As global markets continue to navigate through geopolitical uncertainties and domestic policy shifts, U.S. indices such as the Dow Jones Industrial Average and the S&P 500 have reached record highs, with small-cap stocks finally joining their larger peers in this upward trajectory. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that demonstrate robust innovation and adaptability to market changes, making them particularly compelling for investors seeking exposure to potential growth opportunities in the technology sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.20% | 28.62% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Wuxi Unicomp Technology (SHSE:688531)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Unicomp Technology Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China, with a market cap of CN¥6.09 billion.

Operations: The company generates revenue primarily through the sale of X-ray technology and intelligent detection equipment. Its market cap stands at CN¥6.09 billion, reflecting its position in the industry.

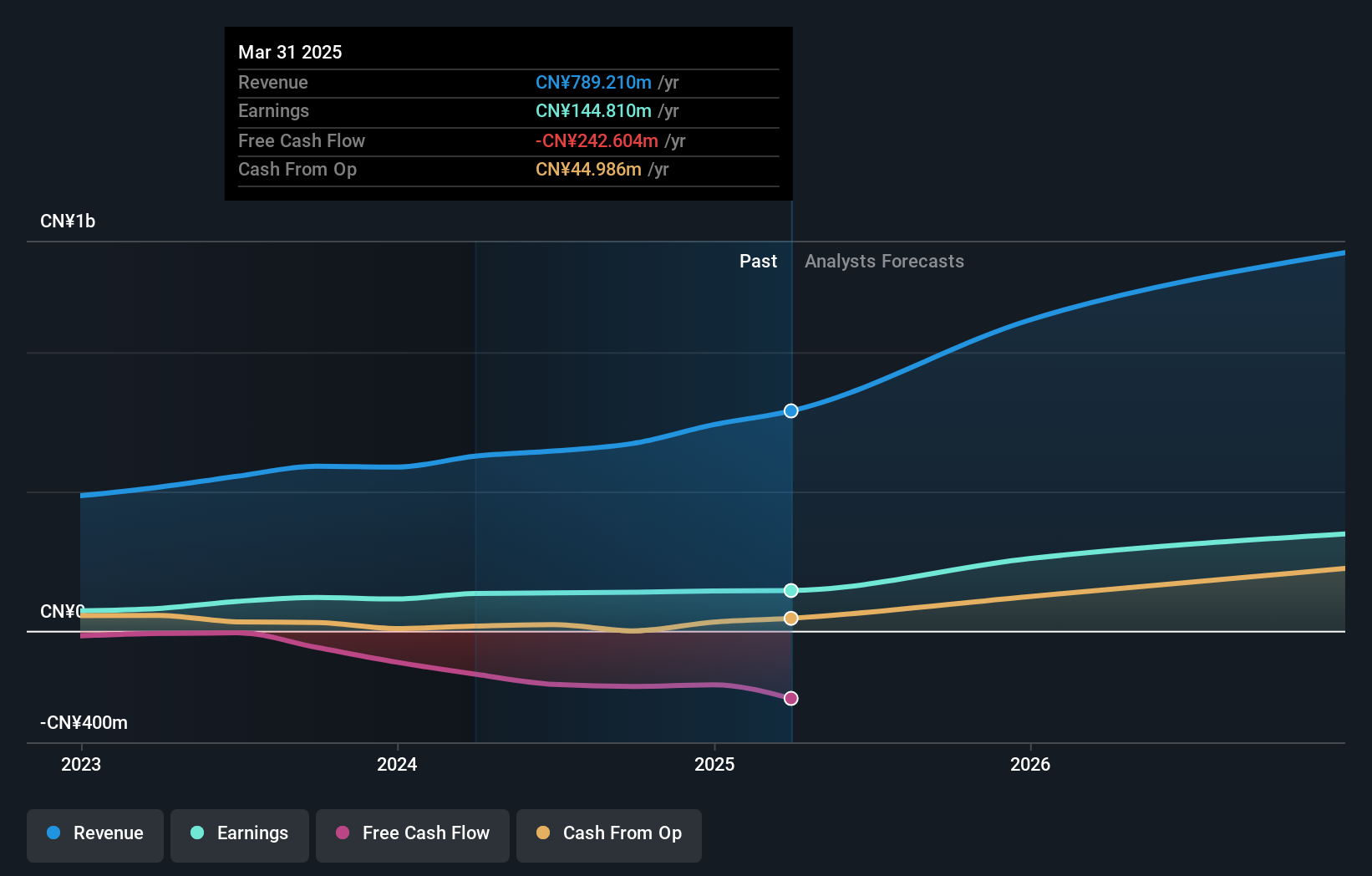

Wuxi Unicomp Technology has demonstrated robust financial health, with a 20% increase in sales to CNY 511.82 million and a 30% rise in net income to CNY 105.03 million over the past nine months. This growth trajectory is bolstered by significant R&D investment, aligning with its strategic focus on innovation in electronic technologies. The company's recent inclusion in the S&P Global BMI Index underscores its expanding influence and potential for sustained growth, supported by a strong forecast of revenue and earnings growth at annual rates of 27.6% and 34.1%, respectively—outpacing broader market trends. Moreover, Wuxi Unicomp's active engagement in share buybacks, with over 1.56 million shares repurchased this year for CNY 103.2 million, reflects a confident capital allocation strategy aimed at enhancing shareholder value. This approach is complemented by their operational focus on high-quality earnings from core business segments which are likely to drive future performance within the competitive tech landscape.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. focuses on the research and development, design, production, and sale of time-frequency and satellite application products both in China and internationally, with a market cap of CN¥6.73 billion.

Operations: Spaceon Electronics generates revenue primarily from the manufacturing of computer, communications, and other electronic equipment, amounting to CN¥1.04 billion. The company operates in both domestic and international markets within the time-frequency and satellite application sectors.

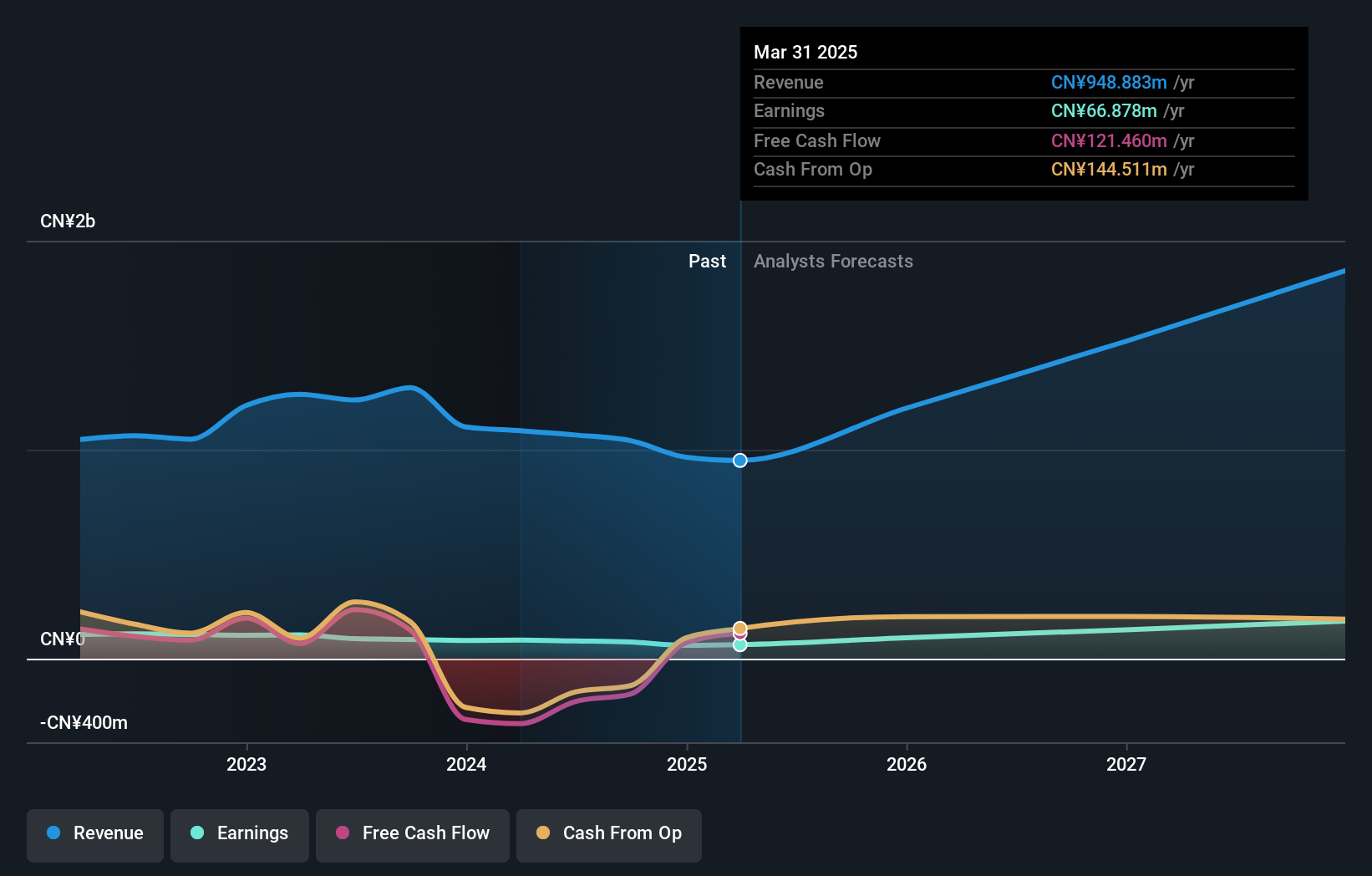

Chengdu Spaceon Electronics, despite a challenging year with a 10.2% drop in sales to CNY 576.91 million, is setting robust targets with expected revenue growth of 27.7% per year, outpacing the CN market average of 13.8%. The company's commitment to innovation is evident from its R&D investments, crucial for maintaining competitiveness in the tech sector. Furthermore, projected earnings growth at an impressive rate of 37% annually highlights potential recovery and expansion capabilities, significantly higher than the broader market forecast of 26.2%. This forward-looking approach could position Chengdu Spaceon favorably if market conditions improve and innovation leads to successful product advancements.

DTS (TSE:9682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DTS Corporation is a Japanese company specializing in systems integration services, with a market capitalization of ¥173.97 billion.

Operations: DTS Corporation operates in Japan, focusing on systems integration services with primary revenue streams from Business & Solutions (¥49.81 billion), Technology & Solutions (¥42.66 billion), and Platform & Services (¥29.38 billion).

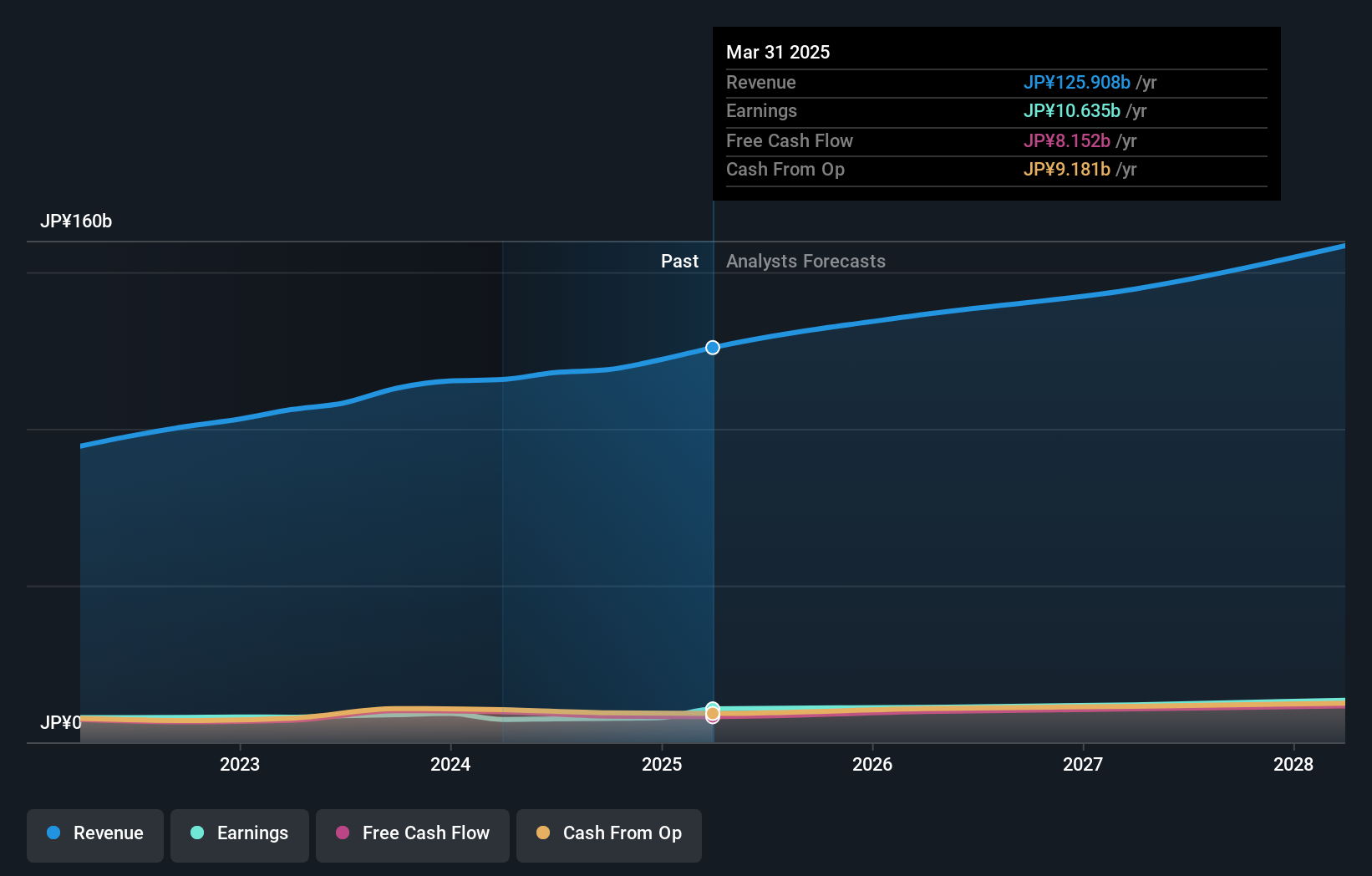

DTS Corporation, amid a competitive tech landscape, is leveraging its R&D prowess to stay ahead. The company's recent revenue growth forecast at 6.8% annually surpasses the JP market's 4.2%, reflecting strategic market positioning. Notably, DTS has committed ¥5 billion towards share repurchases to enhance shareholder value, signaling confidence in its financial health and future prospects. Furthermore, with an expected annual profit growth of 12.3%, DTS is poised for sustainable expansion in a rapidly evolving industry sector where innovation and capital efficiency are paramount.

- Click to explore a detailed breakdown of our findings in DTS' health report.

Examine DTS' past performance report to understand how it has performed in the past.

Taking Advantage

- Reveal the 1288 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9682

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives