- China

- /

- Communications

- /

- SZSE:002446

High Growth Tech And 2 Other Promising Stocks With Potential

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite marking impressive annual gains despite recent economic contractions indicated by the Chicago PMI and a downward GDP revision from the Atlanta Fed, investors are keenly observing how these dynamics impact high-growth sectors. In such an environment, identifying promising stocks often involves looking for companies that demonstrate resilience and potential for innovation amidst fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of human vaccines both in China and internationally, with a market cap of approximately CN¥9.79 billion.

Operations: The company generates revenue primarily through its biotechnology segment, which reported CN¥1.61 billion. It focuses on the development and commercialization of human vaccines across domestic and international markets.

Changchun BCHT Biotechnology has demonstrated robust growth, with earnings surging by 37.7% over the past year, outpacing the biotech industry's average of 1.3%. This trend is expected to continue, with forecasts predicting a significant annual earnings growth of 39.3% and revenue increases at 26.9% per year, both well above market averages in China. Despite a recent dip in net income from CNY 331.09 million to CNY 244.37 million in the latest nine-month report, the company's aggressive investment in R&D and strategic focus on expanding its biotechnological innovations could position it favorably for future market demands and shifts within the healthcare sector.

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

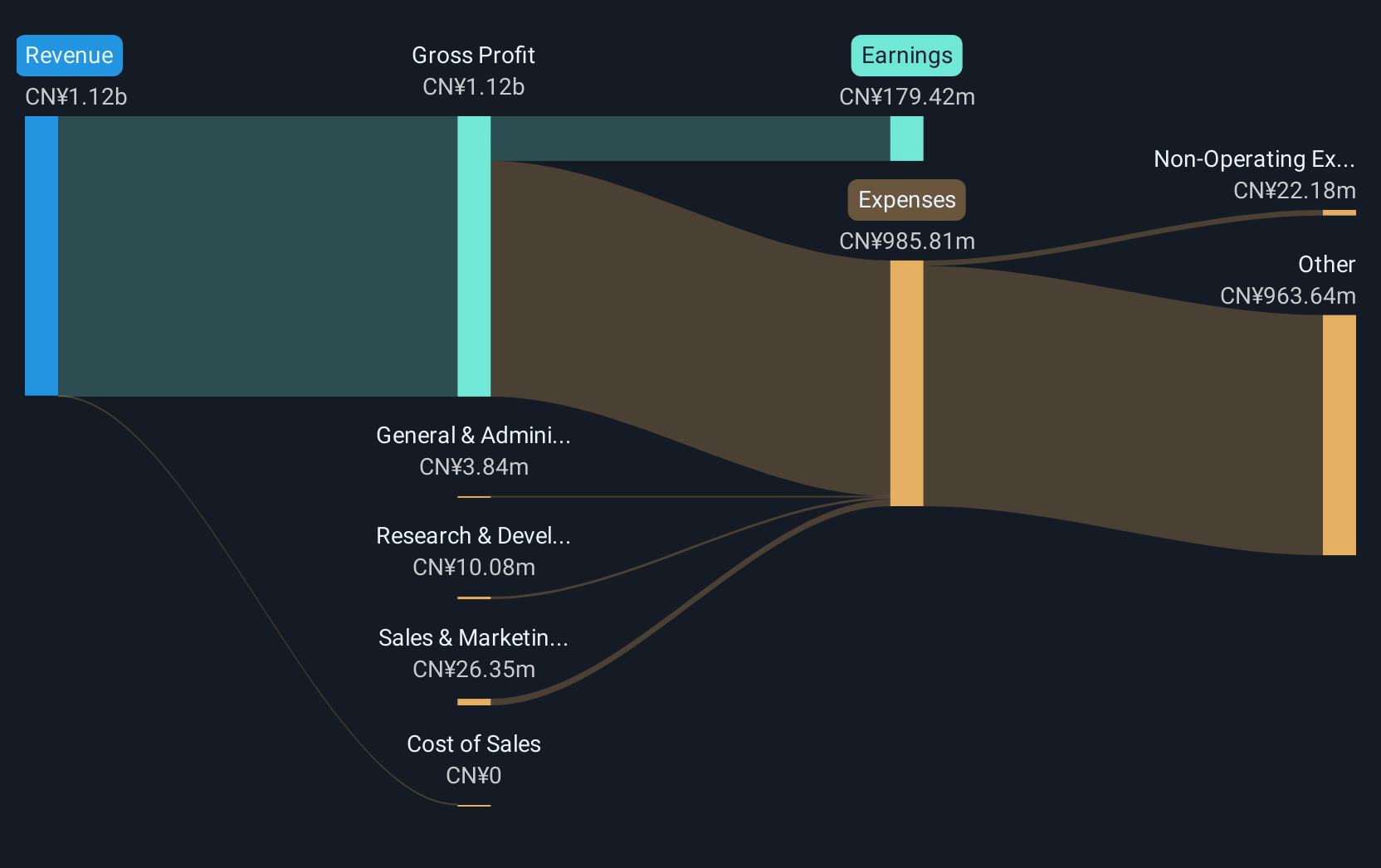

Overview: Guangdong Shenglu Telecommunication Tech is a company involved in the telecommunications industry, with a market cap of CN¥5.62 billion.

Operations: Shenglu Telecommunication Tech operates in the telecommunications sector, focusing on the production and sale of communication antennas and related equipment. The company generates revenue primarily through its antenna products, which cater to various applications such as mobile communications and satellite systems. Its cost structure is influenced by raw material expenses and manufacturing processes. The company's profitability is reflected in its net profit margin trends over recent periods.

Guangdong Shenglu Telecommunication Tech is navigating a challenging landscape with a notable dip in net income from CNY 163.45 million to CNY 66.46 million in the recent nine-month period, reflecting a strategic pivot amid market shifts. Despite these hurdles, the company's commitment to innovation is underscored by an aggressive R&D stance, with forecasts showing potential for profitability and an impressive expected earnings growth of 84.54% annually. This forward-looking approach, combined with a revenue growth forecast at 31.3% per year—twice the pace of China's market average—positions Shenglu to potentially capitalize on emerging telecommunication demands and technological advancements, especially as they recently navigated corporate governance enhancements during their latest extraordinary general meeting.

Hitevision (SZSE:002955)

Simply Wall St Growth Rating: ★★★★☆☆

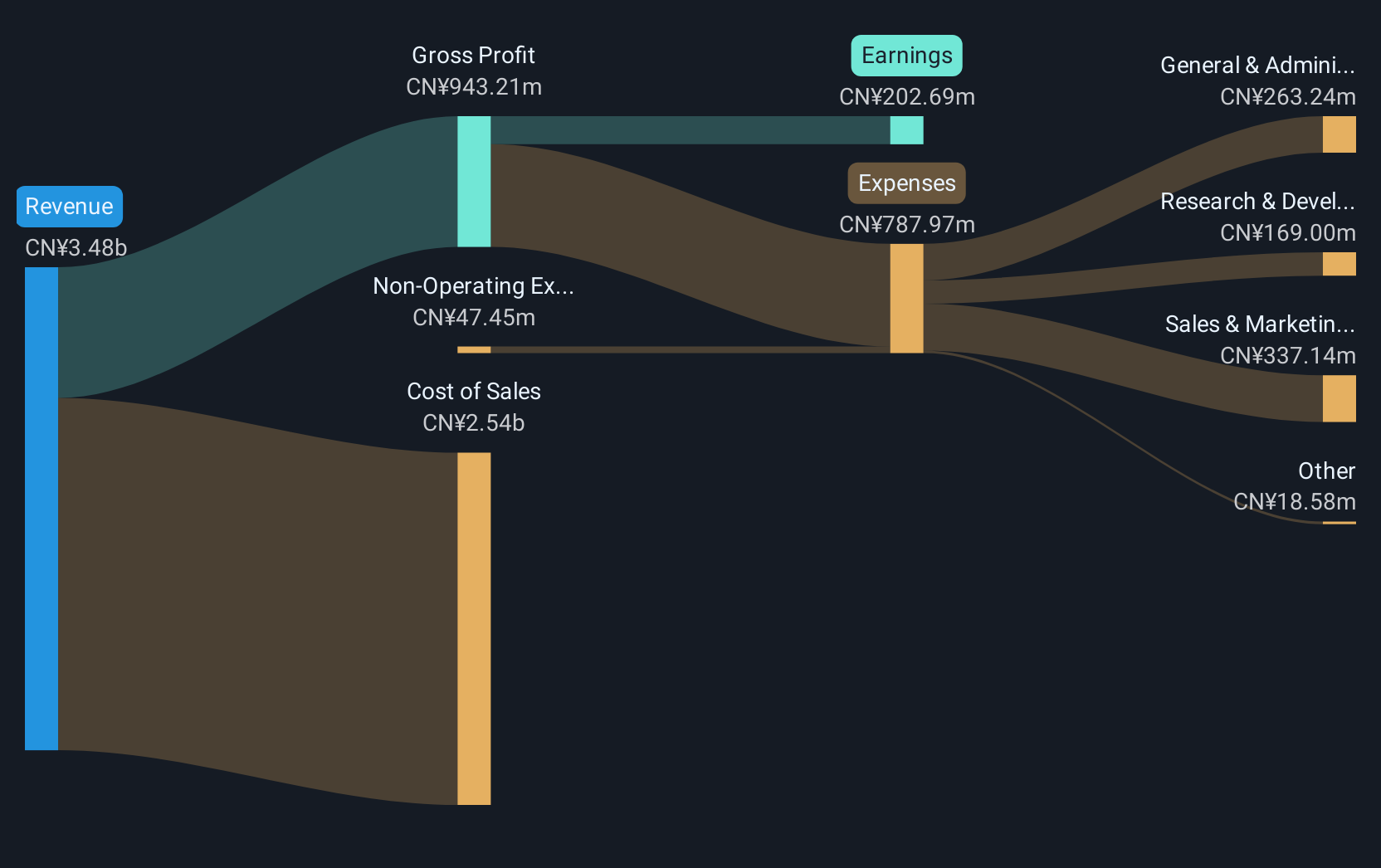

Overview: Hitevision Co., Ltd. focuses on the research, design, development, production, and sale of interactive display products in China with a market capitalization of CN¥5.21 billion.

Operations: Hitevision specializes in interactive display products, leveraging its expertise in research, design, and production to serve the Chinese market. The company operates with a market capitalization of CN¥5.21 billion.

Hitevision's recent financial performance presents a mixed picture, with a decline in net income from CNY 300.02 million to CNY 245.02 million over the nine months ending September 2024, alongside a reduction in sales from CNY 3,069.48 million to CNY 2,764.74 million. Despite these challenges, the company's commitment to shareholder value is evident through its recent repurchase of approximately 2.4 million shares for CNY 51.07 million. Looking forward, Hitevision is poised for potential growth with earnings expected to increase by an annual rate of 25.1% and revenue projected to grow at 15.8% per year—outpacing the Chinese market average of 13.5%. These figures underscore Hitevision’s resilience and adaptability in navigating market fluctuations while maintaining a focus on innovation and growth in the tech sector.

- Get an in-depth perspective on Hitevision's performance by reading our health report here.

Assess Hitevision's past performance with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 1267 High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002446

Guangdong Shenglu Telecommunication Tech

Guangdong Shenglu Telecommunication Tech.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives