- China

- /

- Communications

- /

- SZSE:002881

MeiG Smart Technology Co., Ltd (SZSE:002881) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

MeiG Smart Technology Co., Ltd (SZSE:002881) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

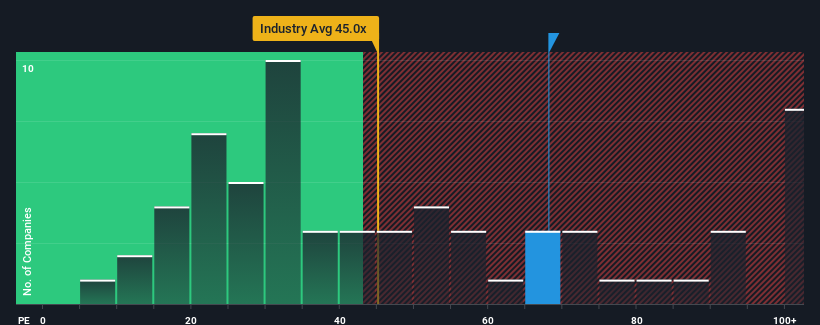

Even after such a large drop in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider MeiG Smart Technology as a stock to avoid entirely with its 68.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, MeiG Smart Technology's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for MeiG Smart Technology

Is There Enough Growth For MeiG Smart Technology?

MeiG Smart Technology's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's bottom line. Even so, admirably EPS has lifted 226% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 129% over the next year. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

With this information, we can see why MeiG Smart Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From MeiG Smart Technology's P/E?

Even after such a strong price drop, MeiG Smart Technology's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MeiG Smart Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MeiG Smart Technology (at least 1 which is potentially serious), and understanding them should be part of your investment process.

You might be able to find a better investment than MeiG Smart Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002881

MeiG Smart Technology

Engages in the research and development, production, and sale of Internet of Things terminals, and wireless communication modules and solutions in China and internationally.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives