- China

- /

- Electronic Equipment and Components

- /

- SZSE:300065

Undiscovered Gems In Asia For May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap indexes have shown resilience with consecutive weeks of gains. This positive momentum in the broader market sets an intriguing backdrop for uncovering potential opportunities in Asia's lesser-known stocks, where unique growth prospects can emerge amid shifting economic dynamics. Identifying such gems often involves looking beyond immediate market sentiment to focus on companies with strong fundamentals and innovative strategies that align well with current macroeconomic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Kanro | NA | 6.67% | 37.24% | ★★★★★★ |

| Korea Ratings | NA | 0.74% | 1.47% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| AlpenLtd | 9.98% | 3.10% | -0.77% | ★★★★★★ |

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

| Iljin DiamondLtd | 2.66% | -2.57% | -7.00% | ★★★★☆☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Nanjing LES Information Technology (SHSE:688631)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing LES Information Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥13.41 billion.

Operations: The company generates revenue through its technology-related operations, with a focus on specific segments that contribute to its financial performance. The net profit margin has shown variability, indicating fluctuations in profitability over time.

Nanjing LES Information Technology, a smaller player in the tech field, is navigating some turbulence. Over the past year, its earnings dipped by 12.4%, mirroring the Aerospace & Defense industry average. Despite this setback, it trades at 22.5% below estimated fair value and boasts high-quality past earnings with a debt-free balance sheet after reducing its debt-to-equity ratio from 24.4% to zero over five years. However, recent financials show first-quarter sales dropped to CNY 108.87 million from CNY 244.81 million last year, with net losses slightly improving to CNY 14.93 million compared to CNY 15.74 million previously.

- Unlock comprehensive insights into our analysis of Nanjing LES Information Technology stock in this health report.

Understand Nanjing LES Information Technology's track record by examining our Past report.

Beijing Highlander Digital Technology (SZSE:300065)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Highlander Digital Technology Co., Ltd. operates in the technology sector, focusing on digital solutions and services, with a market cap of CN¥11.87 billion.

Operations: The company generates revenue primarily from its digital solutions and services. It has a market cap of CN¥11.87 billion.

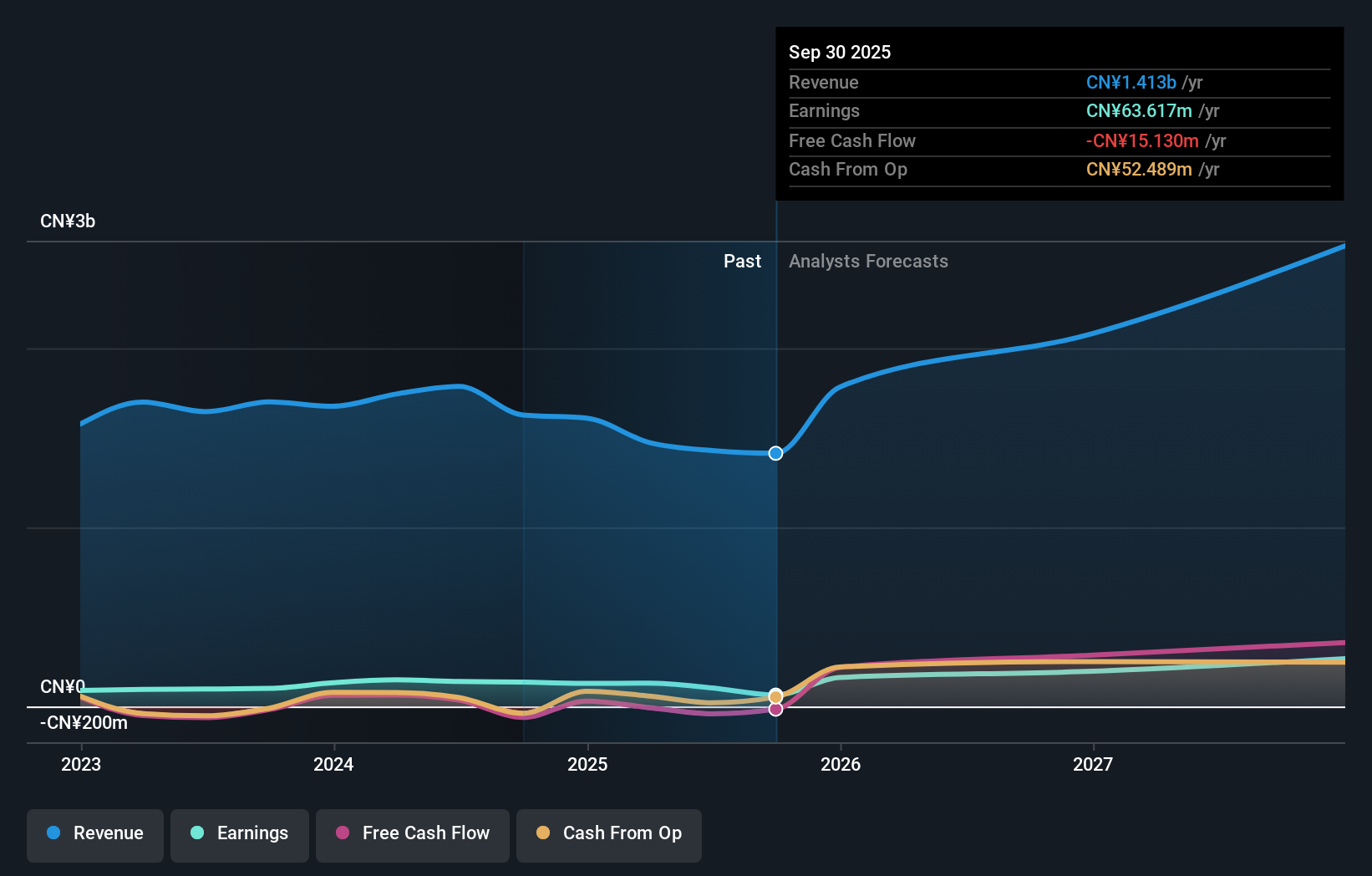

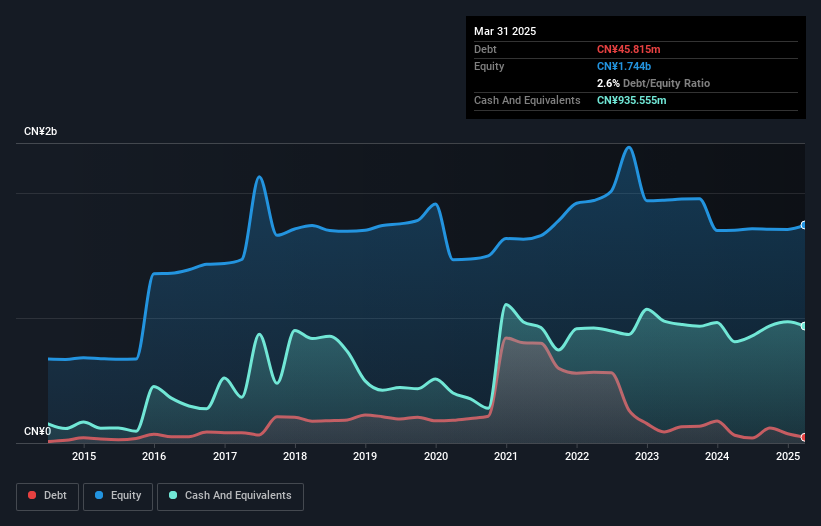

Beijing Highlander Digital Technology, a nimble player in the tech space, has shown a remarkable turnaround with net income reaching CNY 8.21 million from a loss of CNY 116.36 million last year. The company's debt to equity ratio impressively decreased from 12.4% to 2.6% over five years, highlighting prudent financial management. With sales hitting CNY 346.45 million in Q1 2025 compared to just CNY 46.88 million the previous year, it’s clear that revenue generation is on an upswing. Despite its volatile share price recently, Beijing Highlander seems well-positioned with high-quality earnings and positive free cash flow trends.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology solutions and services, with a market cap of CN¥9.76 billion.

Operations: The company generates revenue from its technology solutions and services, with a market capitalization of CN¥9.76 billion.

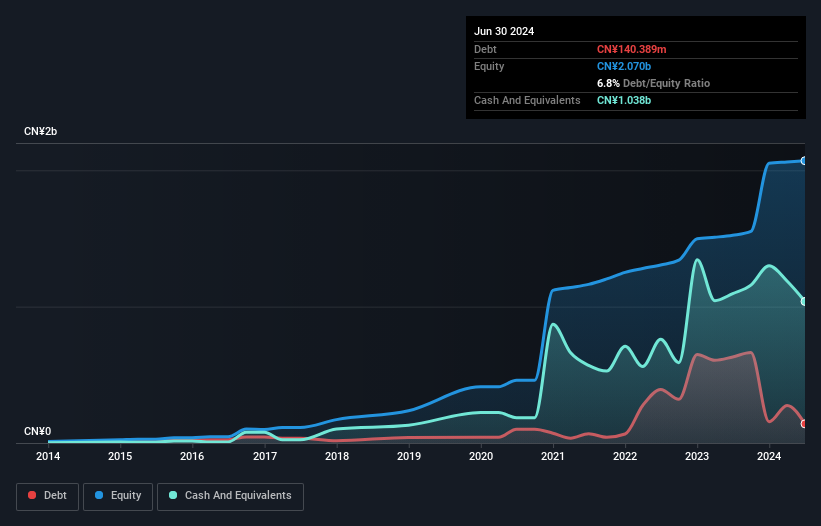

Shenzhen Farben, a dynamic player in the IT sector, showcases a promising outlook with its earnings growth of 15.9% over the past year, outpacing the industry decline of 16.4%. The company reported annual sales of CNY 4.32 billion for 2024, up from CNY 3.88 billion previously, alongside net income rising to CNY 130.98 million from CNY 113.01 million a year ago. Despite an increase in its debt-to-equity ratio from 10% to nearly 14% over five years, Shenzhen Farben maintains strong financial health with more cash than total debt and positive free cash flow trends indicating robust operational efficiency and potential for sustained growth.

Taking Advantage

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2688 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Highlander Digital Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300065

Beijing Highlander Digital Technology

Beijing Highlander Digital Technology Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives