- China

- /

- Commercial Services

- /

- SZSE:300355

3 Asian Penny Stocks With Market Caps Under US$4B

Reviewed by Simply Wall St

As global markets react to easing trade tensions and mixed economic signals, investors are keeping a close eye on opportunities across various regions, including Asia. Penny stocks, though often seen as relics of past market eras, continue to offer intriguing prospects for those seeking growth at lower price points. These smaller or newer companies can provide significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.80 | THB2.98B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.36 | THB2.62B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.191 | SGD38.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$45.79B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.98 | HK$1.65B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,168 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

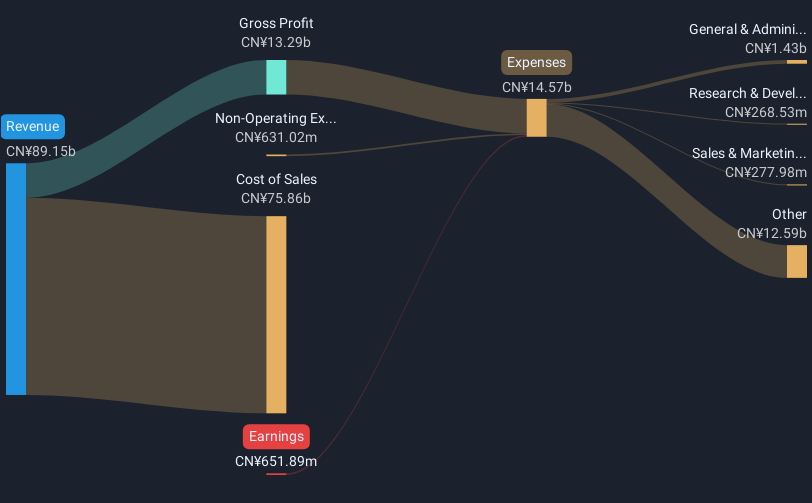

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in the People’s Republic of China, with a market cap of approximately HK$26.40 billion.

Operations: No specific revenue segments are reported for Sinopec Shanghai Petrochemical Company Limited.

Market Cap: HK$26.4B

Sinopec Shanghai Petrochemical, with a market cap of approximately HK$26.40 billion, recently reported a net loss for Q1 2025 despite having become profitable in the past year. The company's short-term assets significantly exceed both its long-term and short-term liabilities, indicating strong balance sheet management. It has more cash than total debt and its debt is well covered by operating cash flow. However, the return on equity remains low at 0.6%, and earnings have been impacted by large one-off gains of CN¥57.6 million over the last year, potentially skewing profitability assessments.

- Click here and access our complete financial health analysis report to understand the dynamics of Sinopec Shanghai Petrochemical.

- Understand Sinopec Shanghai Petrochemical's earnings outlook by examining our growth report.

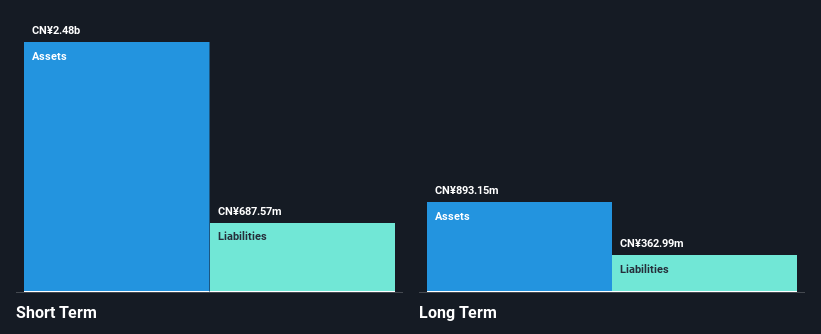

Jiangsu Yinhe ElectronicsLtd (SZSE:002519)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Yinhe Electronics Co., Ltd. operates in the new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment sectors both in China and internationally, with a market cap of CN¥4.93 billion.

Operations: Jiangsu Yinhe Electronics Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.93B

Jiangsu Yinhe Electronics, with a market cap of CN¥4.93 billion, has faced significant financial challenges recently. The company reported a substantial decline in sales for 2024 and Q1 2025, leading to net losses in both periods. Despite being debt-free and having short-term assets of CN¥2.5 billion that exceed its liabilities, the company remains unprofitable with a negative return on equity of -34.39%. Its board is experienced with an average tenure of three years, but profitability issues persist as losses have increased by 34.6% annually over the past five years without meaningful shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Jiangsu Yinhe ElectronicsLtd stock in this financial health report.

- Understand Jiangsu Yinhe ElectronicsLtd's track record by examining our performance history report.

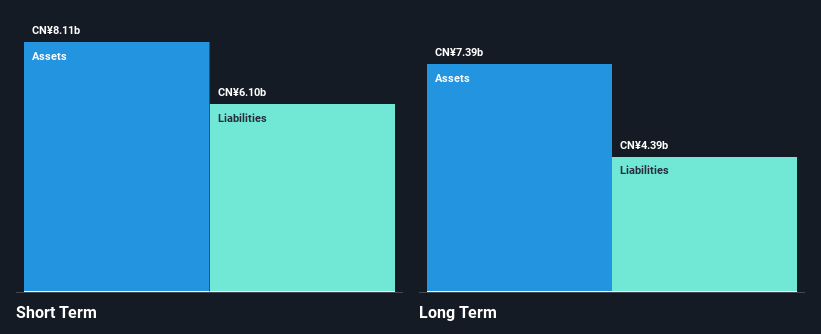

M-Grass Ecology And Environment (Group) (SZSE:300355)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: M-Grass Ecology And Environment (Group) Co., Ltd. focuses on ecological restoration and environmental protection services, with a market cap of approximately CN¥7.01 billion.

Operations: M-Grass Ecology And Environment (Group) Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥7.01B

M-Grass Ecology And Environment (Group), with a market cap of CN¥7.01 billion, has experienced financial volatility. The company reported a decline in net income to CN¥35.38 million for 2024 from CN¥249.13 million the previous year, alongside a basic loss per share of CNY 0.02 from continuing operations. Despite an increase in sales to CNY 2,145.54 million for the full year and improved Q1 revenue, profitability challenges persist with negative earnings growth and low profit margins at 1.6%. The company's high debt levels and recent dividend decrease further highlight its financial constraints amidst stable weekly volatility and seasoned management tenure.

- Get an in-depth perspective on M-Grass Ecology And Environment (Group)'s performance by reading our balance sheet health report here.

- Gain insights into M-Grass Ecology And Environment (Group)'s historical outcomes by reviewing our past performance report.

Make It Happen

- Gain an insight into the universe of 1,168 Asian Penny Stocks by clicking here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300355

M-Grass Ecology And Environment (Group)

M-Grass Ecology And Environment (Group) Co., Ltd.

Adequate balance sheet slight.

Market Insights

Community Narratives