- China

- /

- Communications

- /

- SZSE:300627

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets navigate a mix of rising Treasury yields, fluctuating consumer confidence, and mixed economic indicators, technology stocks continue to capture attention with their potential for high growth. In this dynamic environment, investors often seek companies with innovative products and strong market positioning as they look for opportunities that may thrive amid broader market shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

VGI (SET:VGI)

Simply Wall St Growth Rating: ★★★★☆☆

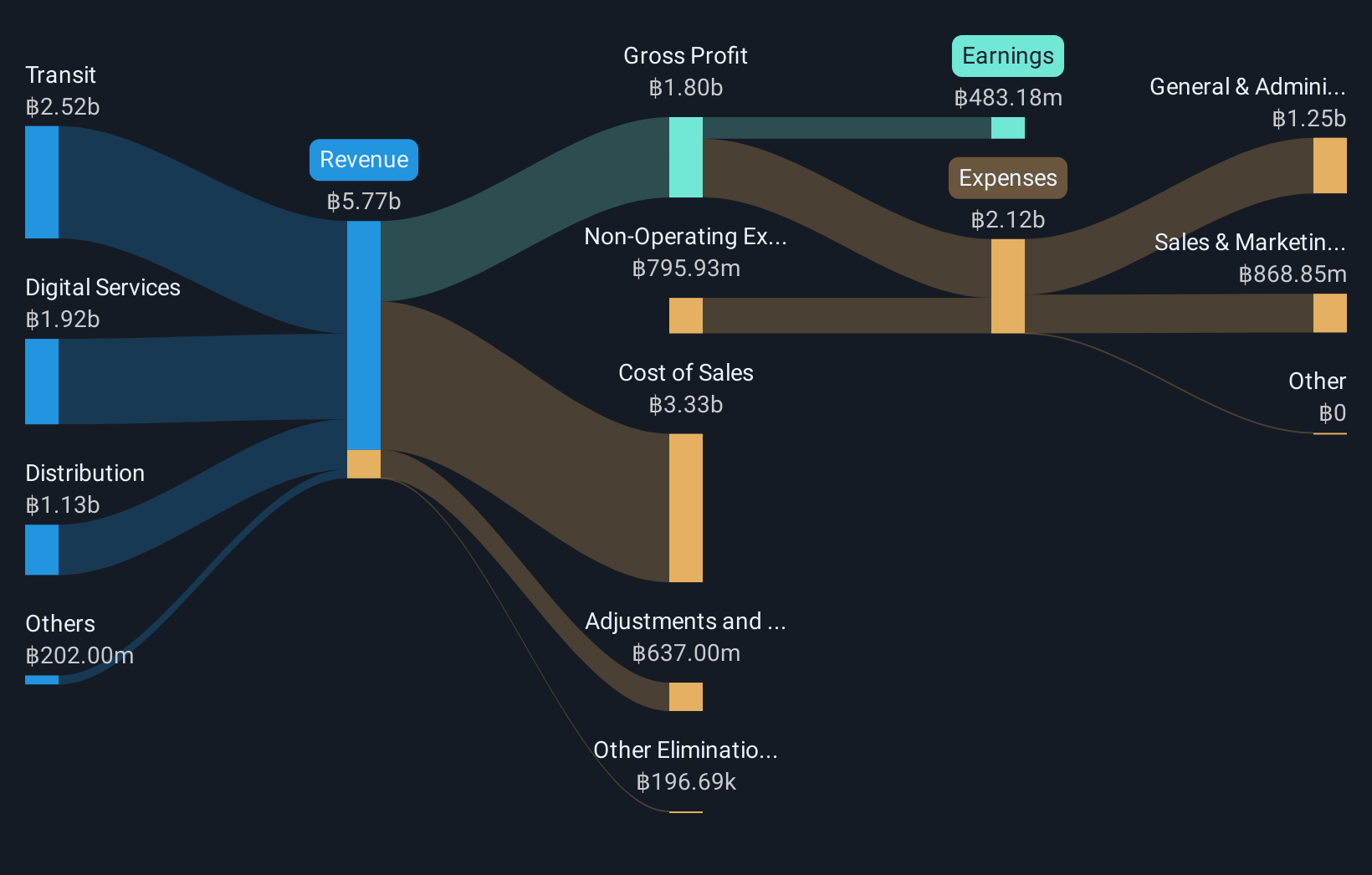

Overview: VGI Public Company Limited, with a market cap of THB39.85 billion, operates in Thailand by providing advertising services through its various subsidiaries.

Operations: VGI generates revenue primarily from transit advertising (THB2.55 billion), digital services (THB1.86 billion), and distribution channels (THB1.26 billion) in Thailand.

VGI, amidst a volatile market, showcases promising growth with its revenue forecast to increase by 10.6% annually, outpacing the Thai market's average of 6.5%. Despite current unprofitability, earnings are expected to surge by an impressive 129.23% per year. Recent strategic moves include a THB 300 million follow-on equity offering and a private placement indicating robust capital inflow and investor confidence. These financial maneuvers coupled with significant R&D investments underline VGI’s commitment to innovation and market expansion in the tech sector, setting a solid foundation for future profitability within three years.

- Dive into the specifics of VGI here with our thorough health report.

Examine VGI's past performance report to understand how it has performed in the past.

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. is a company focused on the development and production of optical and magnetic components, with a market cap of CN¥5.91 billion.

Operations: Mentech Optical & Magnetic specializes in optical and magnetic components, generating revenue primarily through these segments. The company operates with a market cap of CN¥5.91 billion.

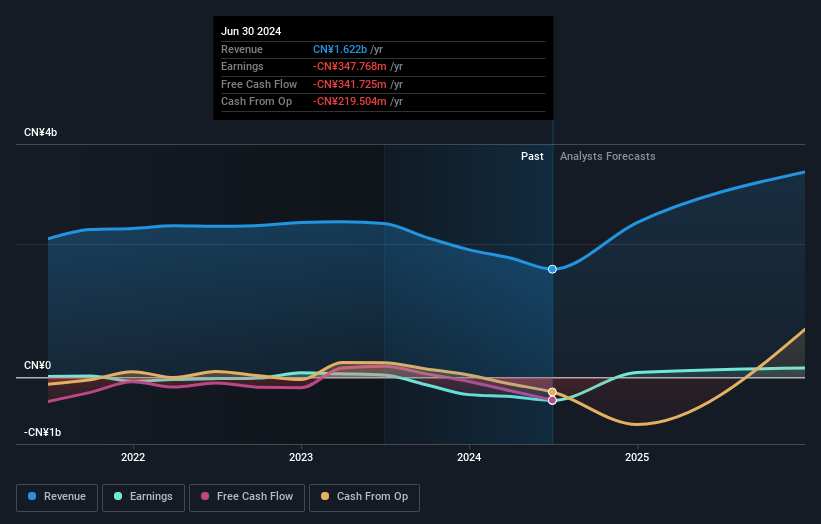

Amidst a challenging backdrop, Dongguan Mentech Optical & Magnetic has demonstrated resilience with an annual revenue growth forecast of 44.8%, significantly outpacing the Chinese market's average of 13.7%. Despite recent financial setbacks, including a net loss increase to CNY 139.46 million from last year's CNY 36.38 million, the company's strategic partnership with Visma | Lease a Bike Team underscores its commitment to expanding its technological footprint in global markets. This collaboration aligns with Mentech’s innovative drive in cycling intelligence technology and positions it for potential recovery and growth as it continues to develop an ecosystem of advanced cycling products and services.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★☆

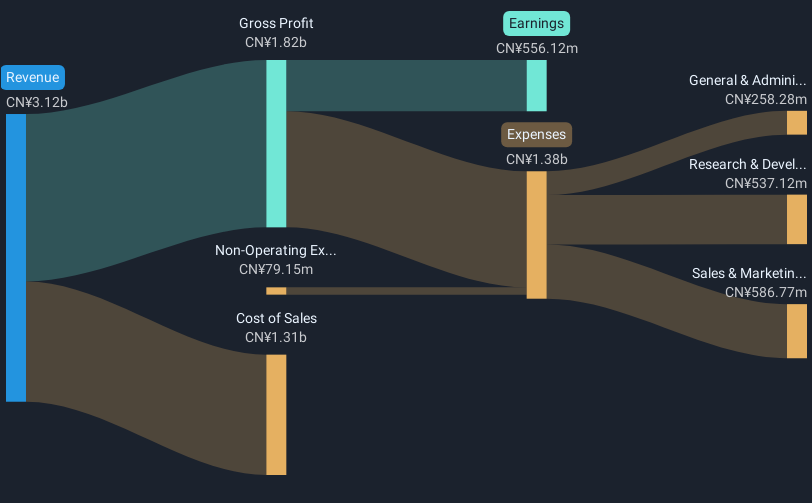

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation technology and has a market capitalization of CN¥23.19 billion.

Operations: Huace Navigation focuses on navigation technology, generating revenue primarily from its advanced positioning and navigation solutions. The company's financial performance is highlighted by a gross profit margin trend that reflects its operational efficiency in the competitive tech industry.

Shanghai Huace Navigation Technology has recently been added to key indices on the Shenzhen Stock Exchange, underscoring its growing influence in the tech sector. This inclusion follows a robust performance with a 24.3% annual earnings growth and a significant revenue increase to CNY 2.27 billion, up from CNY 1.83 billion last year. The company's collaboration with Swift Navigation enhances its competitive edge by integrating precise positioning technology into CHC Navigation’s GNSS receivers, vital for emerging markets like autonomous vehicles and robotics. These strategic moves not only amplify Huace's market presence but also position it well for sustained growth amidst evolving technological landscapes.

Next Steps

- Gain an insight into the universe of 1269 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300627

Shanghai Huace Navigation Technology

Shanghai Huace Navigation Technology Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives