- China

- /

- Electronic Equipment and Components

- /

- SZSE:002902

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced particular challenges with large-cap and growth stocks showing relative resilience. In this environment, identifying high-growth tech stocks requires focusing on companies that demonstrate strong fundamentals and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥4.36 billion.

Operations: Sansec Technology specializes in creating cryptographic products and solutions aimed at enhancing internet information security within China. The company's operations are centered on research and development, driving innovation in commercial encryption technologies.

Sansec Technology, amidst a challenging fiscal year, reported a dip in net income to CN¥14.16 million from last year's CN¥39.7 million, despite an 8% increase in sales to CN¥254.66 million over the same period. This downturn reflects broader market pressures yet contrasts with the company's aggressive R&D spending strategy aimed at innovation and market adaptation; R&D expenses surged by 26.1% this year alone, underscoring a commitment to evolving its tech offerings. Moreover, Sansec has repurchased shares worth CN¥79.96 million since last December, signaling confidence in its strategic direction despite current volatility—a move that might stabilize its share price and reassure stakeholders of its growth trajectory and financial health management.

Shenzhen Sunnypol OptoelectronicsLtd (SZSE:002876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sunnypol Optoelectronics Co., Ltd. operates in the optoelectronics industry, focusing on the development and production of optical films and related products, with a market cap of CN¥4.11 billion.

Operations: Sunnypol Optoelectronics generates its revenue primarily from the sale of optical films and related products within the optoelectronics sector. The company has a market cap of CN¥4.11 billion, reflecting its position in this specialized industry.

Shenzhen Sunnypol Optoelectronics has demonstrated notable financial growth, with a 21.8% increase in sales to CN¥1.87 billion over the last nine months, supported by strategic investments in innovative projects. The company's commitment to R&D is evident as it channels funds into new technologies, aiming for a significant competitive edge in the optoelectronics sector. Despite some challenges with debt coverage and negative earnings growth previously, Sunnypol's aggressive focus on expanding its market reach and enhancing product offerings through research initiatives promises potential for future revenue streams, aligning with an expected annual revenue growth of 32.6%. This strategy positions them well within the high-growth tech landscape, especially considering their proactive approach to adapting business models and capitalizing on emerging industry trends.

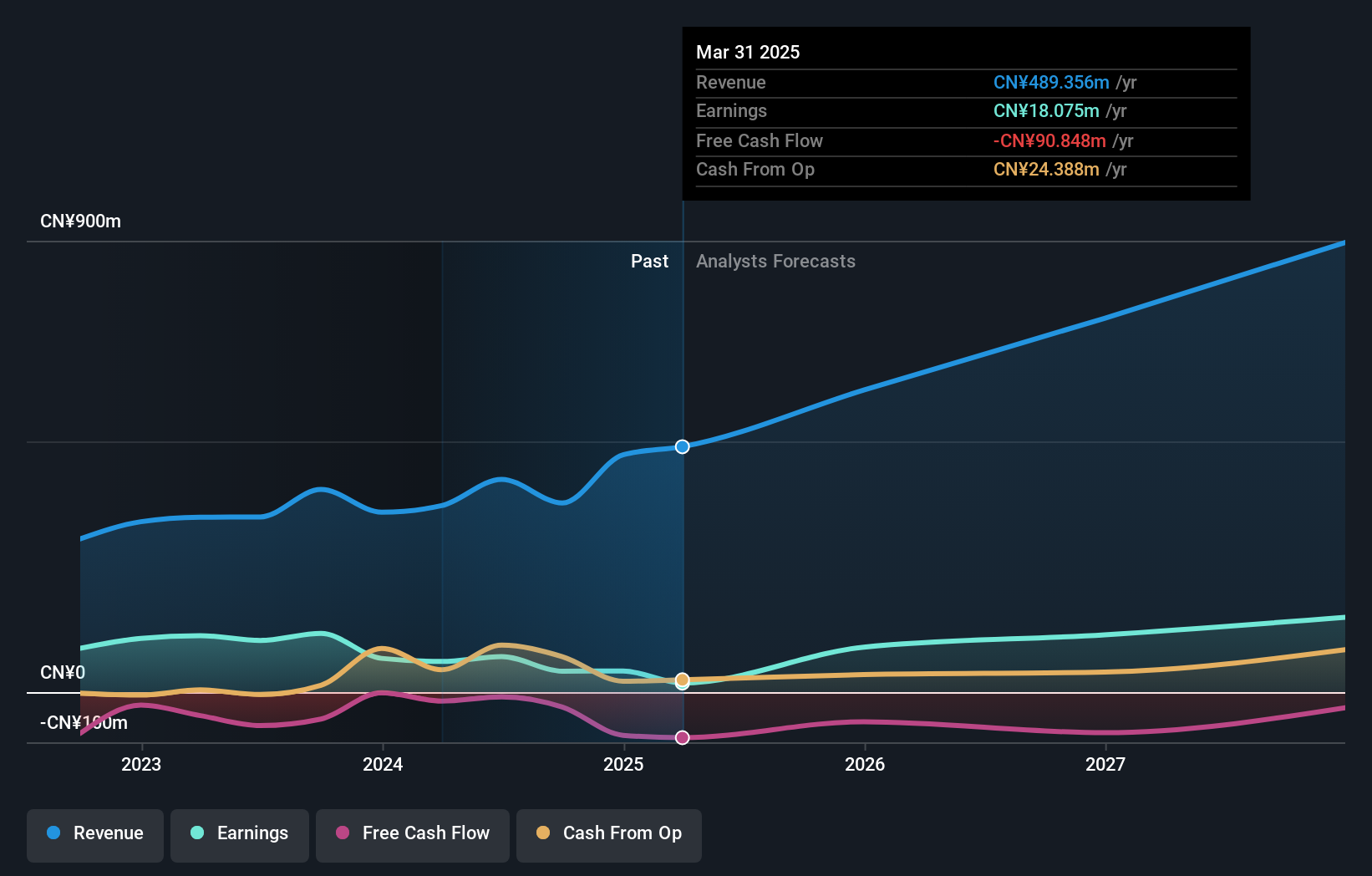

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. specializes in the design and manufacture of optical and magnetic components, with a market cap of CN¥5.99 billion.

Operations: The company generates revenue primarily from the production and sale of optical and magnetic components. Its business model focuses on leveraging its expertise in component design to cater to various industries, contributing significantly to its financial performance.

Dongguan Mentech Optical & Magnetic has faced challenges, evidenced by a significant sales drop to CN¥1.23 billion and a deepening net loss of CN¥139.46 million over the last nine months. Despite these hurdles, the company is positioned for recovery with expected revenue growth at an impressive rate of 44.8% per year, outpacing the broader Chinese market's 13.9%. This potential is underscored by recent strategic moves including a notable stake acquisition by Shenzhen Jiayi Asset Management and inclusion in the S&P Global BMI Index, which could enhance investor confidence and visibility. Moreover, earnings are projected to surge by 159.9% annually over the next three years, indicating robust future prospects if current strategies stabilize financials and drive growth in this high-stakes tech sector.

Key Takeaways

- Explore the 1282 names from our High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002902

Dongguan Mentech Optical & Magnetic

Dongguan Mentech Optical & Magnetic Co., Ltd.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives