Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002913

High Growth Tech Explores 3 Leading Stocks with Promising Expansion

Reviewed by Simply Wall St

The global markets have experienced a turbulent week, with U.S. stocks mostly lower amid AI competition fears and mixed earnings reports, while European indices reached record highs following interest rate cuts by the ECB. In this context of volatility and competitive pressures, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential and resilience to market shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Delton Technology (Guangzhou) (SZSE:001389)

Simply Wall St Growth Rating: ★★★★★★

Overview: Delton Technology (Guangzhou) Inc. engages in the research, development, production, and sale of printed circuit boards both in China and internationally, with a market capitalization of CN¥24.72 billion.

Operations: Delton Technology (Guangzhou) Inc. focuses on the production and sale of printed circuit boards, catering to both domestic and international markets. The company's revenue model is centered around its expertise in printed circuit board manufacturing, though specific revenue figures for different segments are not provided.

Delton Technology (Guangzhou) demonstrates robust growth dynamics, with revenue and earnings forecasted to outpace the broader Chinese market. Specifically, revenue is expected to increase by 20.2% annually, surpassing the national average of 13.3%, while earnings could see a significant rise of 29.5% per year, compared to the market's 25%. This performance is underscored by its recent inclusion in both the Shenzhen Stock Exchange A Share and Component Indexes on December 16, 2024, reflecting growing investor recognition. With an anticipated high Return on Equity of 21.4% in three years' time, Delton's strategic focus on innovation and market expansion could continue to yield substantial results within the tech sector.

- Unlock comprehensive insights into our analysis of Delton Technology (Guangzhou) stock in this health report.

Understand Delton Technology (Guangzhou)'s track record by examining our Past report.

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenglu Telecommunication Tech is a company focused on the telecommunications industry, with a market cap of CN¥5.26 billion.

Operations: Shenglu Telecommunication Tech specializes in the telecommunications sector, generating revenue primarily through its range of telecommunication products and services. The company focuses on delivering innovative solutions to meet the demands of a rapidly evolving industry.

Guangdong Shenglu Telecommunication Tech. Co., Ltd. is setting a brisk pace in the tech sector with its aggressive revenue growth forecast at 31.3% annually, significantly outstripping the Chinese market average of 13.3%. This growth is complemented by an expected surge in earnings, projected to increase by 84.5% per year as the company transitions from unprofitability to profitability within three years. The firm's commitment to innovation and future planning is evident from its recent share repurchase program valued at CNY 285.8 million, aimed at bolstering employee ownership and incentivizing performance through equity plans, funded robustly through internal resources and strategic financial partnerships.

- Click here to discover the nuances of Guangdong Shenglu Telecommunication Tech with our detailed analytical health report.

Learn about Guangdong Shenglu Telecommunication Tech's historical performance.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

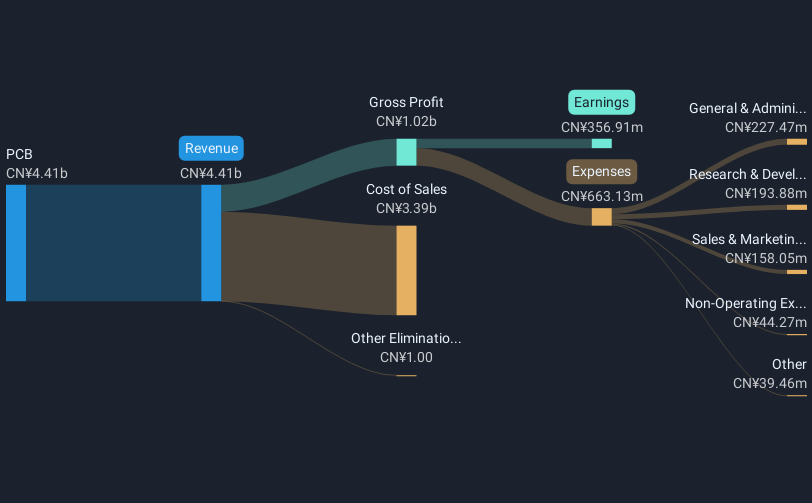

Overview: Aoshikang Technology Co., Ltd. specializes in the research, development, production, and sale of printed circuit boards with a market capitalization of approximately CN¥7.74 billion.

Operations: Aoshikang Technology focuses on producing printed circuit boards, generating revenue of approximately CN¥4.41 billion from this segment.

Aoshikang Technology is navigating the competitive tech landscape with a robust annual revenue growth rate of 19%, outpacing the broader Chinese market's 13.3%. This growth trajectory is bolstered by an impressive forecast for earnings to expand at 30.7% annually, reflecting strong operational efficiencies and market demand. The company’s focus on R&D, crucial for maintaining its competitive edge, is evidenced by its significant investment in this area, aligning with industry leaders who typically allocate substantial resources to innovation. Recent strategic moves include board restructuring and amendments to corporate governance, positioning Aoshikang well for future scalability and adaptability in a rapidly evolving sector.

- Dive into the specifics of Aoshikang Technology here with our thorough health report.

Evaluate Aoshikang Technology's historical performance by accessing our past performance report.

Next Steps

- Discover the full array of 1230 High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002913

Aoshikang Technology

Engages in the research, development, production, and sale of printed circuit boards.