- China

- /

- Electronic Equipment and Components

- /

- SZSE:002655

Discovering February 2025's Undiscovered Gems on None

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating indices and geopolitical uncertainties, small-cap stocks have faced unique challenges amidst broader economic shifts. With the Federal Reserve holding rates steady and competitive pressures in the AI sector influencing market sentiment, investors are keenly observing opportunities that might be overlooked. In this environment, identifying promising stocks often involves looking beyond immediate volatility to find companies with robust fundamentals and potential for sustainable growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ELANTAS Beck India | NA | 15.21% | 25.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Abans Financial Services | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shentong Technology Group (SHSE:605228)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shentong Technology Group Co., Ltd is engaged in the development, manufacturing, and sale of automotive parts in China with a market capitalization of approximately CN¥4.11 billion.

Operations: The primary revenue stream for Shentong Technology Group comes from the sales of auto parts and molds, amounting to CN¥1.55 billion.

Shentong Technology Group, a small cap player in the auto components sector, has seen its earnings grow by 56.9% over the past year, outpacing industry growth of 10.5%. Despite this positive momentum, its earnings have declined by 25.2% annually over five years. The company is trading at 54.7% below estimated fair value and has shown high-quality past earnings with sufficient interest coverage from profits. Recently, Shentong completed a share buyback plan repurchasing 6.59 million shares for CNY 52.94 million, reflecting strategic capital allocation efforts amidst volatile share price movements in recent months.

Gettop Acoustic (SZSE:002655)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gettop Acoustic Co., Ltd. specializes in the research, development, production, and sale of micro-precision electro-acoustic components and assemblies in China, with a market cap of CN¥4.48 billion.

Operations: Gettop Acoustic generates revenue primarily from the sale of micro-precision electro-acoustic components and assemblies. The company has a market capitalization of CN¥4.48 billion, reflecting its significant presence in the Chinese market.

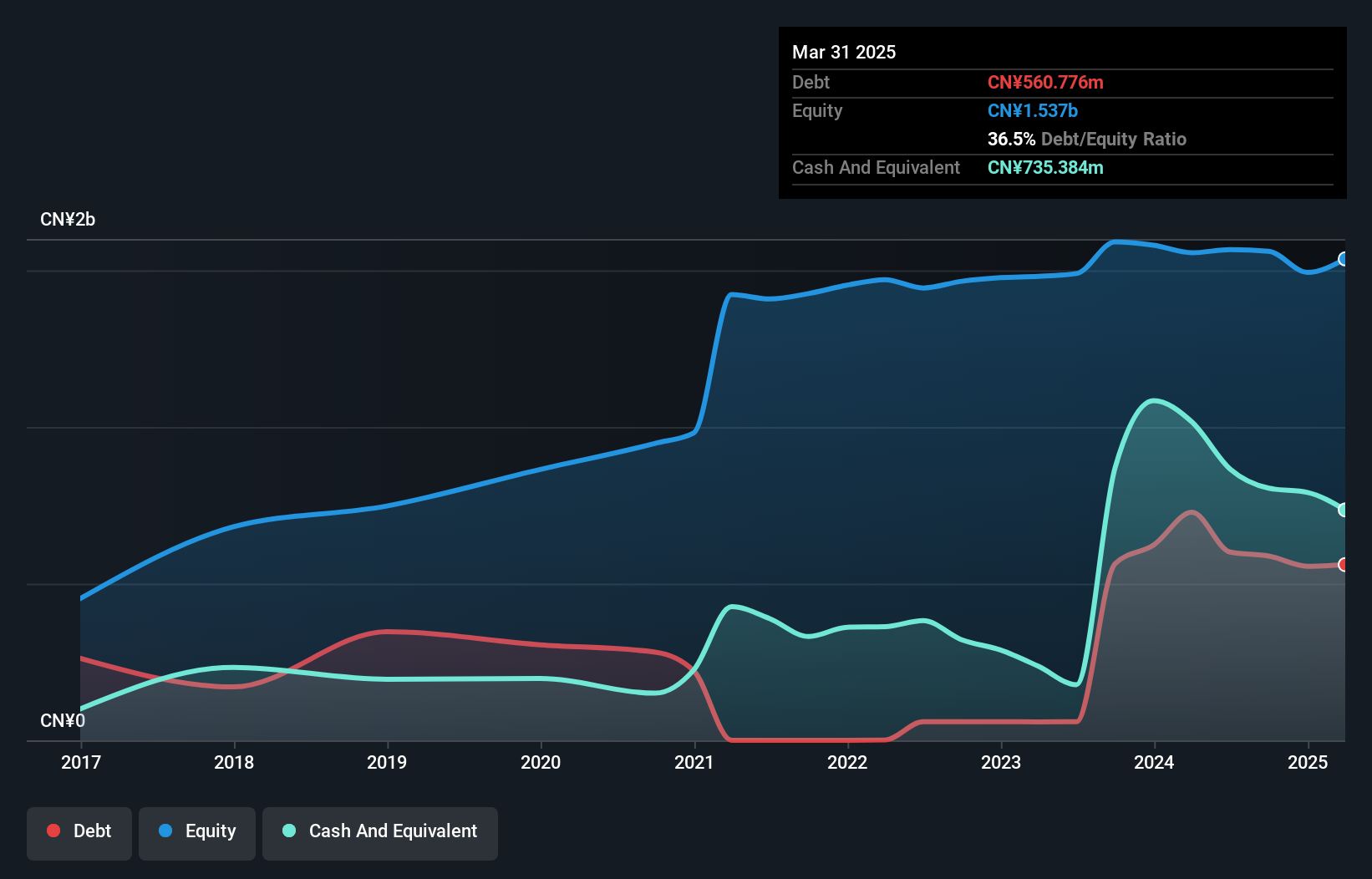

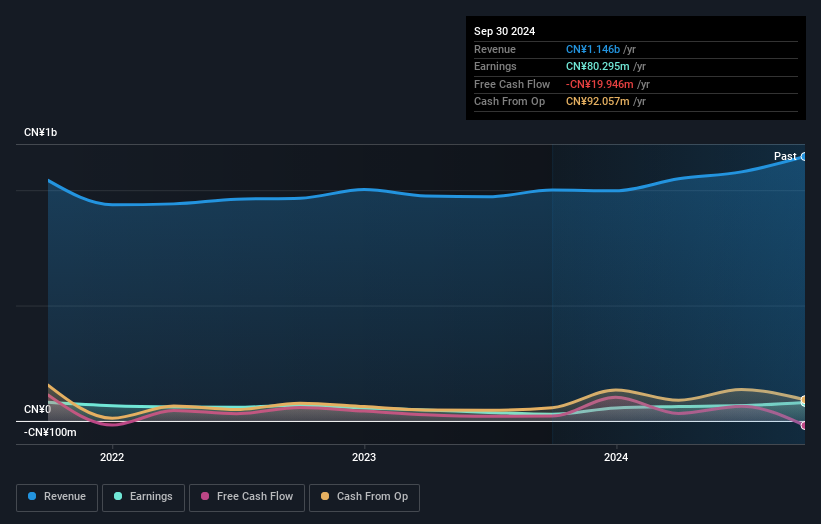

Gettop Acoustic, a small player in the electronics sector, has seen its earnings surge by 180% over the past year, outpacing the industry's modest 3% growth. This impressive performance is backed by high-quality earnings and a satisfactory net debt to equity ratio of 24.8%, indicating robust financial health. However, over five years, its debt to equity ratio has risen from 46.6% to 50.2%, suggesting increased leverage that could be worth monitoring. Despite this, Gettop's interest payments are well covered with EBIT at 19.5 times interest expenses, showcasing strong operational efficiency amidst industry challenges.

PS Construction (TSE:1871)

Simply Wall St Value Rating: ★★★★★☆

Overview: PS Construction Co., Ltd. operates in the civil engineering and architecture sectors both within Japan and internationally, with a market capitalization of ¥58.16 billion.

Operations: PS Construction generates revenue primarily from its Civil Engineering Business, contributing ¥80.43 billion, and the Construction Business, adding ¥53.77 billion. The Manufacturing Business provides an additional ¥7.48 billion to the company's revenue streams.

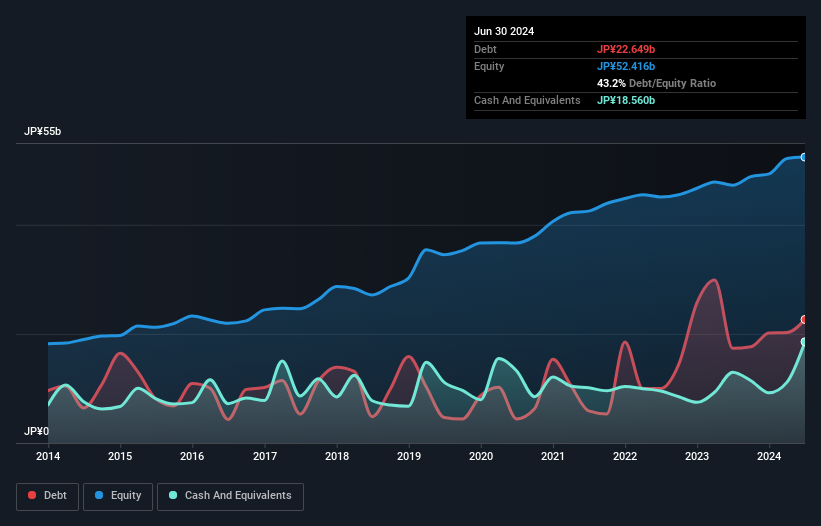

PS Construction, a relatively small player in the construction industry, has been making notable strides. Over the past year, its earnings surged by 49%, outpacing the industry average of 20%. This growth is backed by high-quality earnings and a satisfactory net debt to equity ratio of 9.6%. The company's interest payments are comfortably covered with an EBIT coverage of 83 times. However, over the last five years, earnings have decreased annually by about 4%. Despite this dip, PS Construction's price-to-earnings ratio stands at an attractive 10x compared to the JP market average of 13x.

Seize The Opportunity

- Unlock our comprehensive list of 4719 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002655

Gettop Acoustic

Engages in the research, development, production, and sale of micro-precision electro-acoustic components, and electroacoustic assemblies in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives