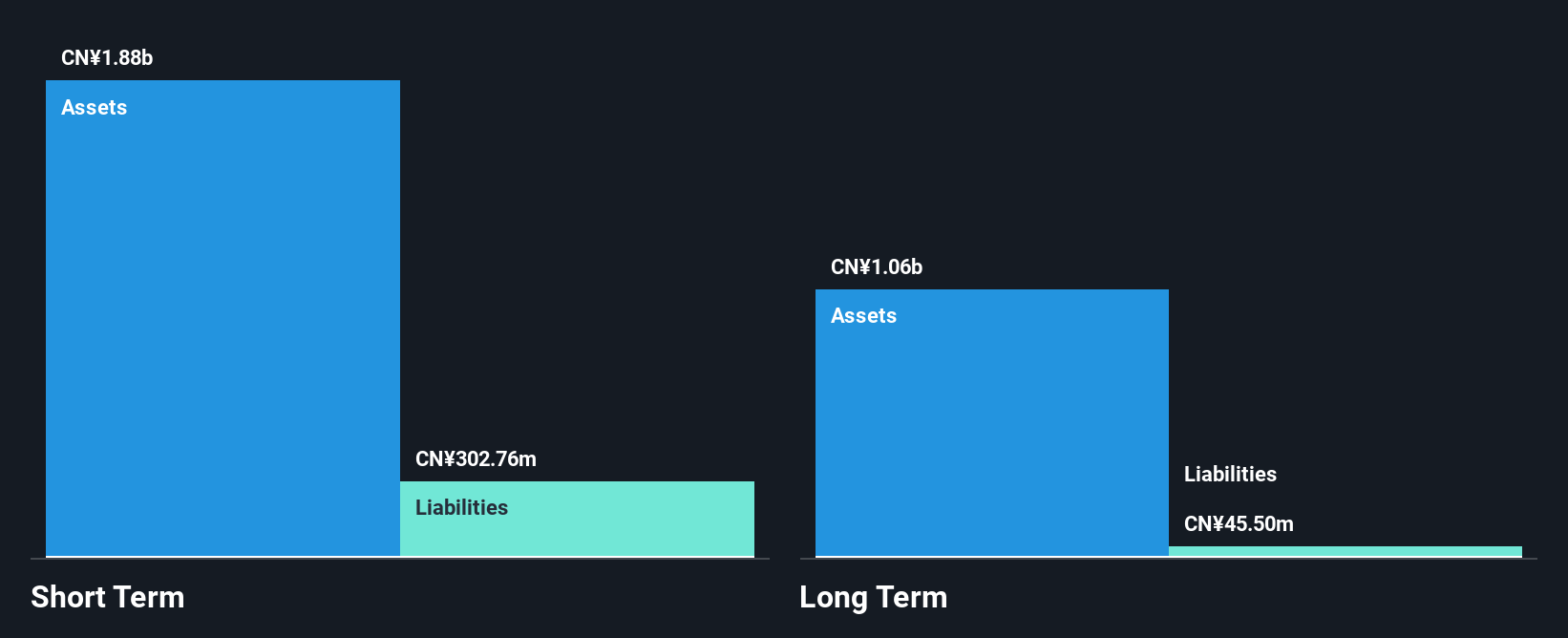

Sanchuan Wisdom Technology, with a market cap of CN¥4.26 billion, has demonstrated mixed financial performance. Despite stable weekly volatility and high-quality earnings, the company faces challenges with declining revenue and profit margins over the past year. Recent earnings reports show a drop in sales from CN¥348.53 million to CN¥213.34 million year-on-year for Q1 2025, though net income increased significantly to CN¥16.31 million from a low base last year. The company's short-term assets comfortably cover its liabilities, and its debt is well managed with more cash than total debt, yet dividend sustainability remains uncertain due to an unstable track record.

- Navigate through the intricacies of Sanchuan Wisdom Technology with our comprehensive balance sheet health report here.

- Explore historical data to track Sanchuan Wisdom Technology's performance over time in our past results report.

Seize The Opportunity

- Investigate our full lineup of 1,158 Asian Penny Stocks right here.

- Seeking Other Investments? The latest GPUs need a type of rare earth metal called Neodymium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKL

Skellerup Holdings

Designs, manufactures, and distributes engineered products for various specialist industrial and agricultural applications.

Flawless balance sheet and good value.

Market Insights

Community Narratives