- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound driven by cooling inflation and strong bank earnings, major U.S. stock indexes have surged, with small-cap stocks also seeing substantial gains amid economic optimism. In this dynamic environment, identifying promising high-growth tech stocks involves looking for companies that can capitalize on technological advancements and market trends while navigating the current economic landscape effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

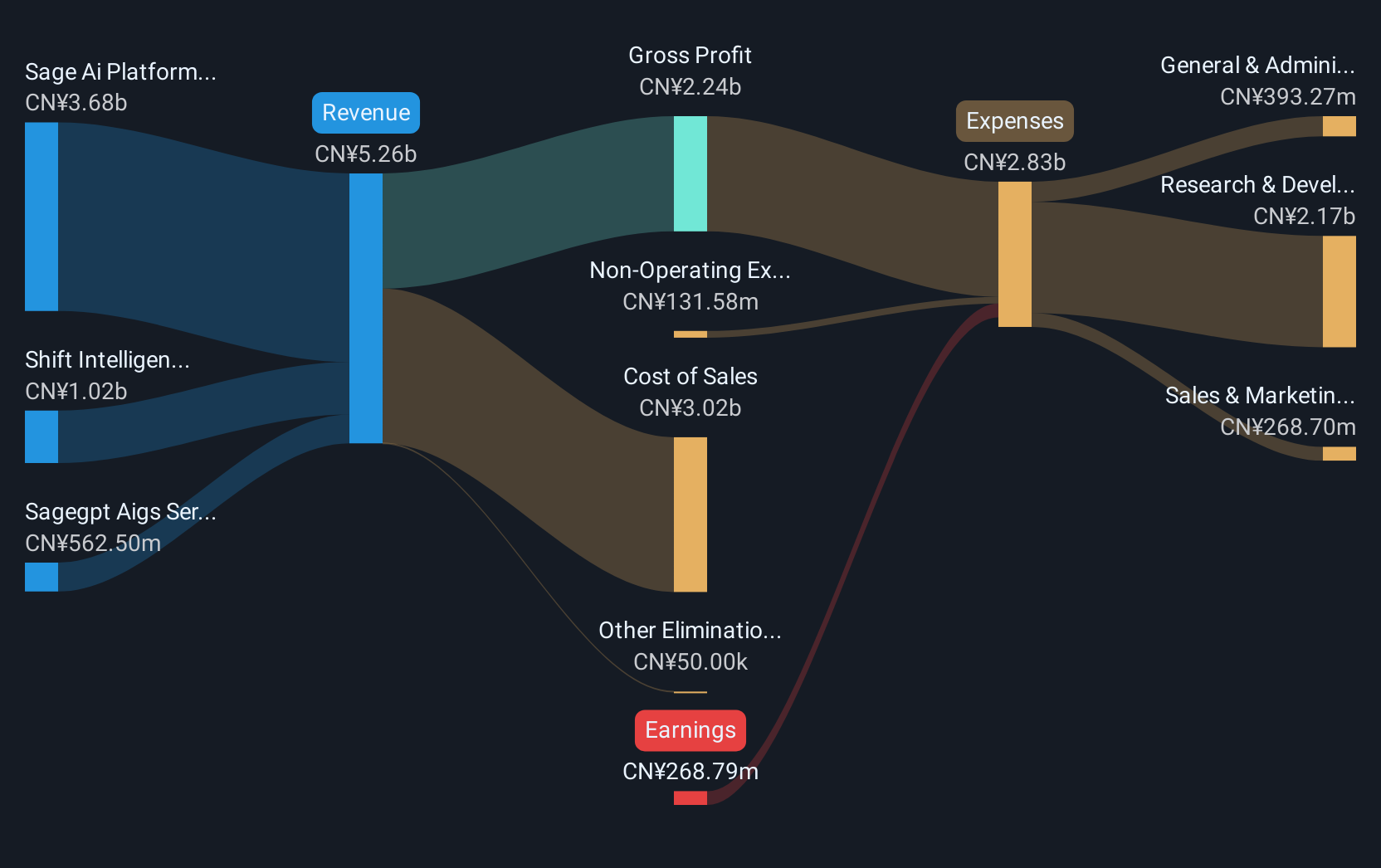

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of approximately HK$18.64 billion.

Operations: The company generates revenue primarily through its Sage AI Platform, contributing CN¥3 billion, along with SageGPT AIGS Services and Shift Intelligent Solutions, which add CN¥448.1 million and CN¥1.15 billion respectively. The business focuses on delivering advanced AI solutions within China.

With a robust forecast of 19.3% annual revenue growth, Beijing Fourth Paradigm Technology outpaces the broader Hong Kong market's 7.6% expansion rate, signaling strong sectoral momentum. Despite current unprofitability, earnings are projected to surge by an impressive 113.1% annually. The recent strategic relocation of their principal business address in Hong Kong underscores a commitment to scaling operations and enhancing accessibility in a key financial hub, potentially catalyzing further growth amidst a volatile share price landscape over the past three months.

Wus Printed Circuit (Kunshan) (SZSE:002463)

Simply Wall St Growth Rating: ★★★★☆☆

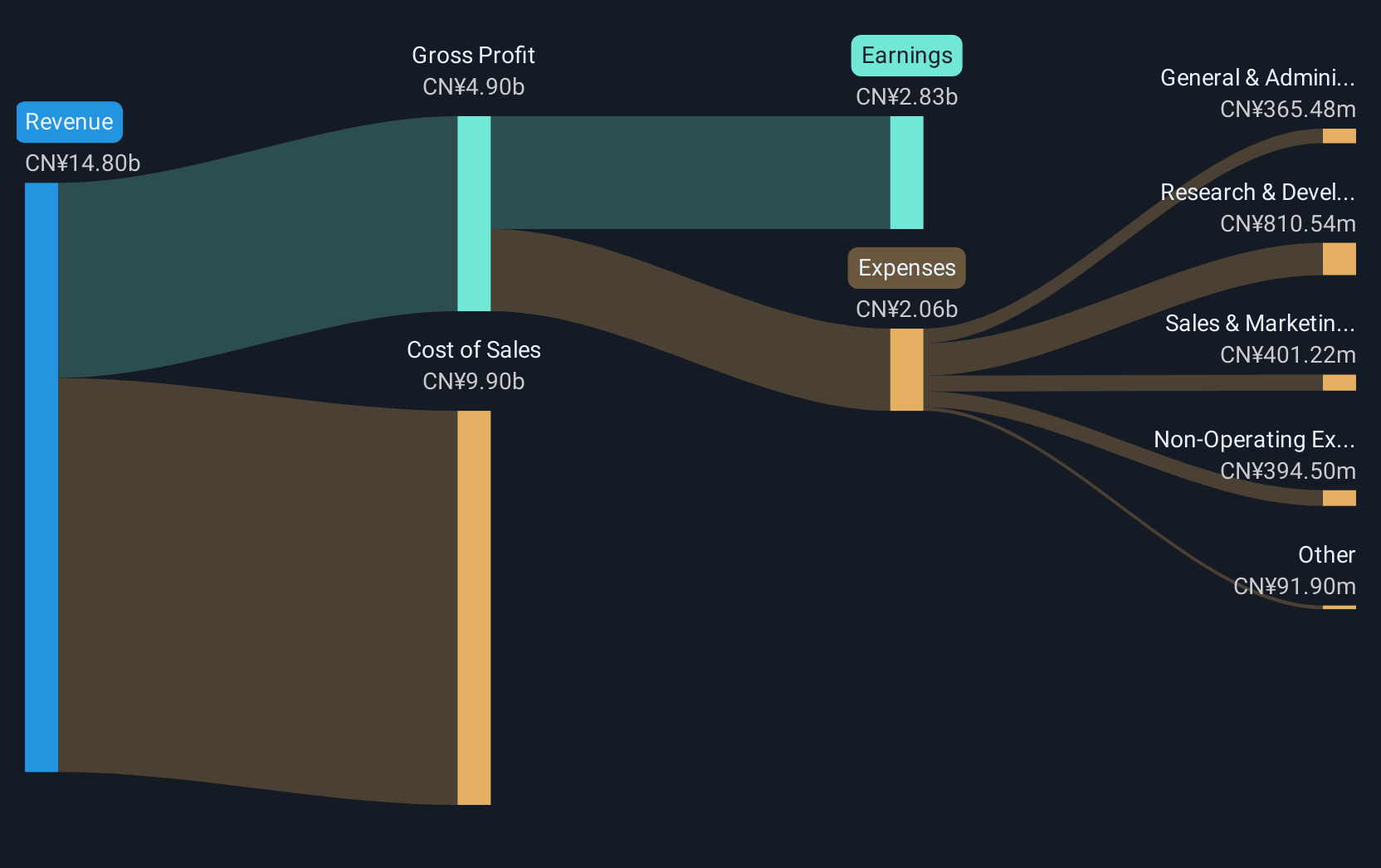

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. focuses on the research, development, design, manufacture, and sale of printed circuit boards in China with a market capitalization of CN¥76.19 billion.

Operations: Wus Printed Circuit (Kunshan) Co., Ltd. generates revenue primarily through the sale of printed circuit boards, leveraging its expertise in research and development to cater to the Chinese market. The company's operations encompass design and manufacturing, contributing significantly to its financial performance within the industry.

Wus Printed Circuit (Kunshan) demonstrates a compelling trajectory in the tech sector, with an annual revenue growth of 18.5%, outpacing the Chinese market average of 13.4%. This growth is underscored by a significant earnings increase of 72.8% over the past year, reflecting robust operational efficiency and market demand. Recent strategic changes, including amendments to its articles of association and plans for new projects as approved in their latest extraordinary meeting, suggest proactive governance aimed at sustaining this growth momentum. Notably, their R&D commitment is evident from recent financials showing substantial investment in innovation to stay ahead in the competitive tech landscape.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★☆☆

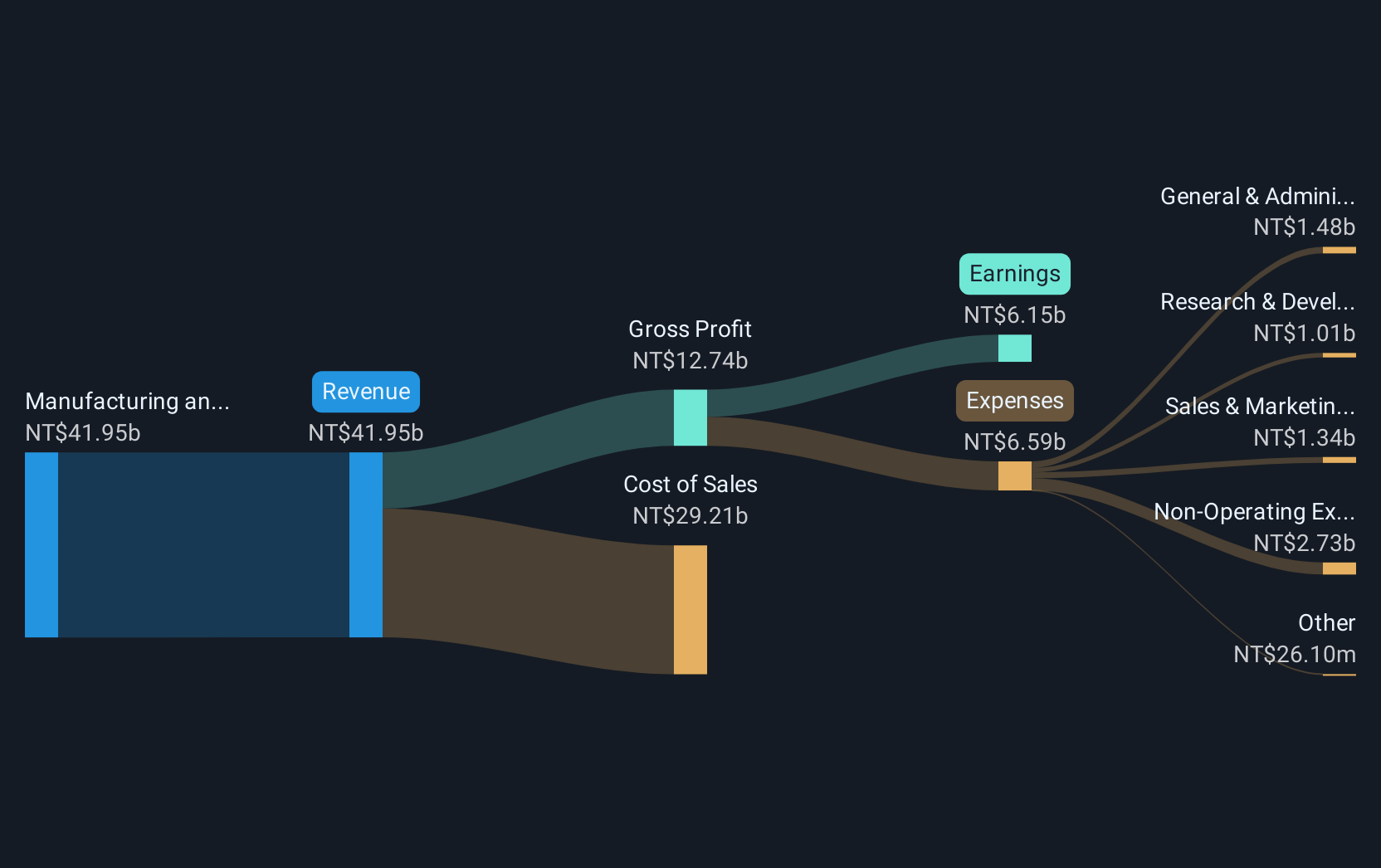

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that specializes in the design, manufacturing, processing, and distribution of multilayer printed circuit boards with a market capitalization of NT$103.18 billion.

Operations: Gold Circuit Electronics Ltd. generates revenue primarily from the manufacturing and sales of printed circuit boards, amounting to NT$37.63 billion. The company focuses on multilayer printed circuit board production within Taiwan.

Gold Circuit Electronics has demonstrated robust growth, with a notable 62.3% increase in earnings over the past year, significantly outperforming the electronic industry's average of 6.6%. This surge is supported by an aggressive R&D investment strategy, aligning with industry demands for continuous innovation and technological advancement. The company's recent financial performance also reflects a strong upward trajectory in revenue, growing at 14.9% annually, which surpasses the broader Taiwanese market growth rate of 11.3%. Moreover, strategic earnings calls and announcements highlight ongoing operational successes and forward-looking initiatives aimed at sustaining this momentum into future quarters.

Key Takeaways

- Explore the 1227 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes multilayer printed circuit boards in Taiwan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives