- China

- /

- Electronic Equipment and Components

- /

- SZSE:300007

Hanwei Electronics Group's (SZSE:300007) Problems Go Beyond Weak Profit

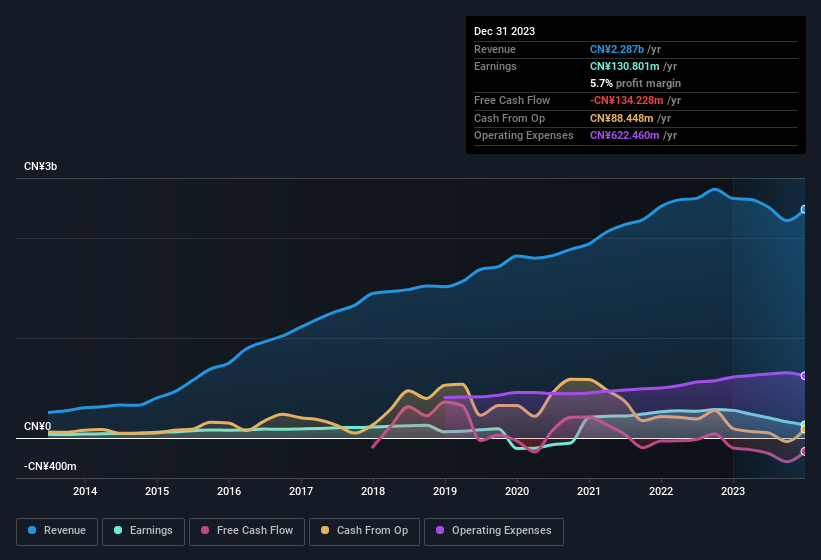

Last week's earnings announcement from Hanwei Electronics Group Corporation (SZSE:300007) was disappointing to investors, with a sluggish profit figure. We did some further digging and think they have a few more reasons to be concerned beyond the statutory profit.

View our latest analysis for Hanwei Electronics Group

How Do Unusual Items Influence Profit?

For anyone who wants to understand Hanwei Electronics Group's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥96m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Hanwei Electronics Group had a rather significant contribution from unusual items relative to its profit to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hanwei Electronics Group.

Our Take On Hanwei Electronics Group's Profit Performance

As previously mentioned, Hanwei Electronics Group's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. For this reason, we think that Hanwei Electronics Group's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Hanwei Electronics Group, and understanding these should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Hanwei Electronics Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Hanwei Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300007

Hanwei Electronics Group

Provides gas sensors and instruments in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.