As December 2024 unfolds, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, which have contributed to broad-based declines in U.S. stocks, particularly impacting smaller-cap indices like the S&P 600. Amid these challenges, investors are keenly observing economic indicators such as retail sales growth and jobless claims for signs of resilience or vulnerability in the market. In this environment, identifying promising stocks requires a focus on companies that demonstrate strong fundamentals and adaptability to shifting economic conditions. These undiscovered gems often possess unique value propositions or innovative strategies that allow them to thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Wiscom System (SZSE:002090)

Simply Wall St Value Rating: ★★★★★★

Overview: Wiscom System Co., Ltd. operates in the smart energy and smart cities sectors in China with a market capitalization of CN¥3.61 billion.

Operations: The company generates revenue through its involvement in the smart energy and smart cities sectors.

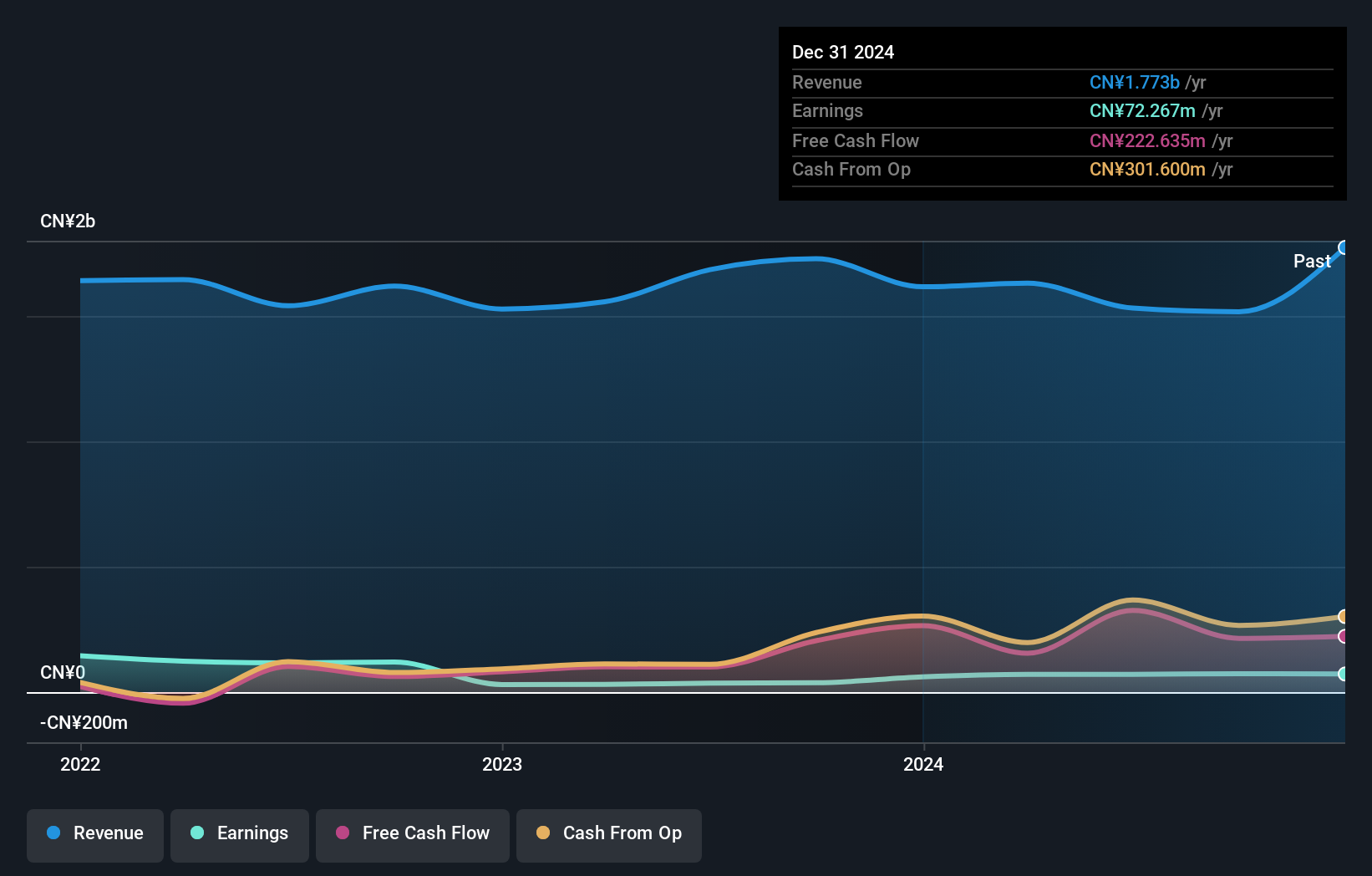

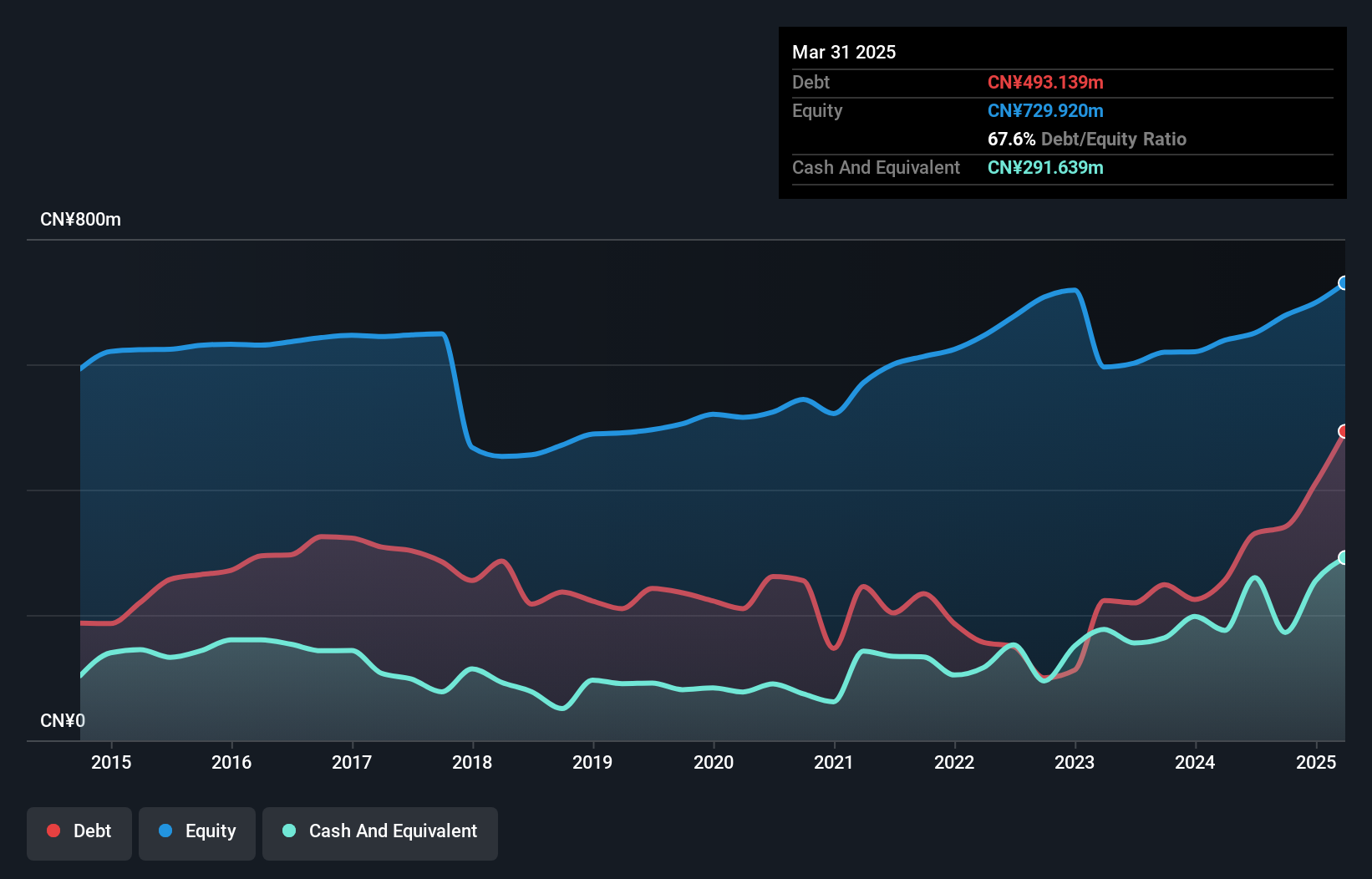

Wiscom System's recent performance paints an intriguing picture, with earnings surging by 98.6% over the past year, outpacing the IT industry's -8.1%. Despite a dip in revenue from CNY 1,169.03 million to CNY 1,069.5 million for the nine months ending September 2024, net income rose to CNY 36.56 million from CNY 23.32 million a year earlier, showcasing robust profitability and high-quality earnings. The company has effectively reduced its debt-to-equity ratio from 72.1% to just 12.2% over five years and trades at nearly a third below estimated fair value, suggesting potential for future appreciation in value.

- Dive into the specifics of Wiscom System here with our thorough health report.

Explore historical data to track Wiscom System's performance over time in our Past section.

Gettop Acoustic (SZSE:002655)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gettop Acoustic Co., Ltd. specializes in the research, development, production, and sale of micro-precision electro-acoustic components and assemblies in China, with a market cap of CN¥4.81 billion.

Operations: Gettop Acoustic generates revenue primarily from the sale of micro-precision electro-acoustic components and assemblies. The company's financial performance is marked by a focus on these core product lines, contributing significantly to its overall revenue streams.

Gettop Acoustic, a smaller player in the electronics market, has shown impressive growth with earnings climbing 180% over the past year. This surge outpaces the broader electronic industry’s 1.9% increase. The company's net income for nine months ended September 2024 was CNY 58.4 million, up from CNY 33.78 million last year, while sales rose to CNY 866.59 million from CNY 718.44 million previously. Its debt to equity ratio moved slightly from 46.6% to a still manageable 50.2% over five years, and interest payments are comfortably covered by EBIT at a ratio of 19:5x, indicating sound financial health amidst its rapid earnings expansion.

- Navigate through the intricacies of Gettop Acoustic with our comprehensive health report here.

Review our historical performance report to gain insights into Gettop Acoustic's's past performance.

Morita Holdings (TSE:6455)

Simply Wall St Value Rating: ★★★★★★

Overview: Morita Holdings Corporation, with a market cap of ¥94.20 billion, operates through its subsidiaries to develop, manufacture, and sell ladder trucks, fire trucks, and specialty vehicles both in Japan and internationally.

Operations: The company's primary revenue streams include fire engines, disaster prevention equipment, and environmental vehicles, generating ¥60.92 billion, ¥25.54 billion, and ¥11.33 billion respectively. The industrial machinery segment contributes an additional ¥6.27 billion to the overall revenue mix.

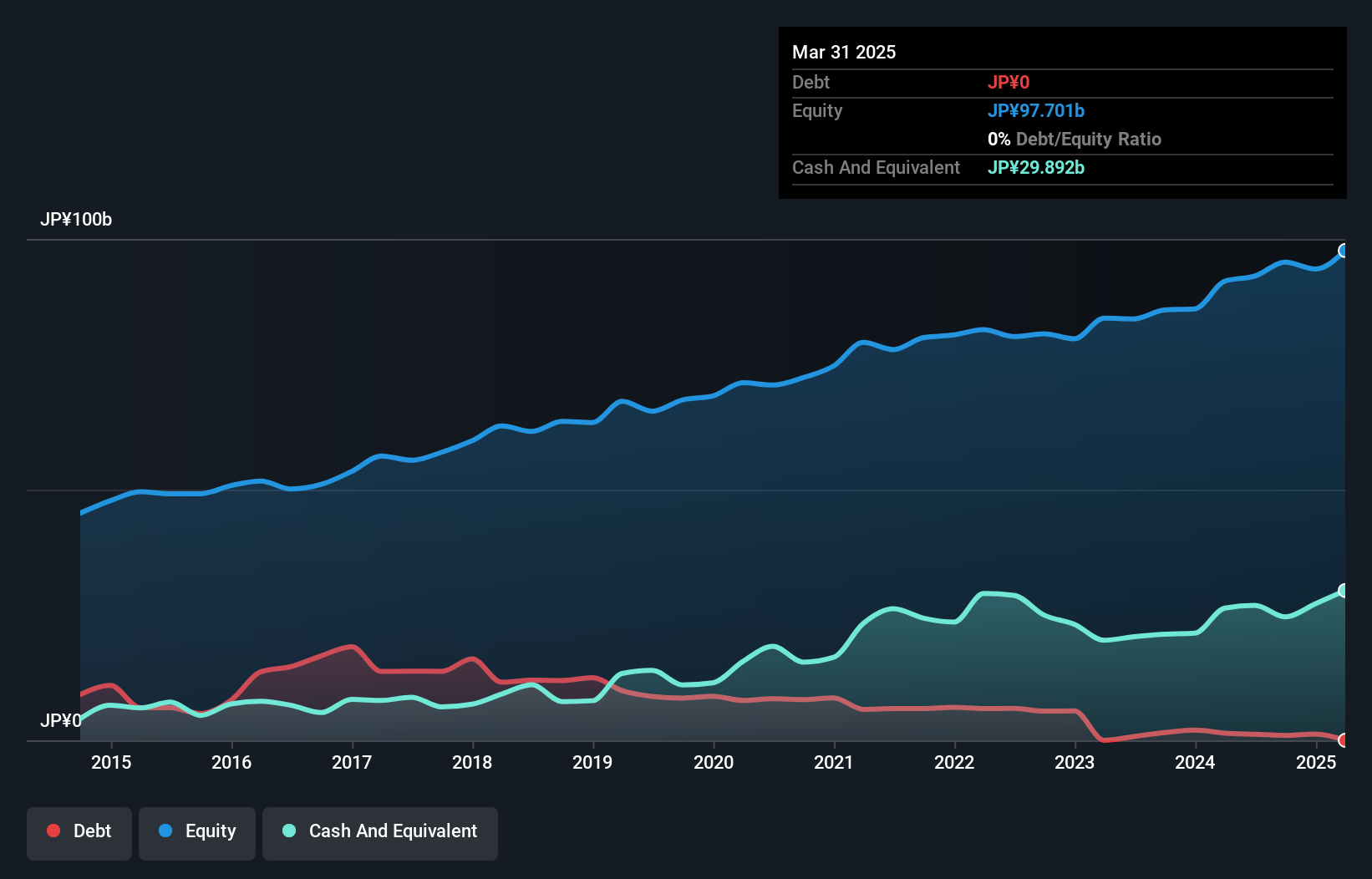

With its strong financial footing, Morita Holdings stands out in the machinery sector. Over the past year, earnings have surged by 70%, vastly outperforming the industry's modest 1% growth. The company trades at a significant discount of 53% to its estimated fair value, suggesting potential upside for investors. Impressively, Morita's debt-to-equity ratio has plummeted from 12% to just 1% over five years, showcasing effective debt management. Despite a yearly earnings decline of nearly 5%, recent performance indicates resilience and adaptability in an evolving market landscape. These factors paint a promising picture for future prospects and investor interest.

- Delve into the full analysis health report here for a deeper understanding of Morita Holdings.

Evaluate Morita Holdings' historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 4621 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6455

Morita Holdings

Through its subsidiaries, engages in the development, manufacture, and sale of ladder trucks, fire trucks, and specialty vehicles in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives