- China

- /

- Communications

- /

- SZSE:002935

High Growth Tech Stocks to Watch in September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of steady U.S. inflation and mixed performances across major indices, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger counterparts like the S&P 500 for several weeks. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential and market adaptability, which can be crucial amid shifting economic indicators and investor sentiment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| CD Projekt | 35.10% | 42.68% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Intellego Technologies (OM:INT)

Simply Wall St Growth Rating: ★★★★★★

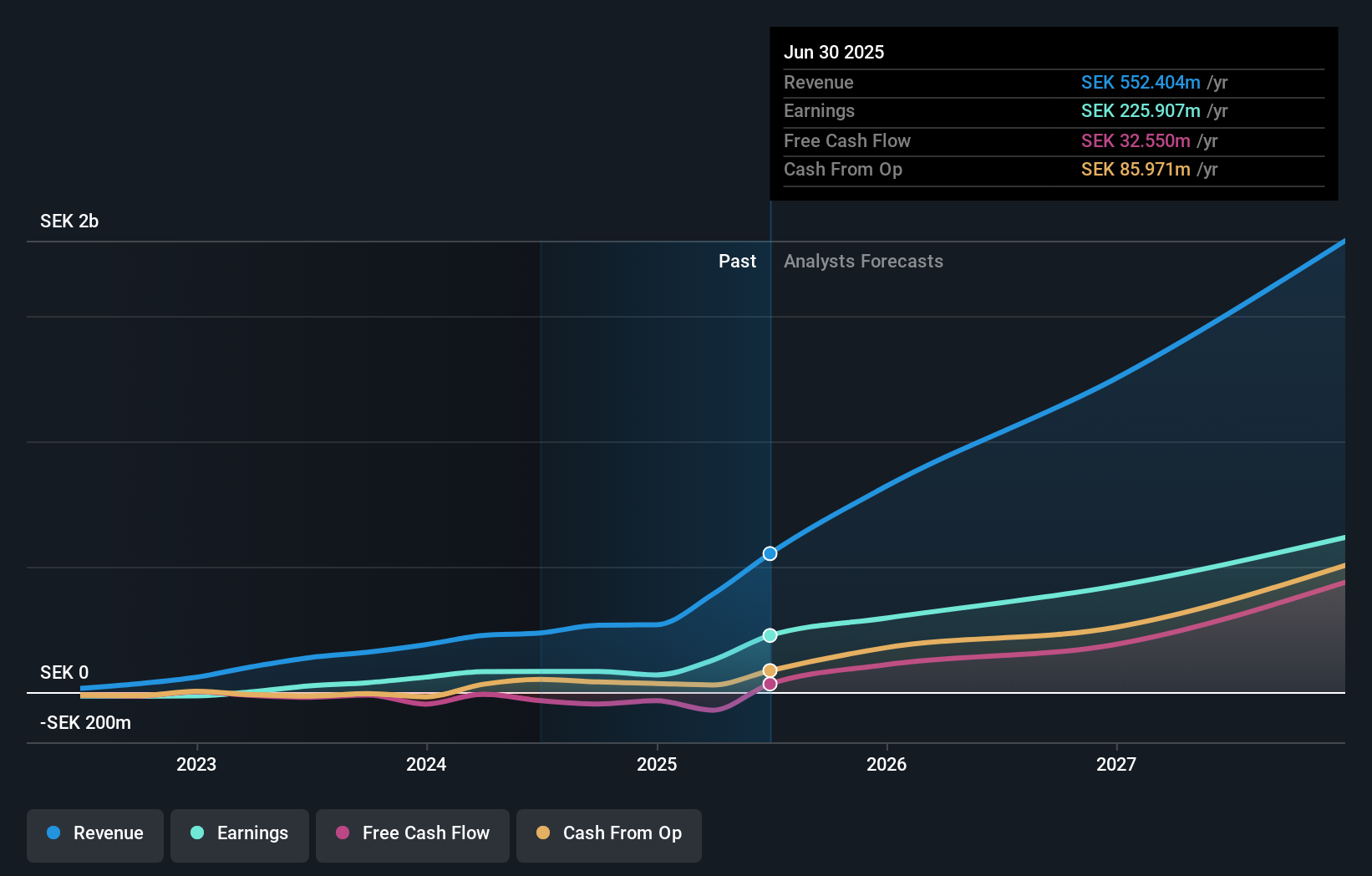

Overview: Intellego Technologies AB is a Swedish company specializing in the production and sale of colorimetric ultraviolet indicators, with a market capitalization of SEK5.97 billion.

Operations: Intellego Technologies AB generates revenue primarily through its Electronic Components & Parts segment, which contributed SEK554.24 million. The company focuses on producing colorimetric ultraviolet indicators in Sweden.

Intellego Technologies has demonstrated remarkable financial performance with a 172.6% increase in earnings over the past year, significantly outpacing the electronic industry's average. This growth is supported by a robust R&D investment strategy, which is evident from their recent expenditure figures showing an impressive allocation towards innovation and development. The company's strategic focus on expanding its technological capabilities can be seen in their latest quarterly results, where revenue soared to SEK 217.15 million from SEK 54.69 million in the previous year, and net income surged to SEK 111.96 million from SEK 13.22 million, highlighting effective execution and market adaptation. With a new CFO at the helm who brings extensive experience in B2B software sectors and SaaS models, Intellego is poised to enhance its market position further by leveraging advanced technologies and customer-centric solutions.

- Navigate through the intricacies of Intellego Technologies with our comprehensive health report here.

Gain insights into Intellego Technologies' past trends and performance with our Past report.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

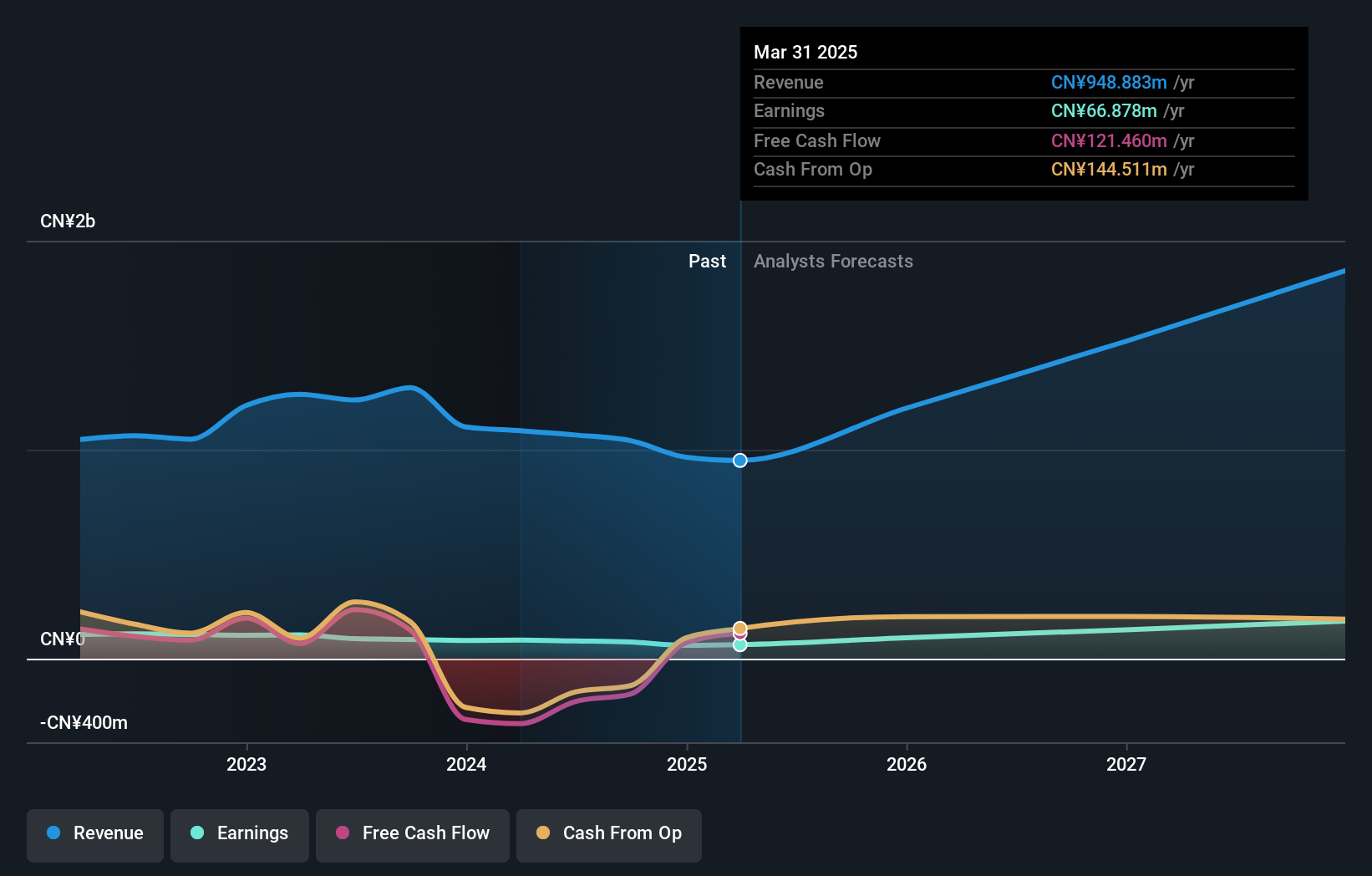

Overview: Chengdu Spaceon Electronics Co., Ltd. focuses on the research, development, design, production, and sale of time-frequency and satellite application products both in China and internationally, with a market cap of CN¥6.88 billion.

Operations: Spaceon Electronics generates revenue primarily from the computer, communications, and other electronic equipment manufacturing segment, totaling CN¥903.44 million. The company operates both domestically and internationally in the time-frequency and satellite application sectors.

Chengdu Spaceon Electronics, despite a challenging year with a 32.7% dip in earnings, forecasts robust growth ahead with expected annual revenue and earnings increases of 27.4% and 39.4%, respectively, outpacing the Chinese market averages of 13.9% and 26.1%. This ambitious growth trajectory is supported by significant R&D investments, which are crucial as the company navigates recent regulatory changes and shareholder meetings aimed at restructuring its governance framework to better align with its strategic objectives. These developments suggest a proactive approach in refining operations and enhancing shareholder value amidst evolving industry dynamics.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a company that focuses on the planning, development, and selling of cloud-based solutions in Japan, with a market capitalization of ¥239.23 billion.

Operations: Sansan, Inc. generates revenue primarily through its cloud-based solutions in Japan.

Sansan, Inc. has navigated a challenging fiscal year with a notable revenue increase to JPY 43.2 billion, up from JPY 33.9 billion, despite a decline in net income from JPY 953 million to JPY 424 million. The company's strategic issuance of Stock Acquisition Rights suggests an emphasis on aligning interests and incentivizing key personnel amid these financial shifts. Looking ahead, Sansan anticipates revenue growth up to JPY 54 billion by next year, supported by robust earnings growth projections of 37.4% annually—significantly outpacing the Japanese market's average of just over 8%. This forward-looking strategy is underscored by their recent annual general meeting decisions aimed at streamlining operations for sustained growth in the competitive software industry landscape.

Summing It All Up

- Gain an insight into the universe of 240 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002935

Chengdu Spaceon Electronics

Engages in the research and development, design, production, and sale of time-frequency and satellite application products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives