Gettop Acoustic And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current market environment, characterized by volatility and sector-specific impacts driven by policy uncertainties and economic indicators, small-cap stocks have shown varied performance. With indices like the Russell 2000 reflecting these fluctuations, investors are increasingly seeking opportunities in lesser-known companies that may offer unique growth potential amidst broader market challenges. In this context, identifying stocks with strong fundamentals and innovative business models can be crucial for enhancing a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Gettop Acoustic (SZSE:002655)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gettop Acoustic Co., Ltd. focuses on the research, development, production, and sale of micro-precision electro-acoustic components in China with a market capitalization of CN¥5.00 billion.

Operations: Gettop Acoustic generates revenue primarily from the sale of micro-precision electro-acoustic components. The company has a market capitalization of CN¥5.00 billion.

Gettop Acoustic, a relatively small player in the electronics sector, has shown impressive growth with earnings surging by 180% over the past year, outpacing industry averages. The company's net income for the first nine months of 2024 was CNY 58.4 million, up from CNY 33.78 million a year earlier, reflecting its high-quality earnings. Despite an increase in its debt-to-equity ratio from 46.6% to 50.2% over five years, Gettop maintains a satisfactory net debt to equity ratio of 24.8%. Interest payments are well covered with EBIT at a robust coverage of 19.5 times interest obligations.

Sichuan Kexin Mechanical and Electrical EquipmentLtd (SZSE:300092)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Kexin Mechanical and Electrical Equipment Co., Ltd. designs, develops, and manufactures heavy-duty process equipment and provides system integration services both in China and internationally, with a market cap of CN¥3.48 billion.

Operations: The company generates revenue through the design, development, and manufacture of heavy-duty process equipment, along with system integration services. It operates both domestically in China and internationally. The net profit margin has shown a notable trend over recent periods.

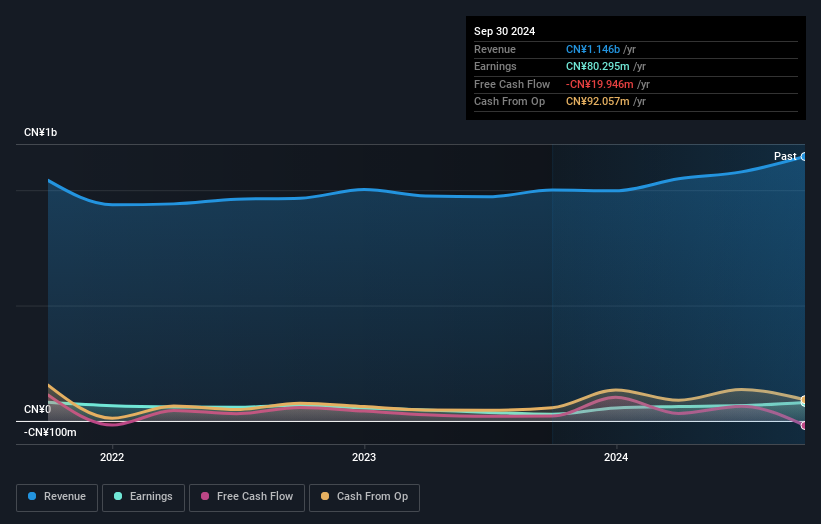

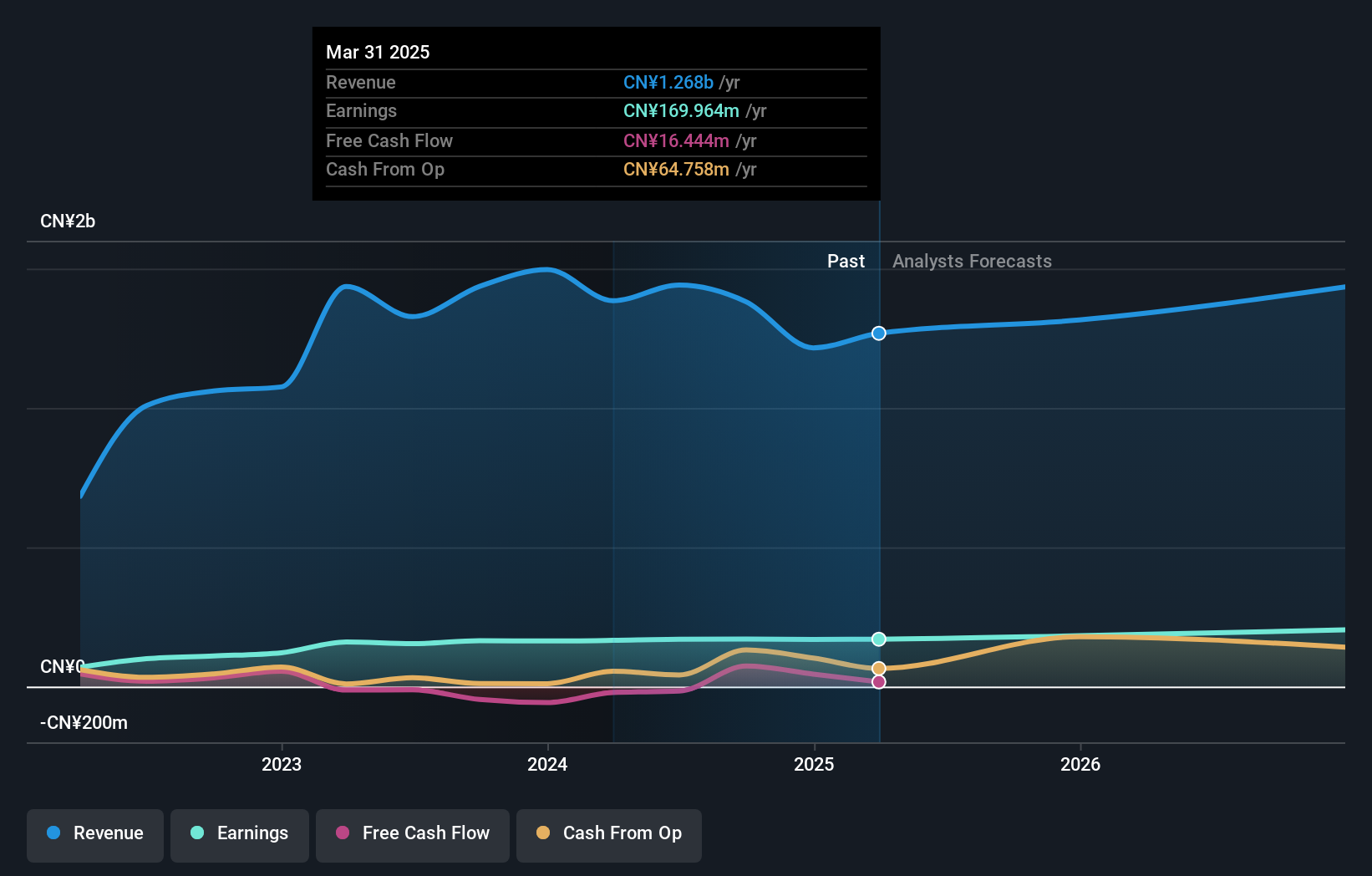

Sichuan Kexin, a nimble player in the machinery sector, is currently trading at 54.1% below its estimated fair value, offering potential upside for investors. Impressively debt-free now compared to a 0.7% debt-to-equity ratio five years ago, the company has shown resilience and financial prudence. Earnings growth of 3.5% over the past year outpaced the industry's -0.4%, highlighting its competitive edge in challenging times. Despite sales dipping to CNY 1,051 million from CNY 1,168 million year-on-year for nine months ending September 2024, net income rose to CNY 143 million from CNY 136 million previously, reflecting operational efficiency and strategic management decisions that bolster confidence moving forward.

VIA Technologies (TWSE:2388)

Simply Wall St Value Rating: ★★★★★★

Overview: VIA Technologies, Inc. is involved in the programming, designing, manufacturing, and sale of semiconductors and PC chip sets with a market capitalization of NT$58.84 billion.

Operations: VIA Technologies generates revenue primarily from the design, manufacturing, and trading of computer integrated circuit (IC) products, amounting to NT$14.62 billion.

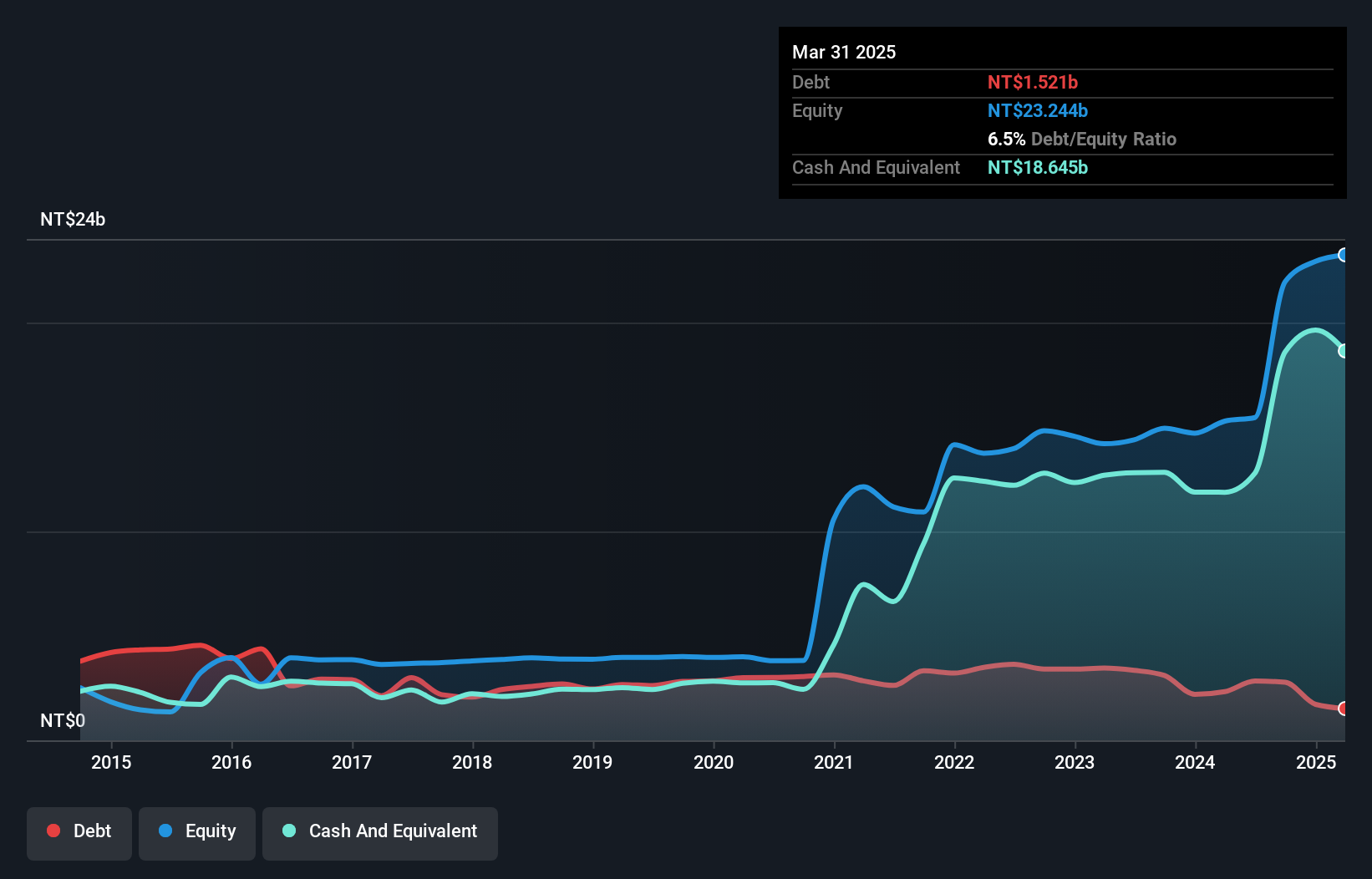

VIA Technologies, a small player in the tech industry, has shown impressive earnings growth of 533.9% over the past year, outpacing the broader semiconductor sector's modest 6% increase. Despite this robust performance, its share price has been highly volatile recently. The company's debt to equity ratio improved significantly from 70.3% to 12.7% over five years, indicating better financial health. However, recent shareholder dilution and a large one-off gain of NT$203.9M have impacted results for the last twelve months ending September 2024. VIA reported Q3 sales of TWD 5,293 million and net income of TWD 295 million compared to TWD 92 million a year ago.

- Click here to discover the nuances of VIA Technologies with our detailed analytical health report.

Gain insights into VIA Technologies' past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4624 more companies for you to explore.Click here to unveil our expertly curated list of 4627 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300092

Sichuan Kexin Mechanical and Electrical EquipmentLtd

Engages in the design, development, and manufacture of heavy-duty process equipment and system integration in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives