- China

- /

- Metals and Mining

- /

- SHSE:600507

3 Penny Stocks In Global With Market Caps Under US$2B

Reviewed by Simply Wall St

As global markets continue to experience robust growth, with major U.S. indices like the S&P 500 and Nasdaq Composite hitting record highs, investors are increasingly looking for opportunities in less conventional areas. Though the term 'penny stock' might sound outdated, these stocks still hold potential for significant growth, particularly when backed by strong financial fundamentals. In this article, we will explore several penny stocks that demonstrate financial resilience and offer promising prospects for investors seeking hidden value in smaller or newer companies.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.34 | A$105.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.33 | HK$858.09M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.24 | HK$1.81B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.455 | SEK2.35B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.995 | MYR7.36B | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,828 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel industry, focusing on the production and sale of special steel products, with a market cap of approximately CN¥10.93 billion.

Operations: No specific revenue segments are reported for Fangda Special Steel Technology.

Market Cap: CN¥10.93B

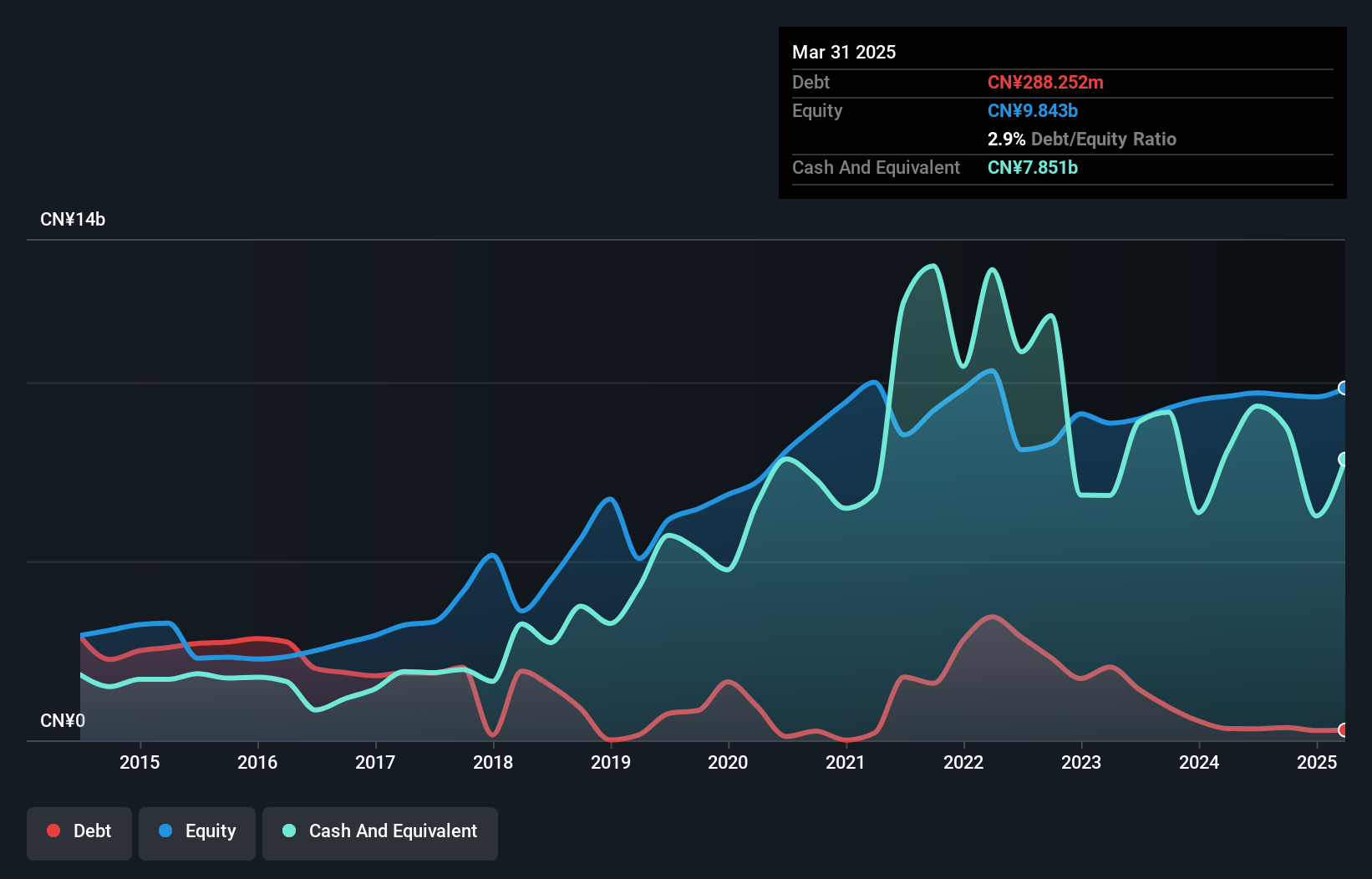

Fangda Special Steel Technology has demonstrated a reduction in its debt-to-equity ratio from 13.2% to 2.9% over the past five years, indicating improved financial stability. Despite this, the company faces challenges with declining earnings, which have decreased by an average of 32.5% annually over the same period and negative operating cash flow suggests difficulties in covering debt through operations. However, Fangda's short-term assets exceed both its short-term and long-term liabilities, providing some balance sheet strength. Recent earnings reports show a significant increase in net income to CN¥250.34 million compared to CN¥93.41 million last year despite declining revenue, suggesting operational improvements or cost management efforts amidst industry challenges.

- Navigate through the intricacies of Fangda Special Steel Technology with our comprehensive balance sheet health report here.

- Learn about Fangda Special Steel Technology's future growth trajectory here.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building decoration, curtain wall decoration, and intelligent system integration, with a market cap of CN¥5.20 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥5.2B

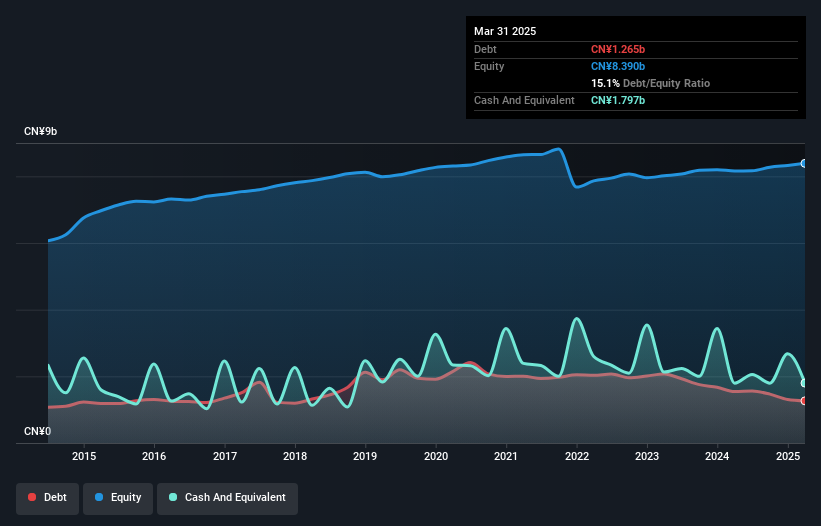

Zhejiang Yasha Decoration Co., Ltd, with a market cap of CN¥5.20 billion, shows financial resilience as its short-term assets (CN¥17.0 billion) surpass both short-term and long-term liabilities, while having more cash than total debt. The company reported first-quarter revenue of CN¥1,781.34 million and net income of CN¥66.74 million, with stable earnings per share from continuing operations at CNY 0.05 year-on-year. Despite trading significantly below estimated fair value and having an unstable dividend track record, it has reduced its debt-to-equity ratio over five years and maintains well-covered interest payments by EBIT (12.2x).

- Dive into the specifics of Zhejiang Yasha DecorationLtd here with our thorough balance sheet health report.

- Gain insights into Zhejiang Yasha DecorationLtd's outlook and expected performance with our report on the company's earnings estimates.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥4.59 billion.

Operations: Sanchuan Wisdom Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.59B

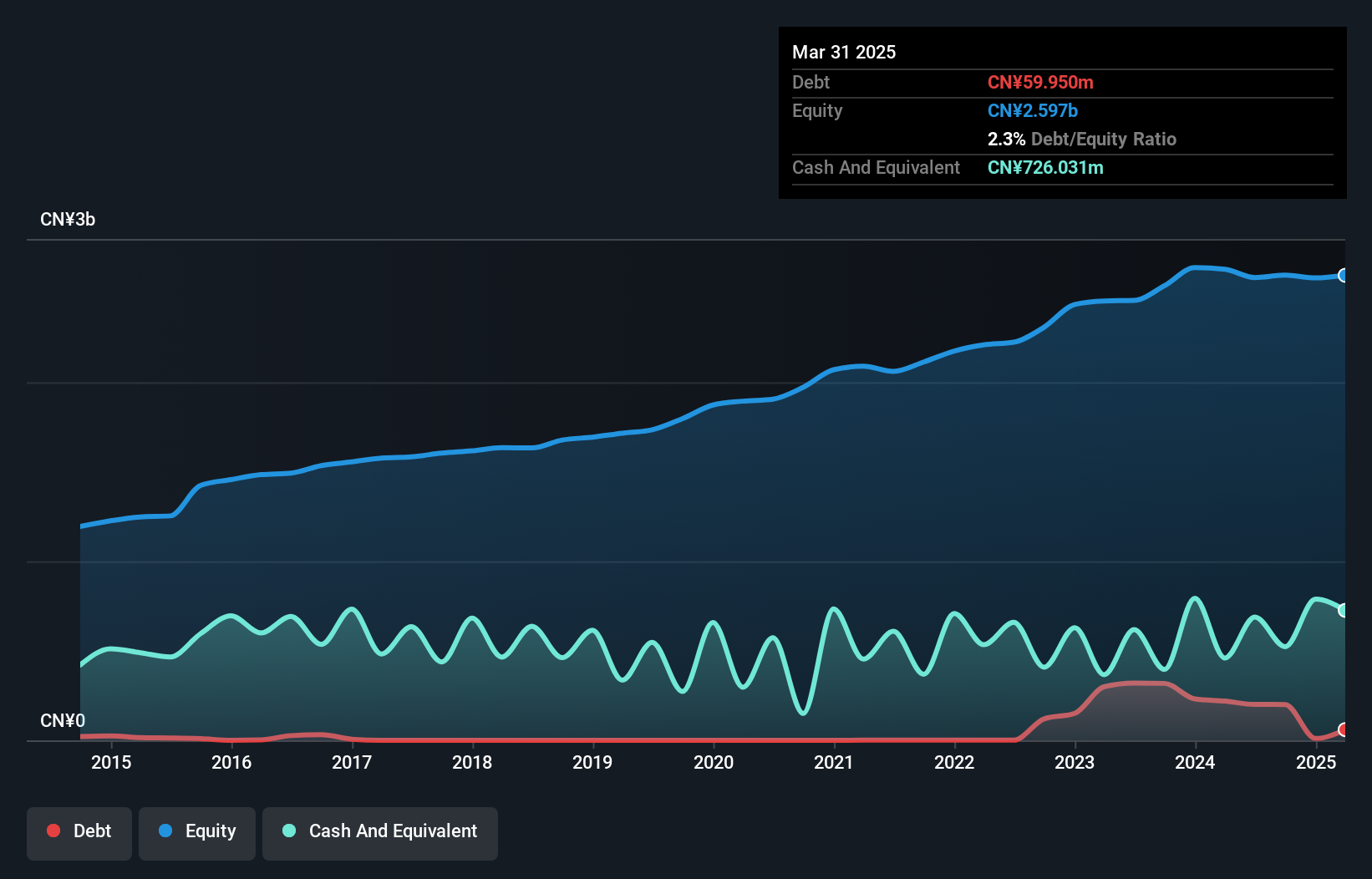

Sanchuan Wisdom Technology Co., Ltd., with a market cap of CN¥4.59 billion, reported first-quarter revenue of CN¥213.34 million and net income of CN¥16.31 million, reflecting improved earnings per share from CNY 0.0005 to CNY 0.0157 year-on-year despite declining sales and profit margins compared to the previous year. The company's short-term assets (CN¥1.9 billion) exceed its liabilities, and it maintains more cash than total debt, although recent large one-off gains have impacted financial results and its dividend track record remains unstable amidst negative earnings growth over the past year.

- Click to explore a detailed breakdown of our findings in Sanchuan Wisdom Technology's financial health report.

- Evaluate Sanchuan Wisdom Technology's historical performance by accessing our past performance report.

Key Takeaways

- Click here to access our complete index of 3,828 Global Penny Stocks.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600507

Fangda Special Steel Technology

Fangda Special Steel Technology Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives