- China

- /

- Electronic Equipment and Components

- /

- SZSE:002658

Exploring Three High Growth Tech Stocks For Future Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant volatility, with U.S. stocks mostly lower amid AI competition fears and mixed corporate earnings results. As investors navigate these turbulent conditions, identifying high growth tech stocks with robust fundamentals and innovative potential becomes crucial for those looking to capitalize on future opportunities in the technology sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥3.62 billion.

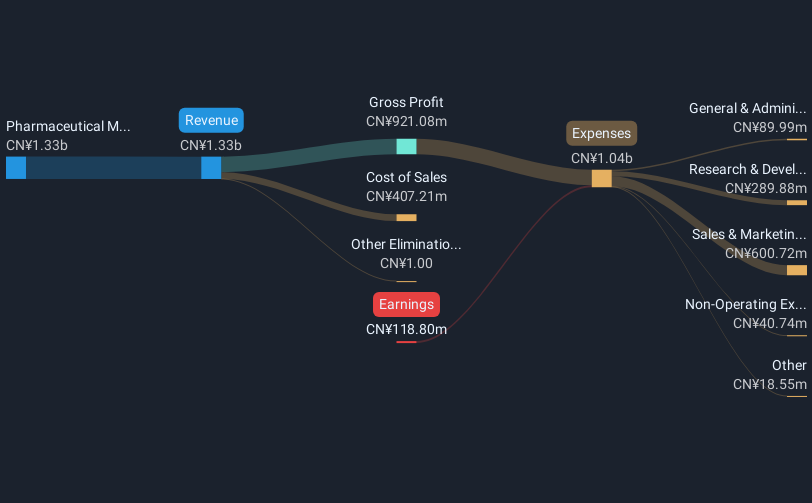

Operations: Kexing Biopharm generates revenue primarily from its pharmaceutical manufacturing segment, which accounts for CN¥1.33 billion. The company is involved in the development and sale of recombinant protein drugs and microbial preparations, targeting both domestic and international markets.

Kexing Biopharm, despite being unprofitable, is poised for significant growth with an expected revenue increase of 27.9% annually, outpacing the Chinese market's 13.5%. This anticipated growth is complemented by a robust forecast in earnings, set to surge by 103.25% per year. However, challenges persist as the company's debt isn't well covered by operating cash flow. Looking ahead, Kexing Biopharm is projected to reach profitability within three years, potentially reshaping its financial landscape and strengthening its position in the biotech sector.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥4.05 billion.

Operations: Beijing SDL Technology Co., Ltd. focuses on developing and selling environmental monitoring equipment and solutions across domestic and international markets. The company's revenue is primarily generated from these products, with a market cap of CN¥4.05 billion.

Beijing SDL TechnologyLtd. is navigating a dynamic landscape with its revenue and earnings both projected to outpace the Chinese market, growing at 16.5% and 27.1% per year respectively. Despite a recent setback from being dropped from the S&P Global BMI Index, the company's commitment to innovation is evident in its R&D spending, which stands robustly at 15% of its annual revenue. This investment fuels advancements in their tech solutions, potentially setting the stage for future growth amidst competitive pressures and evolving industry demands.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. manufactures and sells liquid crystal displays and display modules both in China and internationally, with a market capitalization of CN¥3.02 billion.

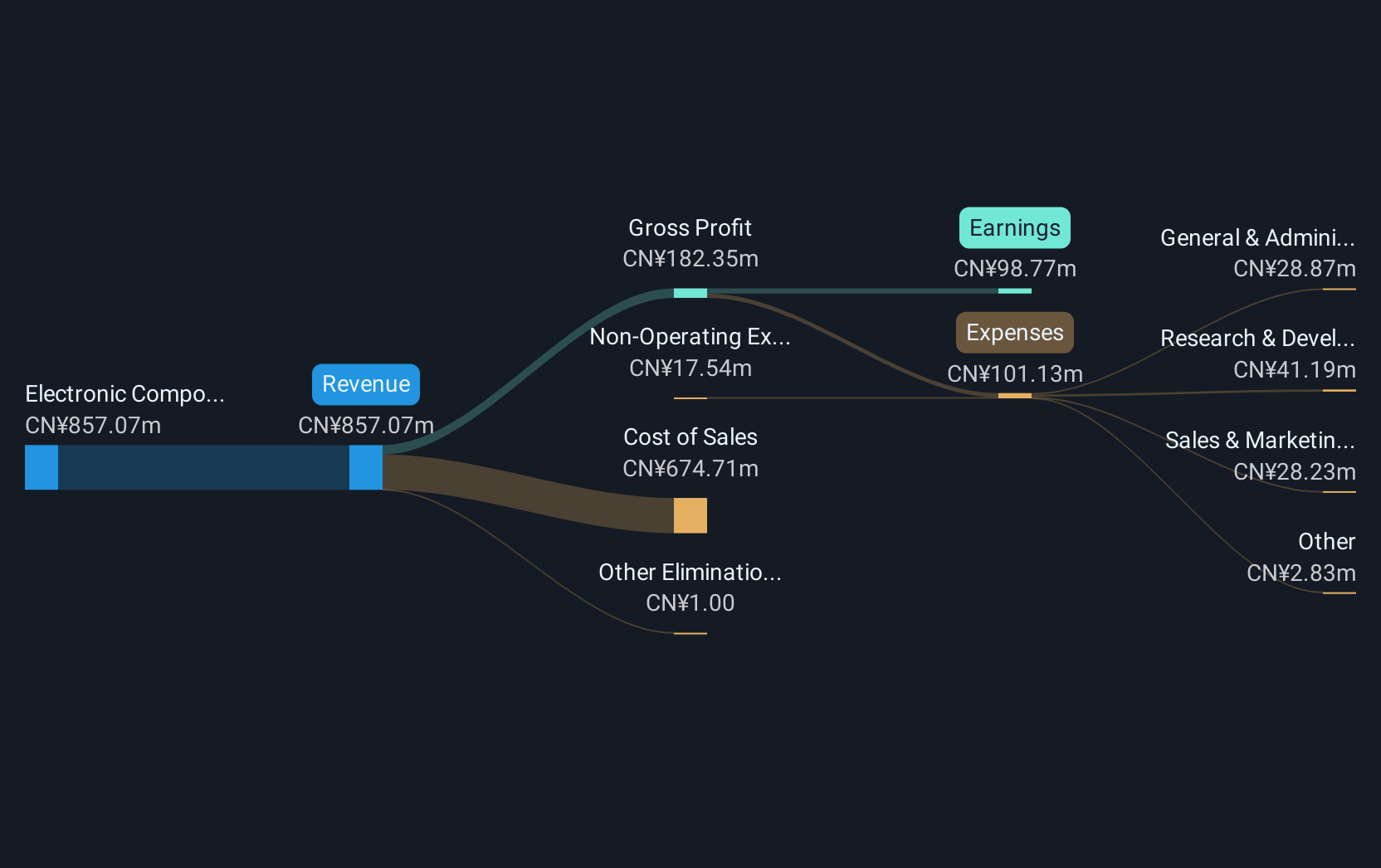

Operations: Smartwin, along with its subsidiaries, focuses on the production and sale of electronic components and parts, specifically liquid crystal displays and modules. The company generates revenue primarily from these electronic components, amounting to CN¥758.76 million.

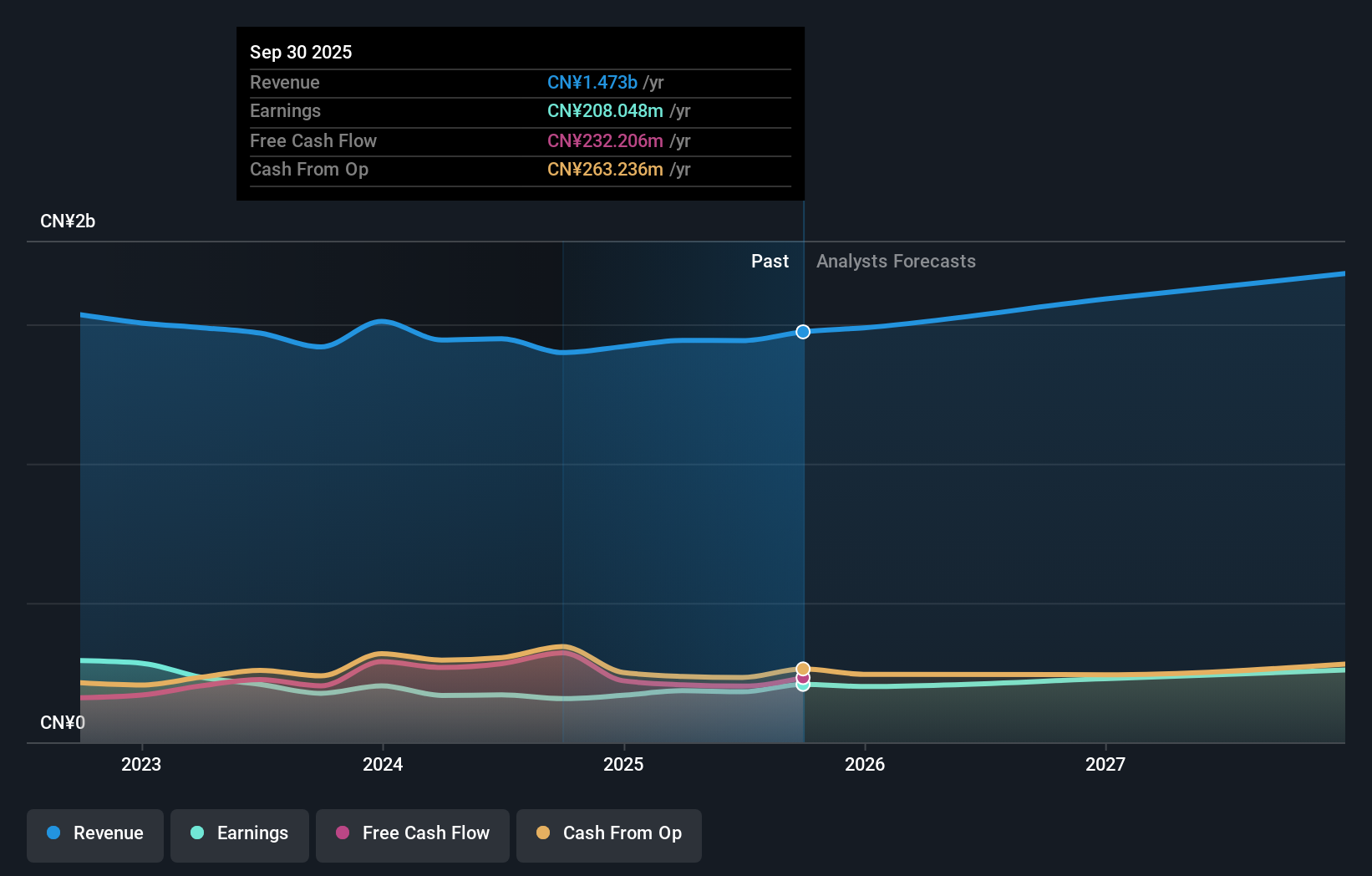

Jiangsu Smartwin Electronics TechnologyLtd. is charting a robust growth trajectory with its revenue and earnings forecast to surge by 28.8% and 33.6% annually, outstripping the broader Chinese market's growth rates of 13.5% and 25.3%, respectively. This performance is underpinned by substantial R&D investments, constituting 15% of annual revenue, which not only demonstrates the company's commitment to innovation but also positions it well for future technological advancements in a competitive landscape. Recent strategic changes, including board reshuffles and cancellation of major transactions, reflect an agile management approach poised to adapt to evolving industry dynamics and stakeholder expectations.

Taking Advantage

- Embark on your investment journey to our 1222 High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SDL TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002658

Beijing SDL TechnologyLtd

Develops and sells environmental monitoring equipment and solutions in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives