- China

- /

- Electrical

- /

- SZSE:002879

Unveiling 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding tariffs and cooling job growth have led to mixed performances across major indices, with small-cap stocks feeling the impact of these broader economic shifts. As investors navigate this complex environment, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering opportunities amidst volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Central Finance | 1.16% | 10.03% | 16.10% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Mesnac (SZSE:002073)

Simply Wall St Value Rating: ★★★★★★

Overview: Mesnac Co., Ltd. focuses on the research, development, and innovation of application software and information equipment for the rubber industry in China and internationally, with a market cap of CN¥9.06 billion.

Operations: Mesnac generates revenue primarily from the sale of application software and information equipment tailored for the rubber industry. The company has a market cap of CN¥9.06 billion, indicating its significant presence in this niche sector.

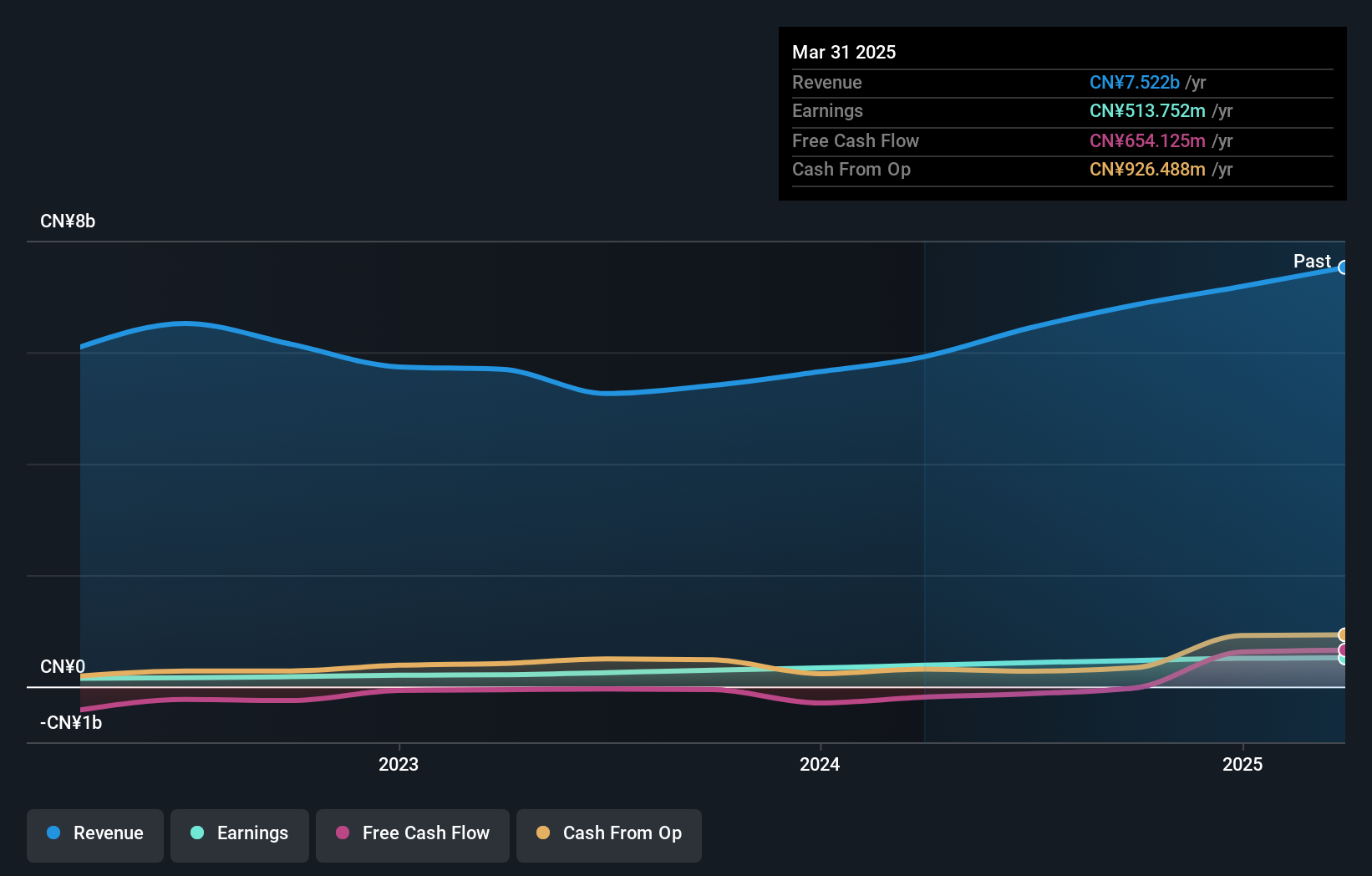

This company, known for its robust performance in the machinery sector, has been catching eyes with a notable 58.1% earnings growth over the past year, outpacing the industry average. Its debt management seems prudent as the debt-to-equity ratio decreased from 34.4% to 27.1% over five years, and it holds more cash than total debt—a comforting sign for investors. Despite not generating positive free cash flow recently, its price-to-earnings ratio of 19.5x suggests it's valued attractively compared to the broader CN market at 36.7x—indicating potential upside if current trends continue favorably.

- Delve into the full analysis health report here for a deeper understanding of Mesnac.

Review our historical performance report to gain insights into Mesnac's's past performance.

Jiangsu Yinhe ElectronicsLtd (SZSE:002519)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yinhe Electronics Co., Ltd. operates in the sectors of new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment both in China and internationally, with a market capitalization of CN¥5.77 billion.

Operations: Yinhe Electronics generates revenue from its involvement in new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment sectors. The company's financial performance is highlighted by a notable trend in its gross profit margin.

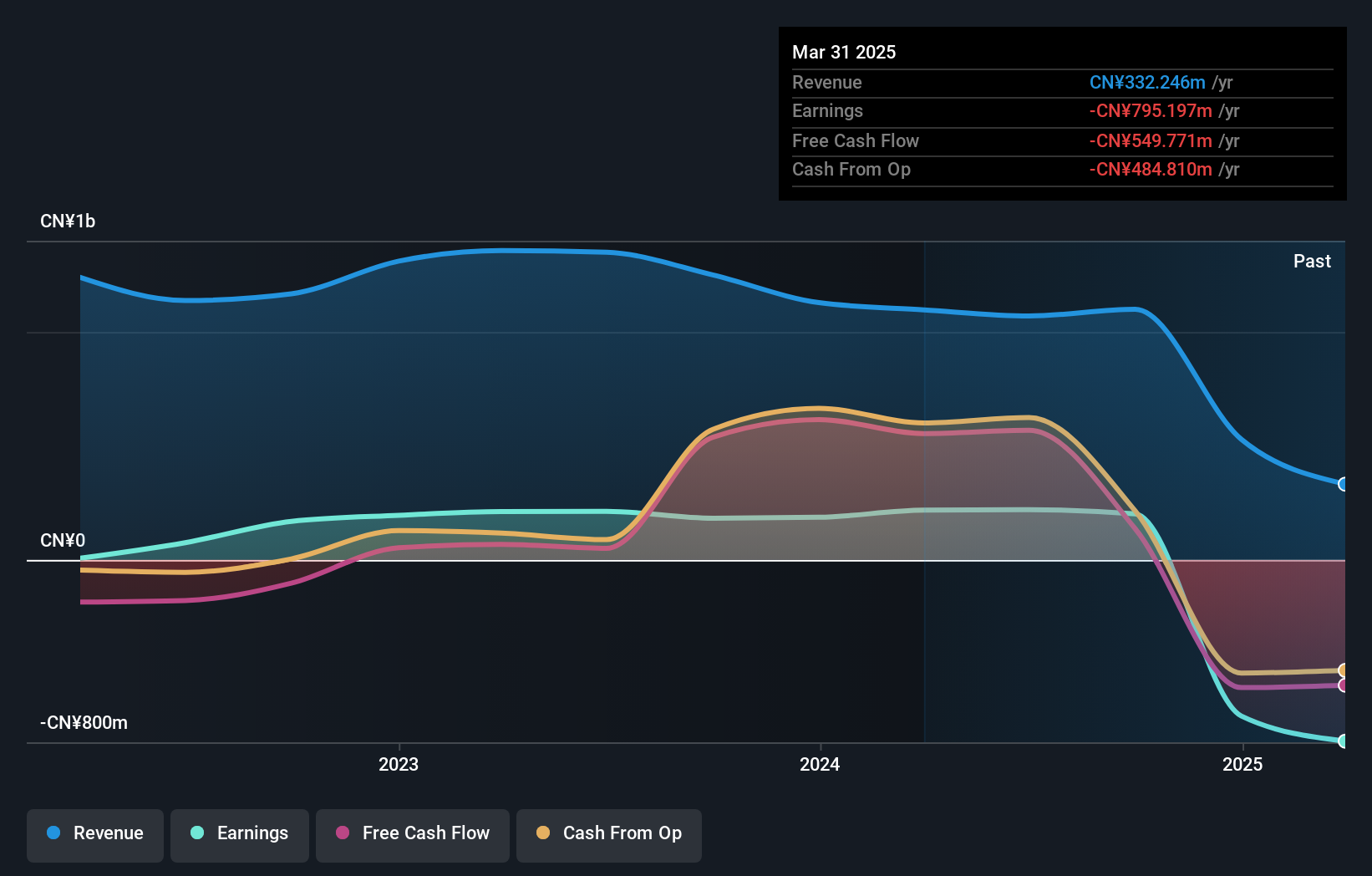

Jiangsu Yinhe Electronics, a notable player in the electronics sector, has been making waves with its impressive earnings growth of 10.7% over the past year, outpacing the industry average of 3%. This company stands out due to its high-quality earnings and debt-free status, which is a significant improvement from five years ago when it had a debt-to-equity ratio of 15.2%. With a price-to-earnings ratio at 28.8x, it's attractively valued below the CN market average of 36.7x. Its free cash flow positivity further underscores financial health and potential for sustained performance in this competitive landscape.

Chang Lan Technology Group (SZSE:002879)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chang Lan Technology Group Co., Ltd. focuses on the research, development, production, sale, and service of power cable accessories and supporting products both in China and internationally, with a market cap of CN¥3.09 billion.

Operations: Chang Lan Technology Group generates revenue primarily from the sale of power cable accessories and related products. The company's financial performance is highlighted by a net profit margin that exhibits notable trends over time.

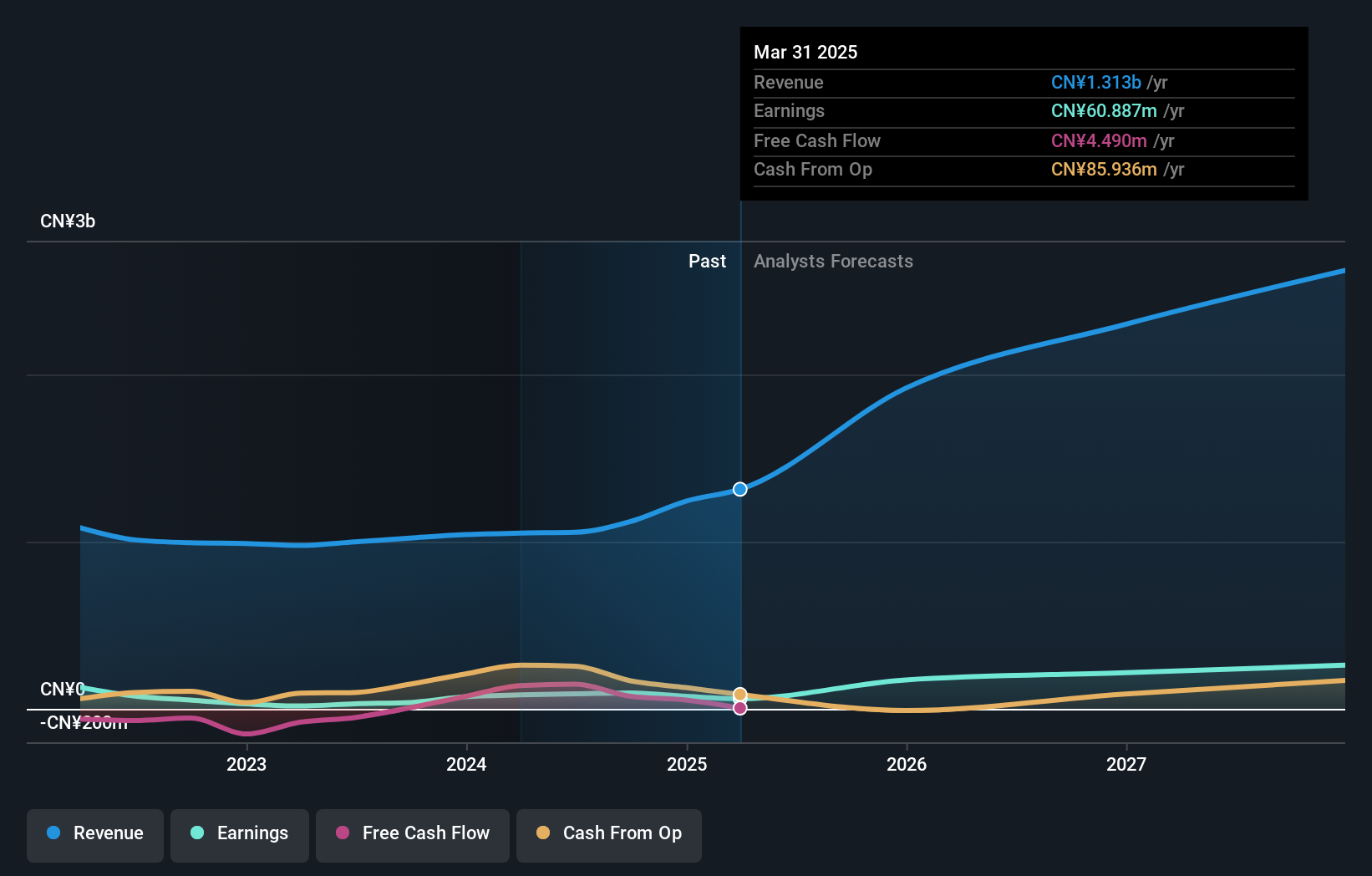

Chang Lan Technology Group, a promising player in the tech sector, has shown impressive financial resilience. The company boasts a Price-To-Earnings ratio of 32.7x, which is competitive against the broader CN market at 36.7x. Over the past year, its earnings surged by 149%, outpacing industry growth significantly. Despite this success, Chang Lan's earnings have seen an average annual decline of 22% over five years, hinting at potential volatility. With more cash than total debt and high-quality earnings reported, it seems well-positioned financially for future opportunities in its niche market segment.

Seize The Opportunity

- Click through to start exploring the rest of the 4692 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002879

Chang Lan Technology Group

Engages in the research and development, production, sale, and service of power cable accessories and supporting products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives